Menu

Featured Solutions

Forex Brokers

Forex VPS Services

Forex Robots

Forex Service Providers

Currency Exchange Companies

Payment Processors

MyFxBots Forex Blog

2026 Posts

Feb, 2026 Posts

Jan, 2026 Posts

2025 Posts

Dec, 2025 Posts

Nov, 2025 Posts

Oct, 2025 Posts

Sep, 2025 Posts

Aug, 2025 Posts

Jun, 2025 Posts

May, 2025 Posts

Apr, 2025 Posts

Mar, 2025 Posts

Jan, 2025 Posts

2024 Posts

Dec, 2024 Posts

Nov, 2024 Posts

Oct, 2024 Posts

Jun, 2024 Posts

Apr, 2024 Posts

Mar, 2024 Posts

Feb, 2024 Posts

Jan, 2024 Posts

2023 Posts

Dec, 2023 Posts

Nov, 2023 Posts

Oct, 2023 Posts

Sep, 2023 Posts

Aug, 2023 Posts

Jul, 2023 Posts

Jun, 2023 Posts

May, 2023 Posts

Apr, 2023 Posts

Mar, 2023 Posts

Feb, 2023 Posts

2022 Posts

Dec, 2022 Posts

Nov, 2022 Posts

Oct, 2022 Posts

Sep, 2022 Posts

Jul, 2022 Posts

Jun, 2022 Posts

May, 2022 Posts

Apr, 2022 Posts

Mar, 2022 Posts

Feb, 2022 Posts

Jan, 2022 Posts

2021 Posts

Dec, 2021 Posts

Oct, 2021 Posts

Sep, 2021 Posts

Aug, 2021 Posts

Jul, 2021 Posts

Jun, 2021 Posts

May, 2021 Posts

Mar, 2021 Posts

Feb, 2021 Posts

Jan, 2021 Posts

2020 Posts

Dec, 2020 Posts

Nov, 2020 Posts

Oct, 2020 Posts

Sep, 2020 Posts

Aug, 2020 Posts

Jul, 2020 Posts

2019 Posts

Dec, 2019 Posts

Nov, 2019 Posts

Jul, 2019 Posts

Jun, 2019 Posts

May, 2019 Posts

Apr, 2019 Posts

2018 Posts

Nov, 2018 Posts

Aug, 2018 Posts

Jun, 2018 Posts

Mar, 2018 Posts

Feb, 2018 Posts

Jan, 2018 Posts

2017 Posts

Dec, 2017 Posts

Nov, 2017 Posts

Sep, 2017 Posts

Aug, 2017 Posts

Apr, 2017 Posts

Mar, 2017 Posts

Jan, 2017 Posts

2016 Posts

Dec, 2016 Posts

Nov, 2016 Posts

Oct, 2016 Posts

Sep, 2016 Posts

Aug, 2016 Posts

Jun, 2016 Posts

May, 2016 Posts

Apr, 2016 Posts

2015 Posts

Nov, 2015 Posts

Oct, 2015 Posts

Jun, 2015 Posts

May, 2015 Posts

Apr, 2015 Posts

Mar, 2015 Posts

2014 Posts

Dec, 2014 Posts

Oct, 2014 Posts

Sep, 2014 Posts

Aug, 2014 Posts

Jul, 2014 Posts

Jun, 2014 Posts

May, 2014 Posts

Apr, 2014 Posts

Mar, 2014 Posts

Feb, 2014 Posts

2013 Posts

Dec, 2013 Posts

Nov, 2013 Posts

Oct, 2013 Posts

Jul, 2013 Posts

Apr, 2013 Posts

Search Queries Cloud

Trading During Market Crashes: Why Smart Systems Sometimes Stay Out

MT Terminal Update: Why Your Expert Advisors Need This Patch

Top Risks and Safe Steps for “Poverty Scalper Robot” Traders

Adaptive Multi‑Algorithm Crypto & Forex Portfolio: Live Results and How to Access

Deep Backtest Review: High‑Risk AUDCAD Grid Results and Live Trading Guide

Why Security Certifications Matter for Forex Traders: ISO, CSA STAR & SOC 2 Explained

High-Risk Gold Expert Advisor Backtest Analysis: XAUUSD 2010–2023 Results & Real Trading Insights

Gold Volatility Strategy: How Traders Captured $20K in Early 2026

Early Access for a Next‑Gen Automated Trading Expert

GOLD Scalper PRO v2.0 Review: Two Systems, Massive Performance Leap

Gold Scalper to Watch: Deep Live Performance Audit of a Top M30 XAUUSD System

Dark Nova 2025 Live Performance Review and Deployment Checklist

Waka Waka EA Performance Review: Gains, Drawdown, and Live Deployment Checklist

SlingShot Live Performance Review: Month‑by‑Month Analysis, Time‑of‑Day Edge, and Deployment Checklist

How to Build Reliable Algo Trading Strategies Using AI Templates and Workflow Automation

Mastering Manual Trading with Infinity Trader: A Practical 4‑Month Performance Tutorial

Perceptrader AI: Modern AI Grid EA for Consistent Forex Automation

Smart Risk Control: NoConcurrentTrades Added in WallStreet Recovery PRO v1.8

Happy Japanese Market v1 Expert Advisor

4.9/5 (23 votes)

Long-term stability is the goal of Happy Japanese Market. Account types are not limited and it works with any broker.

Trading Idea

USDJPY pair is continuously scanned by the Happy Japanese Market's indicators all day for trading inputs based on the indicator methodology.

Specifications

License

1 License for an Unlimited Number of Real or Demo Accounts, a Free Lifetime Monthly Renewal of the License Key will be sent to the Registered email to Protect EA from Mass Copying.

Compatible Brokers

Compatible with any broker and has no limitations on the types of accounts used.

Happy Japanese Market Supports ECN Brokers with Auto-Quotes Detection 4 or 5 Digits, We Recommend Installing it on TradingFX VPS VPS and Using it on Tickmill, and IC Markets Forex Brokers for the Best Stability and Profitability.

Account Recommendations

Any Account type with a Minimal Balance of $100, while the Recommended Balance is $300.

User Guide

A Complete Tutorial is available including a User Guide - English Version, Happy Japanese Market - Installation.

Updates / Upgrades

Free Lifetime Update and Upgrade.

BONUS GIFT

On Purchasing a Copy of Happy Japanese Market, you get Full Access to EAs Happy Forex Full Packs (10x EAs) including Happy News, Happy Forex, Happy MartiGrid, Happy Way, Happy Market Hours, EA Happy Algorithm PRO, Happy Fast Money, Happy Trend, and Happy News.

Refund Policy

30 Days Money Back Guarantee is Offered by the Vendor.

MT5 Compatibility

A Compatible Version with MT5 Trading Station is Available by the EA Developer.

Supported Currency Pairs

USDJPY

MetaTrader Chart Timeframe

D1

Developed By

Happy Forex

About

Happy Japanese Market

Reviewed By

MyFxBots Admin

Last Reviewed On

Tues, 20 Jan 2026

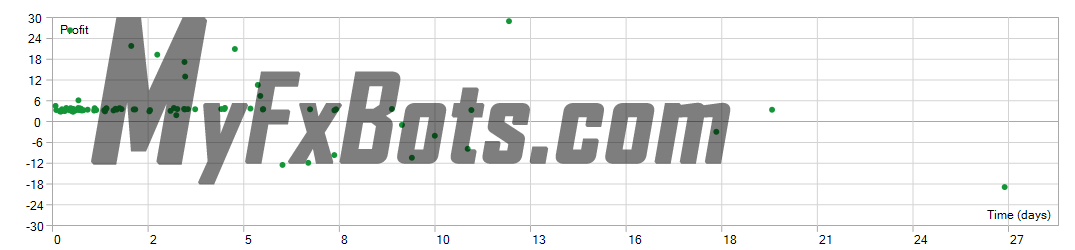

MyFxBook Verified Live Trading Results Statement

Real Money Account

Live Test Summary

Started On

Aug 23, 2024

Account Leverage

1:500

Profit Factor

2.25

Total Gain

+149.67%

Absolute Gain

+73.34%

Monthly Gain

11.00%

Daily Gain

0.35%

Total Pips

1,693.7

Total Trades

113

Profit Amount

$3,667.16

(%) Won Trades

1,693.7

Drawdown

26.04%

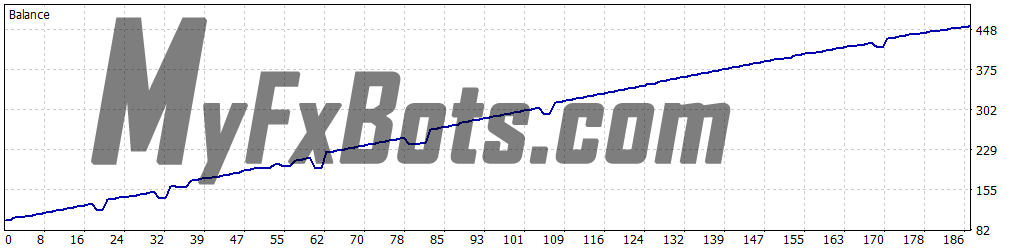

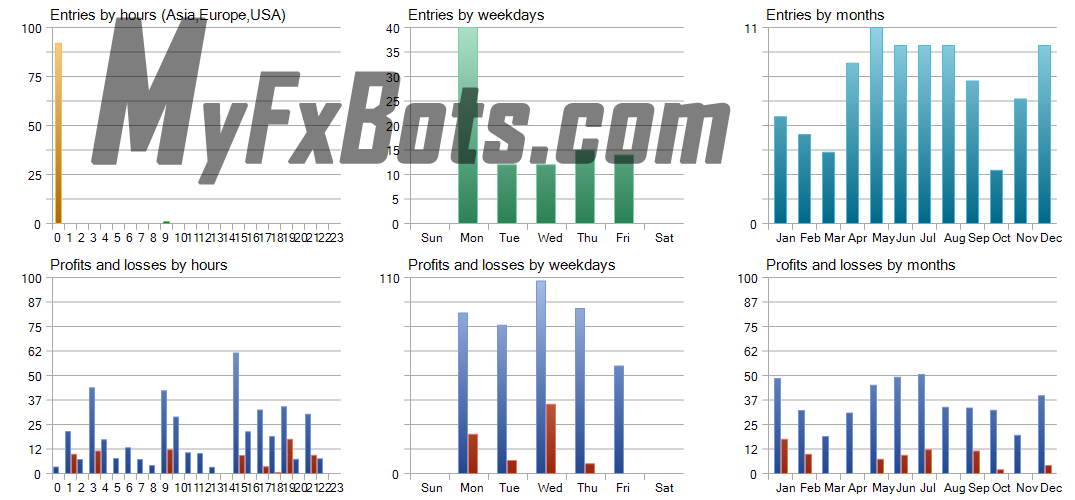

MetaTrader 5 Strategy Tester Backtest

Backtests Settings

Symbol

USDJPY

Period

Daily (2015.01.01 - 2022.07.24)

Broker

Currency

USD

Leverage

1:500

Symbols

1

Bars in test

1961

Ticks modelled

314864722

Modelling quality

100% real ticks

Initial Deposit

$100.00

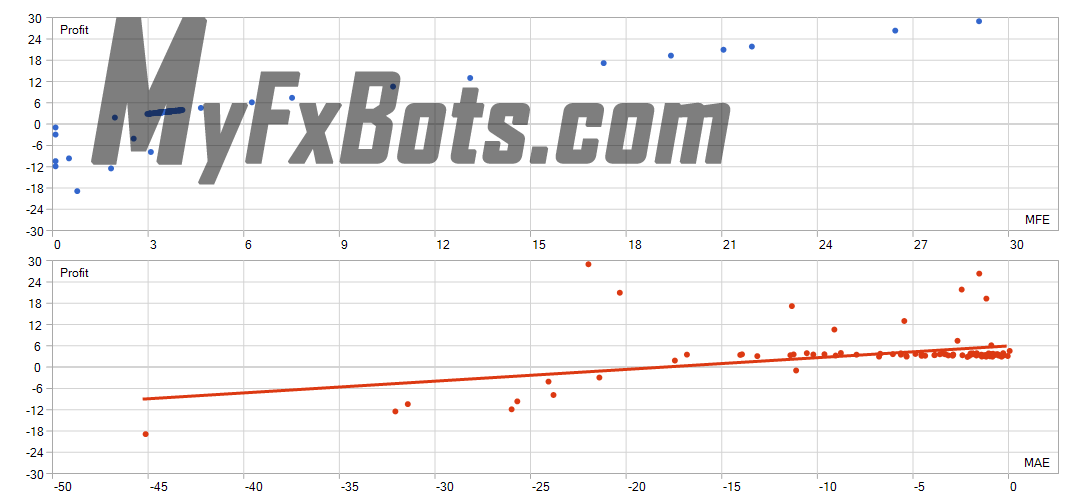

Backtests Results

Total net profit

356.64

Gross profit

434.46

Gross loss

-77.82

Profit factor

5.58

Expected payoff

3.83

Margin level

1782.33%

Absolute Bal DD

0.04

Maximal Bal DD

17.61 (8.29%)

Relative Bal DD

8.29% (17.61)

Absolute EQ DD

0.14

Maximal EQ DD

65.36 (30.69%)

Relative EQ DD

30.69% (65.36)

Recovery Factor

5.46

Sharp Ratio

2.26

Z-Score

1.37 (82.93%)

AHPR

1.0171 (1.71%)

LR Correlation

1.00

OnTester result

0

GHPR

1.0165 (1.65%)

LR Standard Error

6.07

Total Trades

93

Short positions

0 (0.00%)

Long positions

93 (90.32%)

Profit trades

84 (90.32%)

Loss trades

9 (9.68%)

Largest Profit trade

30.17

Largest Loss trade

-17.50

Average Profit trade

5.17

Average Loss trade

-8.65

Maximum consecutive wins (profit in money)

31 (130.84)

Maximum consecutive losses (loss in money)

1 (-17.50)

Maximal consecutive profit (count of wins)

130.84 (31)

Maximal consecutive loss (count of losses)

-17.50 (1)

Avarage consecutive wins

8

Avarage consecutive losses

1

Other Forex Robots from Happy Forex

Happy Market Hours is a scalper EA using identical 40 pips S/L and T/P limits with default maximum spread of 5 pips, basically designed for all types of traders in the Forex market including new users.

Happy Gold uses a trend strategy with a modified ZigZag indicator, that best works on XAUUSD in the M30 chart.

No matter they were good or bad, Happy News EA trades important Forex news automatically.

Happy Trend trades on high volatility including a News Filter. No martingale, no hedging, and no grid are included in its trading algorithm.

Happy Frequency combines the concepts trend/grid/hedge/semi-martingale according to risk low/middle/high/combi EA files. The whole strategy is protected with a News filter.

Happy Algorithm PRO measures performance and deviations in the prices of a currency pair, shows the difference as a line and analyzes it to get an optimal hidden SL and TP.

Happy Forex secures positions using grid strategy without increasing lots (no martingale). It also uses technical analysis (indicator) for safe entry into the market with a News filter.

Happy MartiGrid uses a martingale / grid strategy with technical indicators and a News filter.

HappyWay doesn't use any indicator and its advantage is that it uses reinsurance positions (grid strategy) without increasing lots (no martingale).

USDJPY pair is continuously scanned by the Happy Japanese Market's indicators all day for trading inputs based on the indicator methodology.

Happy Fast Money basic idea is to open a transaction with buy and sell limits. new buy and sell limits are set when the executed transaction price has touched the limits set by the EA.

Happy INDIcators PRO pack is a group of indicators that can determine a certain currency's future movement direction. This integrated mix of a variety of indicators can help to achieve stable profits in Forex trading.

Happy Power comprises a market algorithm that is self-adaptive with reinforcement learning components that are part of the algorithm.

In contrast to supervised learning, reinforcement machine learning does not require labeled input/output pairs to be present in a model, and it does not require suboptimal actions to be explicitly corrected in order for it to work.

Happy Neuron contains several modules based on recurrent neural networks in order to determine market sentiment analysis with a news filter. As a result, the EA makes continuous profits and a constant number of trades.

Happy Galaxy has new built-in methods for determining the trend direction, small grids, or loss recovery. As a bonus, News Filter is implemented to reduce drawdown at high market volatility.

Algorithmic Happy Brexit is a built system based on finding so-called "big fish" time movements; huge pips variations using a very low degree of drawdown.

Happy Bitcoin EA operates based on a strategy that involves identifying market waves and trends and constructing correction-impulse levels. There is no grid, no hedging, no arbitrage, nor martingale elements in the EA trading strategy.

The Happy Index primarily uses a technical analysis and trend-following strategy to trade the US30 (Dow Jones Index). It leverages advanced algorithms and technical indicators to analyze market trends, identify potential entry and exit points, and execute trades precisely. Additionally, it includes a news filter to avoid trading during significant economic news events, reducing the risk of losses due to market volatility.

Tags

Valery Trading

Tickmill

Algocrat AI

FXAutomater

WallStreet Forex Robot 3.0 Domination

Tick Data Suite

Waka Waka

FBS

IC Markets

Perceptrader AI

Forex Diamond

RoboForex

StrategyQuant X

Volatility Factor Pro

XM

HF Markets

InstaForex

Alpari

Forex Combo System

GPS Forex Robot

FX Scalper

GrandCapital

Golden Pickaxe

Automated Forex Tools

Forex Trend Detector

IronFX

Omega Trend

Telegram Signal Copier

Broker Arbitrage

SMRT Algo

AMarkets

FXVM

TradingFX VPS

Gold Miner

Quant Analyzer

Forex Trend Hunter

Binance

Forex Gold Investor

ACY Securities

Gold Scalper PRO

ForexSignals.com

AlgoWizard

RayBOT

FxPro

FXCharger

News Scope EA PRO

FX Choice

Smart Scalper PRO

Commercial Network Services

FX-Builder

Infinity Trader

Pump Trader Robot

Happy Forex

LeapFX Trading Academy

ForexTime

WallStreet Recovery PRO

BlackBull Markets

Libertex

Quant Data Manager

StarTrader

Forex VPS

Best Free Scalper Pro

MTeletool

Pepperstone

VPS Forex Trader

Evening Scalper PRO

QHoster

Telegram Copier

Happy Bitcoin

FX Secret Club

Forex Robot Academy

Trend Matrix EA

Forex Robot Factory (Expert Advisor Generator)

ByBit

Database Mart

Gold Breaker

DARKEAS

Magnetic Exchange

Quant Tekel Funded

Vortex Trader PRO

Swing Trader PRO

EGPForex

Risk

Forex trading can involve the risk of loss beyond your initial deposit. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary.

Forex accounts typically offer various degrees of leverage and their elevated profit potential is counterbalanced by an equally high level of risk. You should never risk more than you are prepared to lose and you should carefully take into consideration your trading experience.

Past performance and simulated results are not necessarily indicative of future performance. All the content on this site represents the sole opinion of the author and does not constitute an express recommendation to purchase any of the products described in its pages.

2013 - 2026©

MyFxBots.

Cookies help us deliver our services! By using our services you agree to our use of cookies! Learn More