Menu

A third‑party verified review of SlingShot from LeapFX Trading Academy. The EA is presented as a medium‑term, price‑action trend system backed by 10 years of test data and multiple MyFXBook live accounts. The reviewer frames it as conservative, FIFO‑friendly, and focused on controlled drawdowns rather than aggressive money‑management techniques.

Trading Idea

SlingShot follows a pure price‑action, trend‑following concept: identify market structure and momentum, enter selective trades, hold positions for hours to days, and size positions by signal strength and stop distance. The approach avoids indicator repainting and refrains from grid or martingale methods.

Specifications

NFA FIFO Compatibility

The expert states FIFO‑compliant design; the reviewer notes it can be used with US brokers that enforce FIFO rules.

License

The EA is licensed per purchase: one real or demo account per license as described by the vendor.

Broker and VPS

The vendor claims broad broker compatibility; no specific spread or latency thresholds are provided in the source.

It is advisable to select a reliable broker such as Tickmill, and IC Markets. Use TradingFX VPS VPS for optimal performance.

MT5 version availability

An MT5‑compatible version is available in addition to MT4.

Recommended starting balance

The vendor suggests account limits up to $50,000; no explicit minimal deposit is mandated in the source.

Recommended trading account criteria

The EA is designed for standard retail forex accounts; specific account types should be confirmed with the vendor.

User guide inclusion

Purchase includes a manual with instructions, graphics, and recommendations.

Customer support

Vendor offers customer support and updates; exact hours and channels are provided by the seller.

Future updates

Buyers receive free updates that optimize settings and maintain compatibility.

Compatible operating systems

Runs on platforms that support MT4/MT5 terminals.

Installer

The EA is delivered with installation instructions; no standalone installer details are provided in the source.

Refund policy

The system is backed by a 30‑day money‑back guarantee.

Supported Currency Pairs

EURUSD and USDJPY

MetaTrader Chart Timeframe

M5

3rd Party-Verified SlingShot's Live Trading Result Statements

The vendor provides multiple MyFXBook widgets showing live, third‑party verified accounts and highlights a smooth equity curve and low drawdowns.

Real Money Account

Live Test Summary

Started On

Jul 14, 2024

Account Leverage

1:100

Profit Factor

1.38

Total Gain

+265.91%

Absolute Gain

+100.71%

Monthly Gain

7.89%

Daily Gain

0.25%

Total Pips

2,484.9

Total Trades

443

Profit Amount

$2,875.18

(%) Won Trades

2,484.9

Drawdown

16.67%

Real Money Account

Started On

May 27, 2025

Leverage

1:500

Broker

Motive Markets

Starting Balance

$20000

Total Gain

+179.07%

Live Test Summary

Started On

May 27, 2025

Account Leverage

1:500

Profit Factor

2.60

Total Gain

+179.07%

Absolute Gain

+179.07%

Monthly Gain

16.32%

Daily Gain

0.50%

Total Pips

1,487.4

Total Trades

119

Profit Amount

$35,814.42

(%) Won Trades

1,487.4

Drawdown

7.25%

Real Money Account

Started On

Nov 13, 2025

Leverage

1:200

Broker

Blaze Markets

Starting Balance

$20000

Total Gain

+62.32%

Live Test Summary

Started On

Nov 13, 2025

Account Leverage

1:200

Profit Factor

2.72

Total Gain

+62.32%

Absolute Gain

+62.31%

Monthly Gain

55.94%

Daily Gain

1.39%

Total Pips

355.3

Total Trades

24

Profit Amount

$12,462.33

(%) Won Trades

355.3

Drawdown

9.62%

The reviewer acknowledges the presence of verified live accounts but recommends independent inspection of each MyFXBook widget and demo testing before committing real capital.

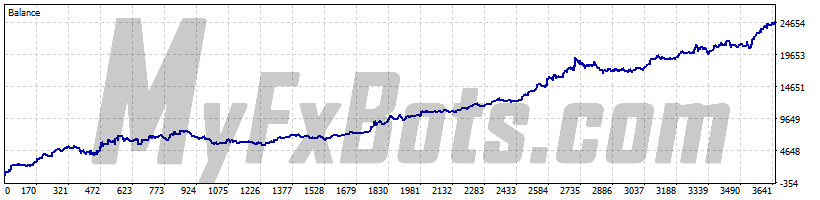

SlingShot's Backtests by MetaTrader Strategy Tester using High Quality Historical Tick Data

Vendor materials include 10‑year backtests presented both with and without compounding to illustrate consistency and the effect of compounding.

CompoundingTest

Backtests Settings

Symbol

USDJPY.ducas

Period

M5 (2015.01.01 - 2025.09.18)

Broker

Currency

USD

Leverage

1:100

Symbols

1

Bars in test

799782

Ticks modelled

310180894

Modelling quality

100% real ticks

Initial Deposit

$1000.00

Backtests Results

Total net profit

1219713.14

Gross profit

5177308.48

Gross loss

-3957595.34

Profit factor

1.31

Expected payoff

334.99

Margin level

181.40%

Absolute Bal DD

20.16

Maximal Bal DD

128 956.97 (22.43%)

Relative Bal DD

59.96% (6 300.14)

Absolute EQ DD

22.49

Maximal EQ DD

147 813.78 (12.85%)

Relative EQ DD

61.32% (6 502.95)

Recovery Factor

8.25

Sharp Ratio

1.77

Z-Score

1.29 (80.29%)

AHPR

1.0025 (0.25%)

LR Correlation

0.74

OnTester result

-

GHPR

1.0020 (0.20%)

LR Standard Error

135977.07

Total Trades

3641

Short positions

1796 (42.82%)

Long positions

1845 (48.78%)

Profit trades

1669 (45.84%)

Loss trades

1972 (54.16%)

Largest Profit trade

178249.91

Largest Loss trade

-26640.09

Average Profit trade

3102.04

Average Loss trade

-2006.89

Maximum consecutive wins (profit in money)

8 (130 034.72)

Maximum consecutive losses (loss in money)

14 (-5 173.07)

Maximal consecutive profit (count of wins)

210 408.17 (2)

Maximal consecutive loss (count of losses)

-89 333.90 (12)

Avarage consecutive wins

2

Avarage consecutive losses

2

NoCompoundingTest

Backtests Settings

Symbol

USDJPY.ducas

Period

M5 (2015.01.01 - 2025.09.18)

Broker

Currency

USD

Leverage

1:100

Symbols

1

Bars in test

799782

Ticks modelled

310180894

Modelling quality

100% real ticks

Initial Deposit

$1000.00

Backtests Results

Total net profit

23772.63

Gross profit

153103.88

Gross loss

-129331.25

Profit factor

1.18

Expected payoff

6.53

Margin level

277.43%

Absolute Bal DD

151.21

Maximal Bal DD

2 456.28 (12.79%)

Relative Bal DD

30.33% (2 384.66)

Absolute EQ DD

167.70

Maximal EQ DD

2 478.30 (12.89%)

Relative EQ DD

31.03% (2 451.07)

Recovery Factor

9.59

Sharp Ratio

1.39

Z-Score

1.29 (80.29%)

AHPR

1.0010 (0.10%)

LR Correlation

0.96

OnTester result

-

GHPR

1.0009 (0.09%)

LR Standard Error

1679.65

Total Trades

3641

Short positions

1796 (42.82%)

Long positions

1845 (48.78%)

Profit trades

1669 (45.84%)

Loss trades

1972 (54.16%)

Largest Profit trade

1296.79

Largest Loss trade

-808.31

Average Profit trade

91.73

Average Loss trade

-65.58

Maximum consecutive wins (profit in money)

8 (1 252.24)

Maximum consecutive losses (loss in money)

14 (-869.52)

Maximal consecutive profit (count of wins)

1 352.24 (2)

Maximal consecutive loss (count of losses)

-928.31 (12)

Avarage consecutive wins

2

Avarage consecutive losses

2

Long‑term backtests are informative for robustness checks; the reviewer notes they do not guarantee future performance and should be used alongside live verification.

SlingShot's Trading Strategy

- Core concept: Price‑action trend following that reads market structure rather than relying on traditional indicators.

- Entry rules: Selective entries based on signal strength and market structure; no indicator repainting claims.

- Position management: One position at a time; never pyramids or add‑ons until the first trade closes; maximum two trades per day to avoid overtrading.

- Risk sizing: Dynamic sizing tied to signal strength and stop distance; conservative by design.

- Money management: No grid; no martingale; each trade is independent.

- Time horizon: Medium‑term trades held for hours to days.

- Compliance: FIFO‑compliant and no hedging to suit US‑regulated brokers and prop‑firm rules.

SlingShot's MetaTrader Parameters

The EA supports both MT4 and MT5 and ships with recommended presets, updateable configuration files, and customer guidance on risk settings. The vendor provides one‑year and lifetime license options and a 30‑day money‑back guarantee. Specific numeric parameter values are supplied with the product and are not restated here.

SlingShot's Review Bottom Line

SlingShot from LeapFX Trading Academy is a conservative, trend‑focused automated system with decade‑long testing and third‑party live verification. It is suitable for traders seeking FIFO‑friendly automation and disciplined risk control; users should verify live widgets, test on demo accounts, and confirm account limits and settings before live deployment.

Promotional Video (by the Vendor)

Other Forex Robots from LeapFX Trading Academy

Arbitrage trading strategy where a certain currency positions are being opened depending on two different broker price feeds. It exploits differences in the price from each feed and profits from those discrepancies.

By measuring market volatility and oscillation, accounting trends and tracking price action, the robot can use the resulting data and combine it perfectly with its settings and built in indicators as CCI, Moving Averages, WPR, and others to wipe out the majority of harmful and bad signals, what finally results in being a huge win rate system.

Vortex Trader PRO uses a MySQL database to broadcast trading signals, it trades around the clock as was proved by its live performance statements with an average win of 11 pips and average loss of 21 pips.

Vortex Trader PRO uses a MySQL database to broadcast trading signals, it trades around the clock as was proved by its live performance statements with an average win of 11 pips and average loss of 21 pips.

It employs a micro channel breakout strategy and scans the lower timeframes, so once a breakout occurs, the robot automatically opens a trade with a 200 pip SL and carefully manages it until its closure on average win of 11 pips or average loss of 21 pips. The EA sends its trading signals via a MySQL database.

Channel Trader PRO not a high frequency scalper as on average it trades about 200 to 300 times a year. It focuses on short term trades to smartly enter and leave the market harvesting its profits with limited exposure to rapid market movements.

It implements the successful Forex trading behaviors including emotion, verifications, trade management, money management, and market awareness into its trading strategy.

Channel Trader PRO not a high frequency scalper as on average it trades about 200 to 300 times a year. It focuses on short term trades to smartly enter and leave the market harvesting its profits with limited exposure to rapid market movements.

It implements the successful Forex trading behaviors including emotion, verifications, trade management, money management, and market awareness into its trading strategy.

Scalp Trader PRO monitors and detects trends on the MT4 chart using moving averages, price action, and some other powerful tools ignoring weak trends and looking only for the strong ones.

Once there is a potential kick in an opposing direction, the system will use its meticulous intelligent algorithm to scan and analyze it and determine if it's just a temporary move or not and signals a continuation pattern starting.

It generally trades every week, but sporadic days with no trades can exist, this is how it avoids unnecessary risk for the account.

Once there is a potential kick in an opposing direction, the system will use its meticulous intelligent algorithm to scan and analyze it and determine if it's just a temporary move or not and signals a continuation pattern starting.

It generally trades every week, but sporadic days with no trades can exist, this is how it avoids unnecessary risk for the account.

As its name suggests, Hedge Track Trader uses a hedge trading strategy that appears to be a safe one with low risk and it could yield high profits. Its integrated algorithm is designed to adapt to the continuously changing market conditions and intelligently managing trades and risk, lock-in profits and strictly limit drawdowns.

Funnel Trader EA strategy simply identifies short term trends and trades in their direction.

Auto ARB is an arbitrage based trading system coded and refined by LeapFX Trading Academy developers team that has a set of automated trading systems being reviewed in MyFxBots.

Auto News Trader is a fully automated Forex trading robot that opens trades depending on news releases. Trading news is an important Forex trading strategy that exists and being used by Forex traders a long time ago although special precautions should be taken to what could occur during and around Forex news releases like spreads increase and execution delay, what is called slippage in the trading industry.

Arbitrage Trading is a method that's not predicting the future market movement but tries to identify where the market will go on a broker based on another price feed and profiting from those differences.

With the help of its built-in Forex indicators, Atomic Trader uses its unique algorithm to identify when the market is supposed to go up or down, then enters or closes trades on your behalf while you live your regular day.

No Grid, No Hedging, No Martingale, and No Massive StopLoss. But a strong evolved Money Management System.

Gold Trader runs completely automated and manages the GOLD investment by capitalizing on the volatility movements of GOLD.

In order to spot trends in the markets, the Easy Money X Ray Robot makes use of a proprietary quad indicator system that is composed of four indicators that are used in combination to determine the best entry points.

To put it bluntly, Econ Power Trader is a news straddle trader that has been designed for day traders. Econ Power Trader Never uses a grid, Never uses martingale, Never uses cost averaging, & Never over leverages.

Instead of looking at signals on your chart just run Instant EA with your indicator and it will automatically trade, manage, and close your trades.

Instant EA allows you to

- Back-test your indicators rapidly, test settings, and optimize.

- Run your indicators on live and demo accounts automatically (no more sitting in front of your computer for hours on end).

- Convert your indicators into fully automated Forex robots.

- And so much more.

Jet Trader Pro's calculate is based on the EURUSD highs and lows, making it the ideal tool for profiting from this currency pair.

News Action Trader utilizes real-time economic information from a reliable news source and automatically opens, manages, and closes trades.

Patterns are formations of pricing that provide us with a graphical representation of what’s going on behind the scenes in the market, Pattern Trader PRO can recognize them and make trades based on their analysis.

The cornerstone principles for Power Trader take into account price action, market volatility, and short-term trending.

Quick Scalp Trader identifies the trend with optimized moving averages, then determines an entry based on fractals and candlestick movement.

Stealth Trader is a low drawdown system, meaning it's designed to trade with very little loss while maximizing profits using NO martingale and NO grid strategy whatsoever. There will be opportunities to profit almost EVERY SINGLE DAY.

Without using a grid, martingale, or hedging strategies, Fund Trader approaches the market via a dualistic (2-step) process to determine when to enter and exit the market with profit.

Money Tree has a win rate of about 90%, with no account exposure risk, and low Stop Loss. It's not a Hedging or Grid system

The Skilled Trader has been developed to utilize and maximize the 3 secrets of successful Forex trading that will be discussed in this review. These 3 secrets actually work to allow the EA to beat the Forex market without being sabotaged by the broker it's trading on.

Trade Explorer efficiently monitors the market trends and price action, while ignoring sharp movements and market noise. It has an advanced dynamic trade management system designed to keep high returns with relatively low drawdowns.

Trade Explorer scans over 27 pairs, hunting for opportunities to be exploited.

The King Robot is a high-growth scalper with no grid, and as its developers ensure, the EA can get 10% to 100% profit per month with a high frequency of trades.

Power Growth Trader is a scalper EA with an intelligent money management system.

The Target Trader system has a proven track record of delivering consistent results based on trend, volatility, and price action movements using intelligent, carefully selected trade entries. Besides that, it's designed to last for years without needing to be updated.

The Pump Trader Robot employs a "calibrated automated trading strategy", most similar to the Trend Following Strategy that focuses on maximizing profits while minimizing risk exposure. This strategy involves using algorithms to make trading decisions based on pre-determined criteria, ensuring consistent performance and lower risk.

The Gold Miner Expert Advisor harnesses market momentum through precise price action analysis to execute rapid scalping trades in gold. With each trade protected by a built-in stop-loss, the system emphasizes disciplined risk management while capturing fleeting profit opportunities.

The trading idea behind Gold Breaker, developed by LeapFX Trading Academy, revolves around capturing gold’s breakout opportunities. It identifies key support and resistance breaches, places pending buy/sell orders at optimal levels, and enters only on genuine momentum signals. By filtering whipsaws and pairing this with adaptive stop-loss and take-profit, it pursues both short-term bursts and major trend moves without emotional bias.

Identify outsized moves away from equilibrium using a dynamic statistical channel on AUDCAD M5, enter on probable reversion points, lock quick confirmations at preset profit targets, and if price extends, layer additional positions at measured intervals while a built‑in timer prevents overexposure.

SlingShot follows a pure price‑action, trend‑following concept: identify market structure and momentum, enter selective trades, hold positions for hours to days, and size positions by signal strength and stop distance. The approach avoids indicator repainting and refrains from grid or martingale methods.

Explore insights on MTeletool, an instant forex trades copying tool that channels real-time transactions from a broker’s account to a Telegram channel, developed by LeapFX Trading Academy — the experts in crafting advanced Expert Advisors. Dive into article summaries that reveal its innovative features and dynamic trading strategies.

Tags

Valery Trading

Tickmill

FXAutomater

Algocrat AI

WallStreet Forex Robot 3.0 Domination

Tick Data Suite

Waka Waka

FBS

IC Markets

Perceptrader AI

Forex Diamond

XM

HF Markets

RoboForex

StrategyQuant X

Volatility Factor Pro

InstaForex

Alpari

GPS Forex Robot

Forex Combo System

Automated Forex Tools

Forex Trend Detector

FX Scalper

GrandCapital

Golden Pickaxe

SMRT Algo

AMarkets

IronFX

Omega Trend

Telegram Signal Copier

Broker Arbitrage

Gold Miner

Forex Trend Hunter

Quant Analyzer

Binance

FXVM

TradingFX VPS

ForexSignals.com

AlgoWizard

RayBOT

FxPro

Forex Gold Investor

ACY Securities

Gold Scalper PRO

Infinity Trader

Pump Trader Robot

LeapFX Trading Academy

ForexTime

WallStreet Recovery PRO

BlackBull Markets

Libertex

Quant Data Manager

FXCharger

FX Choice

News Scope EA PRO

Commercial Network Services

Smart Scalper PRO

FX-Builder

Happy Forex

ByBit

Database Mart

DARKEAS

Gold Breaker

Magnetic Exchange

Quant Tekel Funded

Vortex Trader PRO

Swing Trader PRO

StarTrader

Forex VPS

MTeletool

Best Free Scalper Pro

Pepperstone

VPS Forex Trader

QHoster

Evening Scalper PRO

Telegram Copier

FX Secret Club

Forex Robot Academy

Happy Bitcoin

Forex Robot Factory (Expert Advisor Generator)

Trend Matrix EA

EGPForex

Risk

Forex trading can involve the risk of loss beyond your initial deposit. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary.

Forex accounts typically offer various degrees of leverage and their elevated profit potential is counterbalanced by an equally high level of risk. You should never risk more than you are prepared to lose and you should carefully take into consideration your trading experience.

Past performance and simulated results are not necessarily indicative of future performance. All the content on this site represents the sole opinion of the author and does not constitute an express recommendation to purchase any of the products described in its pages.