Menu

Forex Real Profit EA is a scalper mostly an Asian session but extends through out the day via multiple different TP and SL targets for every pair of its 11 tradable pairs. It also uses a unique filter to wipe out potentially dangerous conditions. It doesn't use a martingale system or recovery mode.

Trading Idea

A scalper EA mostly an Asian session but extends through out the day via multiple different TP and SL targets for every pair of its 11 tradable pairs. It also uses a unique filter to wipe out potentially dangerous conditions. It doesn't use a martingale system or recovery mode.

Specifications

NFA compliance

Yes (special setting).

License

1 live account + unlimited demo accounts for One Year (Extra live Account will cost $99 / year for each)

Refund policy

30 days.

Compatible Brokers

All including ECN brokers which are the recommended as Tickmill, and IC Markets. It operates with 4 and 5 digits after the decimal point, even with micro lots.

Currency Deposit

Any

Supported Currency Pairs

EUR/AUD, EUR/CAD, EUR/CHF, EUR/GBP, EUR/USD, GBP/CHF, GBP/USD, USD/CAD, USD/CHF, USD/JPY

MetaTrader Chart Timeframe

M15

Live Performance Results

More than 60 months of third party (MyfxBook) verified trading results using real money accounts only:

Real Money Account

Started On

Jun 05, 2013

Leverage

1:500

Broker

IC Markets

Starting Balance

$$2,639.00

Total Gain

+456.38%

Live Test Summary

Started On

Jun 05, 2013

Account Leverage

1:500

Profit Factor

1.17

Total Gain

+456.38%

Absolute Gain

+65.32%

Monthly Gain

1.71%

Daily Gain

0.06%

Total Pips

14430.5

Total Trades

7891

Profit Amount

$1723.82

(%) Won Trades

14430.5

Drawdown

27.30%

Real Money Account

Started On

Jun 05, 2013

Leverage

1:500

Broker

IC Markets

Starting Balance

$$2,639.00

Total Gain

+456.38%

Live Test Summary

Started On

Jun 05, 2013

Account Leverage

1:500

Profit Factor

1.17

Total Gain

+456.38%

Absolute Gain

+65.32%

Monthly Gain

1.71%

Daily Gain

0.06%

Total Pips

14430.5

Total Trades

7891

Profit Amount

$1723.82

(%) Won Trades

14430.5

Drawdown

27.30%

Real Money Account

Started On

Jun 05, 2013

Leverage

1:500

Broker

IC Markets

Starting Balance

$$2,639.00

Total Gain

+456.38%

Live Test Summary

Started On

Jun 05, 2013

Account Leverage

1:500

Profit Factor

1.17

Total Gain

+456.38%

Absolute Gain

+65.32%

Monthly Gain

1.71%

Daily Gain

0.06%

Total Pips

14430.5

Total Trades

7891

Profit Amount

$1723.82

(%) Won Trades

14430.5

Drawdown

27.30%

Real Money Account

Started On

Jun 05, 2013

Leverage

1:500

Broker

IC Markets

Starting Balance

$$2,639.00

Total Gain

+456.38%

Live Test Summary

Started On

Jun 05, 2013

Account Leverage

1:500

Profit Factor

1.17

Total Gain

+456.38%

Absolute Gain

+65.32%

Monthly Gain

1.71%

Daily Gain

0.06%

Total Pips

14430.5

Total Trades

7891

Profit Amount

$1723.82

(%) Won Trades

14430.5

Drawdown

27.30%

Real Money Account

Started On

Jun 05, 2013

Leverage

1:500

Broker

IC Markets

Starting Balance

$$2,639.00

Total Gain

+456.38%

Live Test Summary

Started On

Jun 05, 2013

Account Leverage

1:500

Profit Factor

1.17

Total Gain

+456.38%

Absolute Gain

+65.32%

Monthly Gain

1.71%

Daily Gain

0.06%

Total Pips

14430.5

Total Trades

7891

Profit Amount

$1723.82

(%) Won Trades

14430.5

Drawdown

27.30%

Real Money Account

Started On

Jun 05, 2013

Leverage

1:500

Broker

IC Markets

Starting Balance

$$2,639.00

Total Gain

+456.38%

Live Test Summary

Started On

Jun 05, 2013

Account Leverage

1:500

Profit Factor

1.17

Total Gain

+456.38%

Absolute Gain

+65.32%

Monthly Gain

1.71%

Daily Gain

0.06%

Total Pips

14430.5

Total Trades

7891

Profit Amount

$1723.82

(%) Won Trades

14430.5

Drawdown

27.30%

Real Money Account

Started On

Jun 05, 2013

Leverage

1:500

Broker

IC Markets

Starting Balance

$$2,639.00

Total Gain

+456.38%

Live Test Summary

Started On

Jun 05, 2013

Account Leverage

1:500

Profit Factor

1.17

Total Gain

+456.38%

Absolute Gain

+65.32%

Monthly Gain

1.71%

Daily Gain

0.06%

Total Pips

14430.5

Total Trades

7891

Profit Amount

$1723.82

(%) Won Trades

14430.5

Drawdown

27.30%

Real Money Account

Started On

Jun 05, 2013

Leverage

1:500

Broker

IC Markets

Starting Balance

$$2,639.00

Total Gain

+456.38%

Live Test Summary

Started On

Jun 05, 2013

Account Leverage

1:500

Profit Factor

1.17

Total Gain

+456.38%

Absolute Gain

+65.32%

Monthly Gain

1.71%

Daily Gain

0.06%

Total Pips

14430.5

Total Trades

7891

Profit Amount

$1723.82

(%) Won Trades

14430.5

Drawdown

27.30%

Real Money Account

Started On

Jun 05, 2013

Leverage

1:500

Broker

IC Markets

Starting Balance

$$2,639.00

Total Gain

+456.38%

Live Test Summary

Started On

Jun 05, 2013

Account Leverage

1:500

Profit Factor

1.17

Total Gain

+456.38%

Absolute Gain

+65.32%

Monthly Gain

1.71%

Daily Gain

0.06%

Total Pips

14430.5

Total Trades

7891

Profit Amount

$1723.82

(%) Won Trades

14430.5

Drawdown

27.30%

Real Money Account

Started On

Jun 05, 2013

Leverage

1:500

Broker

IC Markets

Starting Balance

$$2,639.00

Total Gain

+456.38%

Live Test Summary

Started On

Jun 05, 2013

Account Leverage

1:500

Profit Factor

1.17

Total Gain

+456.38%

Absolute Gain

+65.32%

Monthly Gain

1.71%

Daily Gain

0.06%

Total Pips

14430.5

Total Trades

7891

Profit Amount

$1723.82

(%) Won Trades

14430.5

Drawdown

27.30%

Real Money Account

Started On

Jun 05, 2013

Leverage

1:500

Broker

IC Markets

Starting Balance

$$2,639.00

Total Gain

+456.38%

Live Test Summary

Started On

Jun 05, 2013

Account Leverage

1:500

Profit Factor

1.17

Total Gain

+456.38%

Absolute Gain

+65.32%

Monthly Gain

1.71%

Daily Gain

0.06%

Total Pips

14430.5

Total Trades

7891

Profit Amount

$1723.82

(%) Won Trades

14430.5

Drawdown

27.30%

Real Money Account

Started On

Jun 05, 2013

Leverage

1:500

Broker

IC Markets

Starting Balance

$$2,639.00

Total Gain

+456.38%

Live Test Summary

Started On

Jun 05, 2013

Account Leverage

1:500

Profit Factor

1.17

Total Gain

+456.38%

Absolute Gain

+65.32%

Monthly Gain

1.71%

Daily Gain

0.06%

Total Pips

14430.5

Total Trades

7891

Profit Amount

$1723.82

(%) Won Trades

14430.5

Drawdown

27.30%

Real Money Account

Started On

Jun 05, 2013

Leverage

1:500

Broker

IC Markets

Starting Balance

$$2,639.00

Total Gain

+456.38%

Live Test Summary

Started On

Jun 05, 2013

Account Leverage

1:500

Profit Factor

1.17

Total Gain

+456.38%

Absolute Gain

+65.32%

Monthly Gain

1.71%

Daily Gain

0.06%

Total Pips

14430.5

Total Trades

7891

Profit Amount

$1723.82

(%) Won Trades

14430.5

Drawdown

27.30%

Real Money Account

Started On

Jun 05, 2013

Leverage

1:500

Broker

IC Markets

Starting Balance

$$2,639.00

Total Gain

+456.38%

Live Test Summary

Started On

Jun 05, 2013

Account Leverage

1:500

Profit Factor

1.17

Total Gain

+456.38%

Absolute Gain

+65.32%

Monthly Gain

1.71%

Daily Gain

0.06%

Total Pips

14430.5

Total Trades

7891

Profit Amount

$1723.82

(%) Won Trades

14430.5

Drawdown

27.30%

Real Money Account

Started On

Jun 05, 2013

Leverage

1:500

Broker

IC Markets

Starting Balance

$$2,639.00

Total Gain

+456.38%

Live Test Summary

Started On

Jun 05, 2013

Account Leverage

1:500

Profit Factor

1.17

Total Gain

+456.38%

Absolute Gain

+65.32%

Monthly Gain

1.71%

Daily Gain

0.06%

Total Pips

14430.5

Total Trades

7891

Profit Amount

$1723.82

(%) Won Trades

14430.5

Drawdown

27.30%

Real Money Account

Started On

Jun 05, 2013

Leverage

1:500

Broker

IC Markets

Starting Balance

$$2,639.00

Total Gain

+456.38%

Live Test Summary

Started On

Jun 05, 2013

Account Leverage

1:500

Profit Factor

1.17

Total Gain

+456.38%

Absolute Gain

+65.32%

Monthly Gain

1.71%

Daily Gain

0.06%

Total Pips

14430.5

Total Trades

7891

Profit Amount

$1723.82

(%) Won Trades

14430.5

Drawdown

27.30%

Real Money Account

Started On

Jun 05, 2013

Leverage

1:500

Broker

IC Markets

Starting Balance

$$2,639.00

Total Gain

+456.38%

Live Test Summary

Started On

Jun 05, 2013

Account Leverage

1:500

Profit Factor

1.17

Total Gain

+456.38%

Absolute Gain

+65.32%

Monthly Gain

1.71%

Daily Gain

0.06%

Total Pips

14430.5

Total Trades

7891

Profit Amount

$1723.82

(%) Won Trades

14430.5

Drawdown

27.30%

Real Money Account

Started On

Jun 05, 2013

Leverage

1:500

Broker

IC Markets

Starting Balance

$$2,639.00

Total Gain

+456.38%

Live Test Summary

Started On

Jun 05, 2013

Account Leverage

1:500

Profit Factor

1.17

Total Gain

+456.38%

Absolute Gain

+65.32%

Monthly Gain

1.71%

Daily Gain

0.06%

Total Pips

14430.5

Total Trades

7891

Profit Amount

$1723.82

(%) Won Trades

14430.5

Drawdown

27.30%

Real Money Account

Started On

Jun 05, 2013

Leverage

1:500

Broker

IC Markets

Starting Balance

$$2,639.00

Total Gain

+456.38%

Live Test Summary

Started On

Jun 05, 2013

Account Leverage

1:500

Profit Factor

1.17

Total Gain

+456.38%

Absolute Gain

+65.32%

Monthly Gain

1.71%

Daily Gain

0.06%

Total Pips

14430.5

Total Trades

7891

Profit Amount

$1723.82

(%) Won Trades

14430.5

Drawdown

27.30%

Real Money Account

Started On

Jun 05, 2013

Leverage

1:500

Broker

IC Markets

Starting Balance

$$2,639.00

Total Gain

+456.38%

Live Test Summary

Started On

Jun 05, 2013

Account Leverage

1:500

Profit Factor

1.17

Total Gain

+456.38%

Absolute Gain

+65.32%

Monthly Gain

1.71%

Daily Gain

0.06%

Total Pips

14430.5

Total Trades

7891

Profit Amount

$1723.82

(%) Won Trades

14430.5

Drawdown

27.30%

Real Money Account

Started On

Jun 05, 2013

Leverage

1:500

Broker

IC Markets

Starting Balance

$$2,639.00

Total Gain

+456.38%

Live Test Summary

Started On

Jun 05, 2013

Account Leverage

1:500

Profit Factor

1.17

Total Gain

+456.38%

Absolute Gain

+65.32%

Monthly Gain

1.71%

Daily Gain

0.06%

Total Pips

14430.5

Total Trades

7891

Profit Amount

$1723.82

(%) Won Trades

14430.5

Drawdown

27.30%

Real Money Account

Started On

Jun 05, 2013

Leverage

1:500

Broker

IC Markets

Starting Balance

$$2,639.00

Total Gain

+456.38%

Live Test Summary

Started On

Jun 05, 2013

Account Leverage

1:500

Profit Factor

1.17

Total Gain

+456.38%

Absolute Gain

+65.32%

Monthly Gain

1.71%

Daily Gain

0.06%

Total Pips

14430.5

Total Trades

7891

Profit Amount

$1723.82

(%) Won Trades

14430.5

Drawdown

27.30%

Real Money Account

Started On

Jun 05, 2013

Leverage

1:500

Broker

IC Markets

Starting Balance

$$2,639.00

Total Gain

+456.38%

Live Test Summary

Started On

Jun 05, 2013

Account Leverage

1:500

Profit Factor

1.17

Total Gain

+456.38%

Absolute Gain

+65.32%

Monthly Gain

1.71%

Daily Gain

0.06%

Total Pips

14430.5

Total Trades

7891

Profit Amount

$1723.82

(%) Won Trades

14430.5

Drawdown

27.30%

Real Money Account

Started On

Jun 05, 2013

Leverage

1:500

Broker

IC Markets

Starting Balance

$$2,639.00

Total Gain

+456.38%

Live Test Summary

Started On

Jun 05, 2013

Account Leverage

1:500

Profit Factor

1.17

Total Gain

+456.38%

Absolute Gain

+65.32%

Monthly Gain

1.71%

Daily Gain

0.06%

Total Pips

14430.5

Total Trades

7891

Profit Amount

$1723.82

(%) Won Trades

14430.5

Drawdown

27.30%

Real Money Account

Started On

Jun 05, 2013

Leverage

1:500

Broker

IC Markets

Starting Balance

$$2,639.00

Total Gain

+456.38%

Live Test Summary

Started On

Jun 05, 2013

Account Leverage

1:500

Profit Factor

1.17

Total Gain

+456.38%

Absolute Gain

+65.32%

Monthly Gain

1.71%

Daily Gain

0.06%

Total Pips

14430.5

Total Trades

7891

Profit Amount

$1723.82

(%) Won Trades

14430.5

Drawdown

27.30%

Real Money Account

Started On

Jun 05, 2013

Leverage

1:500

Broker

IC Markets

Starting Balance

$$2,639.00

Total Gain

+456.38%

Live Test Summary

Started On

Jun 05, 2013

Account Leverage

1:500

Profit Factor

1.17

Total Gain

+456.38%

Absolute Gain

+65.32%

Monthly Gain

1.71%

Daily Gain

0.06%

Total Pips

14430.5

Total Trades

7891

Profit Amount

$1723.82

(%) Won Trades

14430.5

Drawdown

27.30%

Real Money Account

Started On

Dec 11, 2013

Leverage

1:500

Broker

IC Markets

Starting Balance

$$3,534.53

Total Gain

+721.01%

Live Test Summary

Started On

Dec 11, 2013

Account Leverage

1:500

Profit Factor

1.26

Total Gain

+721.01%

Absolute Gain

+27.34%

Monthly Gain

2.24%

Daily Gain

0.07%

Total Pips

5155.8

Total Trades

1635

Profit Amount

$966.21

(%) Won Trades

5155.8

Drawdown

37.56%

Real Money Account

Started On

Dec 11, 2013

Leverage

1:500

Broker

IC Markets

Starting Balance

$$3,534.53

Total Gain

+721.01%

Live Test Summary

Started On

Dec 11, 2013

Account Leverage

1:500

Profit Factor

1.26

Total Gain

+721.01%

Absolute Gain

+27.34%

Monthly Gain

2.24%

Daily Gain

0.07%

Total Pips

5155.8

Total Trades

1635

Profit Amount

$966.21

(%) Won Trades

5155.8

Drawdown

37.56%

Real Money Account

Started On

Dec 11, 2013

Leverage

1:500

Broker

IC Markets

Starting Balance

$$3,534.53

Total Gain

+721.01%

Live Test Summary

Started On

Dec 11, 2013

Account Leverage

1:500

Profit Factor

1.26

Total Gain

+721.01%

Absolute Gain

+27.34%

Monthly Gain

2.24%

Daily Gain

0.07%

Total Pips

5155.8

Total Trades

1635

Profit Amount

$966.21

(%) Won Trades

5155.8

Drawdown

37.56%

Real Money Account

Started On

Dec 11, 2013

Leverage

1:500

Broker

IC Markets

Starting Balance

$$3,534.53

Total Gain

+721.01%

Live Test Summary

Started On

Dec 11, 2013

Account Leverage

1:500

Profit Factor

1.26

Total Gain

+721.01%

Absolute Gain

+27.34%

Monthly Gain

2.24%

Daily Gain

0.07%

Total Pips

5155.8

Total Trades

1635

Profit Amount

$966.21

(%) Won Trades

5155.8

Drawdown

37.56%

Real Money Account

Started On

Dec 11, 2013

Leverage

1:500

Broker

IC Markets

Starting Balance

$$3,534.53

Total Gain

+721.01%

Live Test Summary

Started On

Dec 11, 2013

Account Leverage

1:500

Profit Factor

1.26

Total Gain

+721.01%

Absolute Gain

+27.34%

Monthly Gain

2.24%

Daily Gain

0.07%

Total Pips

5155.8

Total Trades

1635

Profit Amount

$966.21

(%) Won Trades

5155.8

Drawdown

37.56%

Real Money Account

Started On

Dec 11, 2013

Leverage

1:500

Broker

IC Markets

Starting Balance

$$3,534.53

Total Gain

+721.01%

Live Test Summary

Started On

Dec 11, 2013

Account Leverage

1:500

Profit Factor

1.26

Total Gain

+721.01%

Absolute Gain

+27.34%

Monthly Gain

2.24%

Daily Gain

0.07%

Total Pips

5155.8

Total Trades

1635

Profit Amount

$966.21

(%) Won Trades

5155.8

Drawdown

37.56%

Real Money Account

Started On

Dec 11, 2013

Leverage

1:500

Broker

IC Markets

Starting Balance

$$3,534.53

Total Gain

+721.01%

Live Test Summary

Started On

Dec 11, 2013

Account Leverage

1:500

Profit Factor

1.26

Total Gain

+721.01%

Absolute Gain

+27.34%

Monthly Gain

2.24%

Daily Gain

0.07%

Total Pips

5155.8

Total Trades

1635

Profit Amount

$966.21

(%) Won Trades

5155.8

Drawdown

37.56%

Real Money Account

Started On

Dec 11, 2013

Leverage

1:500

Broker

IC Markets

Starting Balance

$$3,534.53

Total Gain

+721.01%

Live Test Summary

Started On

Dec 11, 2013

Account Leverage

1:500

Profit Factor

1.26

Total Gain

+721.01%

Absolute Gain

+27.34%

Monthly Gain

2.24%

Daily Gain

0.07%

Total Pips

5155.8

Total Trades

1635

Profit Amount

$966.21

(%) Won Trades

5155.8

Drawdown

37.56%

Real Money Account

Started On

Dec 11, 2013

Leverage

1:500

Broker

IC Markets

Starting Balance

$$3,534.53

Total Gain

+721.01%

Live Test Summary

Started On

Dec 11, 2013

Account Leverage

1:500

Profit Factor

1.26

Total Gain

+721.01%

Absolute Gain

+27.34%

Monthly Gain

2.24%

Daily Gain

0.07%

Total Pips

5155.8

Total Trades

1635

Profit Amount

$966.21

(%) Won Trades

5155.8

Drawdown

37.56%

Real Money Account

Started On

Dec 11, 2013

Leverage

1:500

Broker

IC Markets

Starting Balance

$$3,534.53

Total Gain

+721.01%

Live Test Summary

Started On

Dec 11, 2013

Account Leverage

1:500

Profit Factor

1.26

Total Gain

+721.01%

Absolute Gain

+27.34%

Monthly Gain

2.24%

Daily Gain

0.07%

Total Pips

5155.8

Total Trades

1635

Profit Amount

$966.21

(%) Won Trades

5155.8

Drawdown

37.56%

Real Money Account

Started On

Dec 11, 2013

Leverage

1:500

Broker

IC Markets

Starting Balance

$$3,534.53

Total Gain

+721.01%

Live Test Summary

Started On

Dec 11, 2013

Account Leverage

1:500

Profit Factor

1.26

Total Gain

+721.01%

Absolute Gain

+27.34%

Monthly Gain

2.24%

Daily Gain

0.07%

Total Pips

5155.8

Total Trades

1635

Profit Amount

$966.21

(%) Won Trades

5155.8

Drawdown

37.56%

Real Money Account

Started On

Dec 11, 2013

Leverage

1:500

Broker

IC Markets

Starting Balance

$$3,534.53

Total Gain

+721.01%

Live Test Summary

Started On

Dec 11, 2013

Account Leverage

1:500

Profit Factor

1.26

Total Gain

+721.01%

Absolute Gain

+27.34%

Monthly Gain

2.24%

Daily Gain

0.07%

Total Pips

5155.8

Total Trades

1635

Profit Amount

$966.21

(%) Won Trades

5155.8

Drawdown

37.56%

Real Money Account

Started On

Dec 11, 2013

Leverage

1:500

Broker

IC Markets

Starting Balance

$$3,534.53

Total Gain

+721.01%

Live Test Summary

Started On

Dec 11, 2013

Account Leverage

1:500

Profit Factor

1.26

Total Gain

+721.01%

Absolute Gain

+27.34%

Monthly Gain

2.24%

Daily Gain

0.07%

Total Pips

5155.8

Total Trades

1635

Profit Amount

$966.21

(%) Won Trades

5155.8

Drawdown

37.56%

Real Money Account

Started On

Dec 11, 2013

Leverage

1:500

Broker

IC Markets

Starting Balance

$$3,534.53

Total Gain

+721.01%

Live Test Summary

Started On

Dec 11, 2013

Account Leverage

1:500

Profit Factor

1.26

Total Gain

+721.01%

Absolute Gain

+27.34%

Monthly Gain

2.24%

Daily Gain

0.07%

Total Pips

5155.8

Total Trades

1635

Profit Amount

$966.21

(%) Won Trades

5155.8

Drawdown

37.56%

Real Money Account

Started On

Dec 11, 2013

Leverage

1:500

Broker

IC Markets

Starting Balance

$$3,534.53

Total Gain

+721.01%

Live Test Summary

Started On

Dec 11, 2013

Account Leverage

1:500

Profit Factor

1.26

Total Gain

+721.01%

Absolute Gain

+27.34%

Monthly Gain

2.24%

Daily Gain

0.07%

Total Pips

5155.8

Total Trades

1635

Profit Amount

$966.21

(%) Won Trades

5155.8

Drawdown

37.56%

Real Money Account

Started On

Dec 11, 2013

Leverage

1:500

Broker

IC Markets

Starting Balance

$$3,534.53

Total Gain

+721.01%

Live Test Summary

Started On

Dec 11, 2013

Account Leverage

1:500

Profit Factor

1.26

Total Gain

+721.01%

Absolute Gain

+27.34%

Monthly Gain

2.24%

Daily Gain

0.07%

Total Pips

5155.8

Total Trades

1635

Profit Amount

$966.21

(%) Won Trades

5155.8

Drawdown

37.56%

Real Money Account

Started On

Dec 11, 2013

Leverage

1:500

Broker

IC Markets

Starting Balance

$$3,534.53

Total Gain

+721.01%

Live Test Summary

Started On

Dec 11, 2013

Account Leverage

1:500

Profit Factor

1.26

Total Gain

+721.01%

Absolute Gain

+27.34%

Monthly Gain

2.24%

Daily Gain

0.07%

Total Pips

5155.8

Total Trades

1635

Profit Amount

$966.21

(%) Won Trades

5155.8

Drawdown

37.56%

Real Money Account

Started On

Dec 11, 2013

Leverage

1:500

Broker

IC Markets

Starting Balance

$$3,534.53

Total Gain

+721.01%

Live Test Summary

Started On

Dec 11, 2013

Account Leverage

1:500

Profit Factor

1.26

Total Gain

+721.01%

Absolute Gain

+27.34%

Monthly Gain

2.24%

Daily Gain

0.07%

Total Pips

5155.8

Total Trades

1635

Profit Amount

$966.21

(%) Won Trades

5155.8

Drawdown

37.56%

Real Money Account

Started On

Dec 11, 2013

Leverage

1:500

Broker

IC Markets

Starting Balance

$$3,534.53

Total Gain

+721.01%

Live Test Summary

Started On

Dec 11, 2013

Account Leverage

1:500

Profit Factor

1.26

Total Gain

+721.01%

Absolute Gain

+27.34%

Monthly Gain

2.24%

Daily Gain

0.07%

Total Pips

5155.8

Total Trades

1635

Profit Amount

$966.21

(%) Won Trades

5155.8

Drawdown

37.56%

Real Money Account

Started On

Dec 11, 2013

Leverage

1:500

Broker

IC Markets

Starting Balance

$$3,534.53

Total Gain

+721.01%

Live Test Summary

Started On

Dec 11, 2013

Account Leverage

1:500

Profit Factor

1.26

Total Gain

+721.01%

Absolute Gain

+27.34%

Monthly Gain

2.24%

Daily Gain

0.07%

Total Pips

5155.8

Total Trades

1635

Profit Amount

$966.21

(%) Won Trades

5155.8

Drawdown

37.56%

Real Money Account

Started On

Dec 11, 2013

Leverage

1:500

Broker

IC Markets

Starting Balance

$$3,534.53

Total Gain

+721.01%

Live Test Summary

Started On

Dec 11, 2013

Account Leverage

1:500

Profit Factor

1.26

Total Gain

+721.01%

Absolute Gain

+27.34%

Monthly Gain

2.24%

Daily Gain

0.07%

Total Pips

5155.8

Total Trades

1635

Profit Amount

$966.21

(%) Won Trades

5155.8

Drawdown

37.56%

Real Money Account

Started On

Dec 11, 2013

Leverage

1:500

Broker

IC Markets

Starting Balance

$$3,534.53

Total Gain

+721.01%

Live Test Summary

Started On

Dec 11, 2013

Account Leverage

1:500

Profit Factor

1.26

Total Gain

+721.01%

Absolute Gain

+27.34%

Monthly Gain

2.24%

Daily Gain

0.07%

Total Pips

5155.8

Total Trades

1635

Profit Amount

$966.21

(%) Won Trades

5155.8

Drawdown

37.56%

Real Money Account

Started On

Dec 11, 2013

Leverage

1:500

Broker

IC Markets

Starting Balance

$$3,534.53

Total Gain

+721.01%

Live Test Summary

Started On

Dec 11, 2013

Account Leverage

1:500

Profit Factor

1.26

Total Gain

+721.01%

Absolute Gain

+27.34%

Monthly Gain

2.24%

Daily Gain

0.07%

Total Pips

5155.8

Total Trades

1635

Profit Amount

$966.21

(%) Won Trades

5155.8

Drawdown

37.56%

Real Money Account

Started On

Dec 11, 2013

Leverage

1:500

Broker

IC Markets

Starting Balance

$$3,534.53

Total Gain

+721.01%

Live Test Summary

Started On

Dec 11, 2013

Account Leverage

1:500

Profit Factor

1.26

Total Gain

+721.01%

Absolute Gain

+27.34%

Monthly Gain

2.24%

Daily Gain

0.07%

Total Pips

5155.8

Total Trades

1635

Profit Amount

$966.21

(%) Won Trades

5155.8

Drawdown

37.56%

Real Money Account

Started On

Dec 11, 2013

Leverage

1:500

Broker

IC Markets

Starting Balance

$$3,534.53

Total Gain

+721.01%

Live Test Summary

Started On

Dec 11, 2013

Account Leverage

1:500

Profit Factor

1.26

Total Gain

+721.01%

Absolute Gain

+27.34%

Monthly Gain

2.24%

Daily Gain

0.07%

Total Pips

5155.8

Total Trades

1635

Profit Amount

$966.21

(%) Won Trades

5155.8

Drawdown

37.56%

Real Money Account

Started On

Dec 11, 2013

Leverage

1:500

Broker

IC Markets

Starting Balance

$$3,534.53

Total Gain

+721.01%

Live Test Summary

Started On

Dec 11, 2013

Account Leverage

1:500

Profit Factor

1.26

Total Gain

+721.01%

Absolute Gain

+27.34%

Monthly Gain

2.24%

Daily Gain

0.07%

Total Pips

5155.8

Total Trades

1635

Profit Amount

$966.21

(%) Won Trades

5155.8

Drawdown

37.56%

Real Money Account

Started On

Apr 15, 2010

Leverage

1:50

Broker

MB Trading

Starting Balance

$$3,657.51

Total Gain

+378.03%

Live Test Summary

Started On

Apr 15, 2010

Account Leverage

1:50

Profit Factor

1.27

Total Gain

+378.03%

Absolute Gain

+119.12%

Monthly Gain

2.35%

Daily Gain

0.04%

Total Pips

6803.6

Total Trades

4163

Profit Amount

$4345.53

(%) Won Trades

6803.6

Drawdown

31.96%

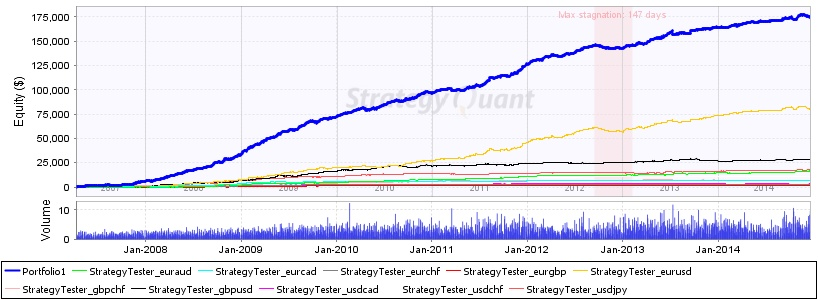

Historical Data Backtests

EA Analyzer: All the 10 currencies with all the 5 strategies used; FRPEAv6.20, Defaultt settings

Testing results (using all of the 10 currencies combined:

Total positions = 15.871 trades ; Total pips lost = 97.140 pips ; Total pips won = 145.938 pips ; Net gain = 48.798 pips ; Winner (%) = 71,33 (%) ; Loser (%) = 28,67 (%) ; Profit Factor = 1,50 ; Average win = 12,89 pips ; Average loss = 21,34 pips ; Max DD = 906 pips (21,14% of the account, with default settings) ; Average time/trade = 2.75 hours.

Backtests Settings

Symbol

EURAUD (Euro vs Australian Dollar)

Period

15 Minutes (M15) 2007.04.08 21:01 - 2014.12.19 21:59 (2007.04.08 - 2014.12.21)

Model

Every tick (the most precise method based on all available least timeframes)

Parameters

Bars in test

188662

Ticks modelled

76695831

Modelling quality

99.00%

Initial Deposit

$10000.00

Spread

Backtests Results

Total net profit

16447.61

Gross profit

50008.84

Gross loss

-33561.24

Profit factor

1.49

Expected payoff

10.19

Absolute Bal DD

624.02

Maximal Bal DD

1650.44 (12.57%)

Relative Bal DD

12.57% (1650.44)

Total Trades

1614

Short positions

883 (76.44%)

Long positions

731 (72.23%)

Profit trades

1203 (74.54%)

Loss trades

411 (25.46%)

Largest Profit trade

386.10

Largest Loss trade

-473.96

Average Profit trade

41.57

Average Loss trade

-81.66

Maximum consecutive wins (profit in money)

23 (833.99)

Maximum consecutive losses (loss in money)

4 (-844.25)

Maximal consecutive profit (count of wins)

1836.26 (7)

Maximal consecutive loss (count of losses)

-844.25 (4)

Avarage consecutive wins

4

Avarage consecutive losses

1

Backtests Settings

Symbol

EURCAD (Euro vs Canadian Dollar)

Period

15 Minutes (M15) 2007.04.08 21:00 - 2014.12.19 22:00 (2007.04.08 - 2014.12.21)

Model

Every tick (the most precise method based on all available least timeframes)

Parameters

Bars in test

191915

Ticks modelled

76695831

Modelling quality

99.00%

Initial Deposit

$10000.00

Spread

Backtests Results

Total net profit

6939.08

Gross profit

20245.28

Gross loss

-13306.20

Profit factor

1.52

Expected payoff

5.93

Absolute Bal DD

30.50

Maximal Bal DD

919.50 (5.58%)

Relative Bal DD

5.58% (919.50)

Total Trades

1171

Short positions

605 (70.41%)

Long positions

566 (71.73%)

Profit trades

832 (71.05%)

Loss trades

339 (28.95%)

Largest Profit trade

285.15

Largest Loss trade

-292.77

Average Profit trade

24.33

Average Loss trade

-39.25

Maximum consecutive wins (profit in money)

16 (359.39)

Maximum consecutive losses (loss in money)

6 (-351.26)

Maximal consecutive profit (count of wins)

865.51 (11)

Maximal consecutive loss (count of losses)

-396.02 (4)

Avarage consecutive wins

3

Avarage consecutive losses

1

Backtests Settings

Symbol

EURCHF (Euro vs Swiss Franc)

Period

15 Minutes (M15) 2007.04.08 21:00 - 2014.12.19 22:00 (2007.04.08 - 2014.12.21)

Model

Every tick (the most precise method based on all available least timeframes)

Parameters

Bars in test

191602

Ticks modelled

75061922

Modelling quality

99.00%

Initial Deposit

$10000.00

Spread

Backtests Results

Total net profit

3059.28

Gross profit

8899.86

Gross loss

-5840.58

Profit factor

1.52

Expected payoff

3.50

Absolute Bal DD

181.13

Maximal Bal DD

626.04 (4.80%)

Relative Bal DD

4.80% (626.04)

Total Trades

873

Short positions

432 (69.21%)

Long positions

441 (70.29%)

Profit trades

609 (69.76%)

Loss trades

264 (30.24%)

Largest Profit trade

143.18

Largest Loss trade

-283.82

Average Profit trade

14.61

Average Loss trade

-22.12

Maximum consecutive wins (profit in money)

17 (136.75)

Maximum consecutive losses (loss in money)

5 (-73.22)

Maximal consecutive profit (count of wins)

341.67 (10)

Maximal consecutive loss (count of losses)

-294.78 (3)

Avarage consecutive wins

3

Avarage consecutive losses

1

Backtests Settings

Symbol

EURGBP (Euro vs Great Britain Pound )

Period

15 Minutes (M15) 2007.04.08 21:00 - 2014.12.19 22:00 (2007.04.08 - 2014.12.21)

Model

Every tick (the most precise method based on all available least timeframes)

Parameters

Bars in test

191622

Ticks modelled

76695831

Modelling quality

99.00%

Initial Deposit

$10000.00

Spread

Backtests Results

Total net profit

1688.78

Gross profit

4635.79

Gross loss

-2947.01

Profit factor

1.57

Expected payoff

1.60

Absolute Bal DD

138.44

Maximal Bal DD

301.12 (2.93%)

Relative Bal DD

2.93% (301.12)

Total Trades

1053

Short positions

606 (64.69%)

Long positions

447 (74.27%)

Profit trades

724 (68.76%)

Loss trades

329 (31.24%)

Largest Profit trade

81.68

Largest Loss trade

-134.53

Average Profit trade

6.40

Average Loss trade

-8.96

Maximum consecutive wins (profit in money)

20 (228.45)

Maximum consecutive losses (loss in money)

7 (-12.61)

Maximal consecutive profit (count of wins)

253.21 (10)

Maximal consecutive loss (count of losses)

-145.52 (2)

Avarage consecutive wins

4

Avarage consecutive losses

2

Backtests Settings

Symbol

EURUSD (Euro vs US Dollar)

Period

15 Minutes (M15) 2007.04.08 21:00 - 2014.12.19 21:59 (2007.04.08 - 2014.12.21)

Model

Every tick (the most precise method based on all available least timeframes)

Parameters

Bars in test

191741

Ticks modelled

76695831

Modelling quality

99.00%

Initial Deposit

$10000.00

Spread

Backtests Results

Total net profit

80327.80

Gross profit

218600.83

Gross loss

-138273.03

Profit factor

1.58

Expected payoff

28.76

Absolute Bal DD

378.33

Maximal Bal DD

5706.31 (7.93%)

Relative Bal DD

7.93% (5706.31)

Total Trades

2793

Short positions

1386 (73.88%)

Long positions

1407 (67.87%)

Profit trades

1979 (70.86%)

Loss trades

814 (29.14%)

Largest Profit trade

842.45

Largest Loss trade

-1930.24

Average Profit trade

110.46

Average Loss trade

-169.87

Maximum consecutive wins (profit in money)

28 (1699.56)

Maximum consecutive losses (loss in money)

6 (-641.43)

Maximal consecutive profit (count of wins)

3910.64 (19)

Maximal consecutive loss (count of losses)

-2028.82 (2)

Avarage consecutive wins

4

Avarage consecutive losses

1

Backtests Settings

Symbol

GBPCHF (Great Britain Pound vs Swiss Franc)

Period

15 Minutes (M15) 2007.04.08 21:00 - 2014.12.19 21:59 (2007.04.08 - 2014.12.21)

Model

Every tick (the most precise method based on all available least timeframes)

Parameters

Bars in test

191708

Ticks modelled

76695831

Modelling quality

99.00%

Initial Deposit

$10000.00

Spread

Backtests Results

Total net profit

6737.66

Gross profit

20417.38

Gross loss

-13679.71

Profit factor

1.49

Expected payoff

6.40

Absolute Bal DD

19.13

Maximal Bal DD

Relative Bal DD

7.05% (1155.46)

Total Trades

1052

Short positions

571 (71.45%)

Long positions

481 (74.22%)

Profit trades

765 (72.72%)

Loss trades

287 (27.28%)

Largest Profit trade

272.91

Largest Loss trade

-226.39

Average Profit trade

26.69

Average Loss trade

-47.66

Maximum consecutive wins (profit in money)

22 (818.48)

Maximum consecutive losses (loss in money)

6 (-457.91)

Maximal consecutive profit (count of wins)

857.44 (15)

Maximal consecutive loss (count of losses)

-457.91 (6)

Avarage consecutive wins

4

Avarage consecutive losses

1

Backtests Settings

Symbol

GBPUSD (Great Britain Pound vs US Dollar)

Period

15 Minutes (M15) 2007.04.08 21:00 - 2014.12.19 21:59 (2007.04.08 - 2014.12.21)

Model

Every tick (the most precise method based on all available least timeframes)

Parameters

Bars in test

191517

Ticks modelled

76695831

Modelling quality

99.00%

Initial Deposit

$10000.00

Spread

Backtests Results

Total net profit

28378.64

Gross profit

108665.85

Gross loss

-80287.21

Profit factor

1.35

Expected payoff

12.47

Absolute Bal DD

54.30

Maximal Bal DD

3008.76 (7.71%)

Relative Bal DD

10.34% (1628.07)

Total Trades

2275

Short positions

1120 (73.13%)

Long positions

1155 (72.12%)

Profit trades

1652 (72.62%)

Loss trades

623 (27.38%)

Largest Profit trade

590.85

Largest Loss trade

-934.96

Average Profit trade

65.78

Average Loss trade

-128.87

Maximum consecutive wins (profit in money)

29 (2557.27)

Maximum consecutive losses (loss in money)

5 (-203.97)

Maximal consecutive profit (count of wins)

2557.27 (29)

Maximal consecutive loss (count of losses)

-1110.25 (4)

Avarage consecutive wins

4

Avarage consecutive losses

1

Backtests Settings

Symbol

USDCAD (US Dollar vs Canadian Dollar)

Period

15 Minutes (M15) 2007.04.08 21:00 - 2014.12.19 21:59 (2007.04.08 - 2014.12.21)

Model

Every tick (the most precise method based on all available least timeframes)

Parameters

Bars in test

191568

Ticks modelled

63726532

Modelling quality

99.00%

Initial Deposit

$10000.00

Spread

Backtests Results

Total net profit

3131.25

Gross profit

14683.89

Gross loss

-11552.64

Profit factor

1.27

Expected payoff

2.26

Absolute Bal DD

17.78

Maximal Bal DD

1303.45 (10.99%)

Relative Bal DD

10.99% (1303.45)

Total Trades

1387

Short positions

728 (63.60%)

Long positions

659 (74.96%)

Profit trades

957 (69.00%)

Loss trades

430 (31.00%)

Largest Profit trade

105.55

Largest Loss trade

-206.02

Average Profit trade

15.34

Average Loss trade

-26.87

Maximum consecutive wins (profit in money)

16 (273.15)

Maximum consecutive losses (loss in money)

6 (-118.18)

Maximal consecutive profit (count of wins)

405.20 (15)

Maximal consecutive loss (count of losses)

-353.27 (3)

Avarage consecutive wins

3

Avarage consecutive losses

2

Backtests Settings

Symbol

USDCHF (US Dollar vs Swiss Franc)

Period

15 Minutes (M15) 2007.04.08 21:00 - 2014.12.19 22:00 (2007.04.08 - 2014.12.21)

Model

Every tick (the most precise method based on all available least timeframes)

Parameters

Bars in test

191622

Ticks modelled

76695831

Modelling quality

99.00%

Initial Deposit

$10000.00

Spread

Backtests Results

Total net profit

10412.64

Gross profit

40577.25

Gross loss

-30164.61

Profit factor

1.35

Expected payoff

5.35

Absolute Bal DD

107.01

Maximal Bal DD

1057.56 (5.23%)

Relative Bal DD

5.23% (1057.56)

Total Trades

1946

Short positions

1032 (65.41%)

Long positions

914 (68.27%)

Profit trades

1299 (66.75%)

Loss trades

647 (33.25%)

Largest Profit trade

595.55

Largest Loss trade

-363.77

Average Profit trade

31.24

Average Loss trade

-46.62

Maximum consecutive wins (profit in money)

22 (798.09)

Maximum consecutive losses (loss in money)

6 (-359.24)

Maximal consecutive profit (count of wins)

1299.09 (12)

Maximal consecutive loss (count of losses)

-530.59 (2)

Avarage consecutive wins

3

Avarage consecutive losses

1

Backtests Settings

Symbol

USDJPY (US Dollar vs Japanese Yen)

Period

15 Minutes (M15) 2007.04.08 21:00 - 2014.12.19 22:00 (2007.04.08 - 2014.12.21)

Model

Every tick (the most precise method based on all available least timeframes)

Parameters

Bars in test

191626

Ticks modelled

76695831

Modelling quality

99.00%

Initial Deposit

$10000.00

Spread

Backtests Results

Total net profit

17810.26

Gross profit

54991.19

Gross loss

-37180.93

Profit factor

1.48

Expected payoff

9.85

Absolute Bal DD

6.05

Maximal Bal DD

2001.59 (8.19%)

Relative Bal DD

8.19% (2001.59)

Total Trades

1809

Short positions

951 (72.03%)

Long positions

858 (78.32%)

Profit trades

1357 (75.01%)

Loss trades

452 (24.99%)

Largest Profit trade

497.34

Largest Loss trade

-674.99

Average Profit trade

40.52

Average Loss trade

-82.26

Maximum consecutive wins (profit in money)

19 (1356.35)

Maximum consecutive losses (loss in money)

5 (-160.24)

Maximal consecutive profit (count of wins)

1356.35 (19)

Maximal consecutive loss (count of losses)

-827.19 (2)

Avarage consecutive wins

4

Avarage consecutive losses

1

Trading Strategy

Forex Real Profit EA uses 5 different strategies, 2 for Asian session scalping, 2 for all the day trend scalping and one breakout strategy.

It generates dynamic Stop Loss and Take Profit with high impact news filter and large spread and slippage protection for maximum profitability and minimum risk.

It employs optional (according to user desire) money management or fixed lots and automatically GMT adjusts the trading time.

It also has an invisible mode for protection from non-ECN brokers not to negatively influence the transactions.

It's designed to be compatible to run inline with and parallel to any other Expert Advisor with a special setting option to adjust this capability.

As descried in its official website; at the optimal risk it can generate an average revenue of 30% to 170% per year with re-investing the earned capital along that year.

Tags

Valery Trading

Tickmill

FXAutomater

Algocrat AI

WallStreet Forex Robot 3.0 Domination

Tick Data Suite

Waka Waka

FBS

IC Markets

Perceptrader AI

Forex Diamond

HF Markets

RoboForex

Volatility Factor Pro

StrategyQuant X

XM

InstaForex

Alpari

Forex Combo System

GPS Forex Robot

FX Scalper

GrandCapital

Golden Pickaxe

Automated Forex Tools

Forex Trend Detector

AMarkets

IronFX

Omega Trend

Broker Arbitrage

Telegram Signal Copier

SMRT Algo

Binance

FXVM

TradingFX VPS

Gold Miner

Forex Trend Hunter

Quant Analyzer

RayBOT

FxPro

Forex Gold Investor

ACY Securities

Gold Scalper PRO

ForexSignals.com

AlgoWizard

Quant Data Manager

FXCharger

News Scope EA PRO

FX Choice

Smart Scalper PRO

Commercial Network Services

FX-Builder

Infinity Trader

Pump Trader Robot

Happy Forex

LeapFX Trading Academy

ForexTime

WallStreet Recovery PRO

BlackBull Markets

Libertex

StarTrader

Forex VPS

Best Free Scalper Pro

MTeletool

Pepperstone

VPS Forex Trader

Evening Scalper PRO

QHoster

Telegram Copier

Forex Robot Academy

Happy Bitcoin

FX Secret Club

Forex Robot Factory (Expert Advisor Generator)

Trend Matrix EA

ByBit

Database Mart

DARKEAS

Gold Breaker

Quant Tekel Funded

Vortex Trader PRO

Magnetic Exchange

Swing Trader PRO

EGPForex

Risk

Forex trading can involve the risk of loss beyond your initial deposit. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary.

Forex accounts typically offer various degrees of leverage and their elevated profit potential is counterbalanced by an equally high level of risk. You should never risk more than you are prepared to lose and you should carefully take into consideration your trading experience.

Past performance and simulated results are not necessarily indicative of future performance. All the content on this site represents the sole opinion of the author and does not constitute an express recommendation to purchase any of the products described in its pages.