Menu

Featured Solutions

Forex Brokers

Forex VPS Services

Forex Robots

Forex Service Providers

Currency Exchange Companies

Payment Processors

MyFxBots Forex Blog

2026 Posts

Mar, 2026 Posts

Feb, 2026 Posts

Jan, 2026 Posts

2025 Posts

Dec, 2025 Posts

Nov, 2025 Posts

Oct, 2025 Posts

Sep, 2025 Posts

Aug, 2025 Posts

Jun, 2025 Posts

May, 2025 Posts

Apr, 2025 Posts

Mar, 2025 Posts

Jan, 2025 Posts

2024 Posts

Dec, 2024 Posts

Nov, 2024 Posts

Oct, 2024 Posts

Jun, 2024 Posts

Apr, 2024 Posts

Mar, 2024 Posts

Feb, 2024 Posts

Jan, 2024 Posts

2023 Posts

Dec, 2023 Posts

Nov, 2023 Posts

Oct, 2023 Posts

Sep, 2023 Posts

Aug, 2023 Posts

Jul, 2023 Posts

Jun, 2023 Posts

May, 2023 Posts

Apr, 2023 Posts

Mar, 2023 Posts

Feb, 2023 Posts

2022 Posts

Dec, 2022 Posts

Nov, 2022 Posts

Oct, 2022 Posts

Sep, 2022 Posts

Jul, 2022 Posts

Jun, 2022 Posts

May, 2022 Posts

Apr, 2022 Posts

Mar, 2022 Posts

Feb, 2022 Posts

Jan, 2022 Posts

2021 Posts

Dec, 2021 Posts

Oct, 2021 Posts

Sep, 2021 Posts

Aug, 2021 Posts

Jul, 2021 Posts

Jun, 2021 Posts

May, 2021 Posts

Mar, 2021 Posts

Feb, 2021 Posts

Jan, 2021 Posts

2020 Posts

Dec, 2020 Posts

Nov, 2020 Posts

Oct, 2020 Posts

Sep, 2020 Posts

Aug, 2020 Posts

Jul, 2020 Posts

2019 Posts

Dec, 2019 Posts

Nov, 2019 Posts

Jul, 2019 Posts

Jun, 2019 Posts

May, 2019 Posts

Apr, 2019 Posts

2018 Posts

Nov, 2018 Posts

Aug, 2018 Posts

Jun, 2018 Posts

Mar, 2018 Posts

Feb, 2018 Posts

Jan, 2018 Posts

2017 Posts

Dec, 2017 Posts

Nov, 2017 Posts

Sep, 2017 Posts

Aug, 2017 Posts

Apr, 2017 Posts

Mar, 2017 Posts

Jan, 2017 Posts

2016 Posts

Dec, 2016 Posts

Nov, 2016 Posts

Oct, 2016 Posts

Sep, 2016 Posts

Aug, 2016 Posts

Jun, 2016 Posts

May, 2016 Posts

Apr, 2016 Posts

2015 Posts

Nov, 2015 Posts

Oct, 2015 Posts

Jun, 2015 Posts

May, 2015 Posts

Apr, 2015 Posts

Mar, 2015 Posts

2014 Posts

Dec, 2014 Posts

Oct, 2014 Posts

Sep, 2014 Posts

Aug, 2014 Posts

Jul, 2014 Posts

Jun, 2014 Posts

May, 2014 Posts

Apr, 2014 Posts

Mar, 2014 Posts

Feb, 2014 Posts

2013 Posts

Dec, 2013 Posts

Nov, 2013 Posts

Oct, 2013 Posts

Jul, 2013 Posts

Apr, 2013 Posts

Search Queries Cloud

Cutting-Edge Single-Entry Scalper: What Traders Should Know Now

Which Trading Strategies Give You the Edge in 2026 — Practical Guide for Traders

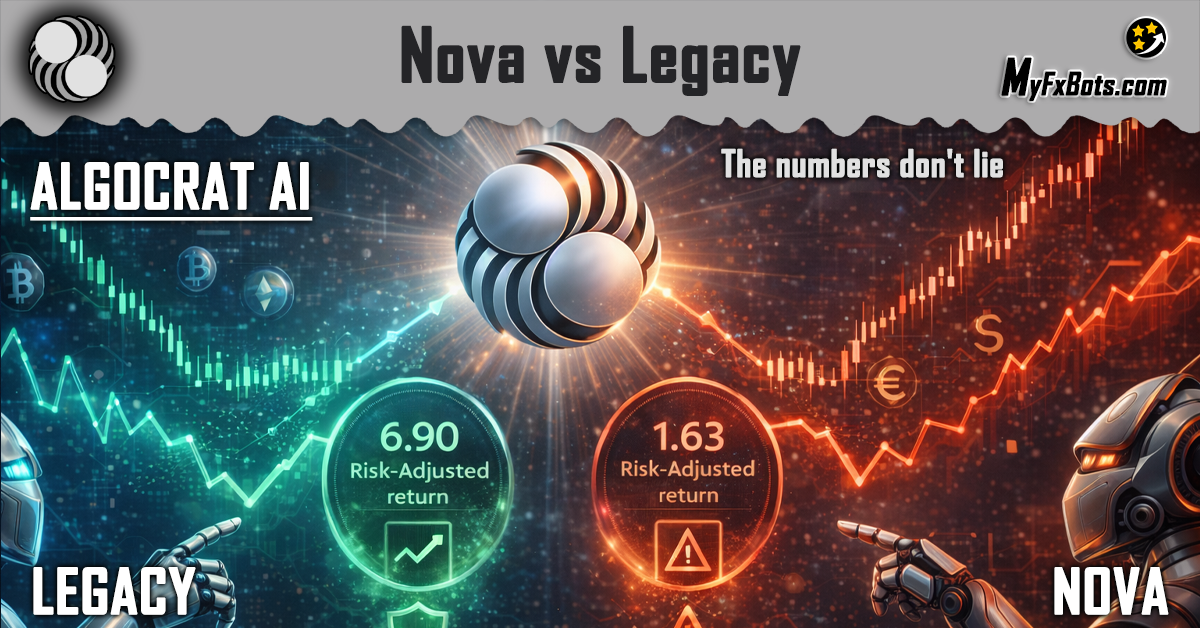

Nova vs Legacy: Risk‑Adjusted Returns That Matter

AI in Automated Trading: Practical Uses, Limits, and What Traders Should Know

Trading During Market Crashes: Why Smart Systems Sometimes Stay Out

MT Terminal Update: Why Your Expert Advisors Need This Patch

Top Risks and Safe Steps for “Poverty Scalper Robot” Traders

Adaptive Multi‑Algorithm Crypto & Forex Portfolio: Live Results and How to Access

Deep Backtest Review: High‑Risk AUDCAD Grid Results and Live Trading Guide

Why Security Certifications Matter for Forex Traders: ISO, CSA STAR & SOC 2 Explained

High-Risk Gold Expert Advisor Backtest Analysis: XAUUSD 2010–2023 Results & Real Trading Insights

Gold Volatility Strategy: How Traders Captured $20K in Early 2026

Early Access for a Next‑Gen Automated Trading Expert

GOLD Scalper PRO v2.0 Review: Two Systems, Massive Performance Leap

Gold Scalper to Watch: Deep Live Performance Audit of a Top M30 XAUUSD System

Dark Nova 2025 Live Performance Review and Deployment Checklist

Waka Waka EA Performance Review: Gains, Drawdown, and Live Deployment Checklist

SlingShot Live Performance Review: Month‑by‑Month Analysis, Time‑of‑Day Edge, and Deployment Checklist

Latest Articles, News & Updates On All Forex Robots, Brokers, & VPS

Welcome to the heart of trading insights and strategies at MyFxBots! 🌟 Dive into a treasure trove of updates, exclusive promotions, and in-depth analyses tailored to elevate your trading journey. Whether you're exploring the latest in Metatrader expert advisors, discovering valuable bonuses from top Forex brokers, or finding the best Forex VPS provider deals, our blog is your ultimate resource. Stay ahead of the curve with our technical analyses, Forex trading strategies, and motivational posts designed for both newbies and seasoned traders. Let's embark on this exciting journey together and unlock the full potential of Forex trading! 🚀

Posted On:

Sun, 1 Mar 2026

An independent reviewer summarizes the latest release of a single-entry scalping Expert Advisor and what active traders need to know: core strategies, risk controls, installation steps, membership terms, and how to request files. The review highlights backtest history, trade rules (no grid, no martingale, SL on every trade), and practical setup tips for live accounts and demo testing. Links to vendor resources are preserved for direct access.

Posted On:

Fri, 27 Feb 2026

Trading strategies shape consistent results in modern markets. A clear plan reduces emotion, defines entries and exits, and protects capital. "Trading strategies are the backbone of successful market participation."

This concise guide reviews the 15 top strategies for 2026, explains ideal market conditions, key tools, and practical steps to match a strategy to your style.

Posted On:

Thurs, 26 Feb 2026

Algocrat AI recently compared two live MT5 portfolios hosted on IC Markets: Legacy and Nova. Short bursts can mislead—longer windows reveal true behavior. This concise review highlights CAGR, drawdown, and risk‑adjusted ratios so traders and portfolio watchers can judge which portfolio better fits different market regimes.

Posted On:

Mon, 23 Feb 2026

Valery Trading’s recent note asks a familiar question: are we really using AI for trading? This expert reviewer summarizes how large language models (LLMs) and neural nets are applied inside modern Expert Advisors, why they act mainly as filters rather than autonomous traders, and what practical precautions traders should take when testing AI-enhanced EAs. Also includes links to industry commentary and product references. IC Markets

Posted On:

Tues, 17 Feb 2026

Recent market turbulence has raised a critical question among traders: should automated systems trade during extreme volatility? A closer look at recent events reveals why disciplined strategies sometimes choose patience over action.

Posted On:

Fri, 6 Feb 2026

Valery Trading released a compatibility update after MetaQuotes changed terminal pixel fonts, affecting many Expert Advisors. The update also fixes a rare neural-net bug in Golden Pickaxe, plus minor improvements. This guide explains what changed, why it matters for your trading robots, and step-by-step update options for ValeryVPS and self-hosted setups.

Posted On:

Thurs, 5 Feb 2026

A concise expert review explains what the Poverty Scalper Robot is, how it’s commonly distributed via TikTok/WhatsApp, and why traders should demand verified backtests, transparent logic, and regulated brokers. Safer alternatives include Happy Gold, Golden Pickaxe, Gold Miner, Dark Nova, Waka Waka; broker bonus summary via IC Markets.

Posted On:

Thurs, 22 Jan 2026

Algocrat AI released a new adaptive trading portfolio that combines multiple algorithmic systems into one structure and is available for immediate automated connection from the user dashboard. This review summarizes live performance, risk metrics, and practical access steps for traders and portfolio managers.

Posted On:

Sat, 17 Jan 2026

This independent review analyzes a long MetaTrader backtest published by Valery Trading for the EA tested on AUDCAD (2010–2024). We summarize key metrics, explain the grid + ML filter strategy, recommend brokers, and list practical steps to test and run Perceptrader AI in real accounts.

Posted On:

Thurs, 15 Jan 2026

Independent security certifications are a practical signal for traders choosing a broker. Pepperstone recently announced ISO 27001:2022, CSA STAR Level 1 & 2, and SOC 2 Type 1 verifications — a combination that strengthens data protection, cloud transparency and internal controls. This short expert review explains what each certification means for your trades, accounts and automated systems like Expert Advisors.

Posted On:

Wed, 14 Jan 2026

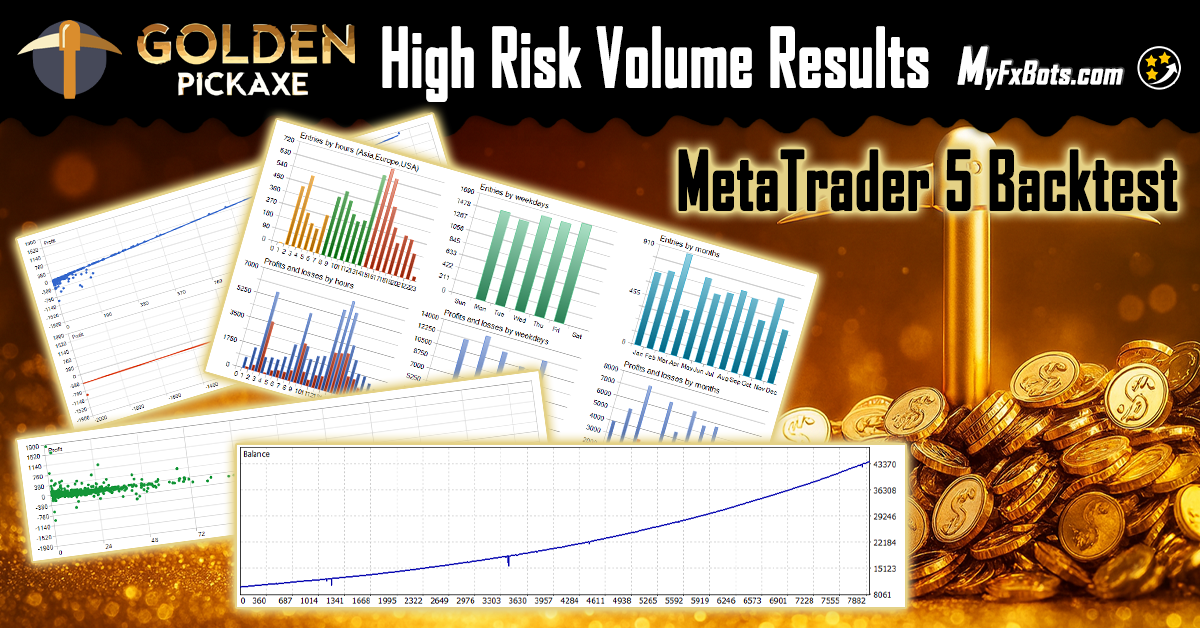

Golden Pickaxe has been tested on XAUUSD from 2010 to 2023 under risky volume presets with variable spread and slippage. This review explores its backtest results, trading logic, real-money expectations, broker recommendations, and risk precautions to help traders make informed decisions.

Posted On:

Tues, 13 Jan 2026

Global instability has pushed gold into extreme volatility, creating rapid profit opportunities for volatility-first systems. This expert review examines how a dedicated gold scalper captures swings, summarizes recent verified performance, and outlines practical steps for traders considering automated systems and broker bonuses.

Posted On:

Tues, 13 Jan 2026

The new Algocrat AI dashboard has launched Nova early access, enabling a first cohort to connect new accounts or migrate from Legacy instantly. This controlled rollout emphasizes execution quality, transparency, and live risk tuning, while teams monitor behavior across brokers and collect tester feedback.

Posted On:

Thurs, 8 Jan 2026

Gold Scalper PRO v2.0 is a major update that refines the core System 1 and adds a pending-order System 2. Backtests show higher trade frequency, stronger profitability, and a new Drawdown Protection System suitable for funded and Prop Firm accounts. This concise expert review highlights performance, safety, setup tips, and what traders should verify before deploying the EA.

Posted On:

Wed, 7 Jan 2026

An independent audit of Happy Gold live Myfxbook results published by Happy Forex, summarizing monthly performance, extracting a time‑of‑day edge, and offering a concise checklist for safe live deployment. This review uses verified live metrics to assess robustness and practical readiness.

Posted On:

Fri, 2 Jan 2026

This independent review examines the Myfxbook statement for Dark Nova published by DARKEAS, summarizing monthly returns, risk metrics and practical deployment steps. The analysis highlights monthly gains, trade statistics and a time‑of‑day inference to help traders decide on live deployment with a conservative risk plan.

Posted On:

Thurs, 1 Jan 2026

This independent review examines the Myfxbook statement for Waka Waka, published by Valery Trading. We break down month‑by‑month performance, extract a time‑of‑day edge, and provide a concise checklist for safe live deployment, plus practical risk notes for traders and prop‑firm applicants.

Posted On:

Tues, 30 Dec 2025

The MyFxBook statement published by LeapFX Trading Academy gives a transparent snapshot of the live trading behavior of the SlingShot Expert Advisor. This concise review extracts month‑by‑month performance signals, identifies a time‑of‑day edge from trade duration and activity, and closes with a short checklist for safe live deployment on brokers such as IC Markets.

Posted On:

Mon, 29 Dec 2025

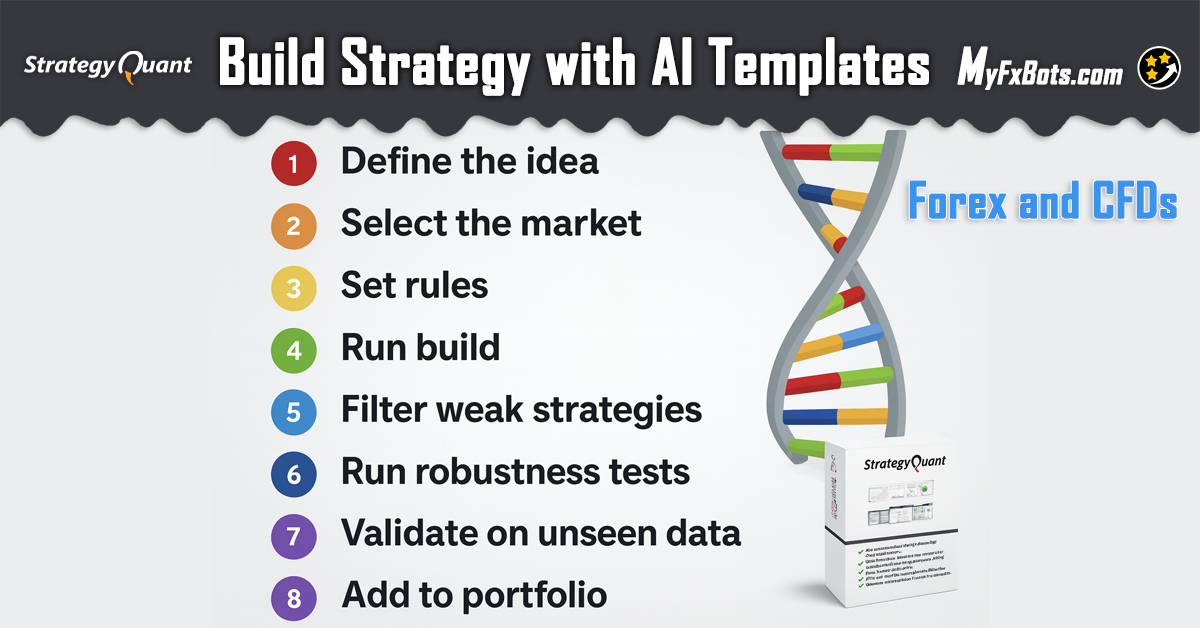

Building a reliable algo trading strategy doesn’t require luck — it requires structure. Using StrategyQuant X, traders can follow a clear workflow to design, test, and validate strategies across multiple markets. This tutorial explains how to choose markets, set up automated workflows, and run your first build, whether you trade via IC Markets or any other broker.

Posted On:

Sun, 28 Dec 2025

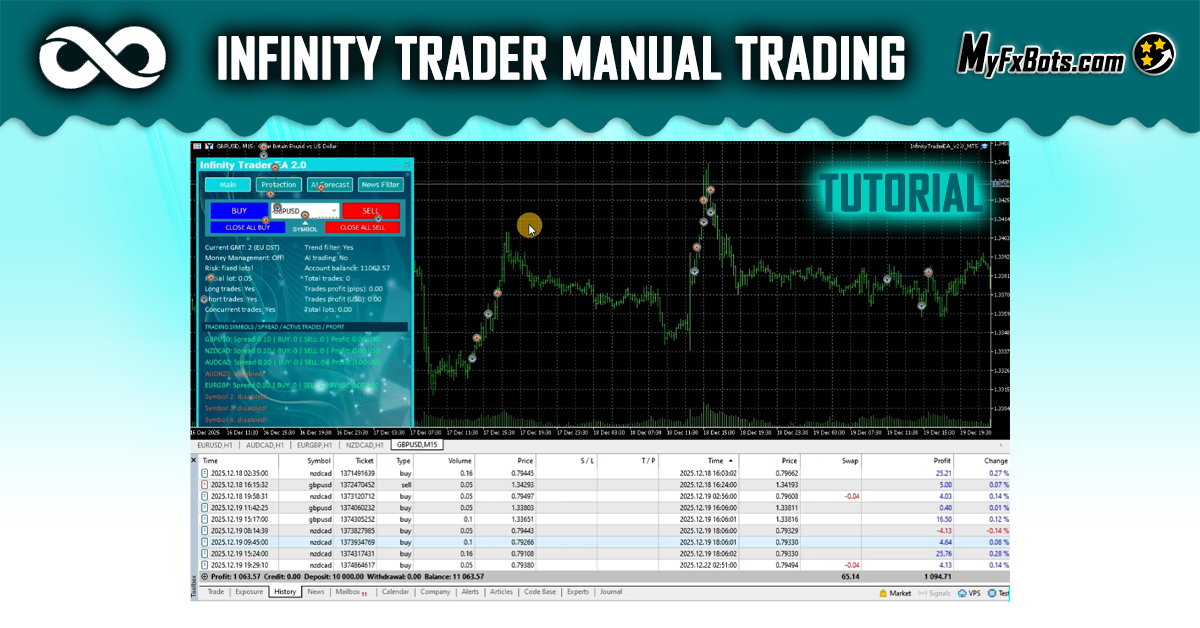

This tutorial explores how traders can use Infinity Trader in manual‑trading mode to achieve consistent results over four months. Based on insights shared by FXAutomater, the walkthrough highlights practical setups, workflow tips, and a compliant summary of the deposit bonus offered by IC Markets.

Loading more Posts...

End of Posts!

No more Posts to load!End of Posts!

No more Posts to load!Tags

Tickmill

FXAutomater

WallStreet Forex Robot 3.0 Domination

Tick Data Suite

FBS

Forex Diamond

Volatility Factor Pro

HF Markets

RoboForex

XM

InstaForex

Alpari

GPS Forex Robot

Forex Combo System

Forex Trend Detector

GrandCapital

Automated Forex Tools

AMarkets

IronFX

Telegram Signal Copier

SMRT Algo

Omega Trend

Broker Arbitrage

Quant Analyzer

Binance

Forex Trend Hunter

FXVM

TradingFX VPS

FxPro

AlgoWizard

ACY Securities

RayBOT

Forex Gold Investor

ForexSignals.com

Libertex

Quant Data Manager

FX Choice

Commercial Network Services

FXCharger

News Scope EA PRO

Smart Scalper PRO

LeapFX Trading Academy

ForexTime

Pump Trader Robot

BlackBull Markets

FX-Builder

WallStreet Recovery PRO

Vortex Trader PRO

StarTrader

Forex VPS

MTeletool

Swing Trader PRO

Telegram Copier

Forex Robot Academy

VPS Forex Trader

Forex Robot Factory (Expert Advisor Generator)

QHoster

ByBit

Best Free Scalper Pro

Database Mart

FX Secret Club

DARKEAS

Quant Tekel Funded

Evening Scalper PRO

Happy Bitcoin

Magnetic Exchange

Trend Matrix EA

Gold Breaker

EGPForex

Risk

Forex trading can involve the risk of loss beyond your initial deposit. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary.

Forex accounts typically offer various degrees of leverage and their elevated profit potential is counterbalanced by an equally high level of risk. You should never risk more than you are prepared to lose and you should carefully take into consideration your trading experience.

Past performance and simulated results are not necessarily indicative of future performance. All the content on this site represents the sole opinion of the author and does not constitute an express recommendation to purchase any of the products described in its pages.

2013 - 2026©

MyFxBots.

Cookies help us deliver our services! By using our services you agree to our use of cookies! Learn More