Several people have made a lot of money from recent crypto market developments. Recently, some people have become increasingly excited about cryptocurrency. The reasons for being excited are numerous. Any professional crypto trader that used to trade for the past few years, often finds himself asking old questions like: "Should I buy now? Would it be better if I waited for a drawdown? What are the best altcoins to buy?" and so on. Some important thoughts will be declared in this post on the current crypto market that will most likely be of interest to many of you.

Taking a look at the charts first, we can see the overall picture. Almost a year has passed since Bitcoin began growing steadily. Bitcoin slipped to $15k-$16k after the collapse of FTX in November 2022. Since then, it has been growing. During the process, there were a few corrections. However, Bitcoin has more than doubled since its lows in November 2022. Since Bitcoin hit $20k, That expert crypto trader should've been buying it. However, since picking the exact bottom is impossible, he wouldn't be able to do that. FTX's collapse, however, seems to have marked the peak of Bitcoin's bear market. Crypto may be dragged back in the future by unforeseen events. It is unlikely, but it is possible. This should be obvious to any sensible crypto investor.

It has been over a year since a developing uptrend first been seen. Cryptocurrencies are likely to continue their trend rather than reverse it. Let's now consider the fundamentals. Due to Bitcoin's incapacity to produce anything, these are tricky. Buyers' and sellers' consensus determines the price in any market. Comparatively to normal stock markets or commodities, there are different metrics to consider here.

The main different price-determining metrics in the Crypto market compared to other stock markets or commodities

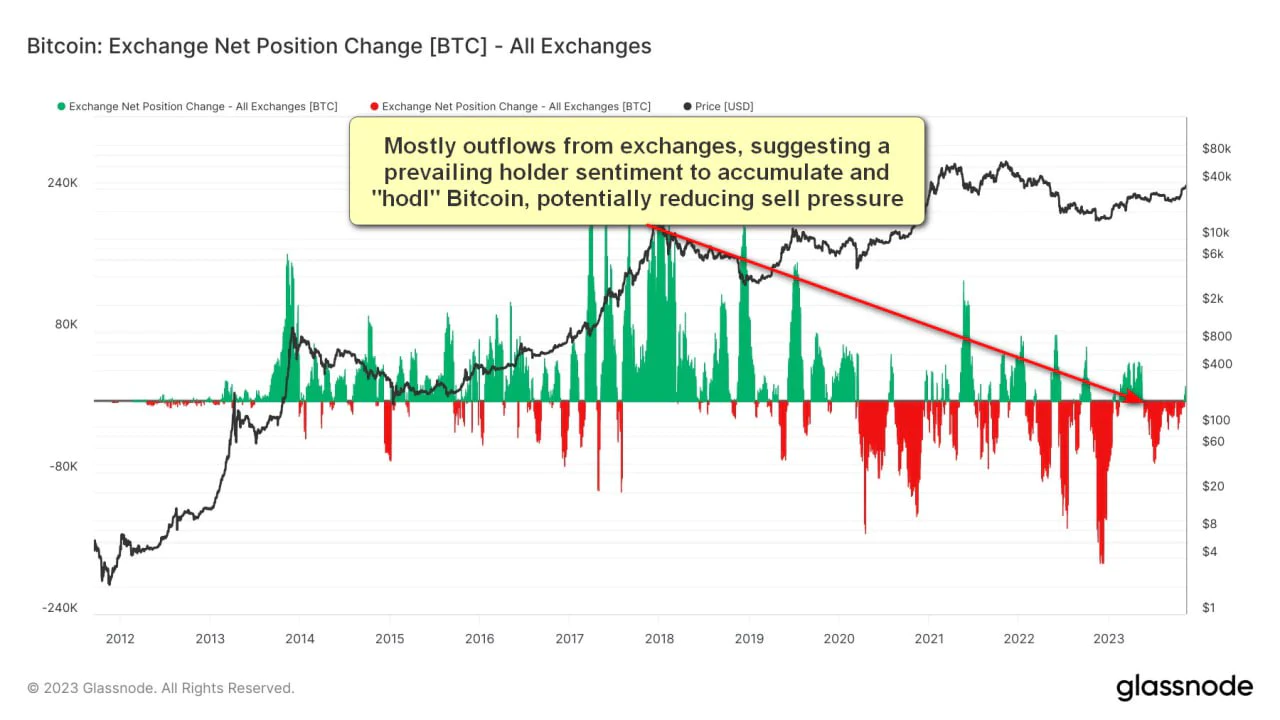

There are 21 million coins in circulation in Bitcoin, which is known to be the total supply. In addition to the upcoming approval of spot ETFs, the Bitcoin halving is about half a year away. Furthermore, exchanges are steadily outflowing their Bitcoins to private wallets, which reduces the Bitcoin supply available.

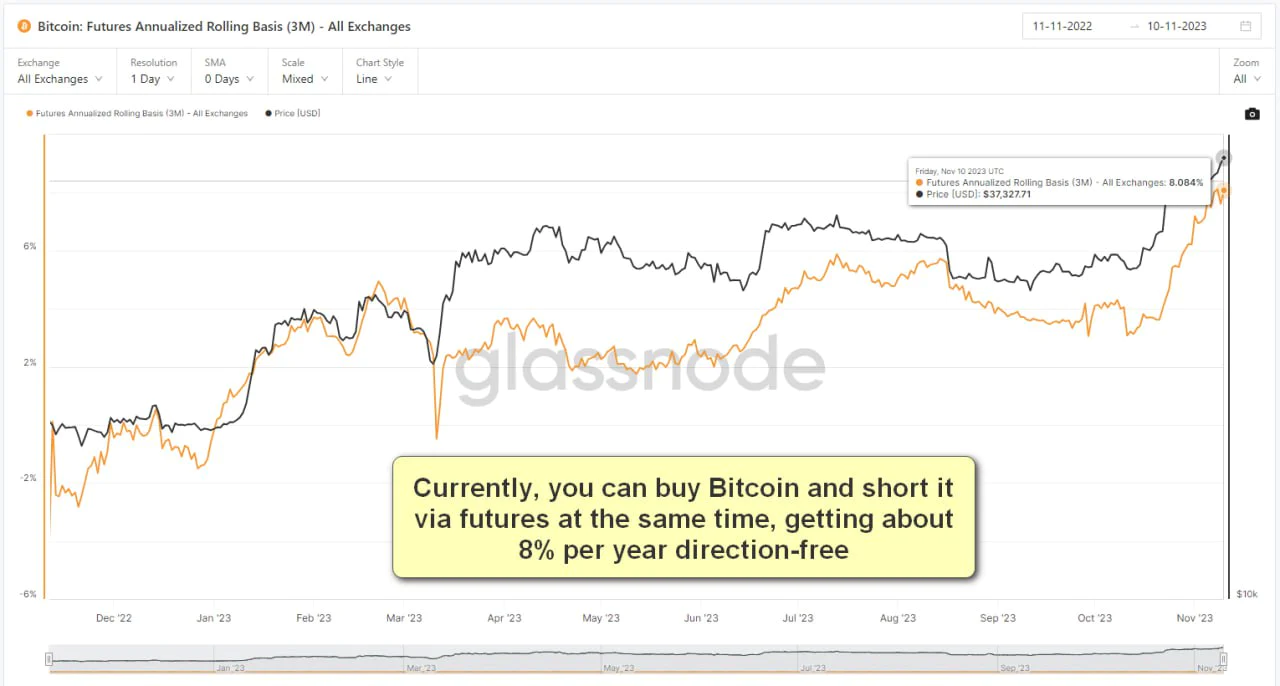

In many cases, the Futures Annualized Rolling Basis is overlooked as an interesting metric. In essence, it can be calculated by buying Bitcoin and shorting it via futures at the same time, in dollars (not Bitcoin). An increase in institutional interest is likely to be reflected in high values. There has been a lot of money flowing into this "basis" trading with zero directional risk during the last Bitcoin bull run. Since bitcoin offered negative returns during the time of "basis" trading, this money has been moving away from Bitcoin. Now, this money is likely to return, increasing Bitcoin's demand. Currently, the average return is 8% on the market, with some exchanges, like Deribit, offering returns above 10%. Those returns are certainly impressive for directional-risk-free trading, suggesting that large amounts of money are aligned for these returns. Thus, Bitcoin has to be bought.

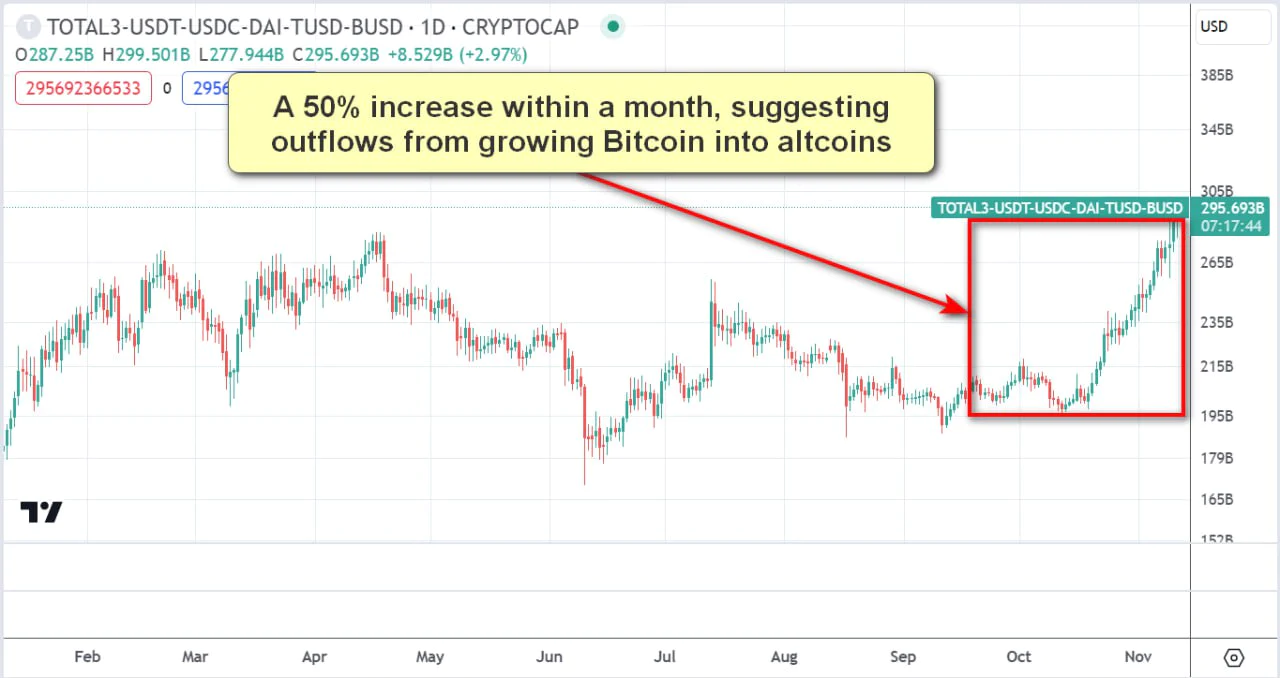

Also noteworthy is the outflow of Bitcoin money into altcoins, something that is very unusual for a bear market. Cryptocurrency market capitalization has increased almost 50% in the last month alone when we subtract Bitcoin, Ethereum, and all top stablecoins. This is an indication that the market is currently in a bull market phase. Using Glassnode's weekly reports, you can see a detailed analysis based on on-chain metrics.

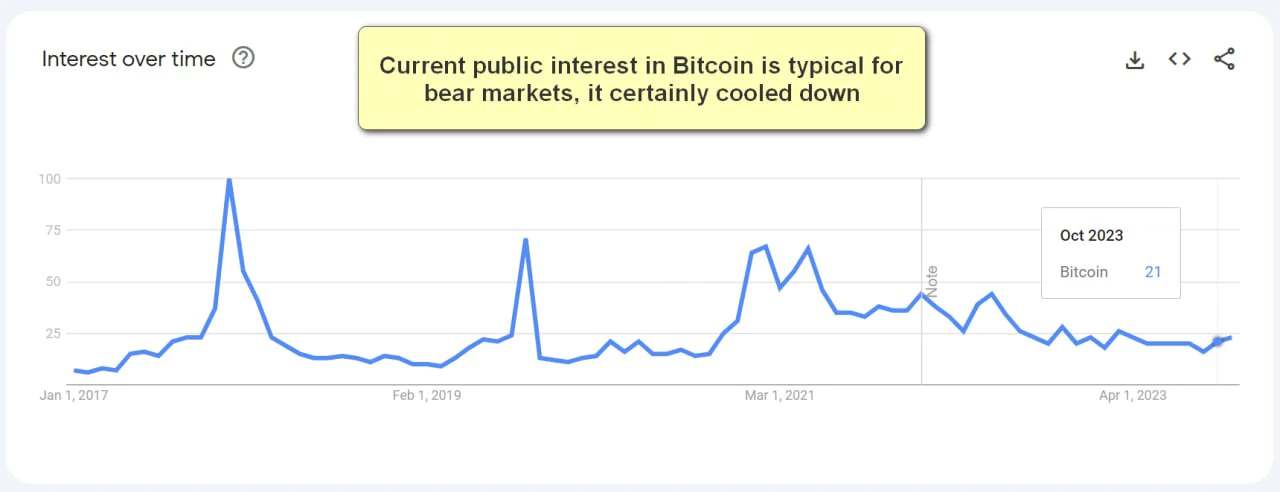

The institutional demand has cooled down significantly since the FTX collapse, on the other hand. Crypto investments are viewed as full of fraud and manipulation by many of the largest investors (which is true) and they don't want to get involved. The demand for crypto has significantly decreased across the institutional board according to several private reports made for professional investors. Surveys of professional market participants are used as vague metrics. All market metrics, however, are rather vague.

Google Trends also shows this cooling down. A bear market is characterized by current interest rates. However, it is important to keep in mind that these values are usually lagging. The big numbers only appear when it's too late to get involved.

U.S. government bonds can also earn you 5% per year in dollars, which reduces anticipated buying pressure. Would you rather put your money in a safe investment and earn 5% per year with almost no risk than risk it on exchanges or in high-risk crypto assets? High-risk investments are likely to be avoided by large institutions in developed economies due to high interest rates.

A saying I remember from my mentor often comes to mind whenever I'm dealing with markets: "If you're hesitant, look at the charts - they're not lying, but people are". According to the charts, we are likely in a bull market phase. It is unlikely that this trend will reverse unexpectedly, but it is possible.

Let's move on to the typical questions "that a professional Crypto trader would ask himself"

-

Is it a good time to buy?

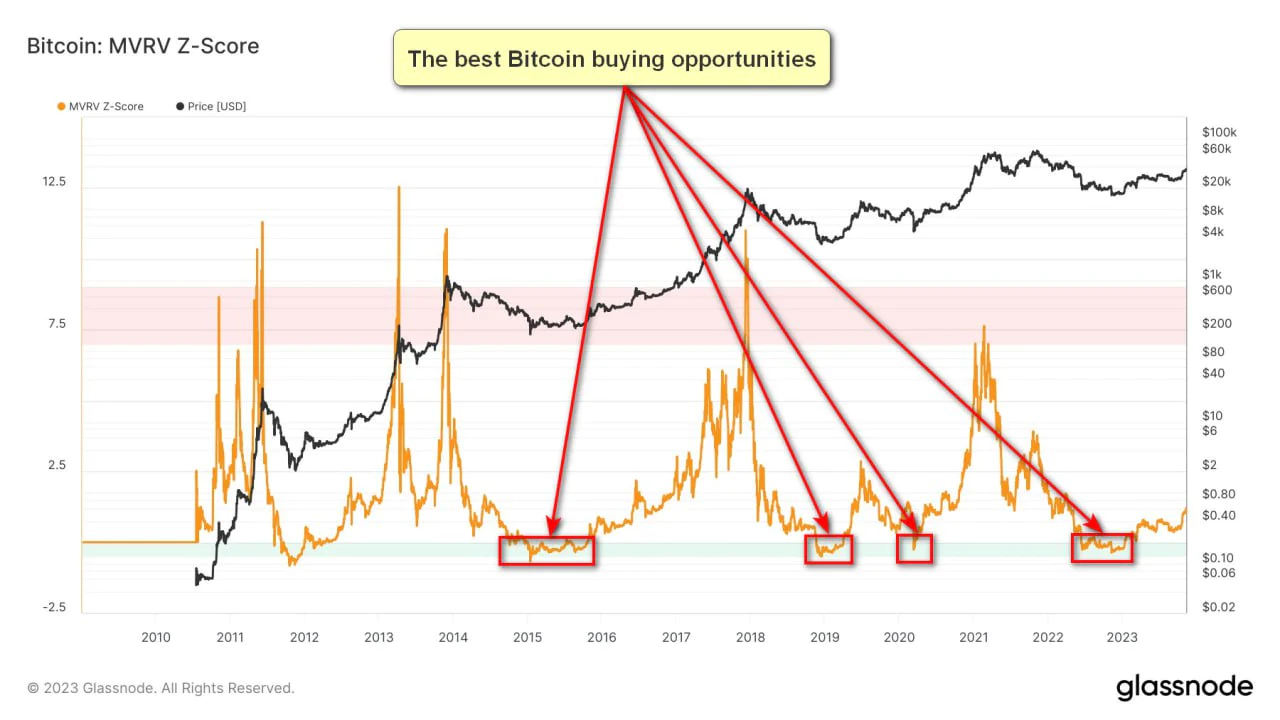

Your investor's profile will determine the answer. The best time to buy a crypto asset, such as Bitcoin, is usually determined by a few indicators, if you are comfortable with high-risk assets. About a year ago, these showed a good time to buy. Warren Buffett said that the second-best time to buy is now. High-risk assets, such as crypto, require you to be prepared for significant drawdowns. As most investors, you will likely exit the market at the worst possible exit point if you aren't ready.

-

Is it a good idea to wait for a drawdown?

The future cannot be predicted with certainty. Therefore, Bitcoin's uptrend or significant decline is impossible to predict. Investments come with the possibility of the worst possible outcomes, so you must be prepared for them. Market experts who don't try to be prophets will tell you that. It is impossible to predict the future with confidence at all times, so there is no prophet capable of doing so.

-

Crypto markets are expected to grow in the future. What are the best altcoins to buy?

There will be a lot of "surplus" Bitcoin growth flowing into altcoins if we are indeed in a bull run market phase. The additional liquidity of these instruments may also lead to their rapid growth, since they are much less liquid than Bitcoin. During the last week alone, altcoins such as Link have grown by over 40%. Several times more growth is possible for these altcoins if an uptrend continues.

As I mentioned, Link is one of the safest altcoins to invest in. In spite of its underperformance, Ethereum remains one of the most reliable investments. I'm unsure about Binance's BNB because it is losing market share and will continue to do so. I also hold speculative medium-term positions in coins like RLB. In the next bull market phase, you may be able to find rare gems that are not currently in the top 100, but their chances are slim. There are two ways to do it: either you're lucky or you're an expert in the crypto market.

Bottom Line

A cautious optimism is currently prevailing in the crypto market, but attractive bond yields have given the traditional financial sector renewed appeal. Technical indicators suggest that Bitcoin is in a bullish phase, encouraging those with high risk tolerances to take advantage. You shouldn't invest in crypto now if you don't have any, but it's better than FOMOing at the height of the market. When it comes to your money that's at stake, I always recommend using sound money and risk management methods.

Here on MyFxBots.com, we reviewed an important crypto-trading expert advisor, Happy Bitcoin which holds a very powerful automated trading strategy for bitcoin, and was proved to be a successful profitable EA via 3rd party live trading result analyzer MyFxBook, but we seem to be waiting for a huge explosion in crypto trading strategy development via Valeriia Mishchenko that started sharing her private crypto trading solution for the past five years to a small group of friends and family members as she claims. A new platform that will open up this exclusive circle of serious investors has been in development behind the scenes due to the growing interest. In a few months, we'll reveal more details. Valeriia Mishchenko's crypto journey is about to get exciting!