Volatility Factor Pro Review Introduction

Is Volatility Based Trading the Best for Forex?

Market volatility is a term to describe the degree of the market's risk as a result of the amount of the next change in the currency price over a short period of time. The higher the expected amount of change, the more the market's volatility, the higher its risk.

With the ability to predict the most approximate value to the amount of the next change in a currency price, the market's volatility can be closely predicted and profits can be made from that, this can be achieved by a balanced use of specific tactics to exploit market's volatility and trend which is called Volatility Based Trading Strategy.

This strategy usually trades and takes advantage of the prevailing market direction except in few cases where it strongly expects a market correction and then takes limited positions. Entry, StopLoss and TakeProfit values are calculated according to the market's volatility.

Trading Idea

Volatility Factor Pro trades by opening a basket of 4 positions maximum depending on market volatility, taking profit at 20 pips with hard StopLoss of 50 pips, this means that touching the SL for the 4 basket trades would mean a drawdown (4 * 50 = 200), this is a so much safer if compared to the older version which drawdowns could be in excess of 1500 pips of (380 * 4 = 1520) pips.Volatility Factor Pro Criteria

NFA and FIFO

Fully Compliant with the US Currency Trading Rules and Regulations.

License

One Real Account and Unlimited Demo Accounts, Additional One and Two Real Account Licenses can be Purchased from the Client Area After Getting the Main EA License.

Compatible Brokers

Compatible with Any Forex Broker, But We Recommend Installing it on FXVM and Using it on IC Markets Forex brokers for the Best Stability and Profitability.

Support & Updates

24/7 Professional Technical Support and FREE Lifetime Updates.

User Manual

A Fully Detailed User Manual is included with some Guidelines about Recommended Account Sizes and the Expected Lot Sizes.

Refund Policy

60 Day Money Back Guarantee by the EA Vendor.

Supported Currency Pairs

GBPUSD, EURUSD and it also trades other unsupported pairs.MetaTrader Chart Timeframe

M15Live Performance

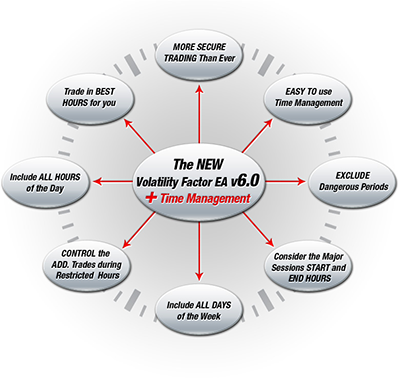

The latest version of Volatility Factor Pro EA had advanced optimized settings and a lower StopLoss level compared to the older versions to provide higher and more secure profits with minimum drawdown as seen in the MyfxBook verified live performance statements below:

Backtests

We have conducted a set of 5 years backtests from May 2011 to May 2017 on EURUSD and GBPUSD in addition to USDCHF and USDJPY as unsupported pairs that became tradable since version 7.1 using special parameter settings in the EA.

We used high quality 99% Dukascopy tick data for all of the backtests via a Tickmill ECN-PRO Demo account with the broker current spread that ranged from 1 to 3 during the whole backtesting period as a reference for comparison (the lower the spread, the better the results).

The variations we used in the backtests to expose the performance flexibility of Volatility Factor 2.0 PRO included risks (AutoMM) application of 2.0 pips as a moderate risk which is the default risk value in the EA settings and 0 pips with FixedLots of 0.02 pips to trade with the minimum risk.

We applied these different risk levels on each pair alternatively with disabling additional trades (MaxNegAdds=0), and again with enabling additional trades (MaxNegAdds=3).

Trading Style (Visual Backtest)

Dukascopy Tick Data Backtests

Recommended Pairs

Custom Pairs

Trading Strategy

Volatility Based Market Algorithm & Money Management

Volatility Factor Pro EA was designed to make 10-15+ pips per trade via its very powerful volatility-based market algorithm.

This algorithm closely watches the market, so when a desired movement is detected in a certain direction, in a lightning-fast reaction, it initiates trades with leverage to magnify the returns on the current market volatility.

The EA focuses on the medium-term market's signals and with its powerful and sensitive money management system, it can keep your account safe and minimizes risk till the trades get exited.

Prevailing Level Detection

This is the cornerstone for the volatility-based trading strategy via a thorough view over the market to correctly predicting the currency pair trading range within which its price swings.

Moreover, thousands of sophisticated calculations are necessary to correctly map the channel and accurately identify the prevailing level, which is automatically processed by Volatility Factor Pro EA.

Drawdown Correction

By applying the volatility-based market algorithm, the EA can make important profits unless a genuine channel breakout has occurred that isn't in line with the algorithm's calculations, here the EA money management algorithms start its action by closely watching the trades and systematically closing each position with an optimal profit level and a minimum drawdown to protect the account balance and keep it within the risk profile parameters.

Trading Frequency

With such strategy and profiting protocol, any system should end into a lazy one with a slow trading rate, but via its lightning-fast trading logic, Volatility Factor Pro EA can quickly react with the market, analyze it, and makes 3 - 4 profitable trades per session.

Spread and Price Slippage Protection

Volatility Factor Pro EA has an advanced integrated protection system that is configured to minimize the broker-driven price spread and slippage, so it's compatible with any broker and any account type.

Promotional Video (by the Vendor)

Latest Volatility Factor Pro Posts

Talk about Volatility Factor Pro

Information, charts or examples contained in this review article are for illustration and educational purposes only. It should not be considered as an advice or endorsement to purchase or sell any security or financial instrument. We do not and cannot give any kind of financial advice. No employee or persons associated with us are registered or authorized to give financial advice. We do not trade on anyone's behalf, and we do not recommend any broker. On certain occasions, we have a material link to the product or service mentioned in the article. This may be in the form of compensation or remuneration.