Overview of the event

On the day of the tariff announcement, a rapid macro shock hit crypto markets and was amplified by suspected insider selling tied to an associated token, record open interest, and multiple exchange technical failures including pricing glitches and API outages; together these factors produced an unprecedented cascade of liquidations and extreme altcoin drawdowns.

Key drivers (ranked)

- Macro trigger: tariff announcement

- Suspected insider selling on associated token

- Record high open interest across derivatives

- Exchange technical failures: pricing glitches, API outages

- Liquidity migration and concentrated low‑liquidity tokens

Each factor individually raises risk; combined they created rapid price gaps and prevented many traders from closing positions, magnifying forced liquidations.

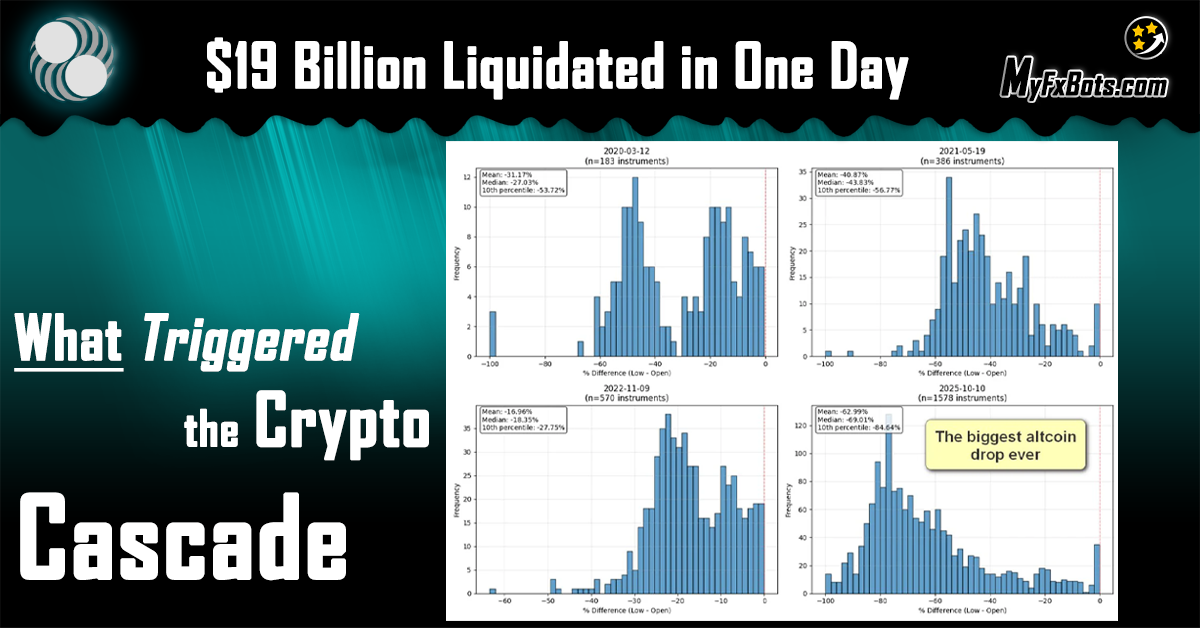

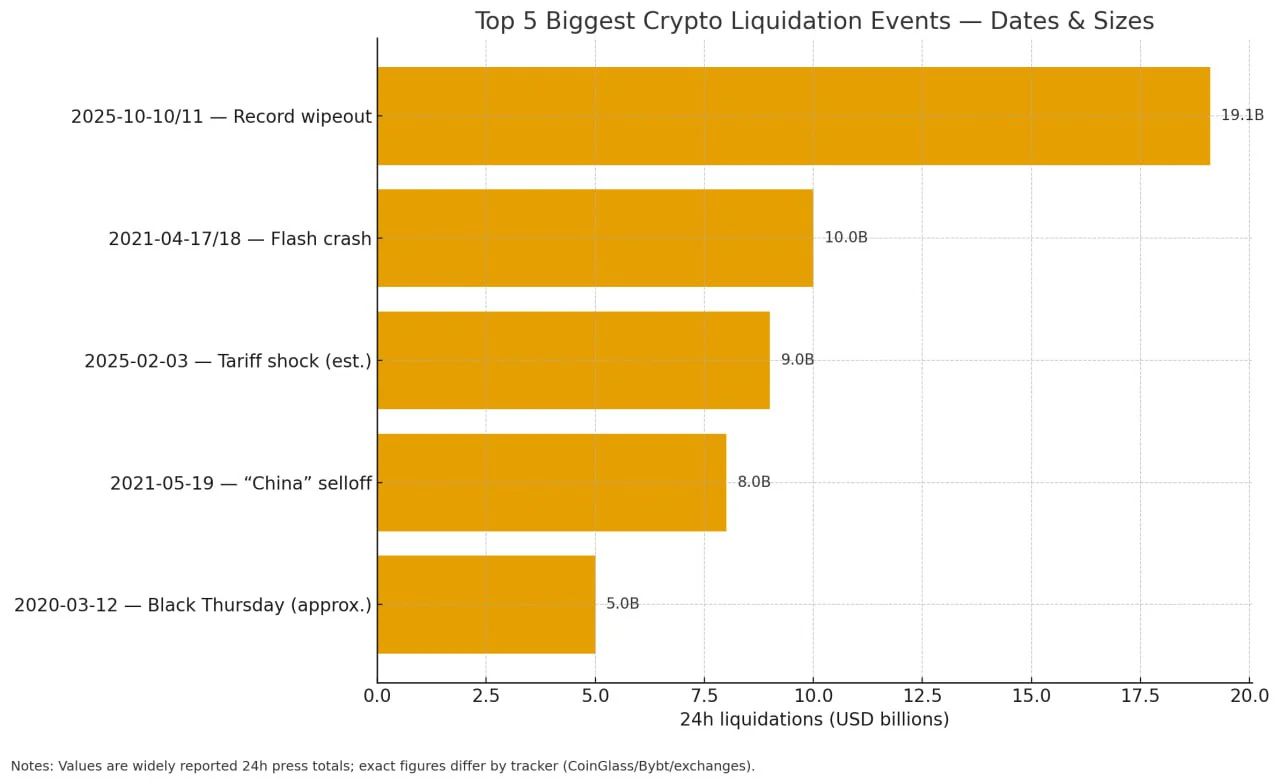

Measured impact

- Estimated total wiped value: $19 billion in one day.

- Average altcoin drawdown: ~69%.

- Bitcoin experienced its steepest single‑day drop since November 2022.

- Losses concentrated in low‑liquidity tokens and highly leveraged derivative positions.

Why being sidelined matters — review perspective

The reviewer notes that volatility‑aware safeguards materially reduced realized losses by pausing trading when unexplained price gaps, abnormal spreads, or exchange instability were detected; in this episode Algocrat AI’s conservative exit/hold‑back rules preserved live performance since 2020.

Practical lessons for traders and platforms

- Prioritize liquidity analysis and apply strict limits on low‑liquidity tokens.

- Monitor open interest and leverage to detect overcrowded positions.

- Implement exchange health checks, pricing sanity filters, and API‑failure fallbacks.

- Treat political events as macro catalysts and use conditional rules to suspend trading.

- Backtest and validate exit rules for extreme‑volatility scenarios.

Final appraisal

The $19 billion event underscores the importance of integrated risk controls, continuous exchange monitoring, and conservative liquidity rules; systems that detect market micro‑anomalies and pause trading can materially protect capital and live track records, a strategy exemplified by Algocrat AI in this incident.