Forex brokers provide two different prices for each currency pair: the bid and ask prices:

- The “bid” is the price at which you can SELL the base currency.

- The “ask” is the price at which you can BUY the base currency.

The spread is the difference between these two prices, also known as the “bid/ask spread“ and it is how “no commission” brokers make their money in the form of the fee for providing transaction immediacy instead of charging a separate fee for making a trade, the cost is added to the buy and sell price of the currency pair you want to trade. This is why “transaction cost” and “bid-ask spread” terms are used alternatively.

From a business point of view, this makes sense. The broker company provides a service and needs to have money in return.

- By selling the currency for more than they paid to buy it.

- By buying the currency for less than they will receive when they sell it.

And this difference is called the spread.

So when a broker claims “zero commissions” or “no commission”, you still pay a commission just built into the bid/ask spread!

How is the Spread Measured in Forex Trading?

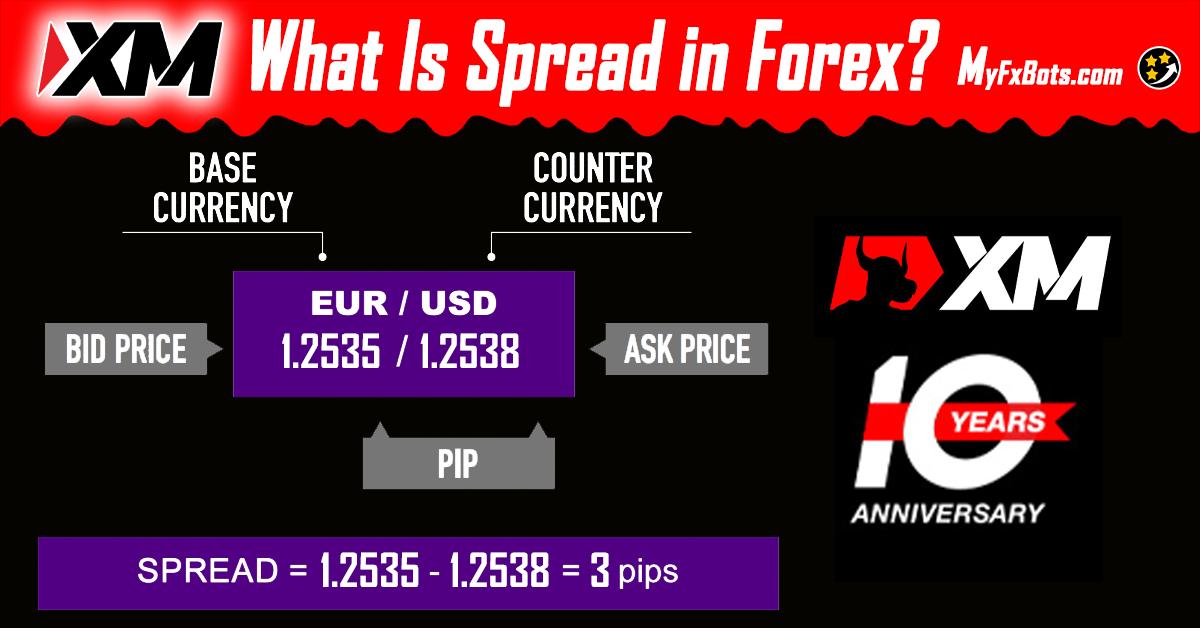

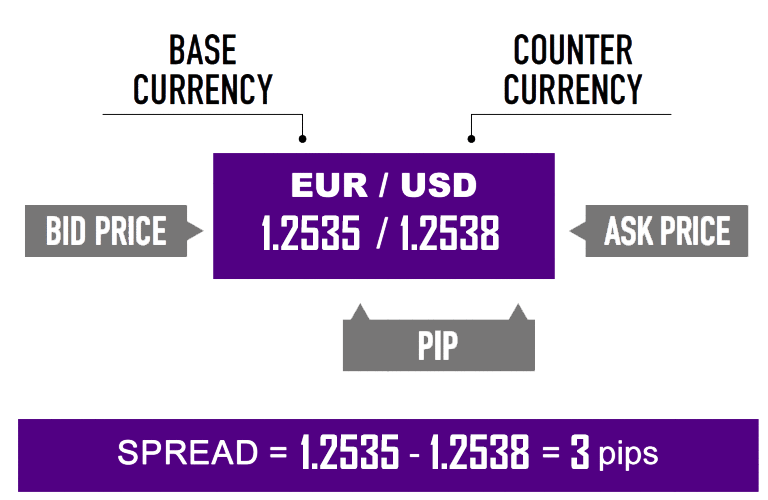

The smallest unit of the price movement of a currency pair is the pip which is the unit used to measure the spread. For most currency pairs, one pip is equal to 0.0001; for example, a 3 pip spread for EUR/USD would be 1.2535/1.2538.

Currency pairs of which the Japanese yen is a part are quoted to only 2 decimal places (unless there are fractional pips, then it’s 3 decimals); for example, USD/JPY would be 109.44/109.49, This quote indicates a spread of 5 pips.

What are the Spread Types in Forex?

This is dependent on the forex brokers you are using and how it makes money. Two types of a spread exist:

-

Fixed Spread

What is a Fixed Spread in Forex?

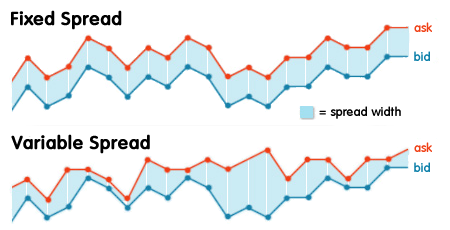

Fixed spreads don't change by the change in market conditions, regardless of whether the market is volatile or quiet, a fixed spread stays the same.

Market maker or “dealing desk” model brokers are those which offer fixed spreads, as they buy large positions from their liquidity provider(s), then offer them in smaller sizes to traders. So the broker acts as the counterparty to its clients’ trades.

These forex brokers offer fixed spreads as they are able to control the prices they display to their clients by having a dealing desk.

What are the Advantages of Trading With a Fixed Spread?

Fixed spreads are more suitable for traders who don’t have a lot of money to start trading with as a cheaper alternative with smaller capital requirements. It also makes transaction costs calculations more predictable, you’re always aware of what is expected to be paid when a trade is opened.

What are the Disadvantages of Trading With a Fixed Spread?

As pricing is coming from just one source (the broker) "requotes" can occur frequently when trading with fixed spreads.

In other words; in times of market volatility when prices are rapidly changing the broker won’t be able to widen the spread to adjust for current market conditions. So the broker will “block” the trade when you try to open at a specific price and ask you to accept a new price which is expressed as you're “re-quoted” with a new price.

The requote message will be displayed on the trading platform disclosing that the price has moved, asking you if you accept that price which is almost always worse than the one you ordered or not.

Also, when prices are changing so fast, the broker is unable to consistently maintain a fixed spread resulting in a totally different price than the intended entry price after entering a trade, which is called "slippage", which is another problem.

-

Variable (Floating) Spread

What is a Variable Spread in Forex?

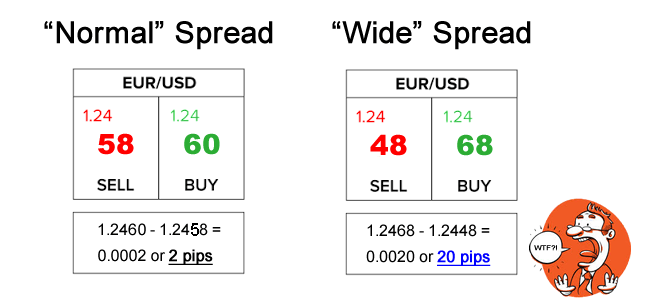

They are always changing, so, the difference between the bid and ask prices of currency pairs is constantly changing.

Non-dealing desk brokers are those offering variable spreads as they get their pricing of currency pairs from multiple liquidity providers and provide these prices to the trader without passing through a dealing desk, with no control over the spreads which will widen or tighten based on the supply and demand of currencies and the overall market volatility.

Basically, spreads widen during economic data releases and periods with low market liquidity as during holidays.

What are the Advantages of Trading With a Variable Spread?

No requotes occur as with fixed spreads due to the variation in the spread factors in changes with price affected by market conditions. But unfortunately, this is not applicable with slippage, it will still exist.

Pricing transparency is much more when trading with variable spreads added to having access to prices from multiple liquidity providers that usually yield better pricing due to competition.

What are the Disadvantages of Trading With a Variable Spread?

Scalpers don't favor variable spreads as when widened they can quickly wipe out any profits the scalper makes. Added to that variable spreads are just as bad for news traders as spreads may widen so much suddenly turning profitable into an unprofitable trade.

Fixed vs Variable Spread: Which is Better?

The answer depends on the trader's needs and his trading possibilities, traders with smaller accounts and those trading less frequently will benefit from fixed spread pricing, while traders with larger accounts and those trading frequently during peak market hours (when spreads are the tightest) will benefit from variable spreads.

Also traders who prefer fast trade execution and try to avoid requotes will find variable spreads more suitable.

Spread Costs and Calculations

How is the spread related to actual transaction costs?

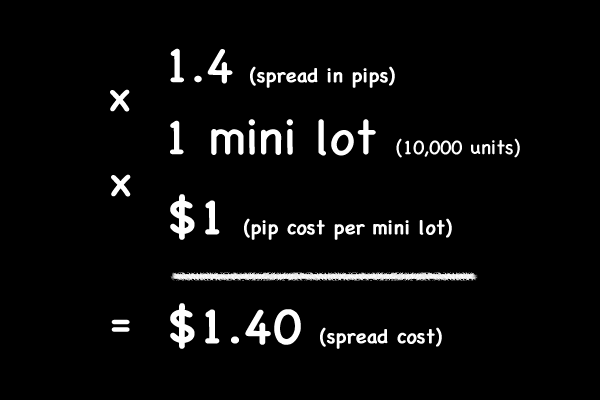

It’s so much easy to calculate based on two things:

- The value per pip.

- The number of lots you’re trading.

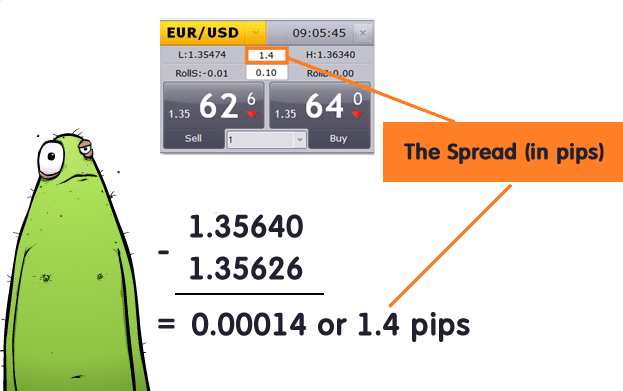

For example; if you can buy EURUSD at 1.35640 and sell EURUSD at 1.35626, this means that if you were to buy EURUSD and then immediately close it, it would result in a loss of 1.4 pips. To find out the total cost, as the pip cost is linear, you should multiply the pip cost by the lots number you’re trading. So if you’re trading mini lots (10,000 units), the value per pip is $1, so your transaction cost would be $1.40 to open this trade.

If you increase your position size, your transaction cost, which is reflected in the spread, will rise as well.

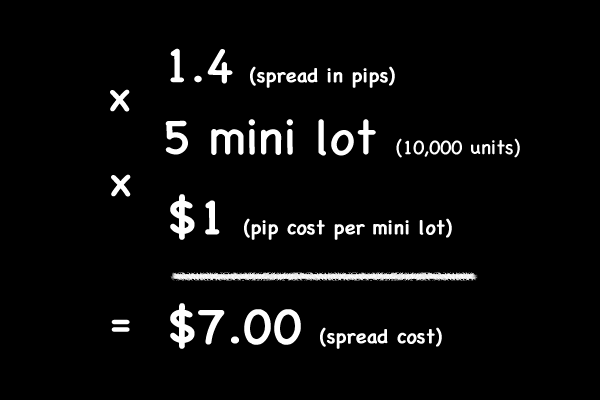

For example; if the spread is 1.4 pips and you’re trading 5 mini lots, then your transaction cost is $7.00.