Menu

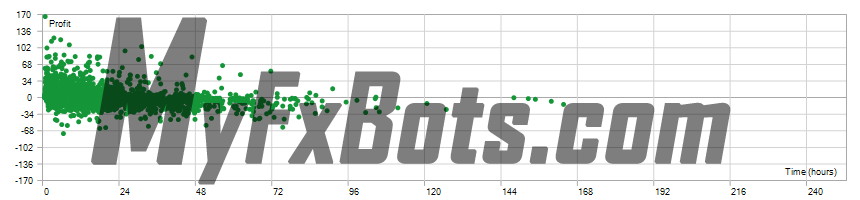

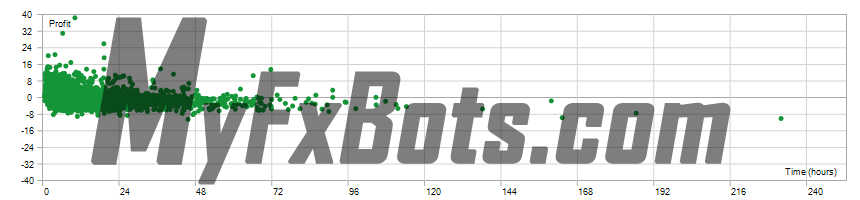

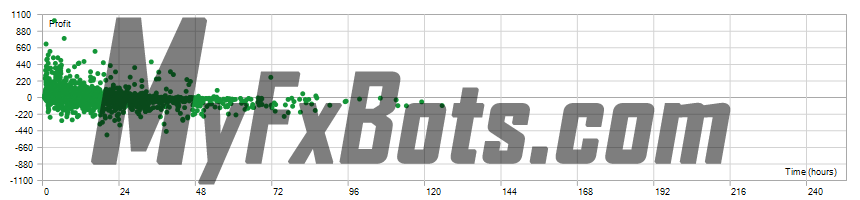

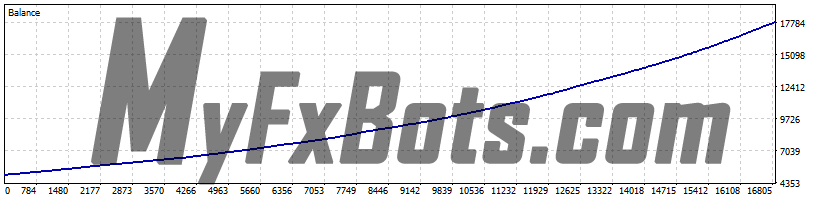

News Catcher PRO uses real market mechanics to its advantage to make profits focused on long-term stable growth rather than making them quickly. It has a (double) verified MyFxBook track record on live accounts with low drawdown made possible by different risk management configurations.

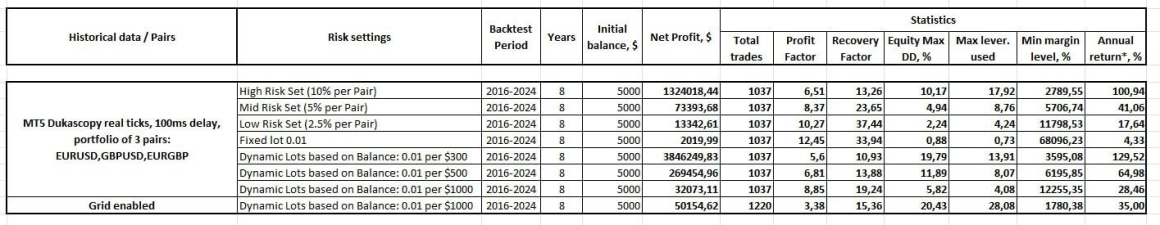

News Catcher PRO also offers custom FTMO/prop-firm challenge set files that adhere to prop-firm regulations. It has been intensively back-tested over 20 years of real tick data with consistent top-notch results.

Trading Idea

Investing in intraday seasonal volatility patterns driven by news events is the goal of News Catcher PRO, which is a sophisticated mean-reversion trading strategy.

News Catcher PRO does not use martingale or grid by default (optional grid is available).

Specifications

License

Lifetime license for 10 MetaTrader 4 or 5 Accounts with 3 different trading sets, FTMO/prop-firm trading set files, & user dashboard access.

FIFO / FTMO

Having orders of the same lot size and having orders in opposite directions are forbidden by the current FIFO rules. News Catcher PRO can be set to trade fully compatible with that.

Broker / VPS

News Catcher PRO requires good brokerage conditions: low spread and slippage during the rollover time. I advise using a really good ECN broker like Tickmill, and IC Markets Forex Brokers and installing it to trade on TradingFX VPS Forex VPS.

MT5 Support

An MT5 version of News Catcher PRO is available.

Updates

Free lifetime updates are included.

User Guide

- Easy to follow "How to install" videos.

- Strategy & risk management guide.

Support

- Access to exclusive Telegram group.

- 1 on 1 support from the developer (Valeriia).

- Remote desktop configuration.

Bonuses

- Volatility filter indicator.

- 6 months of ValeryVPS.

100% Money-Back Guarantee

In the extremely unlikely case that you do not LOVE News Catcher PRO, the EA vendor - ensures that she is willing to return every cent you paid to her, immediately, and with no questions asked.

Not only that, but she promised also to offer you this incredible guarantee for a long period of 30 days (while the MQL market only does it for 7 days, and most Expert Advisor selling sites do not offer it at all).

Supported Currency Pairs

GBPUSD, EURUSD, and EURCHF are the preferred pairs, in addition to USDCAD, USDCHF + CHFJPY, AUDCAD, EURCAD, and EURAUD

MetaTrader Chart Timeframe

M5

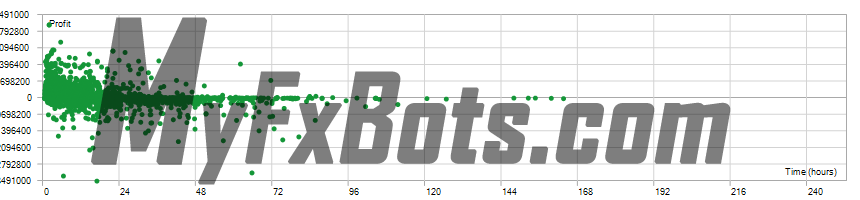

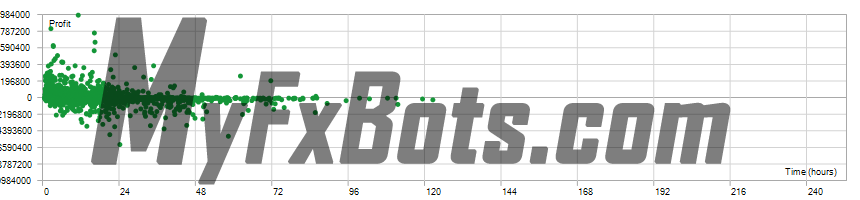

MyFxBook Verified Live Trading Result Statements

Live Test Summary

Started On

Sep 15, 2022

Account Leverage

1:300

Profit Factor

2.34

Total Gain

+108.24%

Absolute Gain

+108.21%

Monthly Gain

2.31%

Daily Gain

0.08%

Total Pips

3,364.6

Total Trades

246

Profit Amount

$432.84

(%) Won Trades

3,364.6

Drawdown

24.27%

Real Money Account

Live Test Summary

Started On

Jan 30, 2023

Account Leverage

1:500

Profit Factor

1.67

Total Gain

+81.34%

Absolute Gain

+81.49%

Monthly Gain

2.20%

Daily Gain

0.07%

Total Pips

1,864.0

Total Trades

270

Profit Amount

$162.98

(%) Won Trades

1,864.0

Drawdown

17.22%

Real Money Account

Live Test Summary

Started On

Jan 30, 2023

Account Leverage

1:500

Profit Factor

1.67

Total Gain

+81.34%

Absolute Gain

+81.49%

Monthly Gain

2.20%

Daily Gain

0.07%

Total Pips

1,864.0

Total Trades

270

Profit Amount

$162.98

(%) Won Trades

1,864.0

Drawdown

17.22%

Real Money Account

Live Test Summary

Started On

Jan 30, 2023

Account Leverage

1:500

Profit Factor

1.67

Total Gain

+81.34%

Absolute Gain

+81.49%

Monthly Gain

2.20%

Daily Gain

0.07%

Total Pips

1,864.0

Total Trades

270

Profit Amount

$162.98

(%) Won Trades

1,864.0

Drawdown

17.22%

Real Money Account

Live Test Summary

Started On

Jan 30, 2023

Account Leverage

1:500

Profit Factor

1.67

Total Gain

+81.34%

Absolute Gain

+81.49%

Monthly Gain

2.20%

Daily Gain

0.07%

Total Pips

1,864.0

Total Trades

270

Profit Amount

$162.98

(%) Won Trades

1,864.0

Drawdown

17.22%

Real Money Account

Live Test Summary

Started On

Jan 30, 2023

Account Leverage

1:500

Profit Factor

1.67

Total Gain

+81.34%

Absolute Gain

+81.49%

Monthly Gain

2.20%

Daily Gain

0.07%

Total Pips

1,864.0

Total Trades

270

Profit Amount

$162.98

(%) Won Trades

1,864.0

Drawdown

17.22%

Real Money Account

Live Test Summary

Started On

Jan 30, 2023

Account Leverage

1:500

Profit Factor

1.67

Total Gain

+81.34%

Absolute Gain

+81.49%

Monthly Gain

2.20%

Daily Gain

0.07%

Total Pips

1,864.0

Total Trades

270

Profit Amount

$162.98

(%) Won Trades

1,864.0

Drawdown

17.22%

Real Money Account

Live Test Summary

Started On

Jan 30, 2023

Account Leverage

1:500

Profit Factor

1.67

Total Gain

+81.34%

Absolute Gain

+81.49%

Monthly Gain

2.20%

Daily Gain

0.07%

Total Pips

1,864.0

Total Trades

270

Profit Amount

$162.98

(%) Won Trades

1,864.0

Drawdown

17.22%

Real Money Account

Live Test Summary

Started On

Jan 30, 2023

Account Leverage

1:500

Profit Factor

1.67

Total Gain

+81.34%

Absolute Gain

+81.49%

Monthly Gain

2.20%

Daily Gain

0.07%

Total Pips

1,864.0

Total Trades

270

Profit Amount

$162.98

(%) Won Trades

1,864.0

Drawdown

17.22%

Real Money Account

Live Test Summary

Started On

Jan 30, 2023

Account Leverage

1:500

Profit Factor

1.67

Total Gain

+81.34%

Absolute Gain

+81.49%

Monthly Gain

2.20%

Daily Gain

0.07%

Total Pips

1,864.0

Total Trades

270

Profit Amount

$162.98

(%) Won Trades

1,864.0

Drawdown

17.22%

Real Money Account

Live Test Summary

Started On

Jan 30, 2023

Account Leverage

1:500

Profit Factor

1.67

Total Gain

+81.34%

Absolute Gain

+81.49%

Monthly Gain

2.20%

Daily Gain

0.07%

Total Pips

1,864.0

Total Trades

270

Profit Amount

$162.98

(%) Won Trades

1,864.0

Drawdown

17.22%

Real Money Account

Live Test Summary

Started On

Jan 30, 2023

Account Leverage

1:500

Profit Factor

1.67

Total Gain

+81.34%

Absolute Gain

+81.49%

Monthly Gain

2.20%

Daily Gain

0.07%

Total Pips

1,864.0

Total Trades

270

Profit Amount

$162.98

(%) Won Trades

1,864.0

Drawdown

17.22%

Real Money Account

Live Test Summary

Started On

Jan 30, 2023

Account Leverage

1:500

Profit Factor

1.67

Total Gain

+81.34%

Absolute Gain

+81.49%

Monthly Gain

2.20%

Daily Gain

0.07%

Total Pips

1,864.0

Total Trades

270

Profit Amount

$162.98

(%) Won Trades

1,864.0

Drawdown

17.22%

Real Money Account

Live Test Summary

Started On

Jan 30, 2023

Account Leverage

1:500

Profit Factor

1.67

Total Gain

+81.34%

Absolute Gain

+81.49%

Monthly Gain

2.20%

Daily Gain

0.07%

Total Pips

1,864.0

Total Trades

270

Profit Amount

$162.98

(%) Won Trades

1,864.0

Drawdown

17.22%

Real Money Account

Live Test Summary

Started On

Jan 30, 2023

Account Leverage

1:500

Profit Factor

1.67

Total Gain

+81.34%

Absolute Gain

+81.49%

Monthly Gain

2.20%

Daily Gain

0.07%

Total Pips

1,864.0

Total Trades

270

Profit Amount

$162.98

(%) Won Trades

1,864.0

Drawdown

17.22%

Real Money Account

Live Test Summary

Started On

Jan 30, 2023

Account Leverage

1:500

Profit Factor

1.67

Total Gain

+81.34%

Absolute Gain

+81.49%

Monthly Gain

2.20%

Daily Gain

0.07%

Total Pips

1,864.0

Total Trades

270

Profit Amount

$162.98

(%) Won Trades

1,864.0

Drawdown

17.22%

Real Money Account

Live Test Summary

Started On

Jan 30, 2023

Account Leverage

1:500

Profit Factor

1.67

Total Gain

+81.34%

Absolute Gain

+81.49%

Monthly Gain

2.20%

Daily Gain

0.07%

Total Pips

1,864.0

Total Trades

270

Profit Amount

$162.98

(%) Won Trades

1,864.0

Drawdown

17.22%

Real Money Account

Live Test Summary

Started On

Jan 30, 2023

Account Leverage

1:500

Profit Factor

1.67

Total Gain

+81.34%

Absolute Gain

+81.49%

Monthly Gain

2.20%

Daily Gain

0.07%

Total Pips

1,864.0

Total Trades

270

Profit Amount

$162.98

(%) Won Trades

1,864.0

Drawdown

17.22%

Real Money Account

Live Test Summary

Started On

Jan 30, 2023

Account Leverage

1:500

Profit Factor

1.67

Total Gain

+81.34%

Absolute Gain

+81.49%

Monthly Gain

2.20%

Daily Gain

0.07%

Total Pips

1,864.0

Total Trades

270

Profit Amount

$162.98

(%) Won Trades

1,864.0

Drawdown

17.22%

Real Money Account

Live Test Summary

Started On

Jan 30, 2023

Account Leverage

1:500

Profit Factor

1.67

Total Gain

+81.34%

Absolute Gain

+81.49%

Monthly Gain

2.20%

Daily Gain

0.07%

Total Pips

1,864.0

Total Trades

270

Profit Amount

$162.98

(%) Won Trades

1,864.0

Drawdown

17.22%

Real Money Account

Live Test Summary

Started On

Jan 30, 2023

Account Leverage

1:500

Profit Factor

1.67

Total Gain

+81.34%

Absolute Gain

+81.49%

Monthly Gain

2.20%

Daily Gain

0.07%

Total Pips

1,864.0

Total Trades

270

Profit Amount

$162.98

(%) Won Trades

1,864.0

Drawdown

17.22%

Real Money Account

Live Test Summary

Started On

Jan 30, 2023

Account Leverage

1:500

Profit Factor

1.67

Total Gain

+81.34%

Absolute Gain

+81.49%

Monthly Gain

2.20%

Daily Gain

0.07%

Total Pips

1,864.0

Total Trades

270

Profit Amount

$162.98

(%) Won Trades

1,864.0

Drawdown

17.22%

Real Money Account

Live Test Summary

Started On

Jan 30, 2023

Account Leverage

1:500

Profit Factor

1.67

Total Gain

+81.34%

Absolute Gain

+81.49%

Monthly Gain

2.20%

Daily Gain

0.07%

Total Pips

1,864.0

Total Trades

270

Profit Amount

$162.98

(%) Won Trades

1,864.0

Drawdown

17.22%

Real Money Account

Live Test Summary

Started On

Jan 30, 2023

Account Leverage

1:500

Profit Factor

1.67

Total Gain

+81.34%

Absolute Gain

+81.49%

Monthly Gain

2.20%

Daily Gain

0.07%

Total Pips

1,864.0

Total Trades

270

Profit Amount

$162.98

(%) Won Trades

1,864.0

Drawdown

17.22%

Real Money Account

Live Test Summary

Started On

Jan 30, 2023

Account Leverage

1:500

Profit Factor

1.67

Total Gain

+81.34%

Absolute Gain

+81.49%

Monthly Gain

2.20%

Daily Gain

0.07%

Total Pips

1,864.0

Total Trades

270

Profit Amount

$162.98

(%) Won Trades

1,864.0

Drawdown

17.22%

Real Money Account

Live Test Summary

Started On

Jan 30, 2023

Account Leverage

1:500

Profit Factor

1.67

Total Gain

+81.34%

Absolute Gain

+81.49%

Monthly Gain

2.20%

Daily Gain

0.07%

Total Pips

1,864.0

Total Trades

270

Profit Amount

$162.98

(%) Won Trades

1,864.0

Drawdown

17.22%

Real Money Account

Live Test Summary

Started On

Jan 30, 2023

Account Leverage

1:500

Profit Factor

1.67

Total Gain

+81.34%

Absolute Gain

+81.49%

Monthly Gain

2.20%

Daily Gain

0.07%

Total Pips

1,864.0

Total Trades

270

Profit Amount

$162.98

(%) Won Trades

1,864.0

Drawdown

17.22%

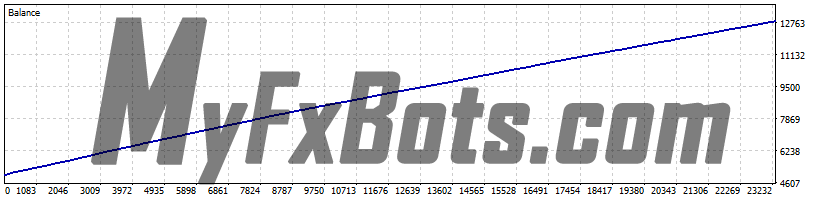

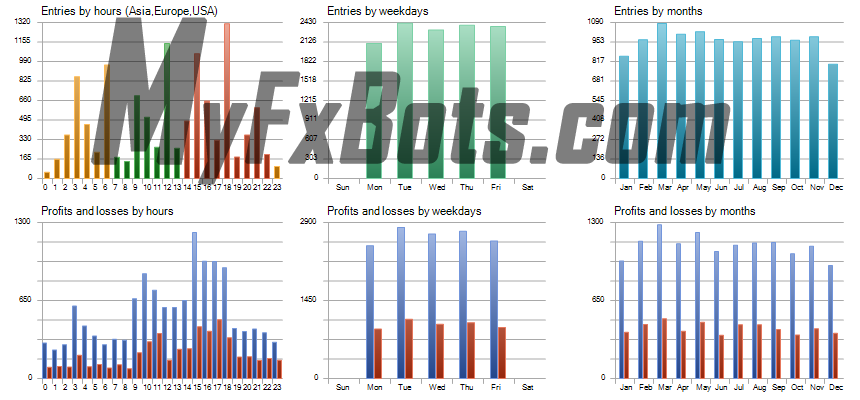

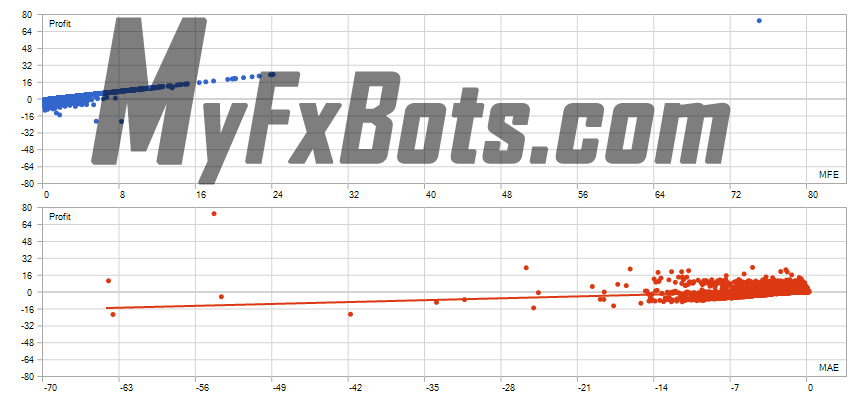

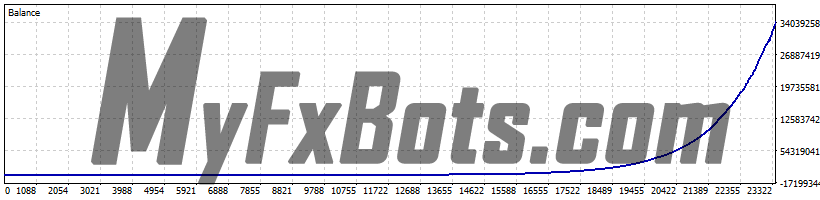

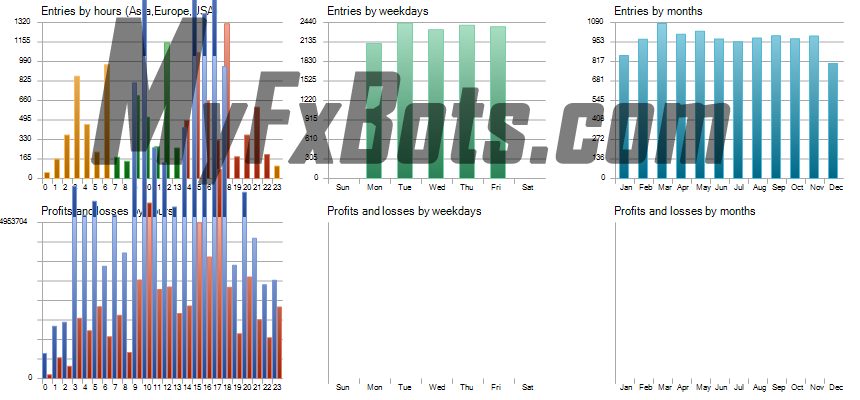

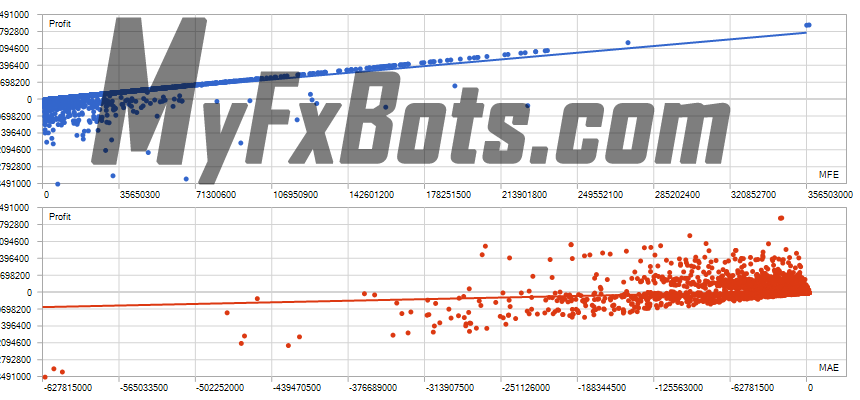

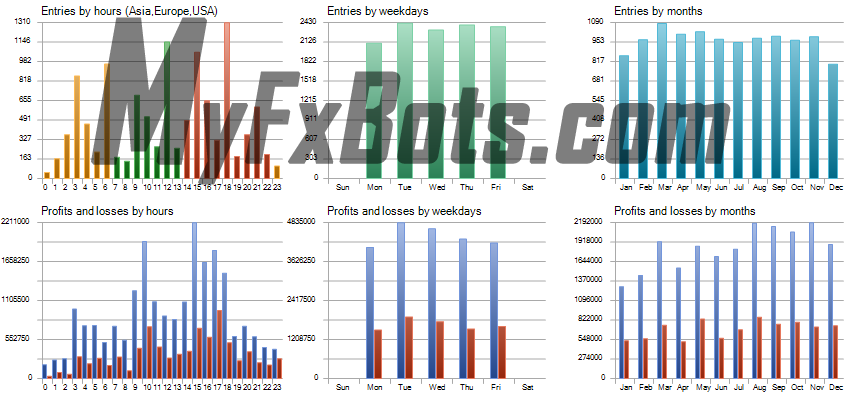

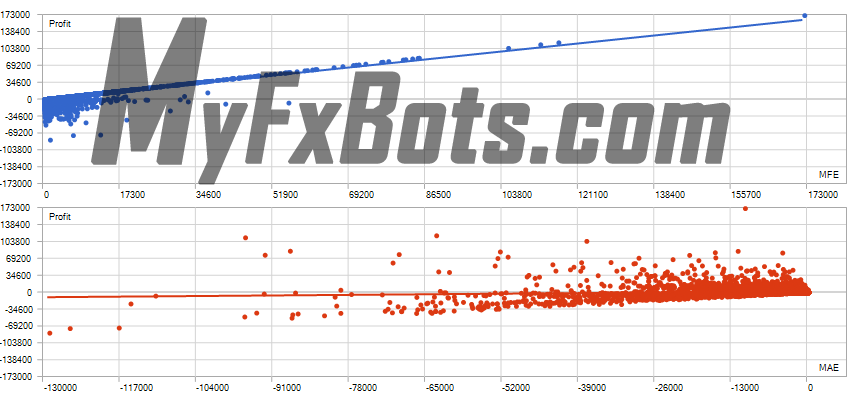

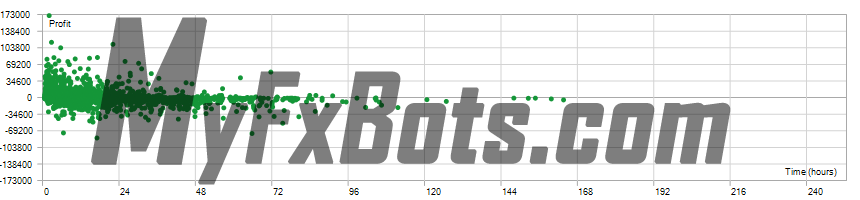

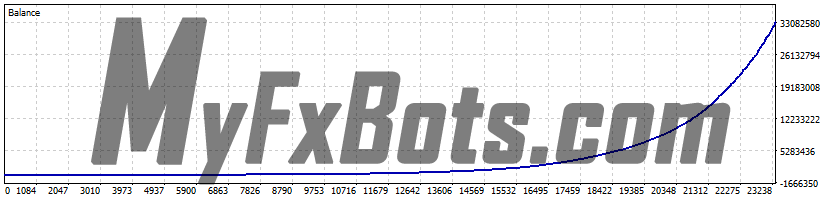

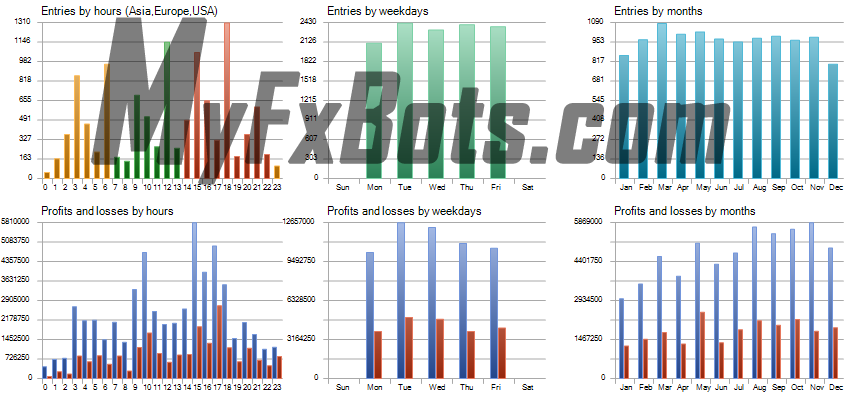

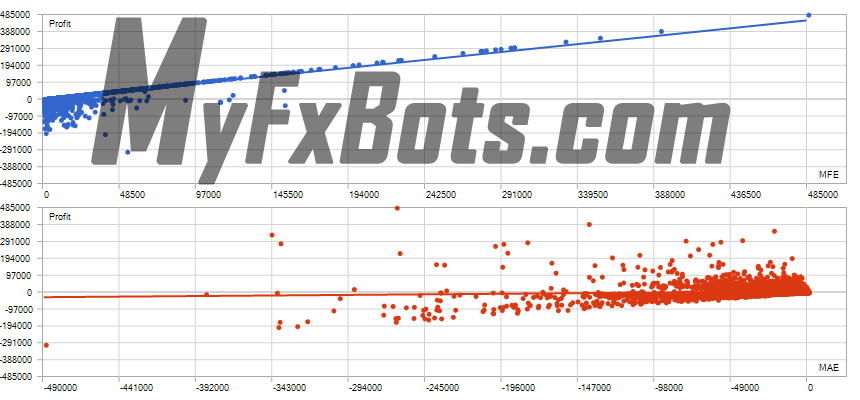

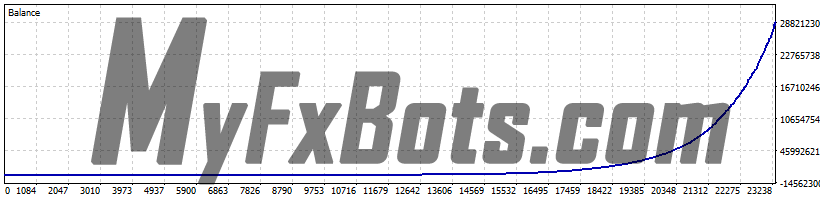

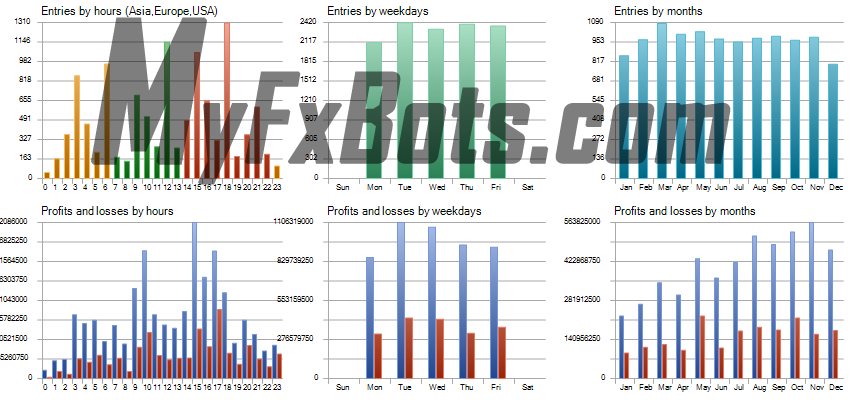

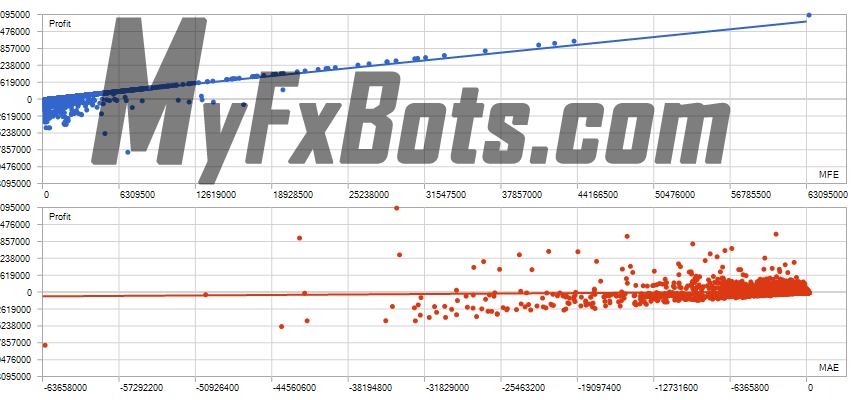

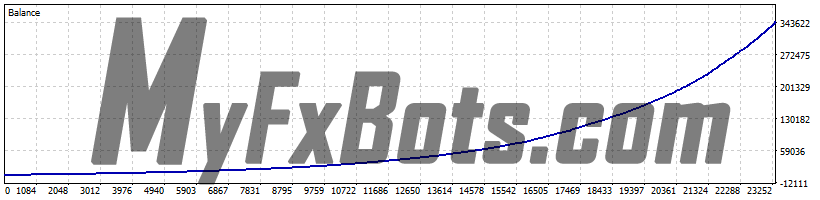

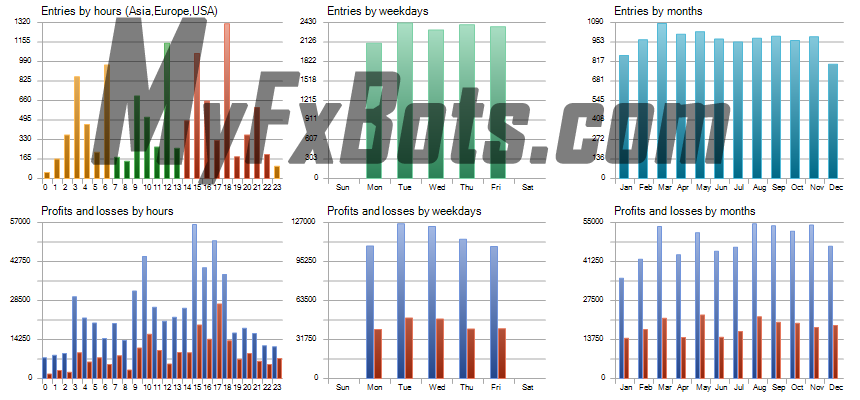

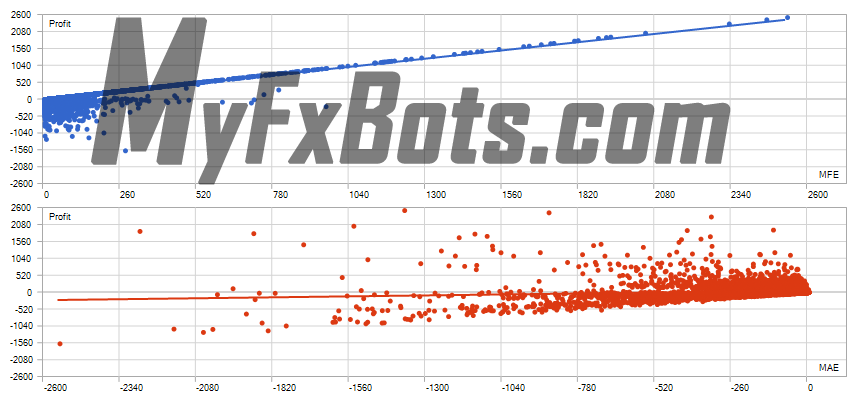

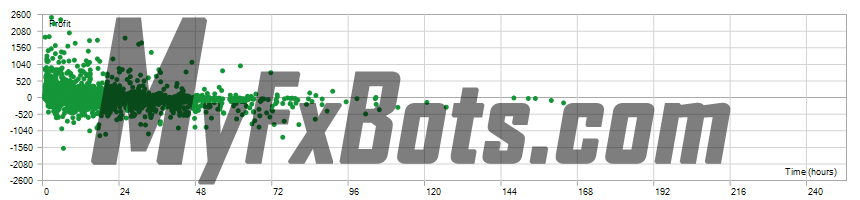

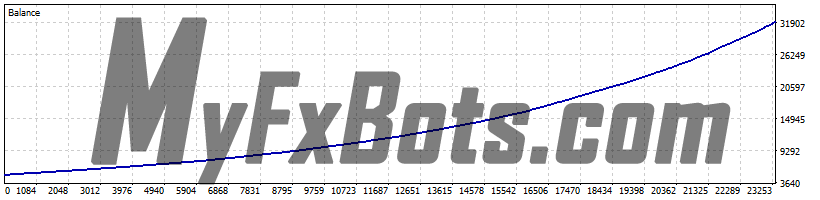

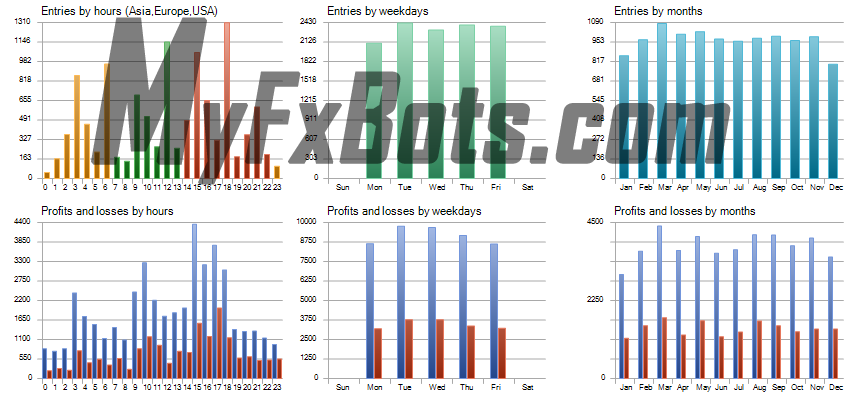

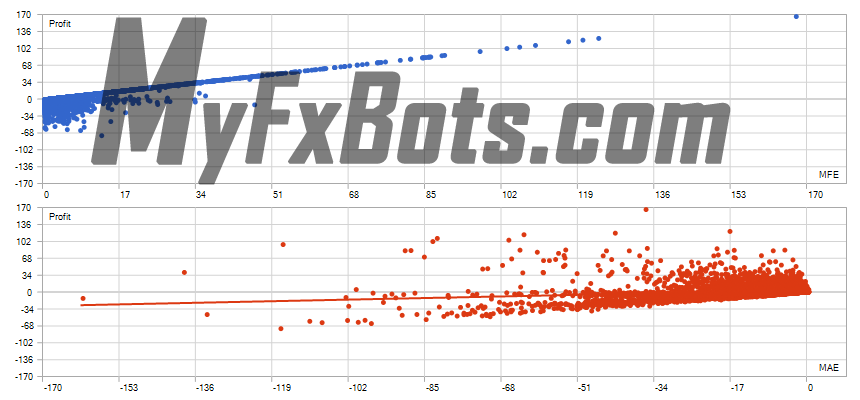

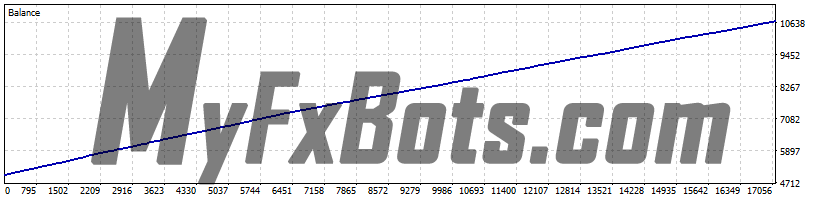

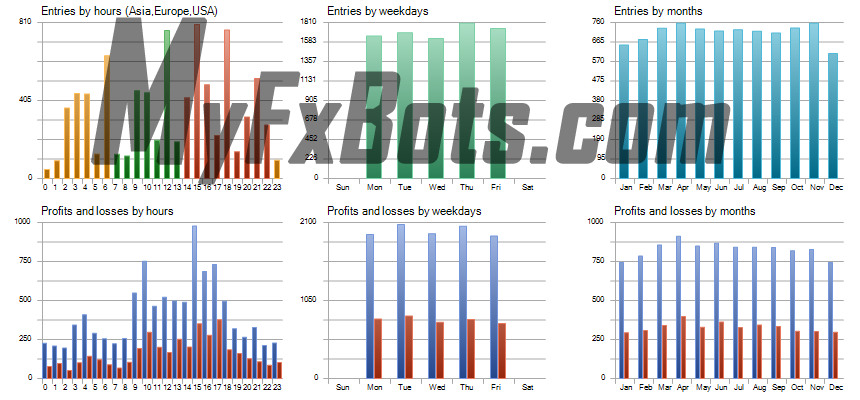

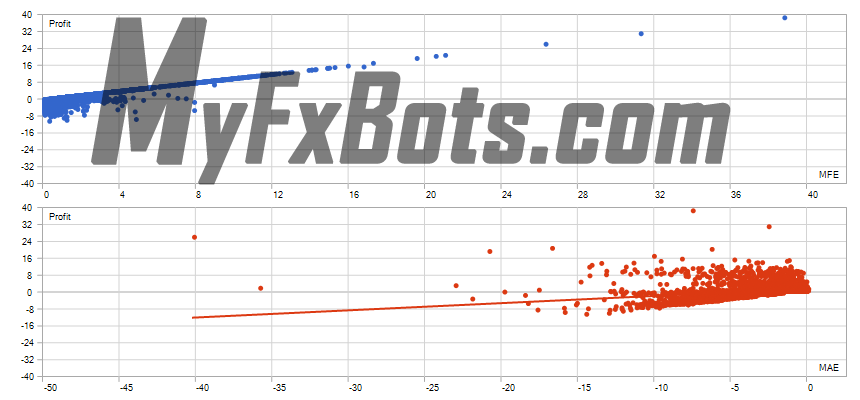

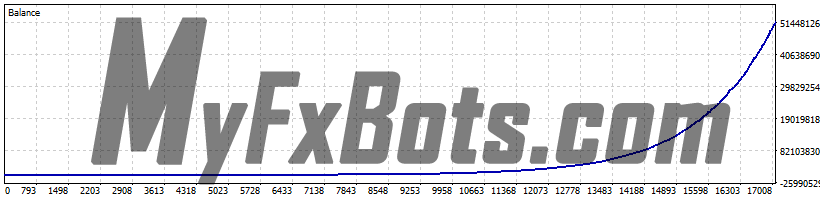

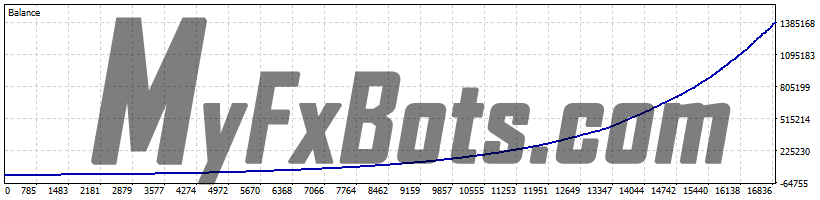

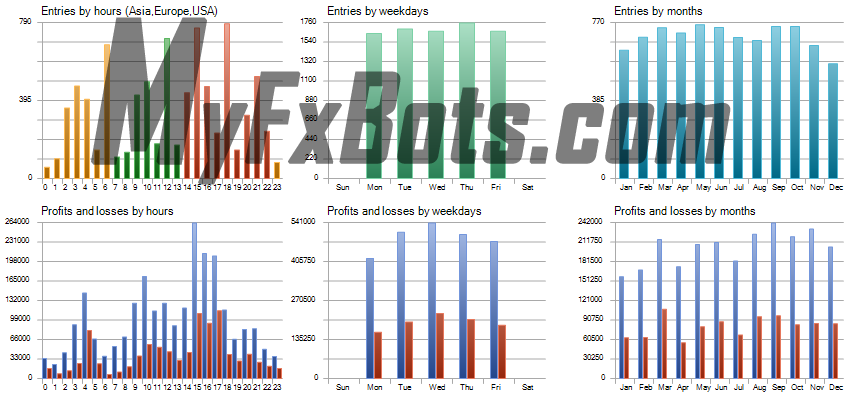

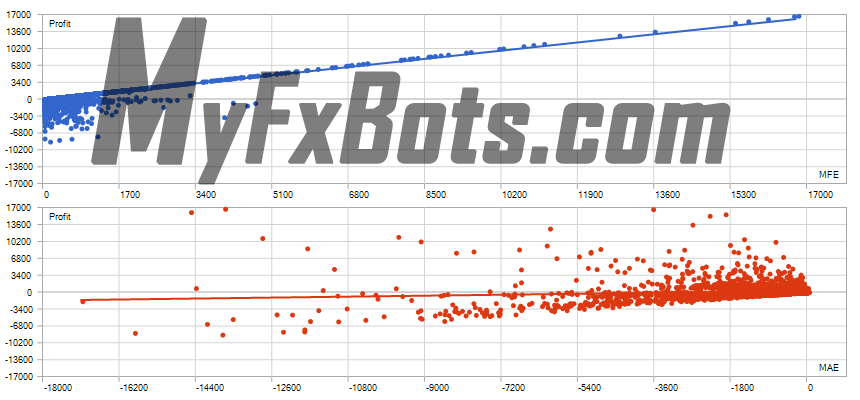

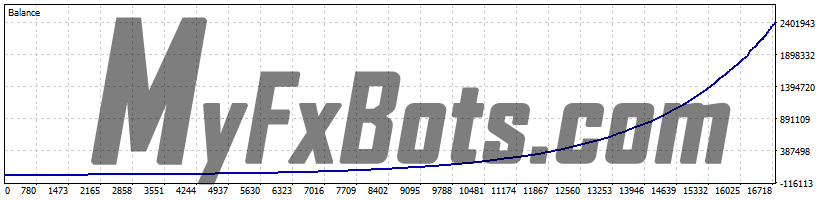

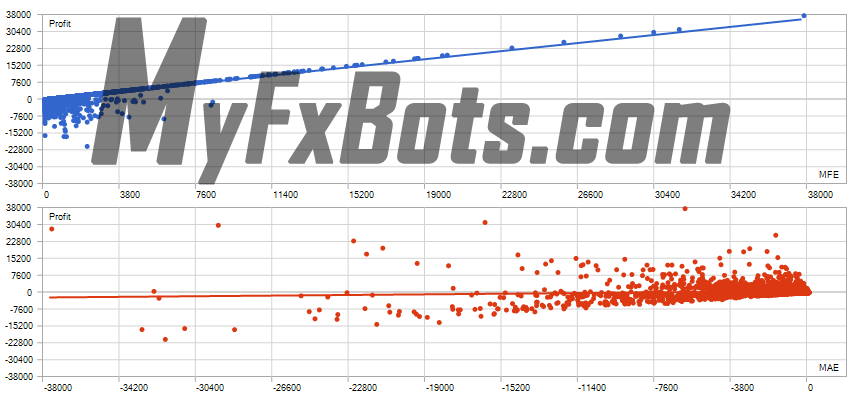

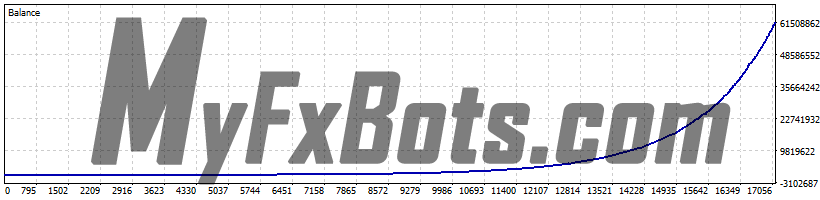

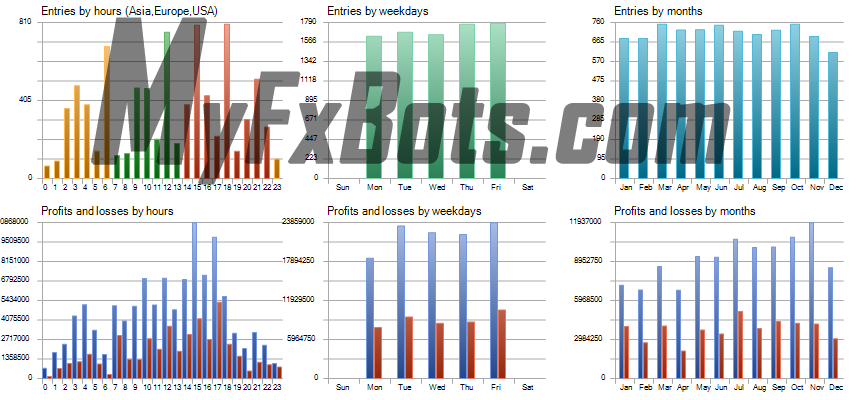

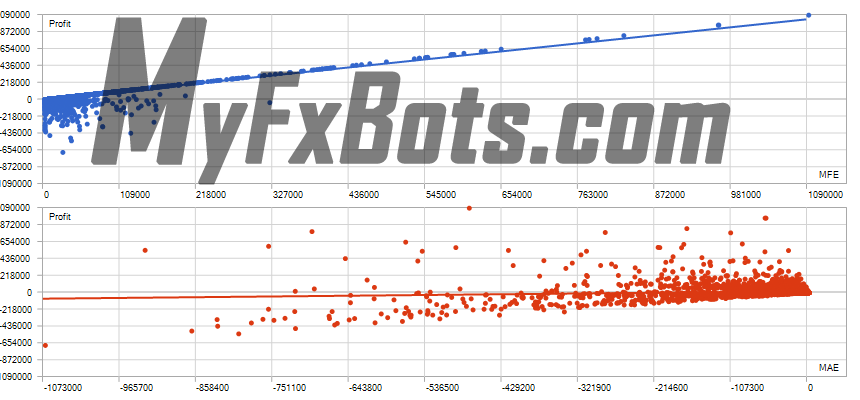

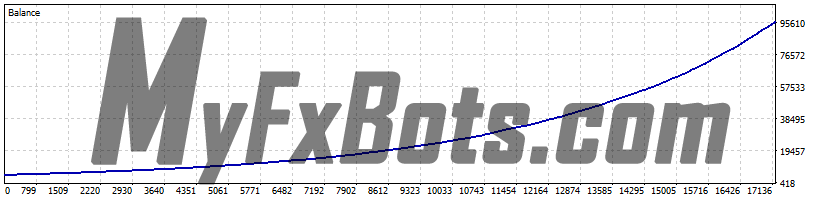

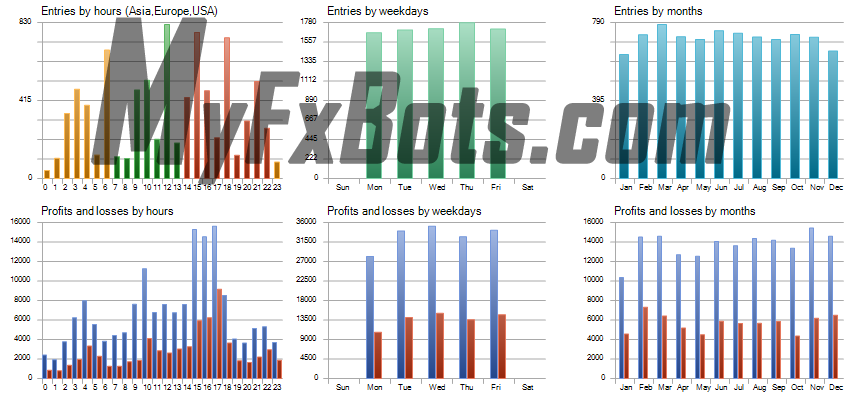

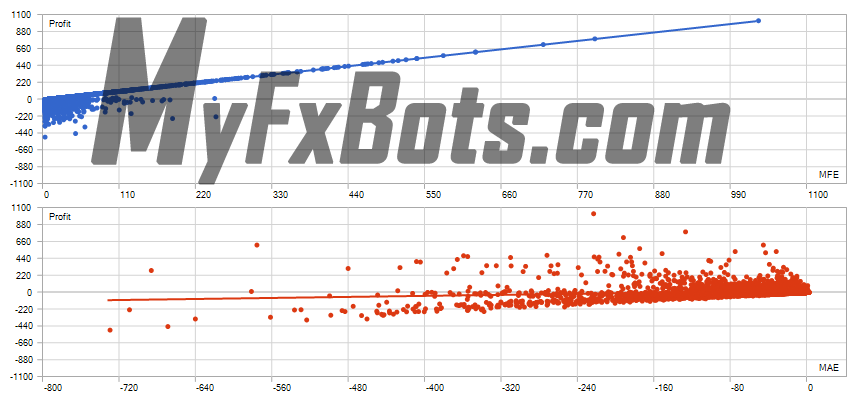

MT5 Strategy Tester Backtests

Standard Trades

Backtests Settings

Symbol

AUDCAD_Duka

Period

M5 (2010.01.01 - 2025.01.01)

Broker

Currency

USD

Leverage

1:500

Symbols

6

Bars in test

1043838

Ticks modelled

307747896

Modelling quality

100% real ticks

Initial Deposit

$5 000.00

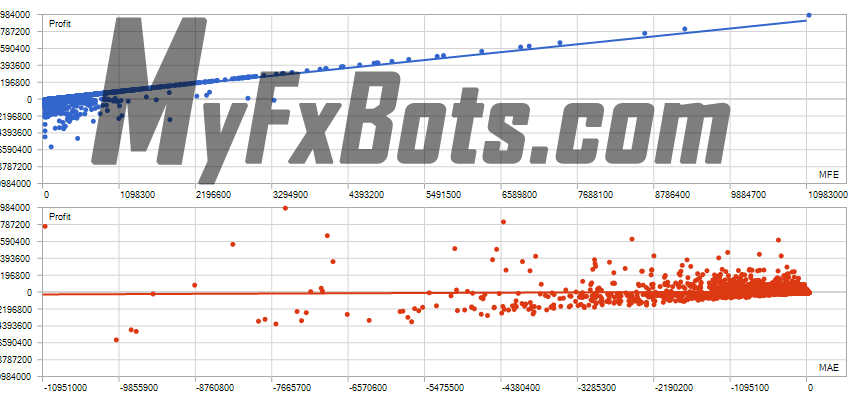

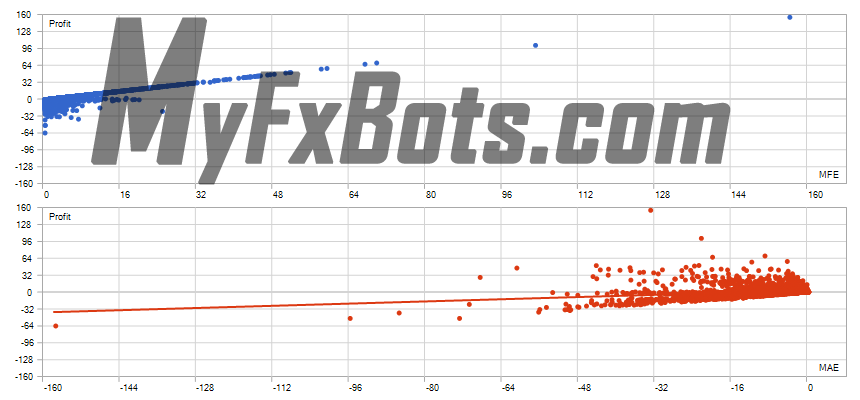

Backtests Results

Total net profit

7 844.71

Gross profit

13 269.53

Gross loss

-5 424.82

Profit factor

2.45

Expected payoff

0.68

Margin level

4982.97%

Absolute Bal DD

0.81

Maximal Bal DD

80.56 (1.34%)

Relative Bal DD

1.34% (80.56)

Absolute EQ DD

5.61

Maximal EQ DD

274.10 (4.57%)

Relative EQ DD

4.57% (274.10)

Recovery Factor

28.62

Sharp Ratio

3.99

Z-Score

-2.59 (99.04%)

AHPR

1.0001 (0.01%)

LR Correlation

1.00

OnTester result

0

GHPR

1.0001 (0.01%)

LR Standard Error

81.11

Total Trades

11602

Short positions

5185 (74.46%)

Long positions

6417 (71.92%)

Profit trades

8476 (73.06%)

Loss trades

3126 (26.94%)

Largest Profit trade

74.11

Largest Loss trade

-21.23

Average Profit trade

1.57

Average Loss trade

-1.61

Maximum consecutive wins (profit in money)

-

Maximum consecutive losses (loss in money)

5 (-79.29)

Maximal consecutive profit (count of wins)

-

Maximal consecutive loss (count of losses)

-79.29 (5)

Avarage consecutive wins

-

Avarage consecutive losses

1

Backtests Settings

Symbol

AUDCAD_Duka

Period

M5 (2010.01.01 - 2025.01.01)

Broker

Currency

USD

Leverage

1:500

Symbols

6

Bars in test

1043838

Ticks modelled

307747036

Modelling quality

100% real ticks

Initial Deposit

$5 000.00

Backtests Results

Total net profit

34 398 788 712.70

Gross profit

57 513 147 439.47

Gross loss

-23 114 358 726.77

Profit factor

2.49

Expected payoff

2 953 699.87

Margin level

784.77%

Absolute Bal DD

8.08

Maximal Bal DD

754 066 843.08 (2.57%)

Relative Bal DD

5.16% (36 949 483.68)

Absolute EQ DD

56.06

Maximal EQ DD

1 973 619 201.31 (6.52%)

Relative EQ DD

23.96% (1 444 734.96)

Recovery Factor

17.43

Sharp Ratio

4.61

Z-Score

-2.72 (99.35%)

AHPR

1.0014 (0.14%)

LR Correlation

0.60

OnTester result

0

GHPR

1.0014 (0.14%)

LR Standard Error

4 874 413 368.76

Total Trades

11646

Short positions

5193 (74.47%)

Long positions

6453 (72.09%)

Profit trades

8519 (73.15%)

Loss trades

3127 (26.85%)

Largest Profit trade

353 712 280.01

Largest Loss trade

-399 529 645.37

Average Profit trade

6 751 161.81

Average Loss trade

-6 835 395.15

Maximum consecutive wins (profit in money)

-

Maximum consecutive losses (loss in money)

4 (-742 779 647.21)

Maximal consecutive profit (count of wins)

-

Maximal consecutive loss (count of losses)

-742 779 647.21 (4)

Avarage consecutive wins

-

Avarage consecutive losses

1

Backtests Settings

Symbol

AUDCAD_Duka

Period

M5 (2010.01.01 - 2025.01.01)

Broker

Currency

USD

Leverage

1:500

Symbols

6

Bars in test

1043838

Ticks modelled

307747896

Modelling quality

100% real ticks

Initial Deposit

$5 000.00

Backtests Results

Total net profit

13 070 605.79

Gross profit

22 072 438.62

Gross loss

-9 001 832.83

Profit factor

2.45

Expected payoff

1 126.58

Margin level

1681.75%

Absolute Bal DD

4.04

Maximal Bal DD

155 254.85 (1.29%)

Relative Bal DD

2.58% (48 863.35)

Absolute EQ DD

28.04

Maximal EQ DD

434 649.91 (5.00%)

Relative EQ DD

12.01% (20 854.81)

Recovery Factor

30.07

Sharp Ratio

4.67

Z-Score

-2.61 (99.09%)

AHPR

1.0007 (0.07%)

LR Correlation

0.78

OnTester result

0

GHPR

1.0007 (0.07%)

LR Standard Error

1 858 316.18

Total Trades

11602

Short positions

5178 (74.45%)

Long positions

6424 (72.03%)

Profit trades

8482 (73.11%)

Loss trades

3120 (26.89%)

Largest Profit trade

170 687.40

Largest Loss trade

-82 217.12

Average Profit trade

2 602.27

Average Loss trade

-2 673.80

Maximum consecutive wins (profit in money)

-

Maximum consecutive losses (loss in money)

4 (-47 718.11)

Maximal consecutive profit (count of wins)

-

Maximal consecutive loss (count of losses)

-152 932.31 (3)

Avarage consecutive wins

-

Avarage consecutive losses

1

Backtests Settings

Symbol

AUDCAD_Duka

Period

M5 (2010.01.01 - 2025.01.01)

Broker

Currency

USD

Leverage

1:500

Symbols

6

Bars in test

1043838

Ticks modelled

307747036

Modelling quality

100% real ticks

Initial Deposit

$5 000.00

Backtests Results

Total net profit

33 426 957.40

Gross profit

56 693 967.03

Gross loss

-23 267 009.63

Profit factor

2.44

Expected payoff

2 880.64

Margin level

1535.00%

Absolute Bal DD

2.41

Maximal Bal DD

411 274.00 (1.24%)

Relative Bal DD

3.99% (120 003.08)

Absolute EQ DD

16.82

Maximal EQ DD

1 587 920.85 (8.00%)

Relative EQ DD

18.05% (31 042.51)

Recovery Factor

21.05

Sharp Ratio

4.51

Z-Score

-2.55 (98.89%)

AHPR

1.0008 (0.08%)

LR Correlation

0.72

OnTester result

0

GHPR

1.0008 (0.08%)

LR Standard Error

4 799 132.52

Total Trades

11604

Short positions

5175 (74.49%)

Long positions

6429 (72.02%)

Profit trades

8485 (73.12%)

Loss trades

3119 (26.88%)

Largest Profit trade

478 917.75

Largest Loss trade

-303 449.86

Average Profit trade

6 681.67

Average Loss trade

-6 903.04

Maximum consecutive wins (profit in money)

-

Maximum consecutive losses (loss in money)

4 (-117 190.43)

Maximal consecutive profit (count of wins)

-

Maximal consecutive loss (count of losses)

-399 368.70 (3)

Avarage consecutive wins

-

Avarage consecutive losses

1

Backtests Settings

Symbol

AUDCAD_Duka

Period

M5 (2010.01.01 - 2025.01.01)

Broker

Currency

USD

Leverage

1:500

Symbols

6

Bars in test

1043838

Ticks modelled

307747896

Modelling quality

100% real ticks

Initial Deposit

$5 000.00

Backtests Results

Total net profit

2 912 560 100.93

Gross profit

4 919 168 381.36

Gross loss

-2 006 608 280.43

Profit factor

2.45

Expected payoff

250 996.22

Margin level

973.08%

Absolute Bal DD

3.23

Maximal Bal DD

53 517 277.20 (1.86%)

Relative Bal DD

5.99% (4 731 951.43)

Absolute EQ DD

22.43

Maximal EQ DD

188 736 423.97 (6.55%)

Relative EQ DD

27.10% (294 604.16)

Recovery Factor

15.43

Sharp Ratio

4.46

Z-Score

-2.47 (98.61%)

AHPR

1.0012 (0.12%)

LR Correlation

0.61

OnTester result

0

GHPR

1.0011 (0.11%)

LR Standard Error

405 169 216.31

Total Trades

11604

Short positions

5176 (74.48%)

Long positions

6428 (72.01%)

Profit trades

8484 (73.11%)

Loss trades

3120 (26.89%)

Largest Profit trade

62 319 460.95

Largest Loss trade

-39 486 596.30

Average Profit trade

579 817.11

Average Loss trade

-594 465.15

Maximum consecutive wins (profit in money)

-

Maximum consecutive losses (loss in money)

4 (-4 621 043.43)

Maximal consecutive profit (count of wins)

-

Maximal consecutive loss (count of losses)

-51 968 092.86 (3)

Avarage consecutive wins

-

Avarage consecutive losses

1

Backtests Settings

Symbol

AUDCAD_Duka

Period

M5 (2010.01.01 - 2025.01.01)

Broker

Currency

USD

Leverage

1:500

Symbols

6

Bars in test

1043838

Ticks modelled

307747896

Modelling quality

100% real ticks

Initial Deposit

$5 000.00

Backtests Results

Total net profit

342 198.44

Gross profit

578 676.14

Gross loss

-236 477.70

Profit factor

2.45

Expected payoff

29.47

Margin level

3254.29%

Absolute Bal DD

0.81

Maximal Bal DD

2 143.22 (0.62%)

Relative Bal DD

1.98% (2 065.00)

Absolute EQ DD

5.61

Maximal EQ DD

10 693.48 (4.00%)

Relative EQ DD

8.90% (2 277.25)

Recovery Factor

32.00

Sharp Ratio

4.53

Z-Score

-2.40 (98.36%)

AHPR

1.0004 (0.04%)

LR Correlation

0.88

OnTester result

0

GHPR

1.0004 (0.04%)

LR Standard Error

41 611.55

Total Trades

11611

Short positions

5183 (74.42%)

Long positions

6428 (72.06%)

Profit trades

8489 (73.11%)

Loss trades

3122 (26.89%)

Largest Profit trade

2 495.70

Largest Loss trade

-1 581.32

Average Profit trade

68.17

Average Loss trade

-70.15

Maximum consecutive wins (profit in money)

-

Maximum consecutive losses (loss in money)

4 (-2 016.60)

Maximal consecutive profit (count of wins)

-

Maximal consecutive loss (count of losses)

-2 137.39 (3)

Avarage consecutive wins

-

Avarage consecutive losses

1

Backtests Settings

Symbol

AUDCAD_Duka

Period

M5 (2010.01.01 - 2025.01.01)

Broker

Currency

USD

Leverage

1:500

Symbols

6

Bars in test

1043838

Ticks modelled

307747036

Modelling quality

100% real ticks

Initial Deposit

$5 000.00

Backtests Results

Total net profit

27 185.98

Gross profit

45 901.88

Gross loss

-18 715.90

Profit factor

2.45

Expected payoff

2.34

Margin level

4984.04%

Absolute Bal DD

0.81

Maximal Bal DD

180.70 (0.98%)

Relative Bal DD

1.34% (80.56)

Absolute EQ DD

5.61

Maximal EQ DD

549.68 (1.93%)

Relative EQ DD

4.57% (274.10)

Recovery Factor

49.46

Sharp Ratio

4.35

Z-Score

-2.61 (99.09%)

AHPR

1.0002 (0.02%)

LR Correlation

0.96

OnTester result

0

GHPR

1.0002 (0.02%)

LR Standard Error

2 100.11

Total Trades

11612

Short positions

5181 (74.50%)

Long positions

6431 (71.95%)

Profit trades

8487 (73.09%)

Loss trades

3125 (26.91%)

Largest Profit trade

164.44

Largest Loss trade

-72.90

Average Profit trade

5.41

Average Loss trade

-5.55

Maximum consecutive wins (profit in money)

-

Maximum consecutive losses (loss in money)

5 (-79.29)

Maximal consecutive profit (count of wins)

-

Maximal consecutive loss (count of losses)

-176.46 (4)

Avarage consecutive wins

-

Avarage consecutive losses

1

Unique Trades

Backtests Settings

Symbol

AUDCAD_Duka

Period

M5 (2010.01.01 - 2025.01.01)

Broker

Currency

USD

Leverage

1:500

Symbols

6

Bars in test

1043838

Ticks modelled

307747036

Modelling quality

100% real ticks

Initial Deposit

$5 000.00

Backtests Results

Total net profit

5 694.50

Gross profit

9 935.00

Gross loss

-4 240.50

Profit factor

2.34

Expected payoff

0.67

Margin level

10346.75%

Absolute Bal DD

3.36

Maximal Bal DD

36.08 (0.57%)

Relative Bal DD

0.57% (36.08)

Absolute EQ DD

13.65

Maximal EQ DD

133.96 (1.72%)

Relative EQ DD

1.72% (133.96)

Recovery Factor

42.51

Sharp Ratio

3.95

Z-Score

-0.87 (61.57%)

AHPR

1.0001 (0.01%)

LR Correlation

1.00

OnTester result

0

GHPR

1.0001 (0.01%)

LR Standard Error

53.95

Total Trades

8518

Short positions

3668 (71.62%)

Long positions

4850 (70.54%)

Profit trades

6048 (71.00%)

Loss trades

2470 (29.00%)

Largest Profit trade

37.68

Largest Loss trade

-10.90

Average Profit trade

1.64

Average Loss trade

-1.60

Maximum consecutive wins (profit in money)

-

Maximum consecutive losses (loss in money)

4 (-35.47)

Maximal consecutive profit (count of wins)

-

Maximal consecutive loss (count of losses)

-35.47 (4)

Avarage consecutive wins

-

Avarage consecutive losses

1

Backtests Settings

Symbol

AUDCAD_Duka

Period

M5 (2010.01.01 - 2025.01.01)

Broker

Currency

USD

Leverage

1:500

Symbols

6

Bars in test

1043838

Ticks modelled

307747896

Modelling quality

100% real ticks

Initial Deposit

$5 000.00

Backtests Results

Total net profit

518 619 576.79

Gross profit

901 753 420.09

Gross loss

-383 133 843.30

Profit factor

2.35

Expected payoff

61 064.36

Margin level

821.44%

Absolute Bal DD

10.31

Maximal Bal DD

9 807 882.61 (2.20%)

Relative Bal DD

8.09% (2 249 099.82)

Absolute EQ DD

74.27

Maximal EQ DD

38 015 374.11 (9.73%)

Relative EQ DD

26.59% (361 990.36)

Recovery Factor

13.64

Sharp Ratio

4.21

Z-Score

-1.05 (70.63%)

AHPR

1.0014 (0.14%)

LR Correlation

0.68

OnTester result

0

GHPR

1.0014 (0.14%)

LR Standard Error

76 361 080.01

Total Trades

8493

Short positions

3695 (72.69%)

Long positions

4798 (72.18%)

Profit trades

6149 (72.40%)

Loss trades

2344 (27.60%)

Largest Profit trade

10 885 735.43

Largest Loss trade

-5 889 686.80

Average Profit trade

146 650.42

Average Loss trade

-152 030.79

Maximum consecutive wins (profit in money)

-

Maximum consecutive losses (loss in money)

5 (-2 197 137.72)

Maximal consecutive profit (count of wins)

-

Maximal consecutive loss (count of losses)

-9 710 147.97 (3)

Avarage consecutive wins

-

Avarage consecutive losses

1

Backtests Settings

Symbol

AUDCAD_Duka

Period

M5 (2010.01.01 - 2025.01.01)

Broker

Currency

USD

Leverage

1:500

Symbols

6

Bars in test

1043838

Ticks modelled

307747036

Modelling quality

100% real ticks

Initial Deposit

$5 000.00

Backtests Results

Total net profit

1 394 746.18

Gross profit

2 439 417.01

Gross loss

-1 044 670.83

Profit factor

2.34

Expected payoff

165.90

Margin level

1711.22%

Absolute Bal DD

17.00

Maximal Bal DD

17 242.44 (1.77%)

Relative Bal DD

4.00% (13 215.30)

Absolute EQ DD

138.21

Maximal EQ DD

58 957.84 (8.78%)

Relative EQ DD

8.78% (58 957.84)

Recovery Factor

23.66

Sharp Ratio

4.29

Z-Score

0.29 (22.05%)

AHPR

1.0007 (0.07%)

LR Correlation

0.85

OnTester result

0

GHPR

1.0007 (0.07%)

LR Standard Error

182 468.62

Total Trades

8407

Short positions

3638 (71.72%)

Long positions

4769 (70.79%)

Profit trades

5985 (71.19%)

Loss trades

2422 (28.81%)

Largest Profit trade

16 628.43

Largest Loss trade

-8 325.65

Average Profit trade

407.59

Average Loss trade

-402.17

Maximum consecutive wins (profit in money)

-

Maximum consecutive losses (loss in money)

4 (-13 229.45)

Maximal consecutive profit (count of wins)

-

Maximal consecutive loss (count of losses)

-16 894.23 (3)

Avarage consecutive wins

-

Avarage consecutive losses

1

Backtests Settings

Symbol

AUDCAD_Duka

Period

M5 (2010.01.01 - 2025.01.01)

Broker

Currency

USD

Leverage

1:500

Symbols

6

Bars in test

1043838

Ticks modelled

307747036

Modelling quality

100% real ticks

Initial Deposit

$5 000.00

Backtests Results

Total net profit

2 422 260.25

Gross profit

4 194 024.42

Gross loss

-1 771 764.17

Profit factor

2.37

Expected payoff

290.16

Margin level

2239.87%

Absolute Bal DD

0.08

Maximal Bal DD

32 668.90 (1.50%)

Relative Bal DD

2.69% (833.51)

Absolute EQ DD

28.84

Maximal EQ DD

124 454.91 (6.57%)

Relative EQ DD

11.95% (3 702.84)

Recovery Factor

19.46

Sharp Ratio

4.38

Z-Score

-1.01 (68.75%)

AHPR

1.0007 (0.07%)

LR Correlation

0.81

OnTester result

0

GHPR

1.0007 (0.07%)

LR Standard Error

332 514.38

Total Trades

8348

Short positions

3527 (72.89%)

Long positions

4821 (71.21%)

Profit trades

6004 (71.92%)

Loss trades

2344 (28.08%)

Largest Profit trade

37 344.24

Largest Loss trade

-21 179.36

Average Profit trade

698.54

Average Loss trade

-701.48

Maximum consecutive wins (profit in money)

-

Maximum consecutive losses (loss in money)

4 (-1 441.12)

Maximal consecutive profit (count of wins)

-

Maximal consecutive loss (count of losses)

-32 168.92 (3)

Avarage consecutive wins

-

Avarage consecutive losses

1

Backtests Settings

Symbol

AUDCAD_Duka

Period

M5 (2010.01.01 - 2025.01.01)

Broker

Currency

USD

Leverage

1:500

Symbols

6

Bars in test

1043838

Ticks modelled

307747036

Modelling quality

100% real ticks

Initial Deposit

$5 000.00

Backtests Results

Total net profit

61 786 342.50

Gross profit

109 916 694.25

Gross loss

-48 130 351.75

Profit factor

2.28

Expected payoff

7 254.47

Margin level

1708.91%

Absolute Bal DD

12.27

Maximal Bal DD

1 086 770.34 (1.91%)

Relative Bal DD

9.13% (431 972.25)

Absolute EQ DD

69.71

Maximal EQ DD

2 736 338.78 (4.82%)

Relative EQ DD

19.59% (925 869.64)

Recovery Factor

22.58

Sharp Ratio

4.14

Z-Score

-1.44 (85.01%)

AHPR

1.0011 (0.11%)

LR Correlation

0.70

OnTester result

0

GHPR

1.0011 (0.11%)

LR Standard Error

8 934 341.14

Total Trades

8517

Short positions

3698 (72.23%)

Long positions

4819 (70.55%)

Profit trades

6071 (71.28%)

Loss trades

2446 (28.72%)

Largest Profit trade

1 061 292.77

Largest Loss trade

-688 023.61

Average Profit trade

18 105.20

Average Loss trade

-18 324.06

Maximum consecutive wins (profit in money)

-

Maximum consecutive losses (loss in money)

4 (-338 681.83)

Maximal consecutive profit (count of wins)

-

Maximal consecutive loss (count of losses)

-1 086 770.34 (2)

Avarage consecutive wins

-

Avarage consecutive losses

1

Backtests Settings

Symbol

AUDCAD_Duka

Period

M5 (2010.01.01 - 2025.01.01)

Broker

Currency

USD

Leverage

1:500

Symbols

6

Bars in test

1043838

Ticks modelled

307747896

Modelling quality

100% real ticks

Initial Deposit

$5 000.00

Backtests Results

Total net profit

91 378.63

Gross profit

164 425.46

Gross loss

-73 046.83

Profit factor

2.25

Expected payoff

10.68

Margin level

3069.23%

Absolute Bal DD

3.33

Maximal Bal DD

1 067.12 (1.38%)

Relative Bal DD

1.77% (307.46)

Absolute EQ DD

13.57

Maximal EQ DD

2 608.80 (3.37%)

Relative EQ DD

9.58% (1 668.22)

Recovery Factor

35.03

Sharp Ratio

3.98

Z-Score

-2.17 (97.00%)

AHPR

1.0003 (0.03%)

LR Correlation

0.93

OnTester result

0

GHPR

1.0003 (0.03%)

LR Standard Error

9 233.77

Total Trades

8557

Short positions

3754 (71.52%)

Long positions

4803 (70.60%)

Profit trades

6076 (71.01%)

Loss trades

2481 (28.99%)

Largest Profit trade

1 014.00

Largest Loss trade

-490.28

Average Profit trade

27.06

Average Loss trade

-27.49

Maximum consecutive wins (profit in money)

-

Maximum consecutive losses (loss in money)

4 (-307.46)

Maximal consecutive profit (count of wins)

-

Maximal consecutive loss (count of losses)

-1 040.72 (3)

Avarage consecutive wins

-

Avarage consecutive losses

1

Backtests Settings

Symbol

AUDCAD_Duka

Period

M5 (2010.01.01 - 2025.01.01)

Broker

Currency

USD

Leverage

1:500

Symbols

6

Bars in test

1043838

Ticks modelled

307747036

Modelling quality

100% real ticks

Initial Deposit

$5 000.00

Backtests Results

Total net profit

12 919.39

Gross profit

22 519.30

Gross loss

-9 599.91

Profit factor

2.35

Expected payoff

1.54

Margin level

6643.68%

Absolute Bal DD

0.94

Maximal Bal DD

151.75 (1.24%)

Relative Bal DD

1.31% (81.71)

Absolute EQ DD

25.17

Maximal EQ DD

326.96 (2.67%)

Relative EQ DD

2.99% (186.25)

Recovery Factor

39.51

Sharp Ratio

4.36

Z-Score

-1.62 (89.48%)

AHPR

1.0002 (0.02%)

LR Correlation

0.98

OnTester result

0

GHPR

1.0002 (0.02%)

LR Standard Error

752.99

Total Trades

8392

Short positions

3705 (72.85%)

Long positions

4687 (70.92%)

Profit trades

6023 (71.77%)

Loss trades

2369 (28.23%)

Largest Profit trade

155.53

Largest Loss trade

-63.41

Average Profit trade

3.74

Average Loss trade

-3.77

Maximum consecutive wins (profit in money)

-

Maximum consecutive losses (loss in money)

5 (-80.44)

Maximal consecutive profit (count of wins)

-

Maximal consecutive loss (count of losses)

-150.98 (3)

Avarage consecutive wins

-

Avarage consecutive losses

1

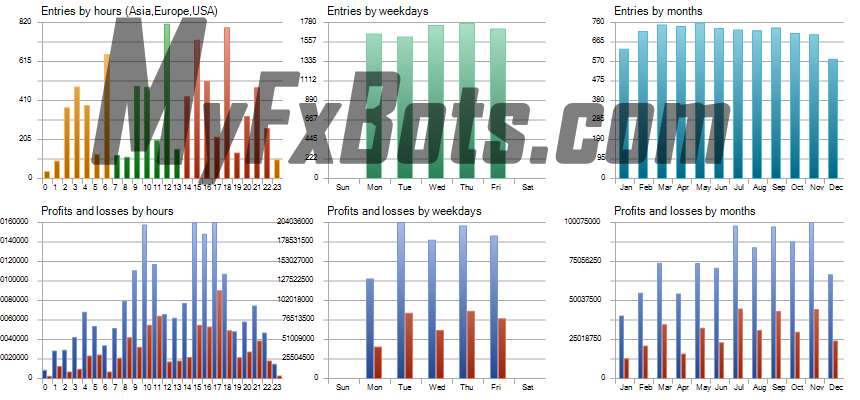

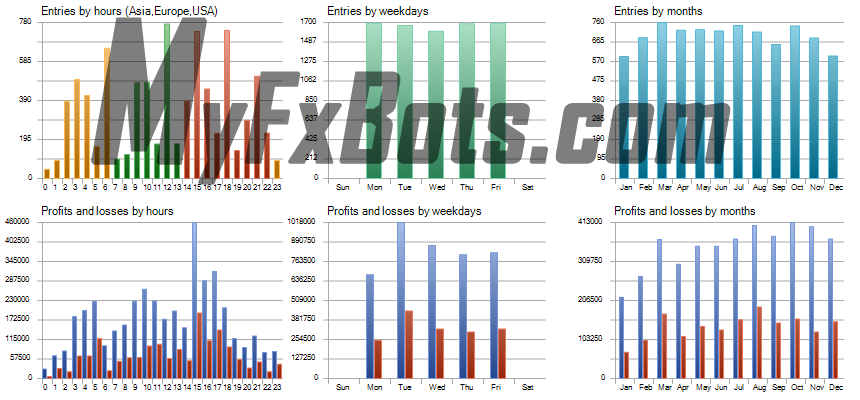

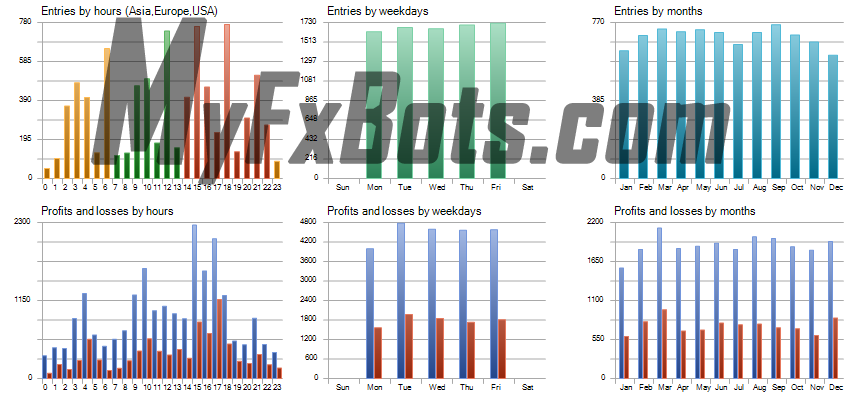

News Catcher PRO Trading Strategy

An intraday seasonal volatility trading strategy based on high-impact news events, News Catcher PRO is a sophisticated mean-reversion strategy with a high level of precision designed to capitalize on intraday seasonal volatility patterns.

By strategically entering the market just before major news events, this meticulously engineered algorithm helps ensure an optimal position for market movements.

News Catcher PRO Expert Advisor trades infrequently because of its trading logic.

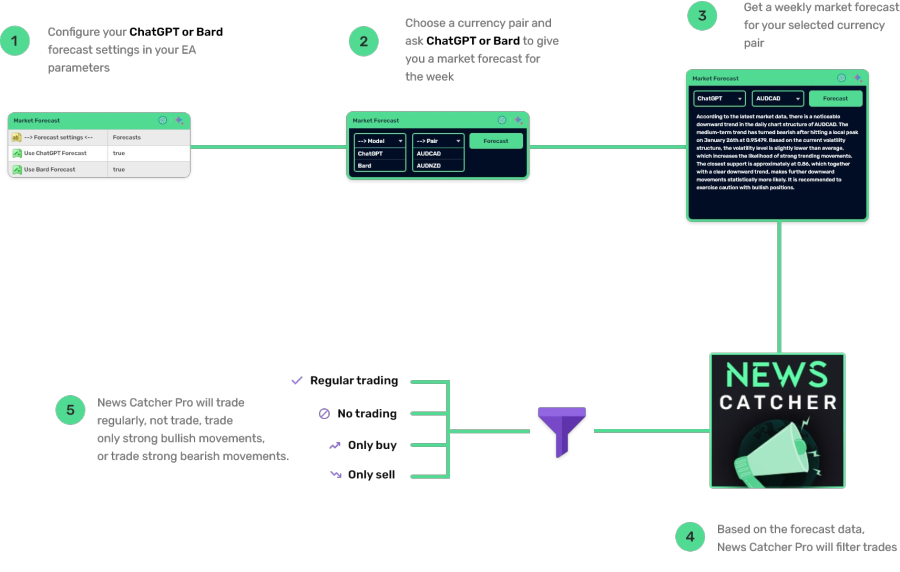

News Catcher PRO ChatGPT and Bard Market Forecasts

News Catcher PRO has been integrated with both ChatGPT and Google's Bard AI, giving the user the possibility to receive weekly market forecasts from these language models and filter trades according to them.

Here's how the market forecasts functionality works:

If you want to make use of the market forecasts functionality, the first step is to enable it from News Catcher PRO's parameters.

To do so, head over to the “Inputs” section of the Expert Advisor, when you load it into your chart or if the EA is already loaded there, and scroll down until you see a section called “--> Forecast settings..”

Once there you can enable ChatGPT or Bards forecast by switching the value from “false” to “true”.

There is nothing else you need to do after that. If the values are set to “true”, News Catcher PRO will automatically use the forecasts to filter trades, without any intervention from you.

The forecast is the same for both language models, the only difference being how they word it. This means that the filter will work exactly the same way if you choose ChatGPT or Bard.

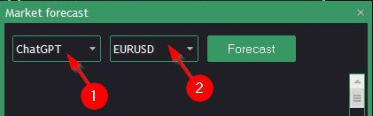

You can access the market forecasts functionality by clicking on the “Forecast” button in News Catcher PRO's user graphics interface, next to ChatGPT/Google Bard icons:

- Here you can choose within ChatGPT or Google's Bard to formulate the market forecast for you.

- Here you can choose within the 3 currency pairs that News Catcher PRO supports.

After selecting the language model and currency pair, click on the “Forecast” button, and you'll receive your market forecast.

This is a brief technical analysis of the pair's price action, chart patterns, and an educated guess of future market movements.

Based on this forecast, News Catcher PRO will filter trades, taking one of four paths:

- Trade normally.

- Not to trade.

- Open only buy positions.

- Open only sell positions.

It is very important to understand here that once you enable ChatGPT or Google Bard's forecasts in your EA parameters, all this process will be done automatically.

Even though you can manually get the market forecast, that is not actually needed for the filter to work. That means if you activate the forecast in your EA parameters, and never click on the “Get forecast” button, the filter will still work.

News Catcher PRO Risk Management

When it comes to selecting a risk level that is appropriate for you personally I recommend using the table below.

Select the risk level with which you get a maximum historical drawdown, which is 1.5 times smaller than what you can handle. That should give you a good estimate of what your ideal risk level is.

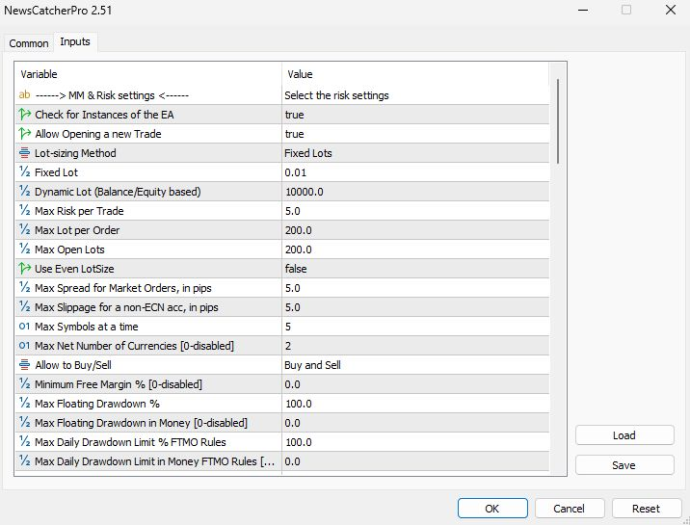

News Catcher PRO Parameters Inputs

Once you load News Catcher PRO on your chart, a pop-up box will appear showing its settings. Make sure that all the settings and alerts are correct before clicking OK. A full list of settings is located in the next slides.

If your broker uses a suffix (e.g. EURUSD.a) you should update names in the Symbols separated by comma parameter (e.g. AUDNZD.a, AUDCAD.a, NZDCAD.a).

- Allow Opening a new Trade - enable/disable opening of new trades. You can disable it while having opened trades to have the EA close trades that are opened, but stop opening new ones after that

- Lot-sizing Method - select the lot sizing method according to the risk you want to take: Fixed Lots will use fixed lot size from the 'Fixed lot' parameter, Dynamic Lots will use the 'Dynamic Lot' parameter, Max Risk per Trade will calculate lots based on % risk per trade, and 3 predefined presets will calculate risk automatically for you. When you choose one method you will only use the parameters that refer to it. For example, if you have chosen the Dynamic Lots option you should use the 'Dynamic Lot' parameter below.

Changing 'Fixed Lot' and 'Max Risk per Trade' won't matter. Also when you choose one of the predefined risk profiles all the three parameters below won't matter - Fixed Lot - fixed trading lot. If you want to have all trades the same fixed lot size, select "Fixed Lots" in the 'Lot-sizing Method' and set here the lot size you want

- Dynamic Lot - balance/equity to be used per 0.01 lot. If you want to have for example 0.01 lot size per 100 of your deposit select "Dynamic Lots" in the 'Lot-sizing Method' and set 100 in the 'Dynamic Lot' parameter

- Max Risk per Trade - will calculate the lot size, so that risk per trade stays within specified limit. E.g. setting this parameter to 5 will have all trades lose 5% of the deposit in case of hitting SL

- Maximum Lot - the maximum allowed trading lot. The EA won't open trades higher than this lot

- Maximum Spread, in pips - maximal allowed spread for position closing. Works rarely, as most of the trades are closed using TP

- Portfolio Mode - allows you to run more than one set file (instance of the EA) and/or my other EAs (instances of Perceptrader AI and Golden Pickaxe) on the same account so that the EAs do not open new initial trades simultaneously.

- Initial Delay for Portfolio Mode, ms - time delay, which will be set automatically based on the UID value. This delay is necessary to ensure one set file recognizes the opened trades of another and skips the trading signal.

Please note that set files of the same EA must have a unique UID!

For example, if you run 2 set files on the same account and want to prevent the same pair from being opened by both set files simultaneously, then I recommend setting as follows:

First set file: Portfolio Mode=true, UID=0 Second set file: Portfolio Mode=true, UID=1 - Consider WAKA Orders (Portfolio only) - the EA will take into account open trades of WakaWaka in portfolio mode.

- Consider PAI Orders (Portfolio only) - the EA will consider open trades of Perceptrader AI in portfolio mode.

- Consider GP Orders (Portfolio only) - the EA will consider open trades of Golden Pickaxe in portfolio mode.

- ML-based Pattern Recognition and Filtering - enable/disable filtering of trades using ML-based candlestick pattern filter. The filter increases the trading quality but reduces the number of trades.

- ML-based Pattern Filter Threshold - the minimal predicted probability that a trade will result in profit.

- Max Floating Drawdown in Money - if the floating drawdown in money exceeds the specified value, the

EA will perform actions specified in the 'Max Drawdown Action' parameter. This option can be used, for

example, to prevent losses higher than specified by your prop trading firm - Max Floating Drawdown % for each Symbol, separated by a comma - allows you to specify the max. drawdown % separately for each symbol.

- Only One Symbol if Grid reaches this Level [0-disabled] - This option allows you to temporarily reduce the "Maximum Symbols at a Time" to one if an open grid reaches the specified level.

- Do Nothing if During Rollover - set to true if you want to ignore max. drawdown checks during a rollover.

- Max Random Delay before sending Orders, sec [0-disabled] - maximum random delay in seconds before sending an order. Values over 15 seconds are not recommended.

- Allow sending SL along with an order (for a non-ECN acc.) - if true, then the EA will send SL along with orders. If false, then SL will be set after the order is sent and executed.

- Max Drawdown Action - allows specifying actions to be taken after the max. drawdown is reached (in money or %):

- 'Close trades and stop trading for 24h' - the EA will close all open trades and will not open new ones for 24 hours;

- 'Close trades and stop trading until restart' - the EA will close all open trades and will not open new ones until the EA/MT restarts;

- 'Prohibit opening new trades' - new trades will be prohibited as long as the floating drawdown is above a specified value;

- 'Prohibit opening new trades until restart' - new trades will be prohibited until the EA/MT restarts

- Max Drawdown Action - Max Drawdown Calculation - allows to specify how the maximum drawdown is calculated:

- 'The account' - takes into account all positions opened on the account, including trades opened manually or by other EAs;

- 'This strategy' - takes into account only positions opened by this set file of the EA

- Maximum Net Number of Currencies - allows to limit the number of open trades with the same currencies (not symbols/currency pairs) in the same direction. The parameter does not lead to performance improvements on tests, still, it limits risks, so it is recommended to be used with a value of 2 when more than 3 pairs are traded at a time. This parameter limits the exposure to risk in a smart way (not just by limiting the number of pairs traded)

For example, we set 'Maximum Net Number of Currencies'=2 and got 3 positions open:- long EURUSD

- long GBPUSD

- short EURCHF

- EUR = 0 (long EURUSD + short EURCHF)

- USD = -2 (long EURUSD + long GBPUSD)

- GBP = 1 (long GBPUSD)

- CHF = 1 (short EURCHF)

As you can see, USD has reached the max. limit (-2), so any orders that can lead to a new short USD trade (for example, short USDCHF) will be canceled and prohibited - Medium Impact News - enable/disable news events with medium impact (2 stars news)

- Low Impact News - enable/disable news events with low impact (1 star news)

- Speaks - if false, then the EA will not take into account news events marked as Speeches/Speaks

- News List Refresh Rate - news events list update frequency (selection from the drop-down list)

- Symbol Suffix - here you can specify a symbol suffix if your broker uses one

- Placing Orders During Rollover Time - enable/disable placing pending orders during rollover time

- Friday Half Lots - halving trading lots on Friday evening

- Handle Max Drawdown Events on Every Tick - enable/disable drawdown event handling on every tick (instead of once a minute that is used by default, it may consume more CPU resources)

- Max Daily Drawdown Limit % FTMO Rules in Money [0-disabled] - maximum daily drawdown limit in MONEY, calculated according to the FTMO rules. Non-trading operations (like withdrawals) during the day are not taken into account

- Max Daily Drawdown Reset Hour FTMO Rules (Broker time) - hour to reset the max. drawdown with the prop firm

- Min Profit To Close Trade Before Midnight, in pips [0-disabled] - automatically closes profitable trades before midnight if the specified profit is reached

- Hide TakeProfit - on/off TakeProfit hiding

- Max Open Lots - here you can put a value limiting the total lots that can be opened by the EA on all currency pairs

- Minutes to Stop Trading - minutes to stop trading

- Block Trading for the Entire Day - prohibits opening new trades throughout the day if HV hits the specified level just once at any moment during the day

- Show Stats - show a panel with some statistics

- Use ChatGPT Forecast - enable/disable filtering of trades using ChatGPT forecasts.

- Use Bard Forecast - enable/disable filtering of trades using Google Bard.

- Rollover Start Hour - rollover start hour.

- Rollover Start Minutes - rollover start minutes.

- Rollover End Hour - rollover end hour.

- Rollover End Minutes - rollover end minutes.

- Send Orders During Rollover - enable/disable sending orders (including grid trades) during rollover time.

- Remove TakeProfit/StopLoss During Rollover - removes TP/SL for all orders at the specified rollover time. This option helps to avoid closing trades via TP/SL during bad trading conditions.

- Pause Between Grid Trades, in min [0-disabled] - a minimum pause between grid trades in minutes.

- Custom Multipliers sep. by comma (e.g., 2,4,8,16,32) - custom multipliers for each GRID step separated by a comma, for example - 2,4,8,16,32.

- Calculate Levels from Initial Trade - if true, then the entry prices of grid levels will be calculated based on the entry price of the initial trade. In this case, if the distance of the previous grid is very large, the next grid can be formed shorter than 35 (by default) or even inside the previous grid. If false, then the entry price of a grid level will be calculated based on the entry price of the previous grid to form grids with distances greater than 75 (by default).

- Force Basket Closure once the Initial Order is Closed - option to force basket closure once the initial order/trade is closed by TP or by manual intervention.

News Catcher PRO Machine learning setup

- Enable Neural Network Filter – enable/disable filtering of trades using machine learning technology based on Perceptron.

- Min Probability of Profit % - minimal predicted probability that a trade will result in profit. If Perceptron predicts a lower value, the trading signal will be ignored, and the INITIAL trade will be skipped.

News Catcher PRO Strategy Parameters

- Symbols separated by comma - list of pairs to trade. Suffix needs to be included if your broker uses one! Supported pairs: GBPUSD, EURUSD, EURCHF, USDCAD, USDCHF + CHFJPY, AUDCAD, EURCAD, EURAUD. First 3 ones are the preferred option (like on Best Pairs and MT5 Extreme signals)

- Hour to Start/Stop Placing Orders - when to start/stop placing pending orders. Set Smart Time Filter to false if you want to optimize these parameters

- Smart Time Filter - enable/disable smart time filter, it is preferred to enable this parameter, unless using custom set files with optimized timing parameters

- Hour to Stop Trading (on Friday) - hour to stop trading (on Friday). All open positions will be closed at this hour. Set it to 22 if you do not want trades to be held over weekends

- New Year Holiday Filter - enable/disable Christmas/New Year filter. It is recommended to use this filter to prevent low-liquidity market tricks during these holidays

- StopLoss, in pips - stop loss value in standard 4 digit pips. By default are used different optimal SL values for different pairs

- Hide StopLoss - enable/disable SL hiding. You may use this option to hide your real SL from the broker

- Rollover Time Filter - enable/disable the rollover filter

- Swap Filter - cancels trading on Wednesday evening in the direction of the negative swap or cancels trading on every day when swap is exceeded (parameter is adjustable). It is preferred to be used with the default value. Can be disabled on swap-free accounts

- Max Negative Swap, in pips - max negative swap

- News Filter Enabled - enable/disable News Filter (must be allowed access to the URL http://ec.forexprostools.com in order to use this filter)

- Wait Minutes Before/After Event - suspend trading before/after the news (default values are preferred)

- Split Orders - embedded feature allowing to split the entry on several slightly different entries. With the default value feature is disabled, 10 is the maximum value (splitting the lot size on 10 different entries)s. Preferred to use with large lot sizes to prevent slippages!

- Adjust Order Price? - if false, the EA will not use the price adjustment for 'Split Orders' parameter and all orders will be placed at the same price

- Minimum Price Range - minimum distance between pending buy and sell orders expressed in %ATR. The option can significantly improve performance (Profit Factor, Expected Payoff), but reduces the number of trades. Recommended value - 0...20. The value of 0 usually shows best results with EURUSD and GBPUSD pairs, while value of 20 is recommended in case of trading other pairs or in case of having bad trading conditions with the broker (higher values make EA less susceptible to bad trading conditions of the broker)

- Randomize Order/TP/SL Levels - if enabled, the EA will randomly slightly change the entry/TP/SL levels. This option allows you to have unique entry/TP/SL values

- Adjust TP Price - allows you to adjust take profit. In case of a positive/negative value, take profit will be increased/decreased by the specified number of pips

- Minimum Free Margin % - if Free Margin% falls below the specified value, the EA will not place new pending orders and will cancel already placed ones

- Trade Comment - comment

- UID (0...9) - unique EA instance number. Usually no need to change it, unless using different set files on the same pair (might be needed for advanced users with their own custom configurations). In this case you need to make sure that every set file uses unique UID number

- ShowPanel - enable/disable Info-panel. It is better to enable the info-panel, as it will show most of what can go wrong there. But it can be disabled to save VPS resources

- GMT/DST Test - GMT offset in winter and DST in Tester. This parameter has no effect on live trading (unless 'Disable Automatic GMT Detection' is set to true)

- Disable Automatic GMT Detection - Set it to 'true' to disable automatic GMT detection. You can use the 'GMT Test/Manual' and 'DST Test/Manual' parameters to manually set the GMT offset in live trading

News Filter can be used in the Strategy Tester. To apply the option you should download the news events data file 'NewsEvents.txt' and copy it to the common MT4/5 directory - '\Common\Files' (File -> Open Data Folder -> Up to ‘Terminal’ -> Common -> Files). The data file can be found using the link above

Promotional Video (by the Vendor)

Other Forex Robots from Valery Trading

Evening Scalper PRO uses an original & compelling trading logic on cross pairs that have a solid mean-reverting tendency with high-profit targets (unlike most night scalpers).

Night Hunter PRO utilizes smart entry/exit algorithms to identify only the safest entry points during calm periods of the

market.

The highest-performing gold EAs all share the same common logic: grid trading.

Valery Trading EA developers team have developed the #1 ranked grid trading EA, called Waka Waka, and then they have applied many of the algorithmic principles from Waka Waka to this gold EA, and the results have been mind-blowing: Golden Pickaxe performs even better than Waka Waka.

Perceptrader AI is a cutting-edge grid trading system that leverages the power of Artificial Intelligence, utilizing Deep Learning algorithms and Artificial Neural Networks (ANN) to analyze big amounts of market data at a high speed and detect high-potential trading opportunities to exploit.

Investing in intraday seasonal volatility patterns driven by news events is the goal of News Catcher PRO, which is a sophisticated mean-reversion trading strategy.

News Catcher PRO does not use martingale or grid by default (optional grid is available).

Explore insights on Algocrat AI, a cutting-edge cryptocurrency copy trading platform crafted by Valery Trading—the masterminds in developing professional Expert Advisors. Discover articles that unveil its innovative strategies, transforming trading into an accessible and intelligent experience.

Tags

Valery Trading

Tickmill

Algocrat AI

FXAutomater

WallStreet Forex Robot 3.0 Domination

Tick Data Suite

Waka Waka

FBS

IC Markets

Perceptrader AI

Forex Diamond

StrategyQuant X

Volatility Factor Pro

XM

HF Markets

RoboForex

InstaForex

Alpari

Forex Combo System

GPS Forex Robot

FX Scalper

GrandCapital

Golden Pickaxe

Automated Forex Tools

Forex Trend Detector

Omega Trend

Telegram Signal Copier

Broker Arbitrage

SMRT Algo

AMarkets

IronFX

FXVM

TradingFX VPS

Gold Miner

Quant Analyzer

Forex Trend Hunter

Binance

Gold Scalper PRO

ForexSignals.com

AlgoWizard

RayBOT

FxPro

Forex Gold Investor

ACY Securities

FX Choice

News Scope EA PRO

Commercial Network Services

Smart Scalper PRO

FX-Builder

Infinity Trader

Pump Trader Robot

LeapFX Trading Academy

ForexTime

WallStreet Recovery PRO

BlackBull Markets

Libertex

Quant Data Manager

FXCharger

StarTrader

Forex VPS

MTeletool

Best Free Scalper Pro

Pepperstone

VPS Forex Trader

QHoster

Evening Scalper PRO

Telegram Copier

FX Secret Club

Forex Robot Academy

Happy Bitcoin

Forex Robot Factory (Expert Advisor Generator)

Trend Matrix EA

Happy Forex

ByBit

Database Mart

DARKEAS

Gold Breaker

Magnetic Exchange

Quant Tekel Funded

Vortex Trader PRO

Swing Trader PRO

EGPForex

Risk

Forex trading can involve the risk of loss beyond your initial deposit. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary.

Forex accounts typically offer various degrees of leverage and their elevated profit potential is counterbalanced by an equally high level of risk. You should never risk more than you are prepared to lose and you should carefully take into consideration your trading experience.

Past performance and simulated results are not necessarily indicative of future performance. All the content on this site represents the sole opinion of the author and does not constitute an express recommendation to purchase any of the products described in its pages.