One of the most frequently discussed topics in the Algocrat AI community is why trading results vary across different brokers. The platform, launched by the Valery Trading Expert Advisors developers team, strives to offer a scalable copytrading solution for identical executions. Yet, subtle differences in execution and quote feeds among brokers continue to influence trading outcomes.

There are two main factors behind these differences:

-

Execution and Expenses – The better a broker’s execution and the lower its expenses, the better the trading results.

-

Quote Differences – Since the trading algorithms of Algocrat AI operate on individual accounts, random variations in quotes affect trade execution; over longer periods, these fluctuations tend to cancel out.

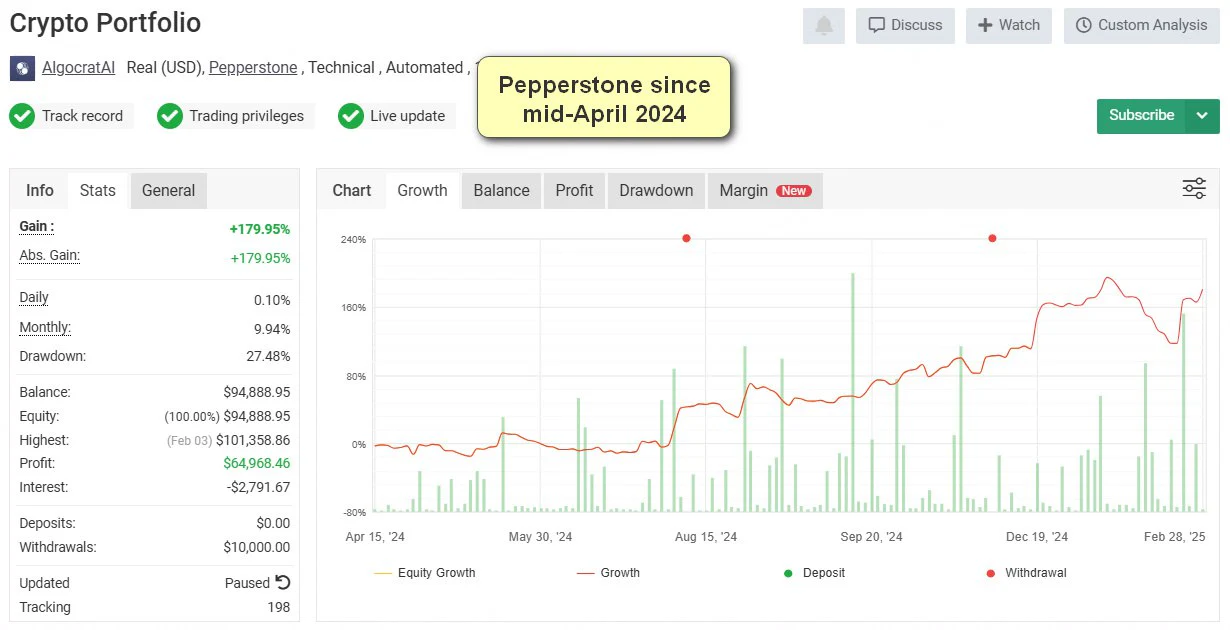

Among the evaluated brokers, Pepperstone stands out for its excellent execution and competitive costs, making it a reliable benchmark for comparison:

Data shows that IC Markets has slightly outperformed Pepperstone from mid-April 2024 to March 2025. Although minor variations arise due to differences in quotes, the long-term performance of both is nearly identical:

Fusion Markets is one of the most popular brokers among Algocrat AI users and is frequently discussed in relation to outcome differences. Analysis of accounts trading with Fusion Markets since April 2024 reveals a slight edge over Pepperstone – a return of 10.17% versus 10.00%, a difference of about 1.7% in favor of Fusion Markets:

If the comparison start date is shifted to mid-May 2024, Fusion Markets’ advantage increases to approximately 5%:

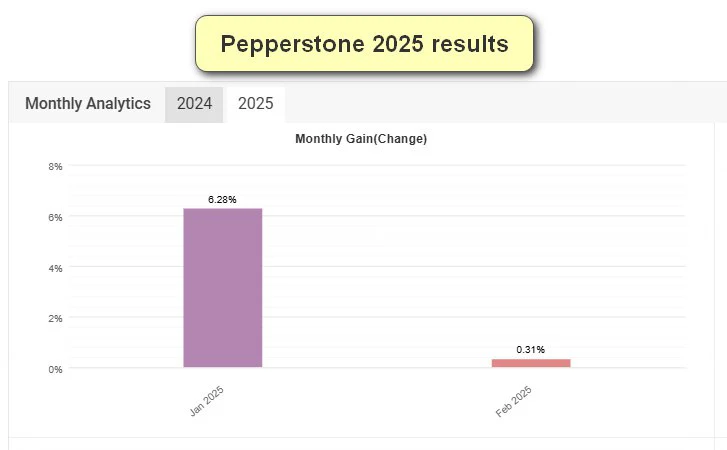

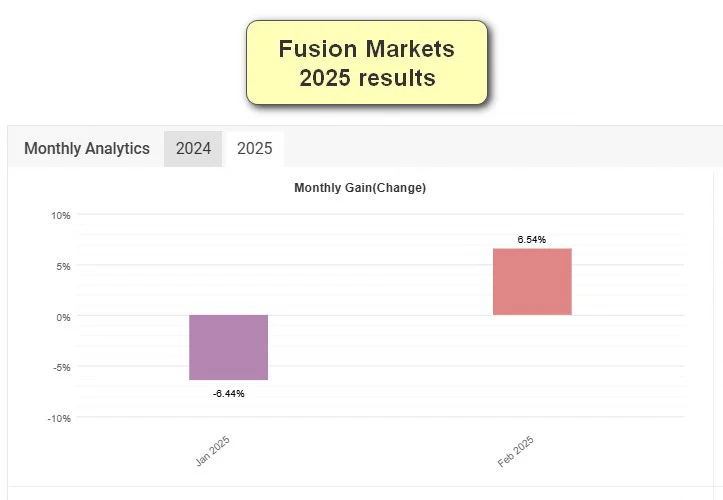

However, there are periods when Pepperstone outperforms Fusion Markets. Consider the short-term swings: Some traders who joined in January 2024 recorded a –6% loss on Fusion Markets while Pepperstone showed a +6% gain. Then, in February 2024, Fusion Markets rebounded with a 6–7% profit, whereas Pepperstone remained nearly flat:

Vantage, with a trading history beginning in September 2024, tells a similar tale. Although overall performance has been slightly lower than Pepperstone, its highest equity peak has, at times, exceeded that of Pepperstone. Adjusting the comparison period can even swing the conclusion in Vantage’s favor:

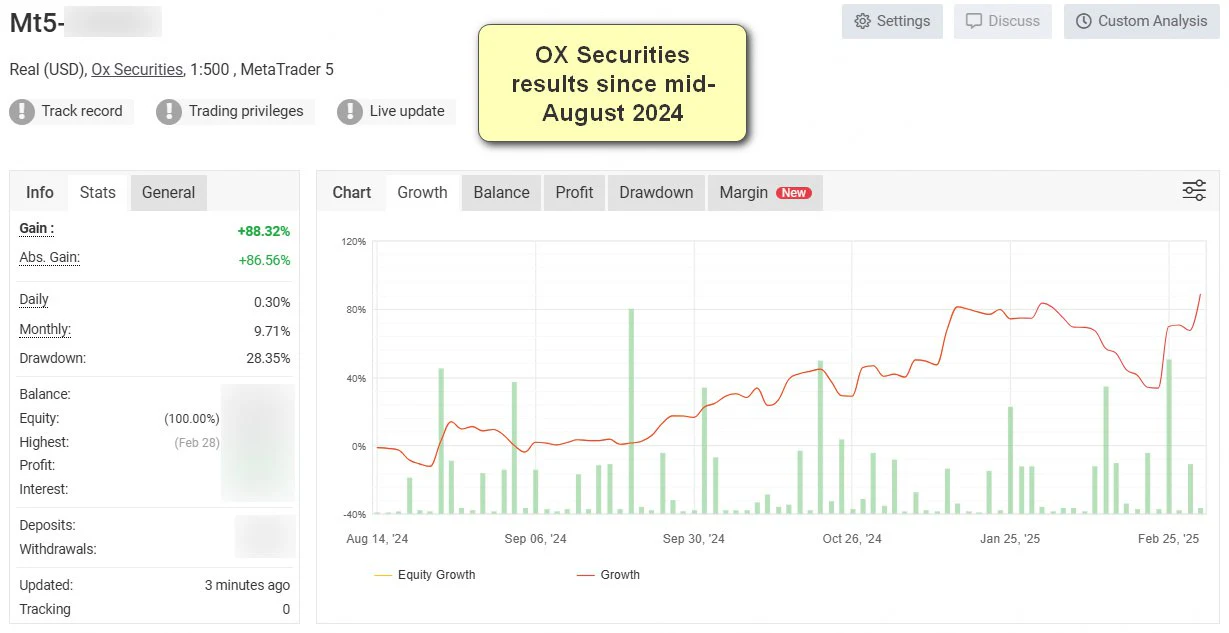

In contrast, OX Securities shows noticeably weaker execution than most brokers; however, its results remain nearly on par with Pepperstone—lagging by roughly 2.89% over seven months. This confirms that while execution quality plays a role, its impact on long-term profitability is limited:

Currently, OX Securities achieved an all-time high with an 8% result in February, even as Pepperstone experienced a drawdown.

In summary, although execution efficiency and fee structures can cause short-term differences, the long-term results among quality brokers tend to converge. The insights from Algocrat AI—developed by the Valery Trading Expert Advisors team—suggest that diversifying funds among brokers with similar trading conditions and focusing on a long-term strategy is the key to trading success.