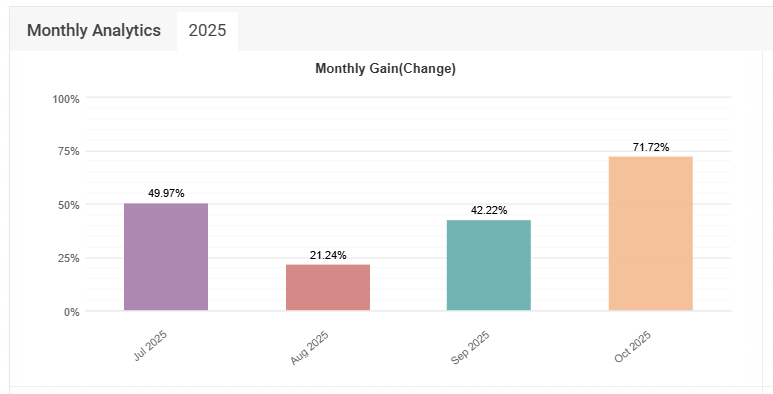

Performance highlights

- Monthly return: 74% on a verified live account.

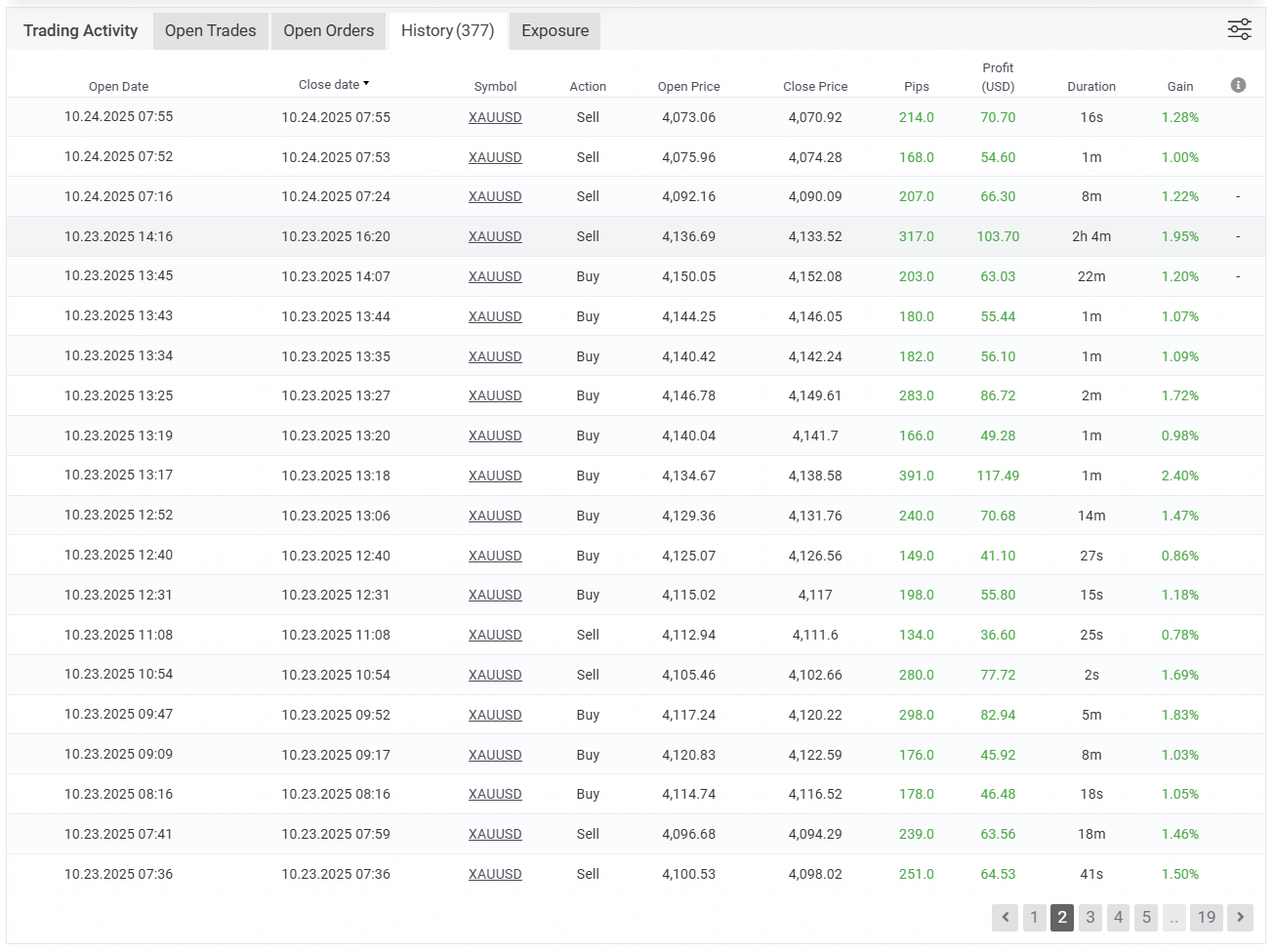

- Consistency: Multiple consecutive winning trades across the month.

- Risk rules: Only one trade at a time; no grid; no martingale.

Why the result matters

- Demonstrates robust handling of gold volatility and market spikes.

- Indicates the EA focuses on high-probability setups rather than aggressive scaling techniques.

- Live-account verification reduces the likelihood that results are backtest artifacts.

Strategy and risk management

- Single-trade logic minimizes exposure to correlated losing positions.

- Active trade management and predefined stop-loss levels control drawdown.

- Suitable for traders who prioritize risk-managed automation over high-leverage martingale systems.

Recommended setup and broker considerations

- Use a low-latency ECN broker for XAUUSD execution; check spreads during news events.

- Ensure account sizing aligns to the EA’s risk profile and your capital.

- Backtest and forward-test on a demo or small live account before scaling.

Practical checklist before using the EA

- Confirm broker compatibility and execution speed.

- Set risk per trade according to account equity.

- Monitor live trades for the first 2–4 weeks to validate behavior.

- Keep account diversification to avoid correlated exposure.

Final assessment

The month’s 74% live profit is notable and worth investigating, especially because it was achieved with defined, conservative-sounding rules: one trade at a time, no grid, no martingale. Traders interested in automated gold strategies should evaluate Gold Miner as an option from LeapFX Trading Academy, test it with IC Markets or another compatible broker, and apply conservative position sizing.