Backtesting a Forex robot or a trading strategy is to test its performance to get gives an idea about how it could react with the market in the past and if that reaction and performance was good, it should theoretically continue that in the future, hence the importance of backtesting is non-ignorable!

To backtest, you must have saved tick data to your computer commonly obtained either via MT4 history center or Dukascopy, the historical data are free and you can get it easily via MT4 as we will discuss later.

Dukascopy tick data which is the most accurate data you can get for backtesting is also free, but the way with which you can download and prepare it for backtesting is so complicated and time consuming. Some 3rd party applications are sold for that purpose, one of them which we already use for our backtesting is Tick Data Suite, it's easy to use and has many important features in addition to downloading and preparing Dukascopy Tick Data.

WallStreet Forex Robot 2.0 Evolution and its FREE bonus robots WallStreet ASIA Evo and WallStreet Recovery PRO Evo are already and carefully optimized by their developers and need no further optimizations or improvements but some custom settings for unsupported pairs should be tested before their use on real money, so the robots should be tested correctly or they may get unexpected results.

For backtesting on MT4, the demo or real account used for that must be activated in the members area of the robot's official website first!

PAID Backtesting Solution (using Dukascopy Tick Data)

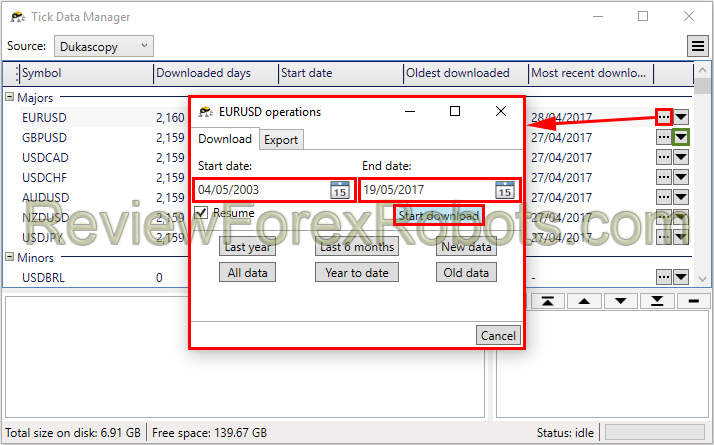

1. Update / Download Tick Data using Tick Data Suite

Launch Tick Data Manager and click the desired currency pair operations button [â€Â¦] the (GBPUSD, EURUSD, USDJPY, USDCAD, USDCHF, AUDUSD, NZDUSD and EURJPY for WallStreet Forex Robot 2.0 Evolution) to set the tick data period then click start download button, or simply click the down arrow button to quickly start downloading all the available tick data for that currency pair.

Do the Backtest in MetaTrader 4

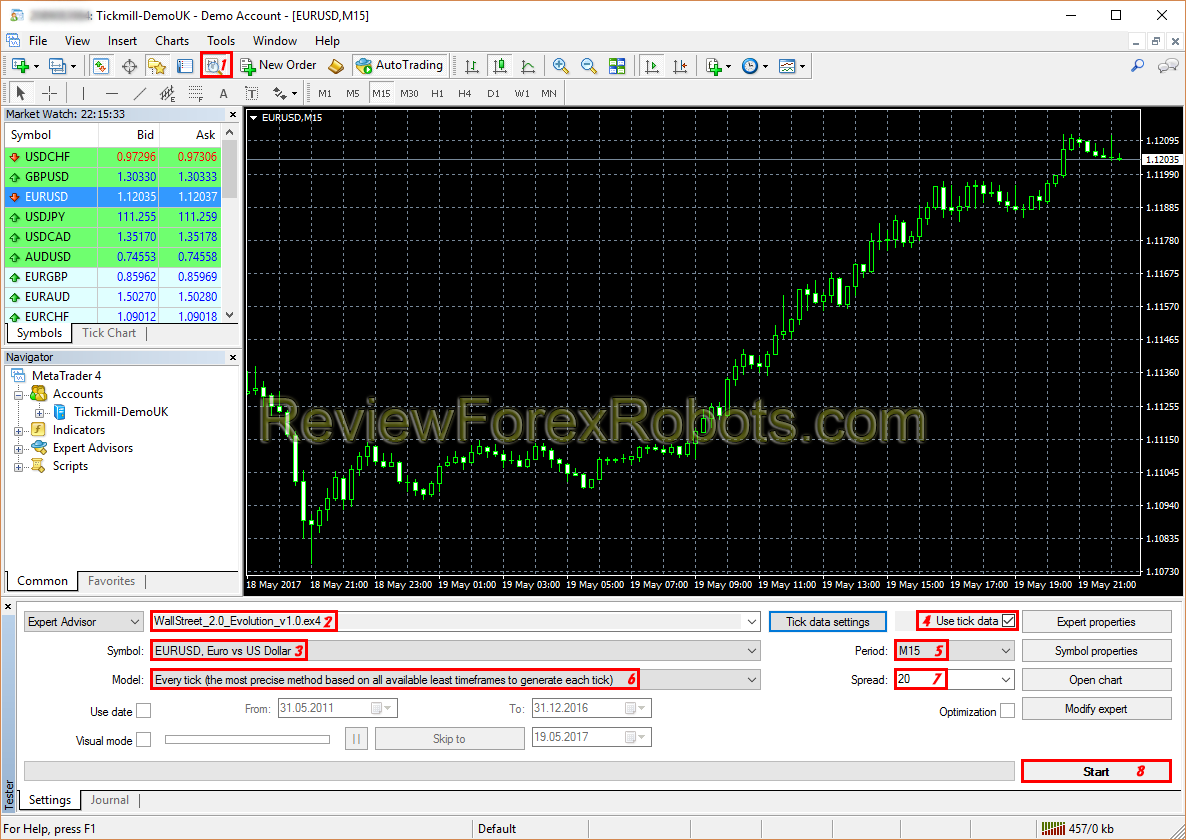

- In the MetaTrader menu click the "Strategy Tester" button, or press "Ctrl+R" on the keyboard to open the "Strategy Tester" window.

- Choose "WallStreet 2.0 Evolution" in the opened "Strategy Tester" window.

- Choose one of the EA supported currency pairs that the data was downloaded for (GBPUSD, EURUSD, USDJPY, USDCAD, USDCHF, AUDUSD, NZDUSD and EURJPY).

- Mark the "Use tick data" checkbox in the same window to allow the MetaTrader to use the downloaded tick data for backtesting.

- Choose M15 timeframe.

- Choose "Every tick ..." method.

- Type 20 for the Spread.

- Click "Start" to launch the backtest.

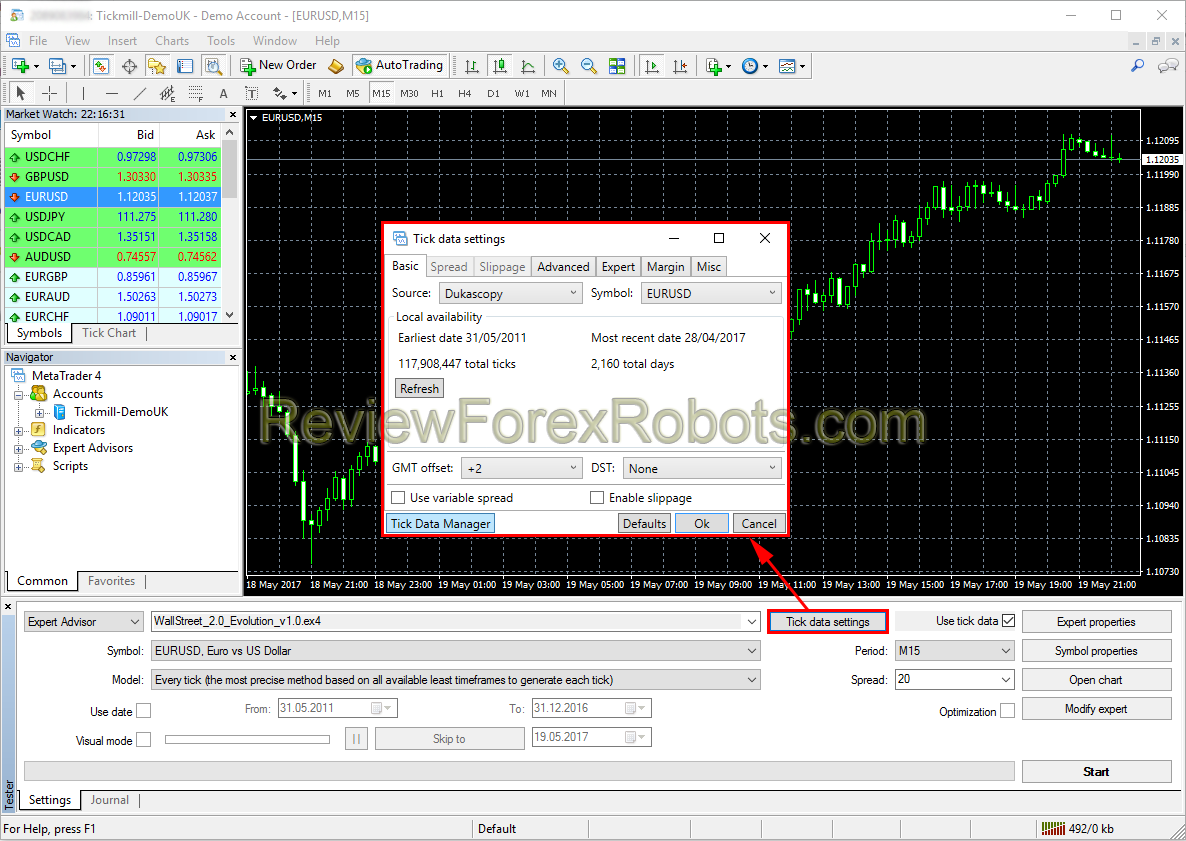

If you'd like to change the GMT/DST of the backtest as with some brokers for backtesting accuracy or if you wish to use variable spread, enable slippage or change any of the advanced settings, you can open the Tick data settings dialog and do your modifications.

When ready, click the "Start" button and wait for the backtest as it progresses.

At the end of the backtest check that the resulting modeling quality is 99% and that the variable spread was used (if enabled in tick data manager).

If the backtesting was interrupted by any problem or if you are getting unexpected results in the final report, you should first check the backtest journal, more information can be typically found in there.

If som unresolvable issues has occured, you can run the Tick Data Suite support assistant to send the problem details and create a support ticket. Don't forget to include the log files, this should help the support team to solve the problem, so you can leave the checkboxes for them enabled.

FREE Backtesting Solution (using MT4 History Center Data)

1. Update / Download the Historical Data

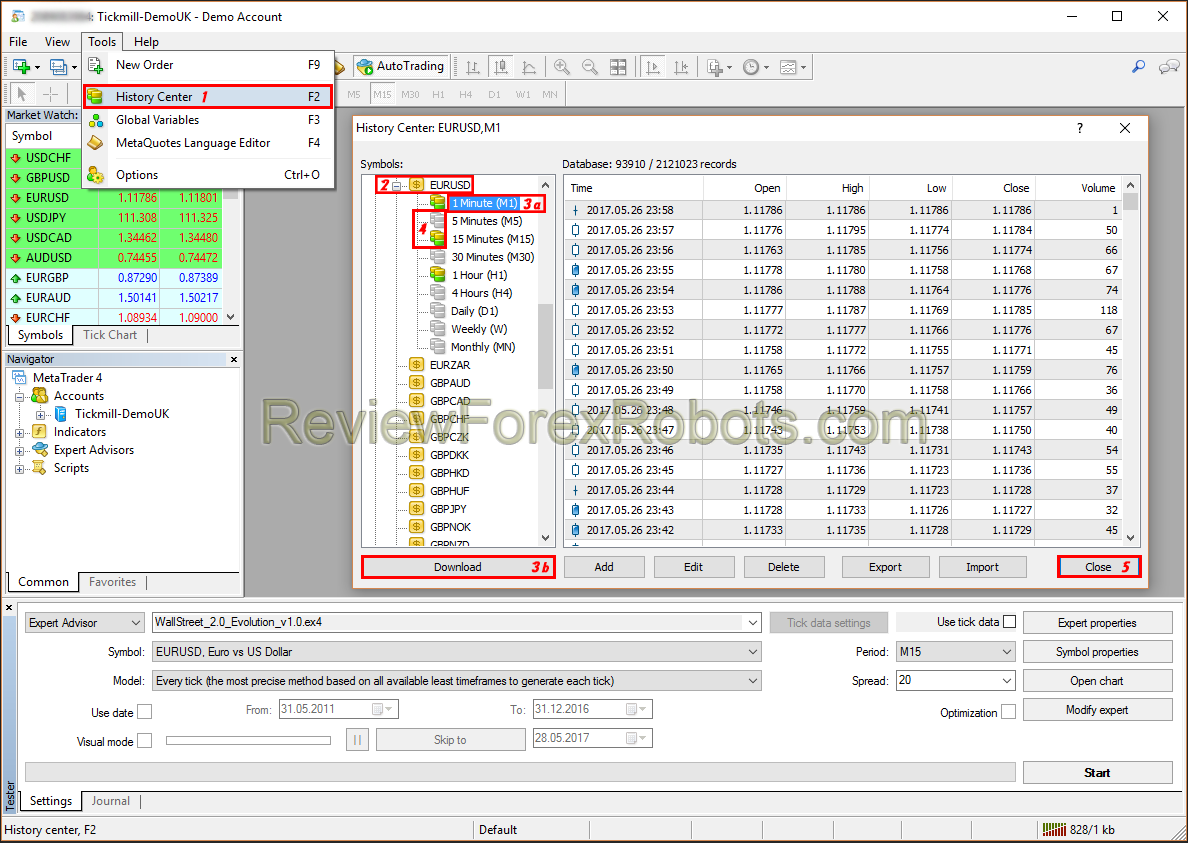

- In the MT4 terminal, click Tools => History Center, or press the "F2" key of the keyboard.

- In the list, find the currency pair that you wish to backtest and double click to expand it.

- Click "1 Minute (M1)" and then click "Download".

- When the download process is finished, double click on "5 Minutes (M5)†and "15 Minutes (M15)" to convert the M1 data.

- Close the "History Center" window.

2. Backtest in the Metatrader Strategy Tester

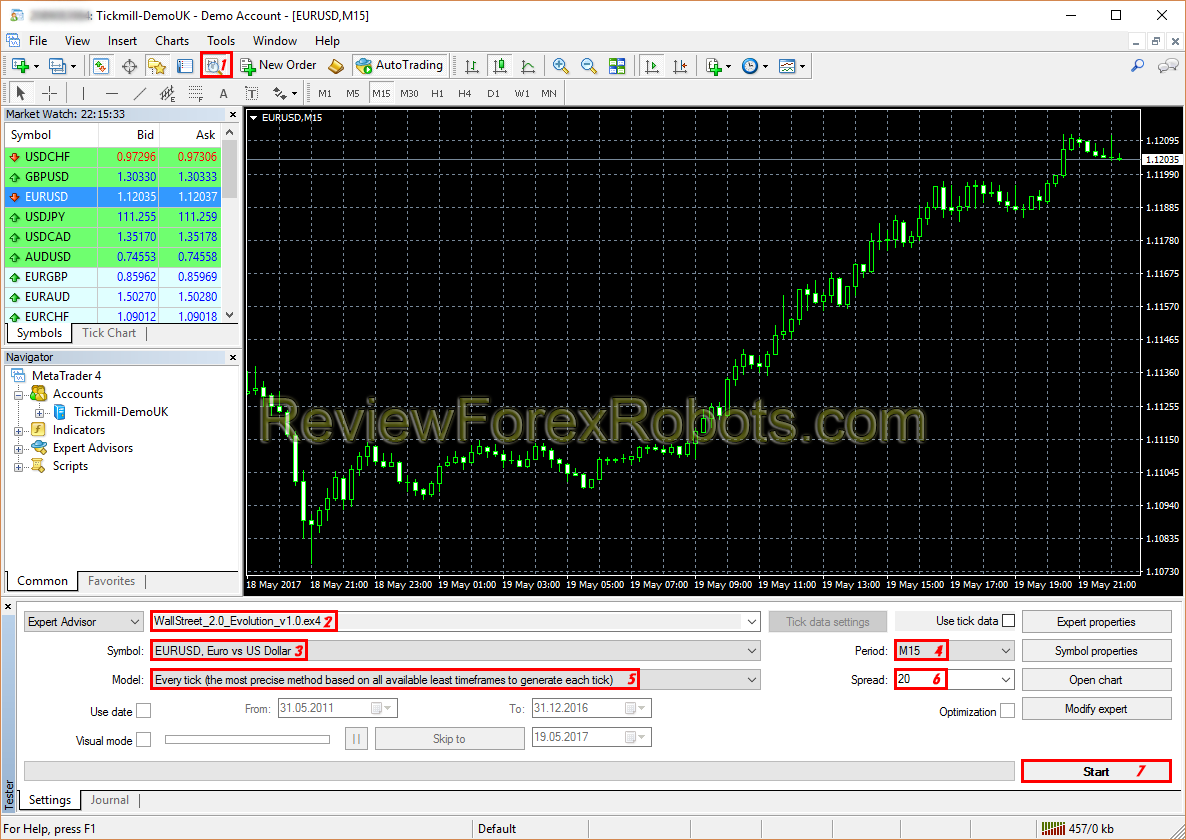

- In the MetaTrader menu click the "Strategy Tester" button, or press "Ctrl+R" on the keyboard to open the "Strategy Tester" window.

- Choose "WallStreet 2.0 Evolution" in the opened "Strategy Tester" window.

- Choose one of the EA supported currency pairs that the data was downloaded for (GBPUSD, EURUSD, USDJPY, USDCAD, USDCHF, AUDUSD, NZDUSD and EURJPY).

- Choose M15 timeframe.

- Choose "Every tick ..." method.

- Type 20 for the Spread.

- Click "Start" to launch the backtest.

The use of "Every tick ..." method for backtesting is the most precise, but too slow and to save time the backtest can be run on M1 timeframe using "Open price only ..." method which will generate a correct final report too.