Menu

Featured Solutions

Forex Brokers

Forex VPS Services

Forex Robots

Forex Service Providers

Currency Exchange Companies

Payment Processors

MyFxBots Forex Blog

2025 Posts

Dec, 2025 Posts

Nov, 2025 Posts

Oct, 2025 Posts

Aug, 2025 Posts

Jun, 2025 Posts

May, 2025 Posts

Apr, 2025 Posts

Mar, 2025 Posts

Jan, 2025 Posts

2024 Posts

Dec, 2024 Posts

Nov, 2024 Posts

Oct, 2024 Posts

Jun, 2024 Posts

Apr, 2024 Posts

Mar, 2024 Posts

Feb, 2024 Posts

Jan, 2024 Posts

2023 Posts

Dec, 2023 Posts

Nov, 2023 Posts

Oct, 2023 Posts

Sep, 2023 Posts

Aug, 2023 Posts

Jul, 2023 Posts

Jun, 2023 Posts

May, 2023 Posts

Apr, 2023 Posts

Mar, 2023 Posts

Feb, 2023 Posts

2022 Posts

Dec, 2022 Posts

Nov, 2022 Posts

Oct, 2022 Posts

Sep, 2022 Posts

Jul, 2022 Posts

Jun, 2022 Posts

May, 2022 Posts

Apr, 2022 Posts

Mar, 2022 Posts

Feb, 2022 Posts

Jan, 2022 Posts

2021 Posts

Dec, 2021 Posts

Oct, 2021 Posts

Sep, 2021 Posts

Aug, 2021 Posts

Jul, 2021 Posts

Jun, 2021 Posts

May, 2021 Posts

Mar, 2021 Posts

Feb, 2021 Posts

Jan, 2021 Posts

2020 Posts

Dec, 2020 Posts

Nov, 2020 Posts

Oct, 2020 Posts

Sep, 2020 Posts

Aug, 2020 Posts

Jul, 2020 Posts

2019 Posts

Dec, 2019 Posts

Nov, 2019 Posts

Jul, 2019 Posts

Jun, 2019 Posts

May, 2019 Posts

Apr, 2019 Posts

2018 Posts

Nov, 2018 Posts

Jun, 2018 Posts

Mar, 2018 Posts

Feb, 2018 Posts

Jan, 2018 Posts

2017 Posts

Dec, 2017 Posts

Nov, 2017 Posts

Sep, 2017 Posts

Aug, 2017 Posts

Apr, 2017 Posts

Mar, 2017 Posts

Jan, 2017 Posts

2016 Posts

Dec, 2016 Posts

Nov, 2016 Posts

Oct, 2016 Posts

Sep, 2016 Posts

Aug, 2016 Posts

Jun, 2016 Posts

May, 2016 Posts

Apr, 2016 Posts

2015 Posts

Nov, 2015 Posts

Oct, 2015 Posts

Jun, 2015 Posts

May, 2015 Posts

Apr, 2015 Posts

Mar, 2015 Posts

2014 Posts

Dec, 2014 Posts

Oct, 2014 Posts

Sep, 2014 Posts

Aug, 2014 Posts

Jul, 2014 Posts

Jun, 2014 Posts

May, 2014 Posts

Apr, 2014 Posts

Mar, 2014 Posts

Feb, 2014 Posts

2013 Posts

Dec, 2013 Posts

Nov, 2013 Posts

Oct, 2013 Posts

Jul, 2013 Posts

Apr, 2013 Posts

Search Queries Cloud

How to Build Reliable Algo Trading Strategies Using AI Templates and Workflow Automation

Mastering Manual Trading with Infinity Trader: A Practical 4‑Month Performance Tutorial

Perceptrader AI: Modern AI Grid EA for Consistent Forex Automation

Smart Risk Control: NoConcurrentTrades Added in WallStreet Recovery PRO v1.8

Christmas Algo Trading Boost: Build Robust EAs Fast

Forex Diamond EA v6.7 Update: MT5 Visibility Fixes and Holiday Offers

Trend‑Focused Forex Robot: 10‑Year Verified Automated Trading

Deposit Bonus Explained: How to Maximize Trading Credit and Manage Risk

Holiday Trading Edge: Top EA Deals and a Free Bonus This Christmas

Nova Portfolio: Limited Spots for a New Automated Trading Edge

When Streaks Defy Chance: Reassessing a 29‑Quarter Run

Why Algorithmic Trading Wins: How Waka Waka Proved Longevity

Nova vs Legacy: How the New Portfolio Access Works for Traders

Waka Waka Review 2025: Why This Grid Expert Advisor Still Leads

Rebuilt Scalping EA: What Traders Should Know About the New Generation

3 Practical Steps to Reach Any Trading Goal

Black Friday 2025: Major Algo‑Trading Discounts, +50% AI Credits, and Faster Strategy Building

Volatility-First Gold Scalper Hits New Peak

The EA developers team is 12 industrial experts from New York City; a union of long-practiced Forex traders and software developers, started working together in 1998 and began developing Manhattan FX robot in 2008.

Trading Idea

Manhattan FX is a breakout based Forex robot without any martingale, arbitrage or grid strategies involvement.

Specifications

License

The Basic Version is Licensed to 1 Account to Trade on EURUSD only, The Ultimate Version is Licensed for 1 Account to Trade on Both EURUSD and GBPUSD while the 2-License Version is Licensed for 2 Accounts to Trade on Both EURUSD and GBPUSD too.

Compatible Brokers

- Any Broker as Long as it Meets the Following Requirements:

- Raw Spreads and Commission (ECN/STP Accounts).

- 5 Digits Price Feed.

- Large Leverage (1:100 Minimum).

Tickmill, and IC Markets Forex Brokers are recommended!

Broker / VPS

Tickmill ECN-Pro Account With TradingFX VPS are the Recommended Broker Account / VPS Combination.

Initial Deposit

No Restrictions on Minimum Account Balance.

Support

Email Support via a Dedicated Support Team 24/7.

Updates

Free Lifetime Updates.

Supported Currency Pairs

EURUSD only for the Basic Version and EURUSD, GBPUSD for the Ultimate and 2-License Versions.

MetaTrader Chart Timeframe

M1

Verified Live Trading Results

Demo Account

Started On

2016/04/22 (GMT)

Leverage

1:500

Broker

Tickmill

Starting Balance

$500.00

Total Gain

+323,911.4%

Live Test Summary

Started On

2016/04/22 (GMT)

Account Leverage

1:500

Profit Factor

2.22

Total Gain

+323,911.4%

Absolute Gain

323,911.43%

Monthly Gain

+51.9%

Daily Gain

2.01%

Total Pips

2,542.5

Total Trades

1771

Profit Amount

+1,619,557.14

(%) Won Trades

2,542.5

Drawdown

-11.6%

Backtests

Backtests Settings

Symbol

EURUSD (Euro vs US Dollar)

Period

1 Minute (M1) 2009.12.31 23:00 - 2016.04.08 22:59 (2014.01.04 - 2016.04.08)

Model

Every tick (the most precise method based on all available least timeframes)

Parameters

Serial="f9dade0470d0ab7e77e0b581ee7e0a9278d493a9"; MagicNumber=212646; Comment_="MANHATTAN EU"; Buy_Enabled=true; Sell_Enabled=true; UseMoneyManagement=true; Lots=1; Risk_Long_Expl="Maximum loss in % on each long trade. Number between 1 and 5."; Risk_Long=5; Risk_Short_Expl="Maximum loss in % on each short trade. Number between 1 and 5."; Risk_Short=5; MaxLot=1000; BalanceRisk_Expl="Maximal Drawdown in %. EA stops trading if it is reached"; BalanceRisk=40;

Bars in test

2319639

Ticks modelled

81592553

Modelling quality

99.00%

Initial Deposit

$1000.00

Spread

Backtests Results

Total net profit

5194945.17

Gross profit

8885323.76

Gross loss

-3690378.59

Profit factor

2.41

Expected payoff

3181.23

Absolute Bal DD

16.50

Maximal Bal DD

251207.57 (11.95%)

Relative Bal DD

11.95% (251207.57)

Total Trades

1633

Short positions

642 (52.18%)

Long positions

991 (51.46%)

Profit trades

845 (51.75%)

Loss trades

788 (48.25%)

Largest Profit trade

347000.00

Largest Loss trade

-64000.00

Average Profit trade

10515.18

Average Loss trade

-4683.22

Maximum consecutive wins (profit in money)

17 (85917.06)

Maximum consecutive losses (loss in money)

12 (-304.32)

Maximal consecutive profit (count of wins)

759000.00 (6)

Maximal consecutive loss (count of losses)

-166778.83 (7)

Avarage consecutive wins

2

Avarage consecutive losses

2

Backtests Settings

Symbol

GBPUSD (Great Britain Pound vs US Dollar)

Period

1 Minute (M1) 2009.12.31 23:00 - 2016.04.08 22:59 (2014.01.04 - 2016.04.08)

Model

Every tick (the most precise method based on all available least timeframes)

Parameters

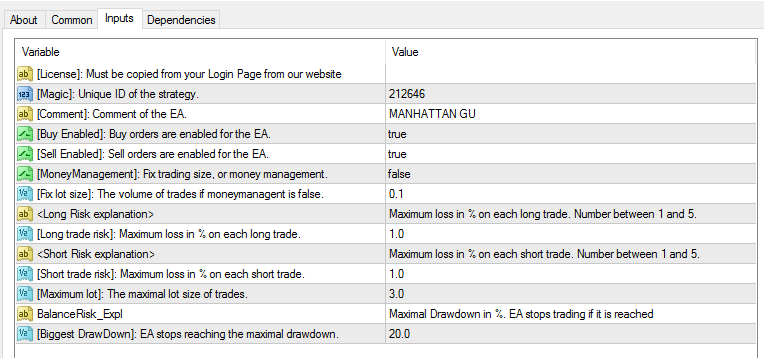

Serial_Number="f9dade0470d0ab7e77e0b581ee7e0a9278d493a9"; MagicNumber=212646; Comment_="MANHATTAN GU"; Buy_Enabled=true; Sell_Enabled=true; UseMoneyManagement=true; Lots=1; Risk_Long_Expl="Maximum loss in % on each long trade. Number between 1 and 5."; Risk_Long=5; Risk_Short_Expl="Maximum loss in % on each short trade. Number between 1 and 5."; Risk_Short=5; MaxLot=1000; BalanceRisk_Expl="Maximal Drawdown in %. EA stops trading if it is reached"; BalanceRisk=40;

Bars in test

2319441

Ticks modelled

68666761

Modelling quality

99.00%

Initial Deposit

$1000.00

Spread

Backtests Results

Total net profit

187618.62

Gross profit

352830.91

Gross loss

-165212.29

Profit factor

2.14

Expected payoff

293.15

Absolute Bal DD

17.42

Maximal Bal DD

17078.68 (15.64%)

Relative Bal DD

18.12% (10813.02)

Total Trades

640

Short positions

334 (51.20%)

Long positions

306 (56.21%)

Profit trades

343 (53.59%)

Loss trades

297 (46.41%)

Largest Profit trade

17417.62

Largest Loss trade

-4065.12

Average Profit trade

1028.66

Average Loss trade

-556.27

Maximum consecutive wins (profit in money)

8 (6695.53)

Maximum consecutive losses (loss in money)

7 (-4960.52)

Maximal consecutive profit (count of wins)

23963.14 (5)

Maximal consecutive loss (count of losses)

-7728.08 (4)

Avarage consecutive wins

2

Avarage consecutive losses

2

Backtests Settings

Symbol

EURUSD (Euro vs US Dollar)

Period

1 Minute (M1) 2009.12.31 23:00 - 2016.04.08 22:59 (2010.01.04 - 2016.04.08)

Model

Every tick (the most precise method based on all available least timeframes)

Parameters

Serial="f9dada0470d0ab7e77e0b581ee7e0a9278d493a9"; MagicNumber=212646; Comment_="MANHATTAN EU"; Buy_Enabled=true; Sell_Enabled=true; UseMoneyManagement=false; Lots=1; Risk_Long_Expl="Maximum loss in % on each long trade. Number between 1 and 5."; Risk_Long=1; Risk_Short_Expl="Maximum loss in % on each short trade. Number between 1 and 5."; Risk_Short=1; MaxLot=1000; BalanceRisk_Expl="Maximal Drawdown in %. EA stops trading if it is reached"; BalanceRisk=30;

Bars in test

2319639

Ticks modelled

81592553

Modelling quality

99.00%

Initial Deposit

$2000.00

Spread

Backtests Results

Total net profit

53929.93

Gross profit

92051.11

Gross loss

-38121.19

Profit factor

2.41

Expected payoff

11.74

Absolute Bal DD

56.00

Maximal Bal DD

552.18 (15.92%)

Relative Bal DD

15.92% (552.18)

Total Trades

4593

Short positions

1661 (51.54%)

Long positions

2932 (53.72%)

Profit trades

2431 (52.93%)

Loss trades

2162 (47.07%)

Largest Profit trade

873.00

Largest Loss trade

-64.00

Average Profit trade

37.87

Average Loss trade

-17.63

Maximum consecutive wins (profit in money)

17 (742.60)

Maximum consecutive losses (loss in money)

12 (-222.25)

Maximal consecutive profit (count of wins)

985.20 (14)

Maximal consecutive loss (count of losses)

-322.75 (10)

Avarage consecutive wins

2

Avarage consecutive losses

2

Trading Strategy

General Trading Features

As a breakout based Forex robot, Manhattan FX always sets a StopLoss for every trade to protect the account, in addition to its clever Money Management system that carefully determines trading opportunities and the suitable lot size for each of them.

Trading Limits

Manhattan FX Trading is limited to 10 lots (1000,000 units) in the 2-License version and 5 lots (500,000 units) in the other 2 versions, this is useful for disallowing unnecessary high positions and is considered a good safety measure.

High Spread Filter

By default, Manhattan FX this built in system forces the robot to cease trading during spreads widening as during summer and before news. This can be stopped manually if not desired.

Important Parameters

Buy Enabled: This option can enable / disable BUY orders excution.

Sell Enabled: This option can enable / disable SELL orders excution.

MoneyManagement: This is a switch between automated money managerment (if set to true) or manually setting a fixed trading lot size (if set to false).

Fix Lot Size: If MoneyManagement is set to false, here you can set the desired trading lot size manually.

Long trade risk: This is a percentage (%) value to set the maximum loss for every Long (BUY) trade.

Short trade risk: This is a percentage (%) value to set the maximum loss for every Short (SELL) trade.

** Please note that Long trade risk and Short trade risk refer to only ONE trade.

Maximum lot: This option determines the maximum lot size of the trades.

Balance Risk: This is the highest allowed drawdown as a percentage of the account balance, which if reached, Manhattan FX will stop trading to protect your account.

Ng Kok Wee

Mon, 27 Jun 2016

May I know does your EA any money back guarantee? Does it be able to cover for all market condition? How reliable for long run? Any technical support if I am facing any problem?

Thank you!

MyFxBots Admin

Thurs, 2 Aug 2018

You can read Manhattan Agreement Click2Sell, it's explaining the info you requested in details!

Dace Lim

Mon, 27 Jun 2016

May I know does your EA any money back guarantee?

MyFxBots Admin

Thurs, 2 Aug 2018

You can read Manhattan Agreement Click2Sell, it's explaining the money back guarantee organized by Click2Sell in details!

Tags

Valery Trading

Tickmill

FXAutomater

Algocrat AI

WallStreet Forex Robot 3.0 Domination

Tick Data Suite

FBS

IC Markets

Waka Waka

Perceptrader AI

Forex Diamond

RoboForex

HF Markets

XM

StrategyQuant X

Volatility Factor Pro

InstaForex

Alpari

GPS Forex Robot

Forex Combo System

FX Scalper

GrandCapital

Forex Trend Detector

IronFX

AMarkets

Telegram Signal Copier

Golden Pickaxe

Broker Arbitrage

SMRT Algo

Omega Trend

Quant Analyzer

FXVM

Binance

TradingFX VPS

ACY Securities

Forex Gold Investor

AlgoWizard

Gold Miner

RayBOT

FxPro

ForexSignals.com

Infinity Trader

Libertex

Smart Scalper PRO

Pump Trader Robot

LeapFX Trading Academy

FXCharger

Quant Data Manager

ForexTime

WallStreet Recovery PRO

FX Choice

BlackBull Markets

FX-Builder

Gold Scalper PRO

News Scope EA PRO

Commercial Network Services

VPS Forex Trader

Happy Forex

ByBit

QHoster

StarTrader

Database Mart

Swing Trader PRO

Forex VPS

DARKEAS

Evening Scalper PRO

Gold Breaker

Magnetic Exchange

MTeletool

Quant Tekel Funded

Telegram Copier

Vortex Trader PRO

Best Free Scalper Pro

FX Secret Club

Forex Robot Academy

Happy Bitcoin

Forex Robot Factory (Expert Advisor Generator)

Trend Matrix EA

EGPForex

Risk

Forex trading can involve the risk of loss beyond your initial deposit. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary.

Forex accounts typically offer various degrees of leverage and their elevated profit potential is counterbalanced by an equally high level of risk. You should never risk more than you are prepared to lose and you should carefully take into consideration your trading experience.

Past performance and simulated results are not necessarily indicative of future performance. All the content on this site represents the sole opinion of the author and does not constitute an express recommendation to purchase any of the products described in its pages.

2013 - 2025©

MyFxBots.

Cookies help us deliver our services! By using our services you agree to our use of cookies! Learn More