Menu

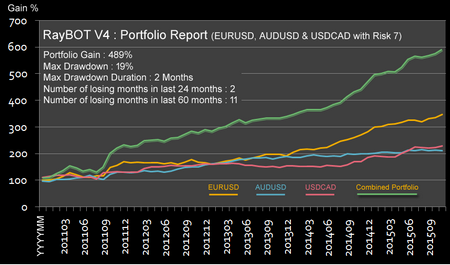

Trading multiple currency pairs ensures stable higher gains with losses much offsetting.

Trading Idea

As a non-Grid, non-Martingale system, RayBOT relies for its trading on price swings between Support / Resistance levels. It is a frequent trader achieving a trading rate of about 5 to 10 trades a week on each currency pair.

Specifications

License

2 Real + 2 Demo Accounts for Any Subscription Type.

NFA / FIFO

Compatible.

Compatible Brokers

All Brokers with All Account Types are Supported (low spread brokers are recommended), We Recommend Tickmill, and IC Markets Forex Brokers With TradingFX VPS for the Best Stability and Profitability.

User Manual

A detailed User Manual is Included with the EA for its installation, setting up and usage on MT4 platform.

Support & Upgrades

24 / 7 Professional Support and Free Monthly Optimized Setting Automatic Updates throughout the Subscription Period.

Refund Policy

30 Day Money Back Guarantee.

Supported Currency Pairs

EURUSD, AUDUSD, USDCAD

MetaTrader Chart Timeframe

M15

Verified Live Trading Results

By analyzing RayBOT MyfxBook verified trading results and its live performance we could find that:

- Its potential gains can be 10% a month by using the developers recommended risk level gathering a compound annual growth rate (CAGR) exceeding 60%

- It has a positive risk reward with a win rate that could exceed 57%.

Real Money Account

Live Test Summary

Started On

Jan 31, 2016

Account Leverage

1:500

Profit Factor

1.06

Total Gain

+37.97%

Absolute Gain

+37.97%

Monthly Gain

0.54%

Daily Gain

0.02%

Total Pips

2549.8

Total Trades

1771

Profit Amount

(%) Won Trades

2549.8

Drawdown

1.65%

Real Money Account

Started On

Feb 09, 2016

Leverage

1:100

Broker

Solidary Markets FX

Starting Balance

$$500.00

Total Gain

+27.87%

Live Test Summary

Started On

Feb 09, 2016

Account Leverage

1:100

Profit Factor

1.04

Total Gain

+27.87%

Absolute Gain

+32.45%

Monthly Gain

0.55%

Daily Gain

0.01%

Total Pips

2437.0

Total Trades

1632

Profit Amount

$143.67

(%) Won Trades

2437.0

Drawdown

18.92%

Trading Style (Visual Backtest)

Backtests Settings

Symbol

EURUSD (Euro vs US Dollar)

Period

15 Minutes (M15) 2011.05.31 22:00 - 2016.05.31 21:59 (2015.09.30 - 2016.05.31)

Model

Every tick (the most precise method based on all available least timeframes)

Parameters

Activation_Code=*********; Max_Risk_Per_Trade=7; Fixed_LotSize=0; Advanced_User_Parameters="Read Manual Before Making Changes"; Use_Full_Account_Balance=true;

Set_Initial_Start_Balance=0; Restrict_Trade_Entry="Period Day-of-Week and Hour"; Allow_Trades_At_All_Times=true;

Activate_On_DayOfWeek=0; Activate_At_HourOfDay=0; DeActivate_On_DayOfWeek=0; DeActivate_At_HourOfDay=0; Prevent_Trades_Over_WeekEnd="Close Any Open Trade At Day-of-Week and Hour"; Force_Close_Trade=false;

Force_Close_On_DayOfWeek=0; Force_Close_At_HourOfDay=0; Auto_Optimization=true;

Volatility_Limit=45; Range_Upper_Limit=65; Range_Lower_Limit=35; ReversalProfitLevel=50; LCNT1=0; LCNT2=0; LCNT3=0; LSens1=5; LSens2=5; LSens3=1; LMan1=5; LMan2=10; Filter_Feed_Variations=true;

Filter_Low_Vol_Trades=true;

MagicNumber=11995533; EA_COMMENT_PREFIX="MyFxBots.com - RayBOT V4"; Use_Free_Margin_Only=false;

Allow_Slippage=5; RefPrice=1.25; MaxRetry=10; Trefresh=10;

Bars in test

124726

Ticks modelled

71793845

Modelling quality

99.00%

Initial Deposit

$1000.00

Spread

10

Backtests Results

Total net profit

241.92

Gross profit

422.44

Gross loss

-180.52

Profit factor

2.34

Expected payoff

3.10

Absolute Bal DD

14.43

Maximal Bal DD

39.59 (3.25%)

Relative Bal DD

3.25% (39.59)

Total Trades

78

Short positions

32 (65.63%)

Long positions

46 (73.91%)

Profit trades

55 (70.51%)

Loss trades

23 (29.49%)

Largest Profit trade

36.00

Largest Loss trade

-10.53

Average Profit trade

7.68

Average Loss trade

-7.85

Maximum consecutive wins (profit in money)

12 (56.06)

Maximum consecutive losses (loss in money)

2 (-21.00)

Maximal consecutive profit (count of wins)

61.93 (9)

Maximal consecutive loss (count of losses)

-21.00 (2)

Avarage consecutive wins

3

Avarage consecutive losses

1

Strategy Backtests

We have tested RayBOT using high quality Dukascopy Tick Data (every tick) from 2011 to 2016 on the three supported pairs via a RoboForex ECN-Pro NDD Real account with a real spread of 6 pips for AUDUSD, 0.5 pips for EURUSD and 1.0 pip for USDCAD (the lower the spread, the better the results). The EA proved its ability to efficiently handle all the price action types.

We have applied different risk levels (Max_Risk_Per_Trade) of 5, 7 and 10 in addition to fixed lot size of 0.1 with no risk! Each variation was tested on every currency pair individually to better understand the EA performance!

The backtests maximum drawdown resulted is below 25% or less than 800 pips over the whole 9 years period of testing, so it's highly expected to be much lower and shorter on live trading thanks to the EA automatic optimization capability as mentioned before.

AUDUSD Backtests

Backtests Settings

Symbol

AUDUSD (Australian Dollar vs US Dollar)

Period

15 Minutes (M15) 2011.05.31 22:00 - 2016.05.31 21:59

Model

Every tick (the most precise method based on all available least timeframes)

Parameters

Max_Risk_Per_Trade=7; Fixed_LotSize=0.1; Use_Full_Account_Balance=true;

Set_Initial_Start_Balance=0; Allow_Trades_At_All_Times=true;

Activate_On_DayOfWeek=0; Activate_At_HourOfDay=0; DeActivate_On_DayOfWeek=0; DeActivate_At_HourOfDay=0; Force_Close_Trade=false;

Force_Close_On_DayOfWeek=0; Force_Close_At_HourOfDay=0; Auto_Optimization=true;

Volatility_Limit=45; Range_Upper_Limit=65; Range_Lower_Limit=35; ReversalProfitLevel=50; LCNT1=0; LCNT2=0; LCNT3=0; LSens1=5; LSens2=5; LSens3=1; LMan1=5; LMan2=10; Filter_Feed_Variations=true;

Filter_Low_Vol_Trades=true;EA_COMMENT_PREFIX="MyFxBots.com - RayBOT V4"; Use_Free_Margin_Only=false;

Allow_Slippage=5; RefPrice=1.25; MaxRetry=10; Trefresh=10;

Bars in test

124628

Ticks modelled

54308860

Modelling quality

99.00%

Initial Deposit

$1000.00

Spread

Current (6)

Backtests Results

Total net profit

3281.44

Gross profit

20996.74

Gross loss

-17715.30

Profit factor

1.19

Expected payoff

2.59

Absolute Bal DD

178.68

Maximal Bal DD

554.58 (35.28%)

Relative Bal DD

35.28% (554.58)

Total Trades

1269

Short positions

616 (54.06%)

Long positions

653 (54.36%)

Profit trades

688 (54.22%)

Loss trades

581 (45.78%)

Largest Profit trade

135.80

Largest Loss trade

-141.00

Average Profit trade

30.52

Average Loss trade

-30.49

Maximum consecutive wins (profit in money)

9 (270.51)

Maximum consecutive losses (loss in money)

12 (-419.34)

Maximal consecutive profit (count of wins)

270.51 (9)

Maximal consecutive loss (count of losses)

-419.34 (12)

Avarage consecutive wins

2

Avarage consecutive losses

2

Backtests Settings

Symbol

AUDUSD (Australian Dollar vs US Dollar)

Period

15 Minutes (M15) 2011.05.31 22:00 - 2016.05.31 21:59

Model

Every tick (the most precise method based on all available least timeframes)

Parameters

Max_Risk_Per_Trade=5; Fixed_LotSize=0; Use_Full_Account_Balance=true;

Set_Initial_Start_Balance=0; Allow_Trades_At_All_Times=true;

Activate_On_DayOfWeek=0; Activate_At_HourOfDay=0; DeActivate_On_DayOfWeek=0; DeActivate_At_HourOfDay=0; Force_Close_Trade=false;

Force_Close_On_DayOfWeek=0; Force_Close_At_HourOfDay=0; Auto_Optimization=true;

Volatility_Limit=45; Range_Upper_Limit=65; Range_Lower_Limit=35; ReversalProfitLevel=50; LCNT1=0; LCNT2=0; LCNT3=0; LSens1=5; LSens2=5; LSens3=1; LMan1=5; LMan2=10; Filter_Feed_Variations=true;

Filter_Low_Vol_Trades=true;EA_COMMENT_PREFIX="MyFxBots.com - RayBOT V4"; Use_Free_Margin_Only=false;

Allow_Slippage=5; RefPrice=1.25; MaxRetry=10; Trefresh=10;

Bars in test

124628

Ticks modelled

54308860

Modelling quality

99.00%

Initial Deposit

$1000.00

Spread

Current (6)

Backtests Results

Total net profit

879.46

Gross profit

5484.40

Gross loss

-4604.94

Profit factor

1.19

Expected payoff

0.69

Absolute Bal DD

35.74

Maximal Bal DD

110.92 (9.95%)

Relative Bal DD

9.95% (110.92)

Total Trades

1269

Short positions

616 (54.06%)

Long positions

653 (54.36%)

Profit trades

688 (54.22%)

Loss trades

581 (45.78%)

Largest Profit trade

40.74

Largest Loss trade

-28.20

Average Profit trade

7.97

Average Loss trade

-7.93

Maximum consecutive wins (profit in money)

9 (81.15)

Maximum consecutive losses (loss in money)

12 (-83.87)

Maximal consecutive profit (count of wins)

81.15 (9)

Maximal consecutive loss (count of losses)

-90.10 (9)

Avarage consecutive wins

2

Avarage consecutive losses

2

Backtests Settings

Symbol

AUDUSD (Australian Dollar vs US Dollar)

Period

15 Minutes (M15) 2011.05.31 22:00 - 2016.05.31 21:59

Model

Every tick (the most precise method based on all available least timeframes)

Parameters

Max_Risk_Per_Trade=7; Fixed_LotSize=0; Use_Full_Account_Balance=true;

Set_Initial_Start_Balance=0; Allow_Trades_At_All_Times=true;

Activate_On_DayOfWeek=0; Activate_At_HourOfDay=0; DeActivate_On_DayOfWeek=0; DeActivate_At_HourOfDay=0; Force_Close_Trade=false;

Force_Close_On_DayOfWeek=0; Force_Close_At_HourOfDay=0; Auto_Optimization=true;

Volatility_Limit=45; Range_Upper_Limit=65; Range_Lower_Limit=35; ReversalProfitLevel=50; LCNT1=0; LCNT2=0; LCNT3=0; LSens1=5; LSens2=5; LSens3=1; LMan1=5; LMan2=10; Filter_Feed_Variations=true;

Filter_Low_Vol_Trades=true;EA_COMMENT_PREFIX="MyFxBots.com - RayBOT V4"; Use_Free_Margin_Only=false;

Allow_Slippage=5; RefPrice=1.25; MaxRetry=10; Trefresh=10;

Bars in test

124628

Ticks modelled

54308860

Modelling quality

99.00%

Initial Deposit

$1000.00

Spread

Current (6)

Backtests Results

Total net profit

1264.58

Gross profit

8642.71

Gross loss

-7378.13

Profit factor

1.17

Expected payoff

1.00

Absolute Bal DD

53.72

Maximal Bal DD

182.85 (8.80%)

Relative Bal DD

14.23% (166.50)

Total Trades

1270

Short positions

617 (53.97%)

Long positions

653 (54.21%)

Profit trades

687 (54.09%)

Loss trades

583 (45.91%)

Largest Profit trade

67.85

Largest Loss trade

-42.30

Average Profit trade

12.58

Average Loss trade

-12.66

Maximum consecutive wins (profit in money)

9 (144.55)

Maximum consecutive losses (loss in money)

12 (-125.86)

Maximal consecutive profit (count of wins)

144.55 (9)

Maximal consecutive loss (count of losses)

-147.61 (8)

Avarage consecutive wins

2

Avarage consecutive losses

2

Backtests Settings

Symbol

AUDUSD (Australian Dollar vs US Dollar)

Period

15 Minutes (M15) 2011.05.31 22:00 - 2016.05.31 21:59

Model

Every tick (the most precise method based on all available least timeframes)

Parameters

Max_Risk_Per_Trade=10; Fixed_LotSize=0; Use_Full_Account_Balance=true;

Set_Initial_Start_Balance=0; Allow_Trades_At_All_Times=true;

Activate_On_DayOfWeek=0; Activate_At_HourOfDay=0; DeActivate_On_DayOfWeek=0; DeActivate_At_HourOfDay=0; Force_Close_Trade=false;

Force_Close_On_DayOfWeek=0; Force_Close_At_HourOfDay=0; Auto_Optimization=true;

Volatility_Limit=45; Range_Upper_Limit=65; Range_Lower_Limit=35; ReversalProfitLevel=50; LCNT1=0; LCNT2=0; LCNT3=0; LSens1=5; LSens2=5; LSens3=1; LMan1=5; LMan2=10; Filter_Feed_Variations=true;

Filter_Low_Vol_Trades=true;EA_COMMENT_PREFIX="MyFxBots.com - RayBOT V4"; Use_Free_Margin_Only=false;

Allow_Slippage=5; RefPrice=1.25; MaxRetry=10; Trefresh=10;

Bars in test

124628

Ticks modelled

54308860

Modelling quality

99.00%

Initial Deposit

$1000.00

Spread

Current (6)

Backtests Results

Total net profit

2317.66

Gross profit

15583.78

Gross loss

-13266.12

Profit factor

1.17

Expected payoff

1.83

Absolute Bal DD

71.47

Maximal Bal DD

342.63 (11.74%)

Relative Bal DD

19.83% (245.85)

Total Trades

1269

Short positions

616 (54.06%)

Long positions

653 (54.36%)

Profit trades

688 (54.22%)

Loss trades

581 (45.78%)

Largest Profit trade

122.22

Largest Loss trade

-70.50

Average Profit trade

22.65

Average Loss trade

-22.83

Maximum consecutive wins (profit in money)

9 (280.32)

Maximum consecutive losses (loss in money)

12 (-181.16)

Maximal consecutive profit (count of wins)

280.32 (9)

Maximal consecutive loss (count of losses)

-281.03 (8)

Avarage consecutive wins

2

Avarage consecutive losses

2

EURUSD Backtests

Backtests Settings

Symbol

EURUSD (Euro vs US Dollar)

Period

15 Minutes (M15) 2011.05.31 22:00 - 2016.05.31 21:59

Model

Every tick (the most precise method based on all available least timeframes)

Parameters

Max_Risk_Per_Trade=7; Fixed_LotSize=0.1; Use_Full_Account_Balance=true;

Set_Initial_Start_Balance=0; Allow_Trades_At_All_Times=true;

Activate_On_DayOfWeek=0; Activate_At_HourOfDay=0; DeActivate_On_DayOfWeek=0; DeActivate_At_HourOfDay=0; Force_Close_Trade=false;

Force_Close_On_DayOfWeek=0; Force_Close_At_HourOfDay=0; Auto_Optimization=true;

Volatility_Limit=45; Range_Upper_Limit=65; Range_Lower_Limit=35; ReversalProfitLevel=50; LCNT1=0; LCNT2=0; LCNT3=0; LSens1=5; LSens2=5; LSens3=1; LMan1=5; LMan2=10; Filter_Feed_Variations=true;

Filter_Low_Vol_Trades=true; EA_COMMENT_PREFIX="MyFxBots.com - RayBOT V4"; Use_Free_Margin_Only=false;

Allow_Slippage=5; RefPrice=1.25; MaxRetry=10; Trefresh=10;

Bars in test

124726

Ticks modelled

71793845

Modelling quality

99.00%

Initial Deposit

$1000.00

Spread

Current (5)

Backtests Results

Total net profit

1480.97

Gross profit

8293.25

Gross loss

-6812.28

Profit factor

1.22

Expected payoff

2.74

Absolute Bal DD

633.57

Maximal Bal DD

685.10 (65.15%)

Relative Bal DD

65.15% (685.10)

Total Trades

540

Short positions

252 (58.73%)

Long positions

288 (60.07%)

Profit trades

321 (59.44%)

Loss trades

219 (40.56%)

Largest Profit trade

120.00

Largest Loss trade

-142.00

Average Profit trade

25.84

Average Loss trade

-31.11

Maximum consecutive wins (profit in money)

12 (191.66)

Maximum consecutive losses (loss in money)

7 (-251.16)

Maximal consecutive profit (count of wins)

253.65 (7)

Maximal consecutive loss (count of losses)

-251.16 (7)

Avarage consecutive wins

3

Avarage consecutive losses

2

Backtests Settings

Symbol

EURUSD (Euro vs US Dollar)

Period

15 Minutes (M15) 2011.05.31 22:00 - 2016.05.31 21:59

Model

Every tick (the most precise method based on all available least timeframes)

Parameters

Max_Risk_Per_Trade=5; Fixed_LotSize=0; Use_Full_Account_Balance=true;

Set_Initial_Start_Balance=0; Allow_Trades_At_All_Times=true;

Activate_On_DayOfWeek=0; Activate_At_HourOfDay=0; DeActivate_On_DayOfWeek=0; DeActivate_At_HourOfDay=0; Force_Close_Trade=false;

Force_Close_On_DayOfWeek=0; Force_Close_At_HourOfDay=0; Auto_Optimization=true;

Volatility_Limit=45; Range_Upper_Limit=65; Range_Lower_Limit=35; ReversalProfitLevel=50; LCNT1=0; LCNT2=0; LCNT3=0; LSens1=5; LSens2=5; LSens3=1; LMan1=5; LMan2=10; Filter_Feed_Variations=true;

Filter_Low_Vol_Trades=true; EA_COMMENT_PREFIX="MyFxBots.com - RayBOT V4"; Use_Free_Margin_Only=false;

Allow_Slippage=5; RefPrice=1.25; MaxRetry=10; Trefresh=10;

Bars in test

124726

Ticks modelled

71793845

Modelling quality

99.00%

Initial Deposit

$1000.00

Spread

Current (5)

Backtests Results

Total net profit

322.07

Gross profit

1708.56

Gross loss

-1386.49

Profit factor

1.23

Expected payoff

0.60

Absolute Bal DD

124.55

Maximal Bal DD

136.16 (13.46%)

Relative Bal DD

13.46% (136.16)

Total Trades

540

Short positions

252 (58.73%)

Long positions

288 (60.07%)

Profit trades

321 (59.44%)

Loss trades

219 (40.56%)

Largest Profit trade

24.00

Largest Loss trade

-28.40

Average Profit trade

5.32

Average Loss trade

-6.33

Maximum consecutive wins (profit in money)

12 (38.57)

Maximum consecutive losses (loss in money)

7 (-50.23)

Maximal consecutive profit (count of wins)

63.28 (9)

Maximal consecutive loss (count of losses)

-50.23 (7)

Avarage consecutive wins

3

Avarage consecutive losses

2

Backtests Settings

Symbol

EURUSD (Euro vs US Dollar)

Period

15 Minutes (M15) 2011.05.31 22:00 - 2016.05.31 21:59

Model

Every tick (the most precise method based on all available least timeframes)

Parameters

Max_Risk_Per_Trade=7; Fixed_LotSize=0; Use_Full_Account_Balance=true;

Set_Initial_Start_Balance=0; Allow_Trades_At_All_Times=true;

Activate_On_DayOfWeek=0; Activate_At_HourOfDay=0; DeActivate_On_DayOfWeek=0; DeActivate_At_HourOfDay=0; Force_Close_Trade=false;

Force_Close_On_DayOfWeek=0; Force_Close_At_HourOfDay=0; Auto_Optimization=true;

Volatility_Limit=45; Range_Upper_Limit=65; Range_Lower_Limit=35; ReversalProfitLevel=50; LCNT1=0; LCNT2=0; LCNT3=0; LSens1=5; LSens2=5; LSens3=1; LMan1=5; LMan2=10; Filter_Feed_Variations=true;

Filter_Low_Vol_Trades=true; EA_COMMENT_PREFIX="MyFxBots.com - RayBOT V4"; Use_Free_Margin_Only=false;

Allow_Slippage=5; RefPrice=1.25; MaxRetry=10; Trefresh=10;

Bars in test

124726

Ticks modelled

71793845

Modelling quality

99.00%

Initial Deposit

$1000.00

Spread

Current (5)

Backtests Results

Total net profit

436.95

Gross profit

2355.31

Gross loss

-1918.36

Profit factor

1.23

Expected payoff

0.81

Absolute Bal DD

181.85

Maximal Bal DD

187.58 (18.65%)

Relative Bal DD

18.65% (187.58)

Total Trades

540

Short positions

252 (58.73%)

Long positions

288 (60.07%)

Profit trades

321 (59.44%)

Loss trades

219 (40.56%)

Largest Profit trade

36.00

Largest Loss trade

-42.60

Average Profit trade

7.34

Average Loss trade

-8.76

Maximum consecutive wins (profit in money)

12 (58.22)

Maximum consecutive losses (loss in money)

7 (-75.35)

Maximal consecutive profit (count of wins)

84.73 (9)

Maximal consecutive loss (count of losses)

-75.35 (7)

Avarage consecutive wins

3

Avarage consecutive losses

2

Backtests Settings

Symbol

EURUSD (Euro vs US Dollar)

Period

15 Minutes (M15) 2011.05.31 22:00 - 2016.05.31 21:59

Model

Every tick (the most precise method based on all available least timeframes)

Parameters

Max_Risk_Per_Trade=10; Fixed_LotSize=0; Use_Full_Account_Balance=true;

Set_Initial_Start_Balance=0; Allow_Trades_At_All_Times=true;

Activate_On_DayOfWeek=0; Activate_At_HourOfDay=0; DeActivate_On_DayOfWeek=0; DeActivate_At_HourOfDay=0; Force_Close_Trade=false;

Force_Close_On_DayOfWeek=0; Force_Close_At_HourOfDay=0; Auto_Optimization=true;

Volatility_Limit=45; Range_Upper_Limit=65; Range_Lower_Limit=35; ReversalProfitLevel=50; LCNT1=0; LCNT2=0; LCNT3=0; LSens1=5; LSens2=5; LSens3=1; LMan1=5; LMan2=10; Filter_Feed_Variations=true;

Filter_Low_Vol_Trades=true; EA_COMMENT_PREFIX="MyFxBots.com - RayBOT V4"; Use_Free_Margin_Only=false;

Allow_Slippage=5; RefPrice=1.25; MaxRetry=10; Trefresh=10;

Bars in test

124726

Ticks modelled

71793845

Modelling quality

99.00%

Initial Deposit

$1000.00

Spread

Current (5)

Backtests Results

Total net profit

701.07

Gross profit

3454.94

Gross loss

-2753.87

Profit factor

1.25

Expected payoff

1.30

Absolute Bal DD

242.95

Maximal Bal DD

251.35 (24.93%)

Relative Bal DD

24.93% (251.35)

Total Trades

540

Short positions

252 (58.73%)

Long positions

288 (60.07%)

Profit trades

321 (59.44%)

Loss trades

219 (40.56%)

Largest Profit trade

60.00

Largest Loss trade

-56.80

Average Profit trade

10.76

Average Loss trade

-12.57

Maximum consecutive wins (profit in money)

12 (97.03)

Maximum consecutive losses (loss in money)

7 (-96.66)

Maximal consecutive profit (count of wins)

140.20 (9)

Maximal consecutive loss (count of losses)

-96.66 (7)

Avarage consecutive wins

3

Avarage consecutive losses

2

USDCAD Backtests

Backtests Settings

Symbol

USDCAD (US Dollar vs Canadian Dollar)

Period

15 Minutes (M15) 2011.05.31 22:00 - 2016.05.31 21:59

Model

Every tick (the most precise method based on all available least timeframes)

Parameters

Max_Risk_Per_Trade=7; Fixed_LotSize=0.1; Use_Full_Account_Balance=true;

Set_Initial_Start_Balance=0; Allow_Trades_At_All_Times=true;

Activate_On_DayOfWeek=0; Activate_At_HourOfDay=0; DeActivate_On_DayOfWeek=0; DeActivate_At_HourOfDay=0; Force_Close_Trade=false;

Force_Close_On_DayOfWeek=0; Force_Close_At_HourOfDay=0; Auto_Optimization=true;

Volatility_Limit=45; Range_Upper_Limit=65; Range_Lower_Limit=35; ReversalProfitLevel=50; LCNT1=0; LCNT2=0; LCNT3=0; LSens1=5; LSens2=5; LSens3=1; LMan1=5; LMan2=10; Filter_Feed_Variations=true;

Filter_Low_Vol_Trades=true;

EA_COMMENT_PREFIX="MyFxBots.com - RayBOT V4"; Use_Free_Margin_Only=false;

Allow_Slippage=5; RefPrice=1.25; MaxRetry=10; Trefresh=10;

Bars in test

124689

Ticks modelled

45637793

Modelling quality

99.00%

Initial Deposit

$1000.00

Spread

Current (10)

Backtests Results

Total net profit

2703.40

Gross profit

9487.62

Gross loss

-6784.22

Profit factor

1.40

Expected payoff

3.48

Absolute Bal DD

45.95

Maximal Bal DD

389.83 (14.19%)

Relative Bal DD

14.19% (389.83)

Total Trades

777

Short positions

411 (62.29%)

Long positions

366 (68.03%)

Profit trades

505 (64.99%)

Loss trades

272 (35.01%)

Largest Profit trade

107.28

Largest Loss trade

-91.07

Average Profit trade

18.79

Average Loss trade

-24.94

Maximum consecutive wins (profit in money)

12 (136.14)

Maximum consecutive losses (loss in money)

6 (-106.15)

Maximal consecutive profit (count of wins)

230.91 (9)

Maximal consecutive loss (count of losses)

-107.78 (5)

Avarage consecutive wins

3

Avarage consecutive losses

1

Backtests Settings

Symbol

USDCAD (US Dollar vs Canadian Dollar)

Period

15 Minutes (M15) 2011.05.31 22:00 - 2016.05.31 21:59

Model

Every tick (the most precise method based on all available least timeframes)

Parameters

Max_Risk_Per_Trade=5; Fixed_LotSize=0; Use_Full_Account_Balance=true;

Set_Initial_Start_Balance=0; Allow_Trades_At_All_Times=true;

Activate_On_DayOfWeek=0; Activate_At_HourOfDay=0; DeActivate_On_DayOfWeek=0; DeActivate_At_HourOfDay=0; Force_Close_Trade=false;

Force_Close_On_DayOfWeek=0; Force_Close_At_HourOfDay=0; Auto_Optimization=true;

Volatility_Limit=45; Range_Upper_Limit=65; Range_Lower_Limit=35; ReversalProfitLevel=50; LCNT1=0; LCNT2=0; LCNT3=0; LSens1=5; LSens2=5; LSens3=1; LMan1=5; LMan2=10; Filter_Feed_Variations=true;

Filter_Low_Vol_Trades=true;

EA_COMMENT_PREFIX="MyFxBots.com - RayBOT V4"; Use_Free_Margin_Only=false;

Allow_Slippage=5; RefPrice=1.25; MaxRetry=10; Trefresh=10;

Bars in test

124689

Ticks modelled

45637793

Modelling quality

99.00%

Initial Deposit

$1000.00

Spread

Current (10)

Backtests Results

Total net profit

776.67

Gross profit

2943.19

Gross loss

-2166.52

Profit factor

1.36

Expected payoff

1.00

Absolute Bal DD

9.20

Maximal Bal DD

116.92 (8.33%)

Relative Bal DD

8.33% (116.92)

Total Trades

777

Short positions

411 (62.29%)

Long positions

366 (68.03%)

Profit trades

505 (64.99%)

Loss trades

272 (35.01%)

Largest Profit trade

53.64

Largest Loss trade

-36.43

Average Profit trade

5.83

Average Loss trade

-7.97

Maximum consecutive wins (profit in money)

12 (40.85)

Maximum consecutive losses (loss in money)

6 (-31.83)

Maximal consecutive profit (count of wins)

81.53 (4)

Maximal consecutive loss (count of losses)

-51.00 (4)

Avarage consecutive wins

3

Avarage consecutive losses

1

Backtests Settings

Symbol

USDCAD (US Dollar vs Canadian Dollar)

Period

15 Minutes (M15) 2011.05.31 22:00 - 2016.05.31 21:59

Model

Every tick (the most precise method based on all available least timeframes)

Parameters

Max_Risk_Per_Trade=7; Fixed_LotSize=0; Use_Full_Account_Balance=true;

Set_Initial_Start_Balance=0; Allow_Trades_At_All_Times=true;

Activate_On_DayOfWeek=0; Activate_At_HourOfDay=0; DeActivate_On_DayOfWeek=0; DeActivate_At_HourOfDay=0; Force_Close_Trade=false;

Force_Close_On_DayOfWeek=0; Force_Close_At_HourOfDay=0; Auto_Optimization=true;

Volatility_Limit=45; Range_Upper_Limit=65; Range_Lower_Limit=35; ReversalProfitLevel=50; LCNT1=0; LCNT2=0; LCNT3=0; LSens1=5; LSens2=5; LSens3=1; LMan1=5; LMan2=10; Filter_Feed_Variations=true;

Filter_Low_Vol_Trades=true;

EA_COMMENT_PREFIX="MyFxBots.com - RayBOT V4"; Use_Free_Margin_Only=false;

Allow_Slippage=5; RefPrice=1.25; MaxRetry=10; Trefresh=10;

Bars in test

124689

Ticks modelled

45637793

Modelling quality

99.00%

Initial Deposit

$1000.00

Spread

Current (10)

Backtests Results

Total net profit

1478.42

Gross profit

5051.06

Gross loss

-3572.64

Profit factor

1.41

Expected payoff

1.91

Absolute Bal DD

13.42

Maximal Bal DD

191.34 (11.15%)

Relative Bal DD

11.15% (191.34)

Total Trades

774

Short positions

410 (62.93%)

Long positions

364 (68.96%)

Profit trades

509 (65.76%)

Loss trades

265 (34.24%)

Largest Profit trade

96.55

Largest Loss trade

-63.53

Average Profit trade

9.92

Average Loss trade

-13.48

Maximum consecutive wins (profit in money)

12 (56.33)

Maximum consecutive losses (loss in money)

6 (-52.39)

Maximal consecutive profit (count of wins)

147.51 (4)

Maximal consecutive loss (count of losses)

-96.65 (4)

Avarage consecutive wins

3

Avarage consecutive losses

1

Backtests Settings

Symbol

USDCAD (US Dollar vs Canadian Dollar)

Period

15 Minutes (M15) 2011.05.31 22:00 - 2016.05.31 21:59

Model

Every tick (the most precise method based on all available least timeframes)

Parameters

Max_Risk_Per_Trade=10; Fixed_LotSize=0; Use_Full_Account_Balance=true;

Set_Initial_Start_Balance=0; Allow_Trades_At_All_Times=true;

Activate_On_DayOfWeek=0; Activate_At_HourOfDay=0; DeActivate_On_DayOfWeek=0; DeActivate_At_HourOfDay=0; Force_Close_Trade=false;

Force_Close_On_DayOfWeek=0; Force_Close_At_HourOfDay=0; Auto_Optimization=true;

Volatility_Limit=45; Range_Upper_Limit=65; Range_Lower_Limit=35; ReversalProfitLevel=50; LCNT1=0; LCNT2=0; LCNT3=0; LSens1=5; LSens2=5; LSens3=1; LMan1=5; LMan2=10; Filter_Feed_Variations=true;

Filter_Low_Vol_Trades=true;

EA_COMMENT_PREFIX="MyFxBots.com - RayBOT V4"; Use_Free_Margin_Only=false;

Allow_Slippage=5; RefPrice=1.25; MaxRetry=10; Trefresh=10;

Bars in test

124689

Ticks modelled

45637793

Modelling quality

99.00%

Initial Deposit

$1000.00

Spread

Current (10)

Backtests Results

Total net profit

2173.07

Gross profit

8275.77

Gross loss

-6102.70

Profit factor

1.36

Expected payoff

2.80

Absolute Bal DD

18.38

Maximal Bal DD

322.03 (16.08%)

Relative Bal DD

16.08% (322.03)

Total Trades

777

Short positions

411 (62.29%)

Long positions

366 (68.03%)

Profit trades

505 (64.99%)

Loss trades

272 (35.01%)

Largest Profit trade

160.92

Largest Loss trade

-109.29

Average Profit trade

16.39

Average Loss trade

-22.44

Maximum consecutive wins (profit in money)

12 (95.31)

Maximum consecutive losses (loss in money)

6 (-94.63)

Maximal consecutive profit (count of wins)

245.66 (4)

Maximal consecutive loss (count of losses)

-169.12 (4)

Avarage consecutive wins

3

Avarage consecutive losses

1

Portfolio Report with Risk 7 on EURUSD + AUDUSD + USDCAD from 2011 to 2015

(Conducted by the EA developers)

Trading Strategy

By its carefully coded logic, RayBOT trades swings close to support / resistance levels and once a position has been opened, the eagerly acting built in trade management unit starts its work.

To protect the trade, the ideal StopLoss and TakeProfit levels are then immediately calculated by the EA to be set on the broker's side, while the trade is really managed by using undisclosed StopLoss and TakeProfit which are dynamically calculated by the EA according to the running volatility level and usually limited to 65 pips on an average of just 35 pips. During periods of financial crisis, the market could be extremely volatile, in such cases, the EA sets the StopLoss at a maximum of 200 pips.

RayBOT allows winning trades to continue to their full potential to maximize gains while it early cuts losing ones. It usually closes trades on the trend strength loss or at the early beginning of a reversal.

The system is a positive risk to reward ratio dependent, achieving a success rate that could exceed 50%.

Parameter Settings

All what is needed to be set for trading are these parameters (The Most Important):

Activation_Code

This is to be set to your activation code sent to you by the EA vendor after subscription.

Max_Risk_Per_Trade

The Maximum Risk Per Trade value is recommended by the EA developers to be set to 7.0.

Fixed_LotSize

If set to zero, Fixed lot size would be disabled, to enable it set it to any higher value.

Auto_Optimization

This is an interesting advantageous parameter!

When enabled (set to true), the remaining parameters will be automatically updated and optimized online from RayBOT official server, all upcoming updates will be tightly optimized and tested by the EA developers team and are released once every month to be used for trading throughout that month.

Disabling it by setting it to false will expose all the EA parameters to manual setting up and won't be automatically updated.

Max_Risk_Per_Trade

This parameter is important in setting the accurate risk for trading RayBOT and is set by default to 7, so the calculated lot size for EURUSD in a $10000 account would be 0.3 lot.

These parameters with all the others are explained in more details in the included user manual.

The remaining trading parameters can be left as are to be automatically updated if desired.

Bottom Line

What most distinguishes RayBOT is that it's not sold forever as the majority of other Forex Robots, but has a paid periodic subscription license, even the lifetime subscription has an annual renewal fee of $65, this could be a bit costly for the traders using it especially the beginners, but this is the only and surest guarantee for the continued support and development of the EA over time.

Promotional Video (by the Vendor)

Other Forex Robots from Phibase

Ray Scalper core trading strategy is the concept of Ray Tracing on M15 / H1 trading range channels & Fibonacci levels. It never performs martingale nor pyramiding neither pending orders.

Trend following and retracement. If moving averages confirm the required market conditions, price action is used to generate trading signals.

Tags

Valery Trading

Tickmill

FXAutomater

Algocrat AI

WallStreet Forex Robot 3.0 Domination

Tick Data Suite

FBS

Waka Waka

IC Markets

Forex Diamond

Perceptrader AI

Volatility Factor Pro

RoboForex

HF Markets

XM

StrategyQuant X

InstaForex

Alpari

GPS Forex Robot

Forex Combo System

Forex Trend Detector

FX Scalper

GrandCapital

Omega Trend

SMRT Algo

IronFX

AMarkets

Telegram Signal Copier

Broker Arbitrage

Golden Pickaxe

TradingFX VPS

Quant Analyzer

FXVM

Binance

ForexSignals.com

Forex Gold Investor

ACY Securities

AlgoWizard

RayBOT

Gold Miner

FxPro

News Scope EA PRO

Commercial Network Services

Smart Scalper PRO

Libertex

FXCharger

Pump Trader Robot

LeapFX Trading Academy

Quant Data Manager

ForexTime

WallStreet Recovery PRO

FX-Builder

Gold Scalper PRO

FX Choice

BlackBull Markets

Happy Bitcoin

Forex Robot Factory (Expert Advisor Generator)

Trend Matrix EA

Infinity Trader

VPS Forex Trader

Happy Forex

ByBit

Swing Trader PRO

QHoster

StarTrader

Database Mart

Evening Scalper PRO

Forex VPS

DARKEAS

Gold Breaker

Magnetic Exchange

MTeletool

Quant Tekel Funded

Vortex Trader PRO

Best Free Scalper Pro

Telegram Copier

FX Secret Club

Forex Robot Academy

EGPForex

Risk

Forex trading can involve the risk of loss beyond your initial deposit. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary.

Forex accounts typically offer various degrees of leverage and their elevated profit potential is counterbalanced by an equally high level of risk. You should never risk more than you are prepared to lose and you should carefully take into consideration your trading experience.

Past performance and simulated results are not necessarily indicative of future performance. All the content on this site represents the sole opinion of the author and does not constitute an express recommendation to purchase any of the products described in its pages.