Introduction

Many traders today are searching for reliable ways to combine manual decision‑making with the analytical power of modern trading tools. One of the most interesting approaches comes from using Infinity Trader in manual‑trading mode, a method demonstrated in a recent walkthrough published by FXAutomater. Instead of relying on full automation, the trader used the system only as a supportive interface while executing trades manually during spare time. The result was a steady four‑month performance that offers valuable insights for anyone exploring hybrid trading workflows.

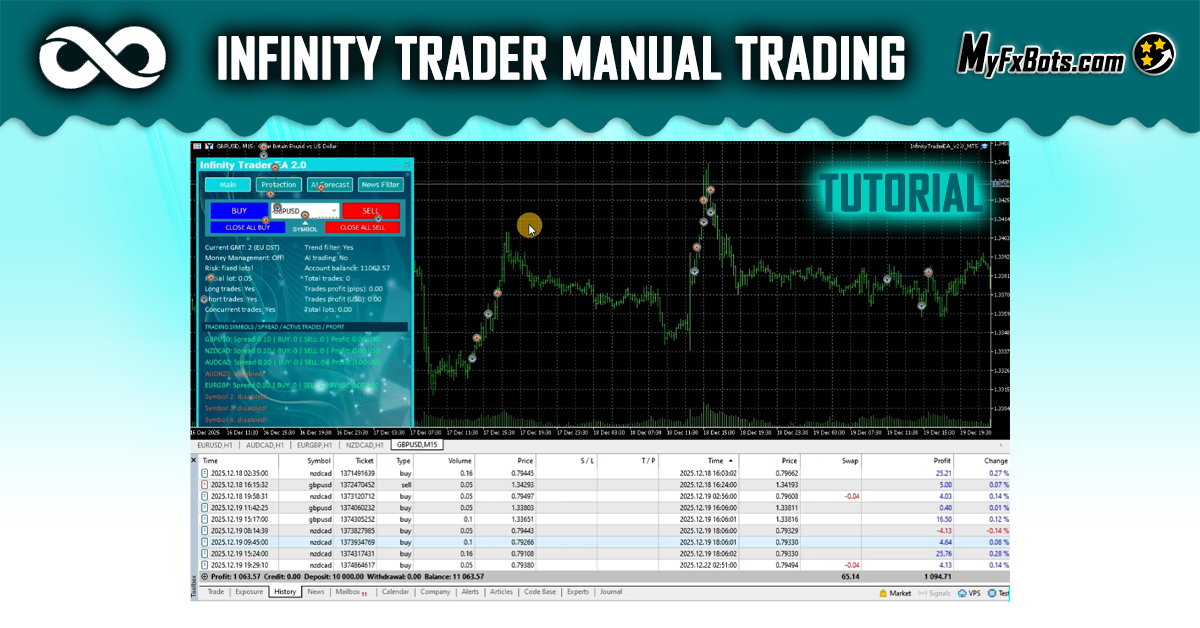

Understanding the Manual‑Trading Setup

The experiment was intentionally simple to replicate:

A new demo account was created

Infinity Trader was installed and switched to manual‑only mode

No automated entries were allowed

Trades were executed only when time permitted

The test ran for four consecutive months

This setup mirrors the reality of many retail traders who cannot monitor charts all day but still want structured, data‑driven decision support.

Key Tools That Support Manual Trading

Even without automation, Infinity Trader provides several advantages:

1. Market Structure Visualization

The system highlights trend direction, volatility zones, and price‑action behavior, helping traders avoid emotional entries.

2. Risk‑Management Assistance

Position‑size suggestions and stop‑loss guidelines help maintain consistency.

3. Clean Execution Interface

The manual‑trade panel simplifies order placement, reducing hesitation and execution errors.

4. Strategy Discipline

Because the system does not auto‑trade, the user must confirm every entry, reinforcing structured decision‑making.

Four‑Month Performance Overview

Across the four‑month period, the trader achieved approximately 1,000 USD in profit on a demo account. While results vary for every trader, the experiment demonstrates:

Manual trading can be enhanced by structured tools

Consistency matters more than frequency

A hybrid approach can reduce stress and improve clarity

This makes the workflow appealing for traders who prefer control but still want analytical support.

Practical Tips for Replicating the Workflow

To follow a similar approach:

Use a clean chart layout to avoid distractions

Trade only during calm, focused sessions

Follow a fixed risk percentage per trade

Avoid over‑trading after wins or losses

Review weekly performance to adjust behavior

These habits help maintain discipline, especially when using supportive tools like Infinity Trader.

Deposit Bonus from IC Markets

IC Markets offers a deposit‑bonus program designed to give traders additional trading capital. The bonus can be used for trading purposes, while withdrawals follow the broker’s standard conditions. Traders should review the official details directly with IC Markets before participating, as the bonus is intended to support trading activity rather than guarantee profit.

Final Thoughts

The four‑month experiment shows that combining manual trading with structured tools can create a balanced, sustainable workflow. For traders who want to stay in control while benefiting from analytical guidance, the manual‑mode approach demonstrated with Infinity Trader offers a practical and accessible path.