1. Why a Structured Workflow Matters

Successful algo trading is built on repeatable processes. With tools like StrategyQuant X, traders can move beyond random clicking and instead follow a systematic approach that produces stable, testable strategies suitable for long‑term portfolios.

A structured workflow ensures:

Consistent strategy logic

Measurable performance metrics

Reliable robustness testing

Reduced overfitting

Better integration with brokers such as IC Markets

2. Choosing the Right Market

Beginners often achieve the best results by starting with markets that offer clean data and strong liquidity.

Recommended Markets

Major Forex pairs: EURUSD, GBPUSD

Cross pairs: EURJPY, GBPJPY

Metals: XAUUSD (gold), known for strong trends

CFD indices: NASDAQ, S&P 500, Dow Jones

Futures equivalents: High‑liquidity index futures

These markets provide statistically favorable environments for building breakout and trend‑based strategies.

3. Core Metrics Every Trader Should Monitor

When evaluating an algo strategy, focus on metrics that reveal stability and risk efficiency:

Profit Factor: Measures profitability vs. losses

Return/Drawdown Ratio: Shows reward relative to risk

Sharpe Ratio: Evaluates how efficiently volatility is converted into profit

Trade Count: Ensures statistical significance

Win Rate: Helps validate execution quality

These metrics help determine whether a strategy can survive real‑market conditions.

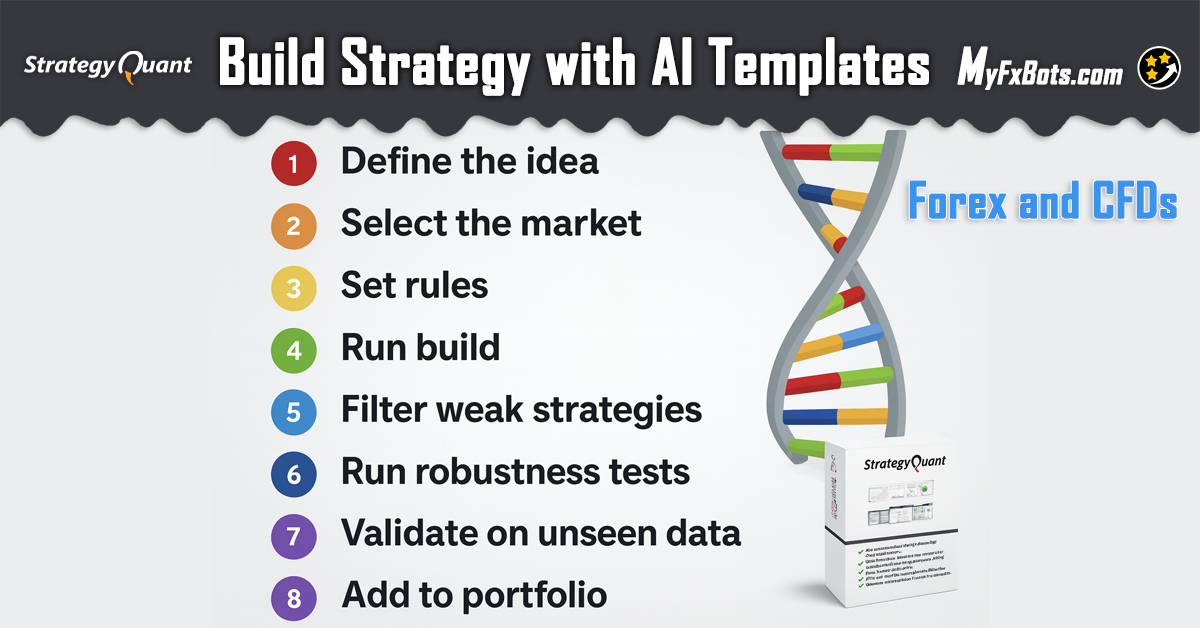

4. Building Your Workflow with AI Templates

AI templates in StrategyQuant X allow traders to automate the strategy‑building process while maintaining control over logic and structure.

Typical Workflow Steps

Define the idea

Select the market

Set measurable rules

Run the build

Filter weak strategies

Perform robustness tests

Validate on unseen data

Add to your portfolio

This approach transforms strategy creation into a repeatable, scalable process.

5. Automating Custom Projects

Custom projects allow traders to automate multi‑step workflows.

Key Components

Build settings: Time ranges, in‑sample vs. out‑of‑sample

Entry/exit logic: Long‑only, short‑only, or both

Genetic vs. random generation: Controls how strategies evolve

Indicator limits: Number of conditions and periods

Risk parameters: Stop‑loss, take‑profit, slippage

Cross‑checks: Higher precision backtests, multi‑market tests

Ranking filters: Minimum PF, R/DD, trade count, win rate

This ensures only statistically meaningful strategies survive.

6. Robustness Testing Across Markets and Conditions

A strategy that works only on one dataset is unreliable. Robustness testing helps eliminate fragile systems.

Recommended Tests

Unseen data (2023–present)

Other markets (Dow Jones, S&P 500)

Higher timeframes (H4)

Lower timeframes (M30)

Slippage stress tests

Monte Carlo simulations

Random trade skipping

These tests reveal sensitivity to execution, volatility, and parameter shifts.

7. Running the Build and Saving Your Strategies

Once the workflow is ready:

Start the build

Allow strategies to pass through all filters

Review the final data bank

Save selected strategies in SQX format

Prepare them for further robustness testing or live deployment

This structured approach helps traders build portfolios of durable, diversified strategies.