A few days ago these Tick Data backtests to Live trading results comparison charts were released by Phibase, the vendors and developers of the new amazing RayBOT EA. These results are spanning from the 1st Feb to the 18th March 2016 and here they are (to enlarge an image, left click on it):

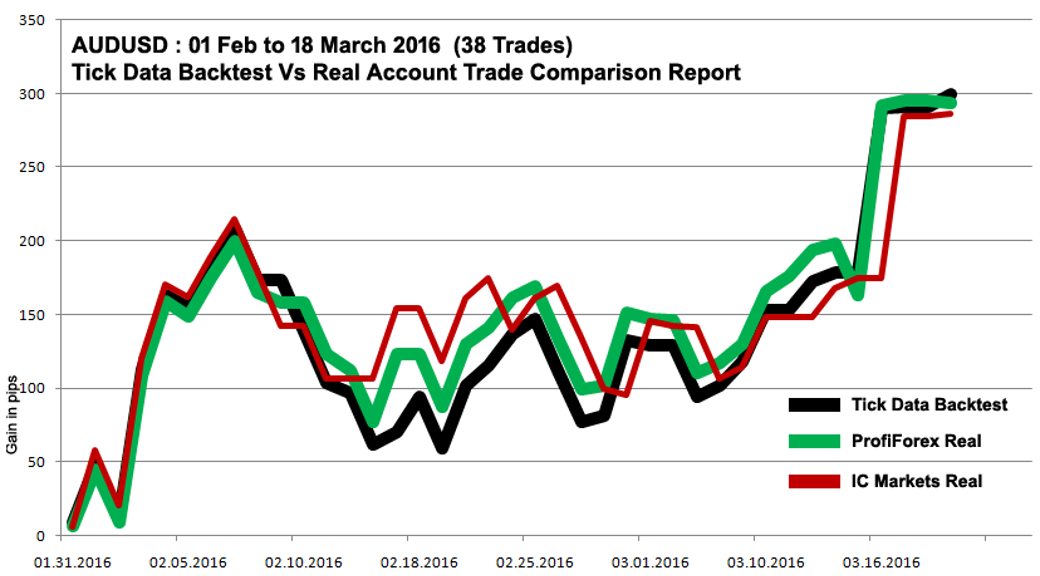

Comparison Results For AUDUSD

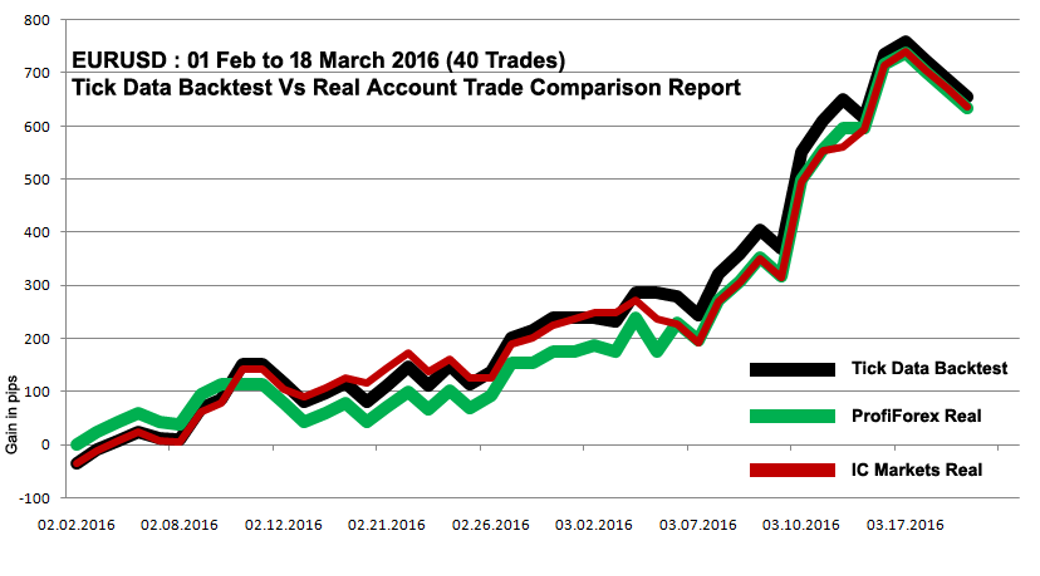

Comparison Results for EURUSD

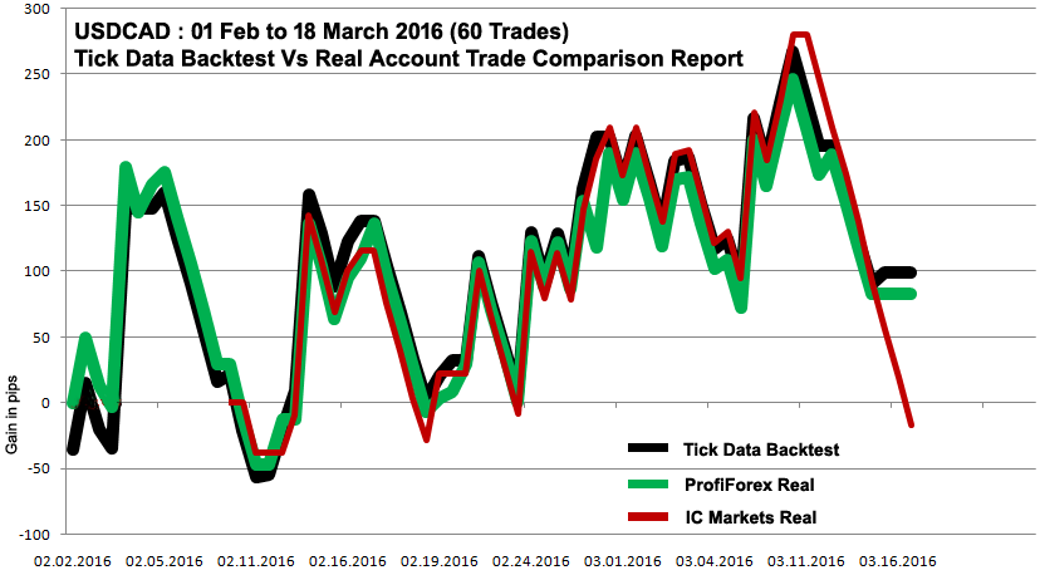

Comparison Results for USDCAD

Brief Analysis of the Comparison

- The backtests used for this comparison were performed using tickdata and the generated strategy test files were uploaded to MyfxBook for more detailed analysis at these links:

- By brief analysis for this comparison, it's obvious that the Backtest results are too closely matching those of real account live trading. This strongly validate the long-term strategy used by RayBOT algorithm. More comparison reports like this will be released periodically by Phibase every 3 months as they promised, a perfect way to properly develop and fine tune the EA strategy and performance by its own developers.

- Since the first launch of this comparison on the 1st Feb till its end, no settings updates or optimization were needed to give the previous results on the charts and they are summarized as:

- Individual currency pairs performance:

- The best performing pair was EURUSD with gains of about +630 pips.

- Comes next in performance, AUDUSD with gains of about +290 pips.

- USDCAD was the least gaining pair with a long flat period without so much contribution to RayBOT equity curve.

- Periods of loss are inevitable, but thanks to this market varieties confrontation ability of the EA strategy, the drawdown durations are maximally reduced.

- RayBOT performance has another good proof of rapid recovery capability through its positive risk:reward ratio.

- The potential profits that RayBOT can generate according to the Backtest results ranges from 5% to 15% a month using the default recommended risk of 7 with 20% drawdown which is considered logic at this risk level.

- RayBOT calculates the lot size which may vary from one pair to another in a way that guarantees a similar equity gain / loss per pip for the three pairs together. In the current market situation, the lot size calculated by the EA for USDCAD is normally larger than that calculated for EURUSD or AUDUSD.

Important Note (For Beginners)

Some users of the EA could experience unmatched trades with the 3rd party (MyfxBook) verified live performance results and this is most commonly due to missing the history files.

As stated in the RayBOT user manual, the EA uses M15 and H1 indicator calculations to generate an overview on the market's trend and price action.

Historical bars of M15 and H1 timeframes for not less than 3 days prior to the first attachment of the EA are mandatory.

To ensure that you have this in your MT4 terminal, you can do the following:

Load a chart of one of the supported pairs and change it to M15 timeframe.

From the chart properties (by left click menu on the chart), switch off the Auto-Scroll option.

Scroll the chart screen for about a week back.

Change the chart's timeframe again to H1.

Further scroll for a few days back.

Now you can attach RayBOT to this chart after changing its timeframe once again to M15.

During the previous steps, when you scroll the chart screen back, the MT4 terminal creates and stores the required HST files for drawing the chart on the screen which provides the EA with the required look back data.

Don't forget to set all the charts' timeframes to M15 before attaching the EA to them.