Menu

Featured Solutions

Forex Brokers

Forex VPS Services

Forex Robots

Forex Service Providers

Currency Exchange Companies

Payment Processors

MyFxBots Forex Blog

2026 Posts

Feb, 2026 Posts

Jan, 2026 Posts

2025 Posts

Dec, 2025 Posts

Nov, 2025 Posts

Oct, 2025 Posts

Sep, 2025 Posts

Aug, 2025 Posts

Jun, 2025 Posts

May, 2025 Posts

Apr, 2025 Posts

Mar, 2025 Posts

Jan, 2025 Posts

2024 Posts

Dec, 2024 Posts

Nov, 2024 Posts

Oct, 2024 Posts

Jun, 2024 Posts

Apr, 2024 Posts

Mar, 2024 Posts

Feb, 2024 Posts

Jan, 2024 Posts

2023 Posts

Dec, 2023 Posts

Nov, 2023 Posts

Oct, 2023 Posts

Sep, 2023 Posts

Aug, 2023 Posts

Jul, 2023 Posts

Jun, 2023 Posts

May, 2023 Posts

Apr, 2023 Posts

Mar, 2023 Posts

Feb, 2023 Posts

2022 Posts

Dec, 2022 Posts

Nov, 2022 Posts

Oct, 2022 Posts

Sep, 2022 Posts

Jul, 2022 Posts

Jun, 2022 Posts

May, 2022 Posts

Apr, 2022 Posts

Mar, 2022 Posts

Feb, 2022 Posts

Jan, 2022 Posts

2021 Posts

Dec, 2021 Posts

Oct, 2021 Posts

Sep, 2021 Posts

Aug, 2021 Posts

Jul, 2021 Posts

Jun, 2021 Posts

May, 2021 Posts

Mar, 2021 Posts

Feb, 2021 Posts

Jan, 2021 Posts

2020 Posts

Dec, 2020 Posts

Nov, 2020 Posts

Oct, 2020 Posts

Sep, 2020 Posts

Aug, 2020 Posts

Jul, 2020 Posts

2019 Posts

Dec, 2019 Posts

Nov, 2019 Posts

Jul, 2019 Posts

Jun, 2019 Posts

May, 2019 Posts

Apr, 2019 Posts

2018 Posts

Nov, 2018 Posts

Aug, 2018 Posts

Jun, 2018 Posts

Mar, 2018 Posts

Feb, 2018 Posts

Jan, 2018 Posts

2017 Posts

Dec, 2017 Posts

Nov, 2017 Posts

Sep, 2017 Posts

Aug, 2017 Posts

Apr, 2017 Posts

Mar, 2017 Posts

Jan, 2017 Posts

2016 Posts

Dec, 2016 Posts

Nov, 2016 Posts

Oct, 2016 Posts

Sep, 2016 Posts

Aug, 2016 Posts

Jun, 2016 Posts

May, 2016 Posts

Apr, 2016 Posts

2015 Posts

Nov, 2015 Posts

Oct, 2015 Posts

Jun, 2015 Posts

May, 2015 Posts

Apr, 2015 Posts

Mar, 2015 Posts

2014 Posts

Dec, 2014 Posts

Oct, 2014 Posts

Sep, 2014 Posts

Aug, 2014 Posts

Jul, 2014 Posts

Jun, 2014 Posts

May, 2014 Posts

Apr, 2014 Posts

Mar, 2014 Posts

Feb, 2014 Posts

2013 Posts

Dec, 2013 Posts

Nov, 2013 Posts

Oct, 2013 Posts

Jul, 2013 Posts

Apr, 2013 Posts

Search Queries Cloud

MT Terminal Update: Why Your Expert Advisors Need This Patch

Top Risks and Safe Steps for “Poverty Scalper Robot” Traders

Adaptive Multi‑Algorithm Crypto & Forex Portfolio: Live Results and How to Access

Deep Backtest Review: High‑Risk AUDCAD Grid Results and Live Trading Guide

Why Security Certifications Matter for Forex Traders: ISO, CSA STAR & SOC 2 Explained

High-Risk Gold Expert Advisor Backtest Analysis: XAUUSD 2010–2023 Results & Real Trading Insights

Gold Volatility Strategy: How Traders Captured $20K in Early 2026

Early Access for a Next‑Gen Automated Trading Expert

GOLD Scalper PRO v2.0 Review: Two Systems, Massive Performance Leap

Gold Scalper to Watch: Deep Live Performance Audit of a Top M30 XAUUSD System

Dark Nova 2025 Live Performance Review and Deployment Checklist

Waka Waka EA Performance Review: Gains, Drawdown, and Live Deployment Checklist

SlingShot Live Performance Review: Month‑by‑Month Analysis, Time‑of‑Day Edge, and Deployment Checklist

How to Build Reliable Algo Trading Strategies Using AI Templates and Workflow Automation

Mastering Manual Trading with Infinity Trader: A Practical 4‑Month Performance Tutorial

Perceptrader AI: Modern AI Grid EA for Consistent Forex Automation

Smart Risk Control: NoConcurrentTrades Added in WallStreet Recovery PRO v1.8

Christmas Algo Trading Boost: Build Robust EAs Fast

Golden Pickaxe v2.41 Expert Advisor

4.81/5 (72 votes)

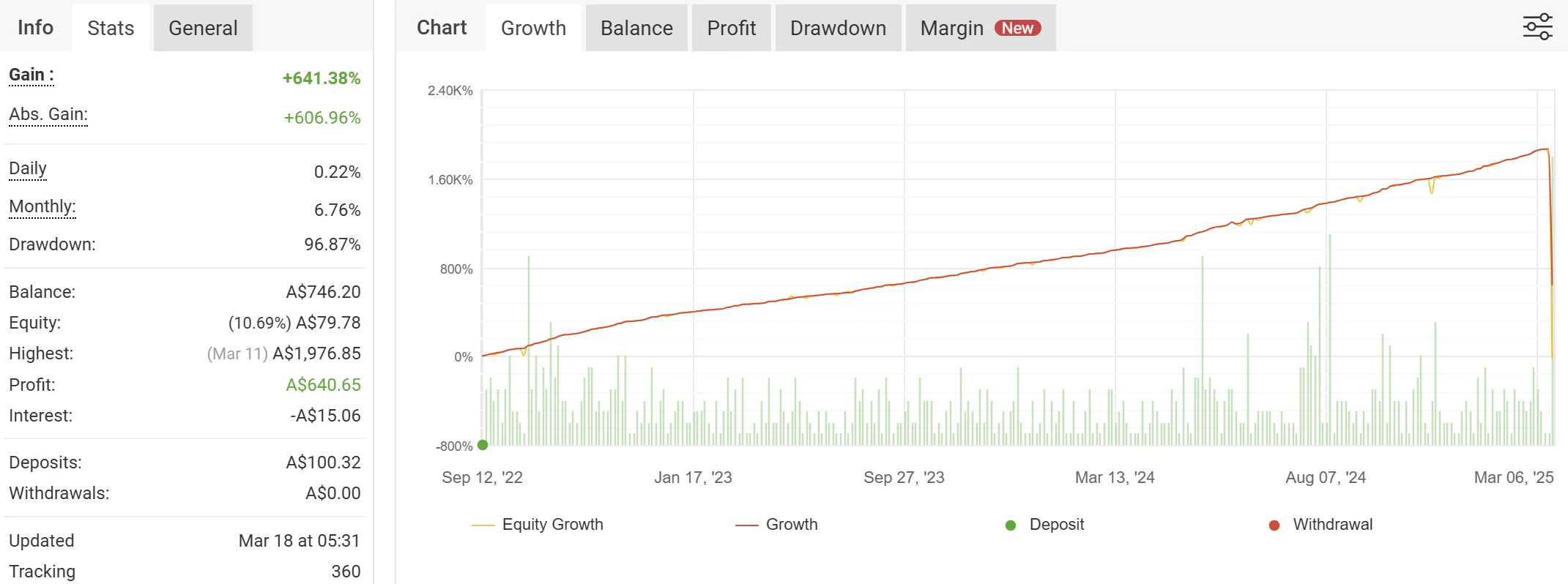

Grid trading, by design, demands disciplined risk management. A recent incident involving a high-risk account from the Golden Pickaxe system—once achieving nearly 20× returns on the initial deposit—is a stark reminder of the inevitable stop-out risk when market forces surge unexpectedly. Such occurrences, though unfortunate, offer valuable lessons for traders.

Industry experts agree that there are two main strategies for sustaining profitability with grid systems. The first approach is to keep risk levels low by ensuring sufficient funds are available to absorb market volatility. The second is to employ a higher risk setting but secure gains through regular profit withdrawals. Failing to adhere to either strategy risks exposing the trader to eventual and often steep losses.

The Golden Pickaxe account clearly illustrates that even systems with more aggressive logic can thrive if risk management is calibrated correctly. By configuring the account to close trades when a 35% drawdown occurs, traders have demonstrated that protection of capital is paramount—even when chasing higher returns.

It is equally important to choose one risk strategy and stick with it. Without a consistent plan, grid trading can transform into a ticking time bomb, vulnerable to strong, sudden trends that trigger stop-outs or breach risk thresholds. A judicious review of one’s portfolio, ensuring either a well-funded buffer or disciplined profit taking, is essential to long-term success.

Ultimately, a careful balance between strategy and risk is what separates sustained profitability from regret. This review underscores that with sound risk management, even a system as dynamic as a grid trader can weather adverse market conditions.

Admin

We specialize in providing advanced forex trading solutions to help traders maximize their potential.

Our mission is to empower you with cutting-edge forex trading tools and insights. Thank you for joining our community, and happy trading!

Author's Profile

Search Blog

Post Categories

Post Sections

Tickmill

26

FXAutomater

21

Algocrat AI

Show more!

21

Similar Posts

Other Forex Robots from Valery Trading

Evening Scalper PRO uses an original & compelling trading logic on cross pairs that have a solid mean-reverting tendency with high-profit targets (unlike most night scalpers).

Night Hunter PRO utilizes smart entry/exit algorithms to identify only the safest entry points during calm periods of the

market.

Waka Waka is a professionally developed grid system with built-in risk settings that you can choose from, ranging from Low to High.

The highest-performing gold EAs all share the same common logic: grid trading.

Valery Trading EA developers team have developed the #1 ranked grid trading EA, called Waka Waka, and then they have applied many of the algorithmic principles from Waka Waka to this gold EA, and the results have been mind-blowing: Golden Pickaxe performs even better than Waka Waka.

Perceptrader AI is a cutting-edge grid trading system that leverages the power of Artificial Intelligence, utilizing Deep Learning algorithms and Artificial Neural Networks (ANN) to analyze big amounts of market data at a high speed and detect high-potential trading opportunities to exploit.

Investing in intraday seasonal volatility patterns driven by news events is the goal of News Catcher PRO, which is a sophisticated mean-reversion trading strategy.

News Catcher PRO does not use martingale or grid by default (optional grid is available).

Explore insights on Algocrat AI, a cutting-edge cryptocurrency copy trading platform crafted by Valery Trading—the masterminds in developing professional Expert Advisors. Discover articles that unveil its innovative strategies, transforming trading into an accessible and intelligent experience.

Tags

Valery Trading

Tickmill

FXAutomater

Algocrat AI

WallStreet Forex Robot 3.0 Domination

Tick Data Suite

FBS

Waka Waka

IC Markets

Perceptrader AI

Forex Diamond

HF Markets

Volatility Factor Pro

RoboForex

StrategyQuant X

XM

InstaForex

Alpari

GPS Forex Robot

Forex Combo System

Forex Trend Detector

GrandCapital

FX Scalper

Automated Forex Tools

Golden Pickaxe

Omega Trend

Broker Arbitrage

IronFX

Telegram Signal Copier

SMRT Algo

AMarkets

Quant Analyzer

Binance

FXVM

Forex Trend Hunter

TradingFX VPS

Gold Miner

AlgoWizard

FxPro

ACY Securities

RayBOT

Forex Gold Investor

Gold Scalper PRO

ForexSignals.com

FX-Builder

Quant Data Manager

FX Choice

Commercial Network Services

FXCharger

News Scope EA PRO

Smart Scalper PRO

Happy Forex

LeapFX Trading Academy

ForexTime

Infinity Trader

BlackBull Markets

Pump Trader Robot

Libertex

WallStreet Recovery PRO

Vortex Trader PRO

StarTrader

Forex VPS

MTeletool

Swing Trader PRO

Pepperstone

VPS Forex Trader

Telegram Copier

QHoster

Forex Robot Academy

Best Free Scalper Pro

Forex Robot Factory (Expert Advisor Generator)

ByBit

FX Secret Club

Database Mart

DARKEAS

Evening Scalper PRO

Quant Tekel Funded

Happy Bitcoin

Magnetic Exchange

Trend Matrix EA

Gold Breaker

EGPForex

Risk

Forex trading can involve the risk of loss beyond your initial deposit. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary.

Forex accounts typically offer various degrees of leverage and their elevated profit potential is counterbalanced by an equally high level of risk. You should never risk more than you are prepared to lose and you should carefully take into consideration your trading experience.

Past performance and simulated results are not necessarily indicative of future performance. All the content on this site represents the sole opinion of the author and does not constitute an express recommendation to purchase any of the products described in its pages.

2013 - 2026©

MyFxBots.

Cookies help us deliver our services! By using our services you agree to our use of cookies! Learn More