Menu

I think being devoid of the widely known FAPTurbo Forex robot review, this website would be incomplete.

Statistics indicate that more than 43000 copies has been sold of it, together with FAPTurbo Evolution, the one that runs on the Dukascopy JForex platform, it's surely the most sold Forex robot by far. If this is not just some marketing bullshit released to the press, as it could be, the money the Forex robot authors has made selling it, has exceeded what they could ever hope to gain trading Forex; 43000 times 149 US dollars - the Forex robot price - equals over 6.4 million US dollars. If this figure was doubtful, the sure thing that a great deal of it should have arrived to the author's account. This Forex robot has - at least until now - a unique claimed performance, it's so impressive, and it's programmatically a very powerful core for other programmers and scams that counterfeit Forex robots authors. Simply, FAP is just the ideal Forex Auto Pilot.

Since the prime EA was released, it took the authors about 5 years equipping and refining the EA to release the next generation FAPTurbo 2.0 and more than 3 years to release further improvement to release FAPTurbo 3.0, a total of 8 years of hard work on the EA, now it doesn't only trade traditional Forex currency pairs - it already trades 8 pairs of them - but also trades Bitcoin, the world talk novel electronic money!

Bitcoin has a so powerful upwards trend and FAPTurbo 3.0 enables you now to trade it through your brokerage!

Yes, Bitcoin on MT4!

Trading Idea

The old-style of FAPTurbo works as an Asian session scalper including a long-term advanced strategy trading around the clock on EURUSD with high SL & TP targets.

Starting from FAPTurbo 2.0 and of course FAPTurbo 3.0 the EA could trade 8 different pairs with an extremely high trades frequency in addition to the crypto-currency Bitcoin, the electronic money that is making news.

Starting from FAPTurbo 2.0 and of course FAPTurbo 3.0 the EA could trade 8 different pairs with an extremely high trades frequency in addition to the crypto-currency Bitcoin, the electronic money that is making news.

Specifications

NFA compliance

Yes (with the Long Term Advanced Strategy Disabled).

License

1 License for 2 Different Live Accounts.

Guidance & Help

Personal email premium support, cool bunch of video tutorials and a perfect step-by-step FAPTurbo guide! so you won't have any problem.

Refund Policy

60 Days Unconditional Money-Back Guarantee by the EA Vendor.

Note

As Stated by its Authors, FAPTurbo is a Verified PATENTED Technology.

Supported Currency Pairs

7 Different Pairs (EURUSD, EURGBP, EURCHF, GBPCHF, USDCHF, GBPUSD, USDCAD) + BITCOIN

MetaTrader Chart Timeframe

M15 for Bitcoin trading and H1 for Multi-currency trading.

Website

Full of marketing tricks like "threats" to raise the price after selling a certain amount of copies, or affirmations like "special launch price". Videos, testimonials, and bizarre font; it looks like a trap for the junior Forex traders that easily get impressed by expressions like "gain money while drinking coffee" and "solution to live happily for ever".

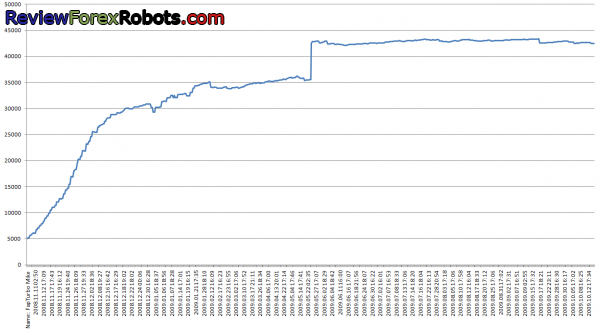

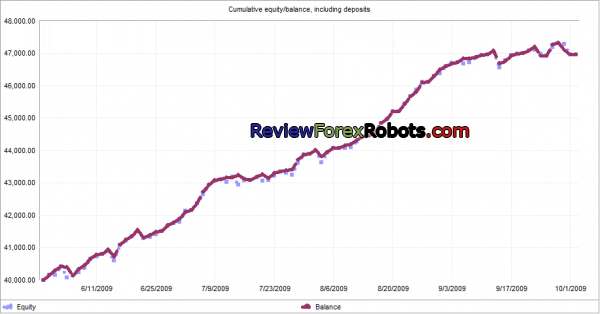

There is a link to a real account statement that looks somehow real. It's announced there that the this account started at $5000, and now it became $42000. By doing some inspection; pasting the data into an XLS file and creating a graph - shown below - we could find that the account really touched the $31000 between 6/11/2008 and 31/12/2008, followed by very few profits, around $3000 till march of 2009, then it just relaxed until a deposit of $7000 was made on 27/5/2009, on that day the account balance was $42511, about 5 months later it was $42482. Their account statements can be browsed easily, a glancing at them revealed that one of them is running since 2005, and had a crash once since then which seems not to be FAP Turbo related, while other accounts ended with no logical reason when FAP profits started to decline or when it started to lose greatly.

Live performance

All the following statements are Forex Forex EA Lab verified.

FAPTurbo Live Update Account (Starting Balance: $5,100)

Here is a public traded real money account starting with $5,100 and now it has grown to around $36,500.

Started

Dec 24, 2010, 19:00Deposit

$5,100Balance

$469,000.44Profit

$463,900.44Gain

3,577.99%These results are updated every 15 minutes by EA Lab.

FAPTurbo 3.0 Real Account (Starting Balance: $50,000)

Started

Oct 27, 2016, 14:00Deposit

$50,000Balance

$52,288.79Profit

$2,288.79Gain

4.58%FAPTurbo 3.0 Multicurrency Trading (Starting Balance: $10,000)

FAPTurbo 2.0 Multicurrency Trading (Starting Balance: $10,000)

FAPTurbo 2.0 Bitcoin Trading (Starting Balance: $10,000)

Real Money Account

Started On

May 17, 2011

Leverage

1:200

Broker

FIBO Group (Cyprus)

Starting Balance

$$3K

Total Gain

+104.03%

Live Test Summary

Started On

May 17, 2011

Account Leverage

1:200

Profit Factor

1.68

Total Gain

+104.03%

Absolute Gain

+81.6%

Monthly Gain

21.99%

Daily Gain

0.02%

Total Pips

571.0

Total Trades

505

Profit Amount

€4303.14

(%) Won Trades

571.0

Drawdown

23.83%

Real Money Account

Started On

Oct 04, 2011

Leverage

1:100

Broker

FX Choice

Starting Balance

$$50,000

Total Gain

+42.22%

Live Test Summary

Started On

Oct 04, 2011

Account Leverage

1:100

Profit Factor

1.20

Total Gain

+42.22%

Absolute Gain

+42.22%

Monthly Gain

5.65%

Daily Gain

0.01%

Total Pips

419.8

Total Trades

701

Profit Amount

$21110.08

(%) Won Trades

419.8

Drawdown

33.02%

Real Money Account

Live Test Summary

Started On

Oct 13, 2011

Account Leverage

1:100

Profit Factor

1.16

Total Gain

+13.0%

Absolute Gain

+13.0%

Monthly Gain

1.59%

Daily Gain

0.00%

Total Pips

209.3

Total Trades

409

Profit Amount

$6500.53

(%) Won Trades

209.3

Drawdown

16.56%

Backtesting

In these backtests - as noted before - the default settings were mostly applied except the GMT offset that was set to manual, 0 and the log settings too that were set to false to speed up the testing.

Backtesting result seem to be opposing the forward test results:

6/2008 - 10/2009

Backtests Settings

Symbol

EURCHF (Euro vs Swiss Franc)

Period

15 Minutes (M15) 1970.01.01 00:00 - 1970.01.01 00:00

Model

Every tick (the most precise method based on all available least timeframes)

Parameters

____Scalper___________="--- Scalper EURCHF, EURGPB, GBPCHF or USDCAD M15 ---"; UseScalperStrategy=true; Scalper_Lots=0.1; Scalper_UseMM=true; Scalper_LotsRiskReductor=5; Scalper_MaxLots=10; Scalper_UseAutoGMToffset=false; Scalper_ManualGMToffset=0; Scalper_StartWorkTimeHour=21; Scalper_StartSessionMinute=0; Scalper_EndWorkTimeHour=23; Scalper_EndSessionMinute=30; Scalper_EURGBP_TakeProfit=6; Scalper_EURGBP_StopLoss=35; Scalper_EURCHF_TakeProfit=5; Scalper_EURCHF_StopLoss=49; Scalper_GBPCHF_TakeProfit=10; Scalper_GBPCHF_StopLoss=81; Scalper_USDCAD_TakeProfit=10; Scalper_USDCAD_StopLoss=58; Scalper_StealthMode=true; Scalper_ProfitLimit=0; Scalper_LossLimit=0; Scalper_UseCustomLevels=true; Scalper_RelaxHours=0; Scalper_SimpleHeightFilter=true; Scalper_TrendFilter=true; Scalper_TradeMonday=true; Scalper_TradeFriday=false; Scalper_OneTrade=0; Scalper_OneOpenTrade=false; Scalper_ReverseTrade=0; Scalper_UseFilterMA=false; Scalper_PeriodFilterMA=100; Scalper_PriceFilterMA=0; Scalper_MethodFilterMA=0; Scalper_MaxSpread=5; Scalper_Slippage=6; Scalper_ExpertComment="TradingRobot"; Scalper_MagicNumber=12464336; ____FapTurbo__________="---------- FapTurbo EUR/USD M1 ----------"; FapTurbo_Lots=0.01; FapTurbo_LotsRiskReductor=1; FapTurbo_MaxOrders=1; FapTurbo_MaxLots=10; FapTurbo_StopTime=9; FapTurbo_aaa=35; FapTurbo_bbb=48; FapTurbo_TakeProfit=140; FapTurbo_StopLoss=500; FapTurbo_TrailingStop=0; FapTurbo_DurationInHours=0; FapTurbo_CloseAfterXmonths=1; FapTurbo_PeriodMALarge=100; FapTurbo_PeriodMASmall=30; FapTurbo_PriceMA_0_6=0; FapTurbo_TypeMA_0_3=0; FapTurbo_ShiftMALarge=3; FapTurbo_ShiftMASmall=1; FapTurbo_LookForDays=2; FapTurbo_CriticalDays=45; FapTurbo_RelaxDays=0; FapTurbo_AlterPosLotReducer=0; FapTurbo_AlterPositions=0; FapTurbo_TradeNFP=1; FapTurbo_TradeFriday=1; FapTurbo_Prudent=0; FapTurbo_SymAlligatorOnCritica=1; FapTurbo_FixedDirection=1; FapTurbo_ClsLsrOnMrktChnge=0; FapTurbo_AlwaysTrade=0; FapTurbo_LowLot=0.1; FapTurbo_TooGoodToBeTrue=50; FapTurbo_PrudentPeriod=30; FapTurbo_StartWorkTimeHour=0; FapTurbo_StartWorkTimeMin=0; FapTurbo_EndWorkTimeHour=0; FapTurbo_EndWorkTimeMin=0; FapTurbo_OneTrade=0; FapTurbo_SpanGator=0.5; FapTurbo_SlipPage=3; FapTurbo_ExpertComment="FapTurboEA"; FapTurbo_MagicNumber=12464337; ____Other_Parameters__="-----------------------------------------"; TradeMicroLots=true; SendEmail=false; SoundAlert=false; SoundFileAtOpen="alert.wav"; SoundFileAtClose="alert.wav"; ColorBuy=Blue; ColorSell=Red; WriteLog=true; WriteDebugLog=false; PrintLogOnChart=true; KEY="012345";

Bars in test

62143

Ticks modelled

23085569

Modelling quality

99.00%

Initial Deposit

$10000.00

Spread

Backtests Results

Total net profit

6349.60

Gross profit

10383.36

Gross loss

-4033.76

Profit factor

2.57

Expected payoff

11.16

Absolute Bal DD

355.71

Maximal Bal DD

1197.24 (11.04%)

Relative Bal DD

11.04% (1197.24)

Total Trades

569

Short positions

123 (91.87%)

Long positions

446 (91.03%)

Profit trades

519 (91.21%)

Loss trades

50 (8.79%)

Largest Profit trade

50.18

Largest Loss trade

-218.38

Average Profit trade

20.01

Average Loss trade

-80.68

Maximum consecutive wins (profit in money)

85 (1931.16)

Maximum consecutive losses (loss in money)

2 (-325.21)

Maximal consecutive profit (count of wins)

1931.16 (85)

Maximal consecutive loss (count of losses)

-325.21 (2)

Avarage consecutive wins

11

Avarage consecutive losses

1

Backtests Settings

Symbol

EURGBP (Euro vs Great Britain Pound )

Period

15 Minutes (M15) 1970.01.01 00:00 - 1970.01.01 00:00

Model

Every tick (the most precise method based on all available least timeframes)

Parameters

____Scalper___________="--- Scalper EURCHF, EURGPB, GBPCHF or USDCAD M15 ---"; UseScalperStrategy=true; Scalper_Lots=0.1; Scalper_UseMM=true; Scalper_LotsRiskReductor=5; Scalper_MaxLots=10; Scalper_UseAutoGMToffset=false; Scalper_ManualGMToffset=0; Scalper_StartWorkTimeHour=21; Scalper_StartSessionMinute=0; Scalper_EndWorkTimeHour=23; Scalper_EndSessionMinute=30; Scalper_EURGBP_TakeProfit=6; Scalper_EURGBP_StopLoss=35; Scalper_EURCHF_TakeProfit=5; Scalper_EURCHF_StopLoss=49; Scalper_GBPCHF_TakeProfit=10; Scalper_GBPCHF_StopLoss=81; Scalper_USDCAD_TakeProfit=10; Scalper_USDCAD_StopLoss=58; Scalper_StealthMode=true; Scalper_ProfitLimit=0; Scalper_LossLimit=0; Scalper_UseCustomLevels=true; Scalper_RelaxHours=0; Scalper_SimpleHeightFilter=true; Scalper_TrendFilter=true; Scalper_TradeMonday=true; Scalper_TradeFriday=false; Scalper_OneTrade=0; Scalper_OneOpenTrade=false; Scalper_ReverseTrade=0; Scalper_UseFilterMA=false; Scalper_PeriodFilterMA=100; Scalper_PriceFilterMA=0; Scalper_MethodFilterMA=0; Scalper_MaxSpread=5; Scalper_Slippage=6; Scalper_ExpertComment="TradingRobot"; Scalper_MagicNumber=12464336; ____FapTurbo__________="---------- FapTurbo EUR/USD M1 ----------"; FapTurbo_Lots=0.01; FapTurbo_LotsRiskReductor=1; FapTurbo_MaxOrders=1; FapTurbo_MaxLots=10; FapTurbo_StopTime=9; FapTurbo_aaa=35; FapTurbo_bbb=48; FapTurbo_TakeProfit=140; FapTurbo_StopLoss=500; FapTurbo_TrailingStop=0; FapTurbo_DurationInHours=0; FapTurbo_CloseAfterXmonths=1; FapTurbo_PeriodMALarge=100; FapTurbo_PeriodMASmall=30; FapTurbo_PriceMA_0_6=0; FapTurbo_TypeMA_0_3=0; FapTurbo_ShiftMALarge=3; FapTurbo_ShiftMASmall=1; FapTurbo_LookForDays=2; FapTurbo_CriticalDays=45; FapTurbo_RelaxDays=0; FapTurbo_AlterPosLotReducer=0; FapTurbo_AlterPositions=0; FapTurbo_TradeNFP=1; FapTurbo_TradeFriday=1; FapTurbo_Prudent=0; FapTurbo_SymAlligatorOnCritica=1; FapTurbo_FixedDirection=1; FapTurbo_ClsLsrOnMrktChnge=0; FapTurbo_AlwaysTrade=0; FapTurbo_LowLot=0.1; FapTurbo_TooGoodToBeTrue=50; FapTurbo_PrudentPeriod=30; FapTurbo_StartWorkTimeHour=0; FapTurbo_StartWorkTimeMin=0; FapTurbo_EndWorkTimeHour=0; FapTurbo_EndWorkTimeMin=0; FapTurbo_OneTrade=0; FapTurbo_SpanGator=0.5; FapTurbo_SlipPage=3; FapTurbo_ExpertComment="FapTurboEA"; FapTurbo_MagicNumber=12464337; ____Other_Parameters__="-----------------------------------------"; TradeMicroLots=true; SendEmail=false; SoundAlert=false; SoundFileAtOpen="alert.wav"; SoundFileAtClose="alert.wav"; ColorBuy=Blue; ColorSell=Red; WriteLog=true; WriteDebugLog=false; PrintLogOnChart=true; KEY="012345";

Bars in test

62164

Ticks modelled

26716363

Modelling quality

99.00%

Initial Deposit

$10000.00

Spread

Backtests Results

Total net profit

22822.13

Gross profit

31172.17

Gross loss

-8350.05

Profit factor

3.73

Expected payoff

41.65

Absolute Bal DD

12.66

Maximal Bal DD

1137.60 (3.39%)

Relative Bal DD

5.27% (672.63)

Total Trades

548

Short positions

250 (88.00%)

Long positions

298 (92.28%)

Profit trades

495 (90.33%)

Loss trades

53 (9.67%)

Largest Profit trade

170.09

Largest Loss trade

-665.38

Average Profit trade

62.97

Average Loss trade

-157.55

Maximum consecutive wins (profit in money)

46 (2783.36)

Maximum consecutive losses (loss in money)

2 (-633.45)

Maximal consecutive profit (count of wins)

3579.82 (44)

Maximal consecutive loss (count of losses)

-665.38 (1)

Avarage consecutive wins

11

Avarage consecutive losses

1

Backtests Settings

Symbol

GBPCHF (Great Britain Pound vs Swiss Franc)

Period

15 Minutes (M15) 1970.01.01 00:00 - 1970.01.01 00:00

Model

Every tick (the most precise method based on all available least timeframes)

Parameters

____Scalper___________="--- Scalper EURCHF, EURGPB, GBPCHF or USDCAD M15 ---"; UseScalperStrategy=true; Scalper_Lots=0.1; Scalper_UseMM=true; Scalper_LotsRiskReductor=5; Scalper_MaxLots=10; Scalper_UseAutoGMToffset=false; Scalper_ManualGMToffset=0; Scalper_StartWorkTimeHour=21; Scalper_StartSessionMinute=0; Scalper_EndWorkTimeHour=23; Scalper_EndSessionMinute=30; Scalper_EURGBP_TakeProfit=6; Scalper_EURGBP_StopLoss=35; Scalper_EURCHF_TakeProfit=5; Scalper_EURCHF_StopLoss=49; Scalper_GBPCHF_TakeProfit=10; Scalper_GBPCHF_StopLoss=81; Scalper_USDCAD_TakeProfit=10; Scalper_USDCAD_StopLoss=58; Scalper_StealthMode=true; Scalper_ProfitLimit=0; Scalper_LossLimit=0; Scalper_UseCustomLevels=true; Scalper_RelaxHours=0; Scalper_SimpleHeightFilter=true; Scalper_TrendFilter=true; Scalper_TradeMonday=true; Scalper_TradeFriday=false; Scalper_OneTrade=0; Scalper_OneOpenTrade=false; Scalper_ReverseTrade=0; Scalper_UseFilterMA=false; Scalper_PeriodFilterMA=100; Scalper_PriceFilterMA=0; Scalper_MethodFilterMA=0; Scalper_MaxSpread=5; Scalper_Slippage=6; Scalper_ExpertComment="TradingRobot"; Scalper_MagicNumber=12464336; ____FapTurbo__________="---------- FapTurbo EUR/USD M1 ----------"; FapTurbo_Lots=0.01; FapTurbo_LotsRiskReductor=1; FapTurbo_MaxOrders=1; FapTurbo_MaxLots=10; FapTurbo_StopTime=9; FapTurbo_aaa=35; FapTurbo_bbb=48; FapTurbo_TakeProfit=140; FapTurbo_StopLoss=500; FapTurbo_TrailingStop=0; FapTurbo_DurationInHours=0; FapTurbo_CloseAfterXmonths=1; FapTurbo_PeriodMALarge=100; FapTurbo_PeriodMASmall=30; FapTurbo_PriceMA_0_6=0; FapTurbo_TypeMA_0_3=0; FapTurbo_ShiftMALarge=3; FapTurbo_ShiftMASmall=1; FapTurbo_LookForDays=2; FapTurbo_CriticalDays=45; FapTurbo_RelaxDays=0; FapTurbo_AlterPosLotReducer=0; FapTurbo_AlterPositions=0; FapTurbo_TradeNFP=1; FapTurbo_TradeFriday=1; FapTurbo_Prudent=0; FapTurbo_SymAlligatorOnCritica=1; FapTurbo_FixedDirection=1; FapTurbo_ClsLsrOnMrktChnge=0; FapTurbo_AlwaysTrade=0; FapTurbo_LowLot=0.1; FapTurbo_TooGoodToBeTrue=50; FapTurbo_PrudentPeriod=30; FapTurbo_StartWorkTimeHour=0; FapTurbo_StartWorkTimeMin=0; FapTurbo_EndWorkTimeHour=0; FapTurbo_EndWorkTimeMin=0; FapTurbo_OneTrade=0; FapTurbo_SpanGator=0.5; FapTurbo_SlipPage=3; FapTurbo_ExpertComment="FapTurboEA"; FapTurbo_MagicNumber=12464337; ____Other_Parameters__="-----------------------------------------"; TradeMicroLots=true; SendEmail=false; SoundAlert=false; SoundFileAtOpen="alert.wav"; SoundFileAtClose="alert.wav"; ColorBuy=Blue; ColorSell=Red; WriteLog=false; WriteDebugLog=false; PrintLogOnChart=false; KEY="012345";

Bars in test

62113

Ticks modelled

31207901

Modelling quality

99.00%

Initial Deposit

$10000.00

Spread

Backtests Results

Total net profit

29409.70

Gross profit

49579.82

Gross loss

-20170.12

Profit factor

2.46

Expected payoff

41.54

Absolute Bal DD

104.27

Maximal Bal DD

2028.69 (4.99%)

Relative Bal DD

5.70% (622.48)

Total Trades

708

Short positions

337 (94.36%)

Long positions

371 (90.84%)

Profit trades

655 (92.51%)

Loss trades

53 (7.49%)

Largest Profit trade

287.75

Largest Loss trade

-1019.86

Average Profit trade

75.69

Average Loss trade

-380.57

Maximum consecutive wins (profit in money)

66 (5523.26)

Maximum consecutive losses (loss in money)

3 (-288.18)

Maximal consecutive profit (count of wins)

5523.26 (66)

Maximal consecutive loss (count of losses)

-1062.45 (2)

Avarage consecutive wins

15

Avarage consecutive losses

1

Backtests Settings

Symbol

USDCAD (US Dollar vs Canadian Dollar)

Period

15 Minutes (M15) 1970.01.01 00:00 - 1970.01.01 00:00

Model

Every tick (the most precise method based on all available least timeframes)

Parameters

____Scalper___________="--- Scalper EURCHF, EURGPB, GBPCHF or USDCAD M15 ---"; UseScalperStrategy=true; Scalper_Lots=0.1; Scalper_UseMM=true; Scalper_LotsRiskReductor=5; Scalper_MaxLots=10; Scalper_UseAutoGMToffset=false; Scalper_ManualGMToffset=0; Scalper_StartWorkTimeHour=21; Scalper_StartSessionMinute=0; Scalper_EndWorkTimeHour=23; Scalper_EndSessionMinute=30; Scalper_EURGBP_TakeProfit=6; Scalper_EURGBP_StopLoss=35; Scalper_EURCHF_TakeProfit=5; Scalper_EURCHF_StopLoss=49; Scalper_GBPCHF_TakeProfit=10; Scalper_GBPCHF_StopLoss=81; Scalper_USDCAD_TakeProfit=10; Scalper_USDCAD_StopLoss=58; Scalper_StealthMode=true; Scalper_ProfitLimit=0; Scalper_LossLimit=0; Scalper_UseCustomLevels=true; Scalper_RelaxHours=0; Scalper_SimpleHeightFilter=true; Scalper_TrendFilter=true; Scalper_TradeMonday=true; Scalper_TradeFriday=false; Scalper_OneTrade=0; Scalper_OneOpenTrade=false; Scalper_ReverseTrade=0; Scalper_UseFilterMA=false; Scalper_PeriodFilterMA=100; Scalper_PriceFilterMA=0; Scalper_MethodFilterMA=0; Scalper_MaxSpread=5; Scalper_Slippage=6; Scalper_ExpertComment="TradingRobot"; Scalper_MagicNumber=12464336; ____FapTurbo__________="---------- FapTurbo EUR/USD M1 ----------"; FapTurbo_Lots=0.01; FapTurbo_LotsRiskReductor=1; FapTurbo_MaxOrders=1; FapTurbo_MaxLots=10; FapTurbo_StopTime=9; FapTurbo_aaa=35; FapTurbo_bbb=48; FapTurbo_TakeProfit=140; FapTurbo_StopLoss=500; FapTurbo_TrailingStop=0; FapTurbo_DurationInHours=0; FapTurbo_CloseAfterXmonths=1; FapTurbo_PeriodMALarge=100; FapTurbo_PeriodMASmall=30; FapTurbo_PriceMA_0_6=0; FapTurbo_TypeMA_0_3=0; FapTurbo_ShiftMALarge=3; FapTurbo_ShiftMASmall=1; FapTurbo_LookForDays=2; FapTurbo_CriticalDays=45; FapTurbo_RelaxDays=0; FapTurbo_AlterPosLotReducer=0; FapTurbo_AlterPositions=0; FapTurbo_TradeNFP=1; FapTurbo_TradeFriday=1; FapTurbo_Prudent=0; FapTurbo_SymAlligatorOnCritica=1; FapTurbo_FixedDirection=1; FapTurbo_ClsLsrOnMrktChnge=0; FapTurbo_AlwaysTrade=0; FapTurbo_LowLot=0.1; FapTurbo_TooGoodToBeTrue=50; FapTurbo_PrudentPeriod=30; FapTurbo_StartWorkTimeHour=0; FapTurbo_StartWorkTimeMin=0; FapTurbo_EndWorkTimeHour=0; FapTurbo_EndWorkTimeMin=0; FapTurbo_OneTrade=0; FapTurbo_SpanGator=0.5; FapTurbo_SlipPage=3; FapTurbo_ExpertComment="FapTurboEA"; FapTurbo_MagicNumber=12464337; ____Other_Parameters__="-----------------------------------------"; TradeMicroLots=true; SendEmail=false; SoundAlert=false; SoundFileAtOpen="alert.wav"; SoundFileAtClose="alert.wav"; ColorBuy=Blue; ColorSell=Red; WriteLog=false; WriteDebugLog=false; PrintLogOnChart=false; KEY="012345";

Bars in test

62116

Ticks modelled

12934356

Modelling quality

99.00%

Initial Deposit

$10000.00

Spread

Backtests Results

Total net profit

13831.05

Gross profit

21203.45

Gross loss

-7372.40

Profit factor

2.88

Expected payoff

32.47

Absolute Bal DD

24.17

Maximal Bal DD

1086.08 (8.96%)

Relative Bal DD

8.96% (1086.08)

Total Trades

426

Short positions

209 (88.04%)

Long positions

217 (89.40%)

Profit trades

378 (88.73%)

Loss trades

48 (11.27%)

Largest Profit trade

168.76

Largest Loss trade

-696.19

Average Profit trade

56.09

Average Loss trade

-153.59

Maximum consecutive wins (profit in money)

55 (3102.01)

Maximum consecutive losses (loss in money)

4 (-374.03)

Maximal consecutive profit (count of wins)

3102.01 (55)

Maximal consecutive loss (count of losses)

-696.19 (1)

Avarage consecutive wins

9

Avarage consecutive losses

1

Long term strategy

The balance curve does not seem comfortable in these backtests. It may was designed to work in the period preceeding the launch of the Forex robot, and it failed after that, not even their forward live performance test is running in 2009. This means that the Forex robot is not that much dependable, but because of the low trades number per unit of time, a higher range of backtesting is needed to confirm that.

Backtests Settings

Symbol

EURUSD (Euro vs US Dollar)

Period

1 Minute (M1) 1970.01.01 00:00 - 1970.01.01 00:00

Model

Every tick (the most precise method based on all available least timeframes)

Parameters

____Scalper___________="--- Scalper EURCHF, EURGPB, GBPCHF or USDCAD M15 ---"; UseScalperStrategy=false; Scalper_Lots=0.1; Scalper_UseMM=true; Scalper_LotsRiskReductor=5; Scalper_MaxLots=10; Scalper_UseAutoGMToffset=false; Scalper_ManualGMToffset=0; Scalper_StartWorkTimeHour=21; Scalper_StartSessionMinute=0; Scalper_EndWorkTimeHour=23; Scalper_EndSessionMinute=30; Scalper_EURGBP_TakeProfit=6; Scalper_EURGBP_StopLoss=35; Scalper_EURCHF_TakeProfit=5; Scalper_EURCHF_StopLoss=49; Scalper_GBPCHF_TakeProfit=10; Scalper_GBPCHF_StopLoss=81; Scalper_USDCAD_TakeProfit=10; Scalper_USDCAD_StopLoss=58; Scalper_StealthMode=true; Scalper_ProfitLimit=0; Scalper_LossLimit=0; Scalper_UseCustomLevels=true; Scalper_RelaxHours=0; Scalper_SimpleHeightFilter=true; Scalper_TrendFilter=true; Scalper_TradeMonday=true; Scalper_TradeFriday=false; Scalper_OneTrade=0; Scalper_OneOpenTrade=false; Scalper_ReverseTrade=0; Scalper_UseFilterMA=false; Scalper_PeriodFilterMA=100; Scalper_PriceFilterMA=0; Scalper_MethodFilterMA=0; Scalper_MaxSpread=5; Scalper_Slippage=6; Scalper_ExpertComment="TradingRobot"; Scalper_MagicNumber=12464336; ____FapTurbo__________="---------- FapTurbo EUR/USD M1 ----------"; FapTurbo_Lots=0; FapTurbo_LotsRiskReductor=1; FapTurbo_MaxOrders=1; FapTurbo_MaxLots=10; FapTurbo_StopTime=9; FapTurbo_aaa=35; FapTurbo_bbb=48; FapTurbo_TakeProfit=140; FapTurbo_StopLoss=500; FapTurbo_TrailingStop=0; FapTurbo_DurationInHours=0; FapTurbo_CloseAfterXmonths=1; FapTurbo_PeriodMALarge=100; FapTurbo_PeriodMASmall=30; FapTurbo_PriceMA_0_6=0; FapTurbo_TypeMA_0_3=0; FapTurbo_ShiftMALarge=3; FapTurbo_ShiftMASmall=1; FapTurbo_LookForDays=2; FapTurbo_CriticalDays=45; FapTurbo_RelaxDays=0; FapTurbo_AlterPosLotReducer=0; FapTurbo_AlterPositions=0; FapTurbo_TradeNFP=1; FapTurbo_TradeFriday=1; FapTurbo_Prudent=0; FapTurbo_SymAlligatorOnCritica=1; FapTurbo_FixedDirection=1; FapTurbo_ClsLsrOnMrktChnge=0; FapTurbo_AlwaysTrade=0; FapTurbo_LowLot=0.1; FapTurbo_TooGoodToBeTrue=50; FapTurbo_PrudentPeriod=30; FapTurbo_StartWorkTimeHour=0; FapTurbo_StartWorkTimeMin=0; FapTurbo_EndWorkTimeHour=0; FapTurbo_EndWorkTimeMin=0; FapTurbo_OneTrade=0; FapTurbo_SpanGator=0.5; FapTurbo_SlipPage=3; FapTurbo_ExpertComment="FapTurboEA"; FapTurbo_MagicNumber=12464337; ____Other_Parameters__="-----------------------------------------"; TradeMicroLots=true; SendEmail=false; SoundAlert=false; SoundFileAtOpen="alert.wav"; SoundFileAtClose="alert.wav"; ColorBuy=Blue; ColorSell=Red; WriteLog=false; WriteDebugLog=false; PrintLogOnChart=false; KEY="012345";

Bars in test

923577

Ticks modelled

30043949

Modelling quality

99.00%

Initial Deposit

$10000.00

Spread

Backtests Results

Total net profit

769.99

Gross profit

5323.19

Gross loss

-4553.20

Profit factor

1.17

Expected payoff

10.13

Absolute Bal DD

584.85

Maximal Bal DD

2082.07 (18.11%)

Relative Bal DD

18.11% (2082.07)

Total Trades

76

Short positions

43 (76.74%)

Long positions

33 (66.67%)

Profit trades

55 (72.37%)

Loss trades

21 (27.63%)

Largest Profit trade

124.40

Largest Loss trade

-440.98

Average Profit trade

96.79

Average Loss trade

-216.82

Maximum consecutive wins (profit in money)

7 (768.06)

Maximum consecutive losses (loss in money)

2 (-682.10)

Maximal consecutive profit (count of wins)

768.06 (7)

Maximal consecutive loss (count of losses)

-682.10 (2)

Avarage consecutive wins

3

Avarage consecutive losses

1

Backtests Settings

Symbol

EURUSD (Euro vs US Dollar)

Period

1 Minute (M1) 2006.01.02 00:01 - 2009.10.15 00:09 (2006.01.01 - 2009.11.01)

Model

Every tick (the most precise method based on all available least timeframes)

Parameters

____Scalper___________="--- Scalper EURCHF, EURGPB, GBPCHF or USDCAD M15 ---"; UseScalperStrategy=false; Scalper_Lots=0.1; Scalper_UseMM=true; Scalper_LotsRiskReductor=5; Scalper_MaxLots=10; Scalper_UseAutoGMToffset=false; Scalper_ManualGMToffset=1; Scalper_StartWorkTimeHour=21; Scalper_StartSessionMinute=0; Scalper_EndWorkTimeHour=23; Scalper_EndSessionMinute=30; Scalper_EURGBP_TakeProfit=6; Scalper_EURGBP_StopLoss=35; Scalper_EURCHF_TakeProfit=5; Scalper_EURCHF_StopLoss=49; Scalper_GBPCHF_TakeProfit=10; Scalper_GBPCHF_StopLoss=81; Scalper_USDCAD_TakeProfit=10; Scalper_USDCAD_StopLoss=58; Scalper_StealthMode=true; Scalper_ProfitLimit=0; Scalper_LossLimit=0; Scalper_UseCustomLevels=true; Scalper_RelaxHours=0; Scalper_SimpleHeightFilter=true; Scalper_TrendFilter=true; Scalper_TradeMonday=true; Scalper_TradeFriday=false; Scalper_OneTrade=0; Scalper_OneOpenTrade=false; Scalper_ReverseTrade=0; Scalper_UseFilterMA=false; Scalper_PeriodFilterMA=100; Scalper_PriceFilterMA=0; Scalper_MethodFilterMA=0; Scalper_MaxSpread=5; Scalper_Slippage=6; Scalper_ExpertComment="TradingRobot"; Scalper_MagicNumber=12464336; ____FapTurbo__________="---------- FapTurbo EUR/USD M1 ----------"; FapTurbo_Lots=0; FapTurbo_LotsRiskReductor=1; FapTurbo_MaxOrders=1; FapTurbo_MaxLots=10; FapTurbo_StopTime=9; FapTurbo_aaa=35; FapTurbo_bbb=48; FapTurbo_TakeProfit=140; FapTurbo_StopLoss=500; FapTurbo_TrailingStop=0; FapTurbo_DurationInHours=0; FapTurbo_CloseAfterXmonths=1; FapTurbo_PeriodMALarge=100; FapTurbo_PeriodMASmall=30; FapTurbo_PriceMA_0_6=0; FapTurbo_TypeMA_0_3=0; FapTurbo_ShiftMALarge=3; FapTurbo_ShiftMASmall=1; FapTurbo_LookForDays=2; FapTurbo_CriticalDays=45; FapTurbo_RelaxDays=0; FapTurbo_AlterPosLotReducer=0; FapTurbo_AlterPositions=0; FapTurbo_TradeNFP=1; FapTurbo_TradeFriday=1; FapTurbo_Prudent=0; FapTurbo_SymAlligatorOnCritica=1; FapTurbo_FixedDirection=1; FapTurbo_ClsLsrOnMrktChnge=0; FapTurbo_AlwaysTrade=0; FapTurbo_LowLot=0.1; FapTurbo_TooGoodToBeTrue=50; FapTurbo_PrudentPeriod=30; FapTurbo_StartWorkTimeHour=0; FapTurbo_StartWorkTimeMin=0; FapTurbo_EndWorkTimeHour=0; FapTurbo_EndWorkTimeMin=0; FapTurbo_OneTrade=0; FapTurbo_SpanGator=0.5; FapTurbo_SlipPage=3; FapTurbo_ExpertComment="FapTurboEA"; FapTurbo_MagicNumber=12464337; ____Other_Parameters__="-----------------------------------------"; TradeMicroLots=true; SendEmail=false; SoundAlert=false; SoundFileAtOpen="alert.wav"; SoundFileAtClose="alert.wav"; ColorBuy=Blue; ColorSell=Red; WriteLog=false; WriteDebugLog=false; PrintLogOnChart=false; KEY="012345";

Bars in test

1293030

Ticks modelled

18104820

Modelling quality

25.00%

Initial Deposit

$1000.00

Spread

Backtests Results

Total net profit

217.25

Gross profit

908.56

Gross loss

-691.31

Profit factor

1.31

Expected payoff

1.62

Absolute Bal DD

4.93

Maximal Bal DD

250.21 (18.01%)

Relative Bal DD

18.01% (250.21)

Total Trades

134

Short positions

52 (71.15%)

Long positions

82 (70.73%)

Profit trades

95 (70.90%)

Loss trades

39 (29.10%)

Largest Profit trade

11.77

Largest Loss trade

-40.21

Average Profit trade

9.56

Average Loss trade

-17.73

Maximum consecutive wins (profit in money)

11 (116.88)

Maximum consecutive losses (loss in money)

6 (-85.50)

Maximal consecutive profit (count of wins)

116.88 (11)

Maximal consecutive loss (count of losses)

-85.50 (6)

Avarage consecutive wins

3

Avarage consecutive losses

1

The history center data was used instead of tick data for backtesting as this strategy is using very large tp/sl targets. There were almost identical trades with small scattered differences. In conclusion, this strategy didn't proof itself to be a good one, and you can safely ignore it, just as the authors did.

Scalping strategy

You can notice that even when the live account is not profitable anymore, all the scalper pairs are still profitable, this is what happens after merging the graphs:

Now, this became more perplexing and in need for another level of backtests synchronously with the real account when it was obviously not very profitable, this started around 06/01/2009.

2009/06/01 - 2009/10/01

Backtests Settings

Symbol

EURCHF (Euro vs Swiss Franc)

Period

15 Minutes (M15) 1970.01.01 00:00 - 1970.01.01 00:00 (2009.06.01 - 2009.11.01)

Model

Every tick (the most precise method based on all available least timeframes)

Parameters

____Scalper___________="--- Scalper EURCHF, EURGPB, GBPCHF or USDCAD M15 ---"; UseScalperStrategy=true; Scalper_Lots=0.1; Scalper_UseMM=true; Scalper_LotsRiskReductor=5; Scalper_MaxLots=10; Scalper_UseAutoGMToffset=false; Scalper_ManualGMToffset=0; Scalper_StartWorkTimeHour=21; Scalper_StartSessionMinute=0; Scalper_EndWorkTimeHour=23; Scalper_EndSessionMinute=30; Scalper_EURGBP_TakeProfit=6; Scalper_EURGBP_StopLoss=35; Scalper_EURCHF_TakeProfit=5; Scalper_EURCHF_StopLoss=49; Scalper_GBPCHF_TakeProfit=10; Scalper_GBPCHF_StopLoss=81; Scalper_USDCAD_TakeProfit=10; Scalper_USDCAD_StopLoss=58; Scalper_StealthMode=true; Scalper_ProfitLimit=0; Scalper_LossLimit=0; Scalper_UseCustomLevels=true; Scalper_RelaxHours=0; Scalper_SimpleHeightFilter=true; Scalper_TrendFilter=true; Scalper_TradeMonday=true; Scalper_TradeFriday=false; Scalper_OneTrade=0; Scalper_OneOpenTrade=false; Scalper_ReverseTrade=0; Scalper_UseFilterMA=false; Scalper_PeriodFilterMA=100; Scalper_PriceFilterMA=0; Scalper_MethodFilterMA=0; Scalper_MaxSpread=5; Scalper_Slippage=6; Scalper_ExpertComment="TradingRobot"; Scalper_MagicNumber=12464336; ____FapTurbo__________="---------- FapTurbo EUR/USD M1 ----------"; FapTurbo_Lots=0.01; FapTurbo_LotsRiskReductor=1; FapTurbo_MaxOrders=1; FapTurbo_MaxLots=10; FapTurbo_StopTime=9; FapTurbo_aaa=35; FapTurbo_bbb=48; FapTurbo_TakeProfit=140; FapTurbo_StopLoss=500; FapTurbo_TrailingStop=0; FapTurbo_DurationInHours=0; FapTurbo_CloseAfterXmonths=1; FapTurbo_PeriodMALarge=100; FapTurbo_PeriodMASmall=30; FapTurbo_PriceMA_0_6=0; FapTurbo_TypeMA_0_3=0; FapTurbo_ShiftMALarge=3; FapTurbo_ShiftMASmall=1; FapTurbo_LookForDays=2; FapTurbo_CriticalDays=45; FapTurbo_RelaxDays=0; FapTurbo_AlterPosLotReducer=0; FapTurbo_AlterPositions=0; FapTurbo_TradeNFP=1; FapTurbo_TradeFriday=1; FapTurbo_Prudent=0; FapTurbo_SymAlligatorOnCritica=1; FapTurbo_FixedDirection=1; FapTurbo_ClsLsrOnMrktChnge=0; FapTurbo_AlwaysTrade=0; FapTurbo_LowLot=0.1; FapTurbo_TooGoodToBeTrue=50; FapTurbo_PrudentPeriod=30; FapTurbo_StartWorkTimeHour=0; FapTurbo_StartWorkTimeMin=0; FapTurbo_EndWorkTimeHour=0; FapTurbo_EndWorkTimeMin=0; FapTurbo_OneTrade=0; FapTurbo_SpanGator=0.5; FapTurbo_SlipPage=3; FapTurbo_ExpertComment="FapTurboEA"; FapTurbo_MagicNumber=12464337; ____Other_Parameters__="-----------------------------------------"; TradeMicroLots=true; SendEmail=false; SoundAlert=false; SoundFileAtOpen="alert.wav"; SoundFileAtClose="alert.wav"; ColorBuy=Blue; ColorSell=Red; WriteLog=false; WriteDebugLog=false; PrintLogOnChart=false; KEY="012345";

Bars in test

62143

Ticks modelled

23085569

Modelling quality

99.00%

Initial Deposit

$10000.00

Spread

Backtests Results

Total net profit

1294.91

Gross profit

1332.71

Gross loss

-37.80

Profit factor

35.25

Expected payoff

13.92

Absolute Bal DD

23.11

Maximal Bal DD

84.50 (0.75%)

Relative Bal DD

0.75% (84.50)

Total Trades

93

Short positions

35 (94.29%)

Long positions

58 (96.55%)

Profit trades

89 (95.70%)

Loss trades

4 (4.30%)

Largest Profit trade

24.11

Largest Loss trade

-13.91

Average Profit trade

14.97

Average Loss trade

-9.45

Maximum consecutive wins (profit in money)

56 (902.09)

Maximum consecutive losses (loss in money)

1 (-13.91)

Maximal consecutive profit (count of wins)

902.09 (56)

Maximal consecutive loss (count of losses)

-13.91 (1)

Avarage consecutive wins

18

Avarage consecutive losses

1

Backtests Settings

Symbol

EURGBP (Euro vs Great Britain Pound )

Period

15 Minutes (M15) 1970.01.01 00:00 - 1970.01.01 00:00 (2009.06.01 - 2009.11.01)

Model

Every tick (the most precise method based on all available least timeframes)

Parameters

____Scalper___________="--- Scalper EURCHF, EURGPB, GBPCHF or USDCAD M15 ---"; UseScalperStrategy=true; Scalper_Lots=0.1; Scalper_UseMM=true; Scalper_LotsRiskReductor=5; Scalper_MaxLots=10; Scalper_UseAutoGMToffset=false; Scalper_ManualGMToffset=0; Scalper_StartWorkTimeHour=21; Scalper_StartSessionMinute=0; Scalper_EndWorkTimeHour=23; Scalper_EndSessionMinute=30; Scalper_EURGBP_TakeProfit=6; Scalper_EURGBP_StopLoss=35; Scalper_EURCHF_TakeProfit=5; Scalper_EURCHF_StopLoss=49; Scalper_GBPCHF_TakeProfit=10; Scalper_GBPCHF_StopLoss=81; Scalper_USDCAD_TakeProfit=10; Scalper_USDCAD_StopLoss=58; Scalper_StealthMode=true; Scalper_ProfitLimit=0; Scalper_LossLimit=0; Scalper_UseCustomLevels=true; Scalper_RelaxHours=0; Scalper_SimpleHeightFilter=true; Scalper_TrendFilter=true; Scalper_TradeMonday=true; Scalper_TradeFriday=false; Scalper_OneTrade=0; Scalper_OneOpenTrade=false; Scalper_ReverseTrade=0; Scalper_UseFilterMA=false; Scalper_PeriodFilterMA=100; Scalper_PriceFilterMA=0; Scalper_MethodFilterMA=0; Scalper_MaxSpread=5; Scalper_Slippage=6; Scalper_ExpertComment="TradingRobot"; Scalper_MagicNumber=12464336; ____FapTurbo__________="---------- FapTurbo EUR/USD M1 ----------"; FapTurbo_Lots=0.01; FapTurbo_LotsRiskReductor=1; FapTurbo_MaxOrders=1; FapTurbo_MaxLots=10; FapTurbo_StopTime=9; FapTurbo_aaa=35; FapTurbo_bbb=48; FapTurbo_TakeProfit=140; FapTurbo_StopLoss=500; FapTurbo_TrailingStop=0; FapTurbo_DurationInHours=0; FapTurbo_CloseAfterXmonths=1; FapTurbo_PeriodMALarge=100; FapTurbo_PeriodMASmall=30; FapTurbo_PriceMA_0_6=0; FapTurbo_TypeMA_0_3=0; FapTurbo_ShiftMALarge=3; FapTurbo_ShiftMASmall=1; FapTurbo_LookForDays=2; FapTurbo_CriticalDays=45; FapTurbo_RelaxDays=0; FapTurbo_AlterPosLotReducer=0; FapTurbo_AlterPositions=0; FapTurbo_TradeNFP=1; FapTurbo_TradeFriday=1; FapTurbo_Prudent=0; FapTurbo_SymAlligatorOnCritica=1; FapTurbo_FixedDirection=1; FapTurbo_ClsLsrOnMrktChnge=0; FapTurbo_AlwaysTrade=0; FapTurbo_LowLot=0.1; FapTurbo_TooGoodToBeTrue=50; FapTurbo_PrudentPeriod=30; FapTurbo_StartWorkTimeHour=0; FapTurbo_StartWorkTimeMin=0; FapTurbo_EndWorkTimeHour=0; FapTurbo_EndWorkTimeMin=0; FapTurbo_OneTrade=0; FapTurbo_SpanGator=0.5; FapTurbo_SlipPage=3; FapTurbo_ExpertComment="FapTurboEA"; FapTurbo_MagicNumber=12464337; ____Other_Parameters__="-----------------------------------------"; TradeMicroLots=true; SendEmail=false; SoundAlert=false; SoundFileAtOpen="alert.wav"; SoundFileAtClose="alert.wav"; ColorBuy=Blue; ColorSell=Red; WriteLog=true; WriteDebugLog=false; PrintLogOnChart=true; KEY="012345";

Bars in test

62164

Ticks modelled

26716363

Modelling quality

99.00%

Initial Deposit

$10000.00

Spread

Backtests Results

Total net profit

1109.95

Gross profit

2323.54

Gross loss

-1213.59

Profit factor

1.91

Expected payoff

9.49

Absolute Bal DD

202.61

Maximal Bal DD

384.21 (3.38%)

Relative Bal DD

3.38% (384.21)

Total Trades

117

Short positions

60 (78.33%)

Long positions

57 (85.96%)

Profit trades

96 (82.05%)

Loss trades

21 (17.95%)

Largest Profit trade

49.56

Largest Loss trade

-223.12

Average Profit trade

24.20

Average Loss trade

-57.79

Maximum consecutive wins (profit in money)

25 (630.70)

Maximum consecutive losses (loss in money)

2 (-47.15)

Maximal consecutive profit (count of wins)

630.70 (25)

Maximal consecutive loss (count of losses)

-223.12 (1)

Avarage consecutive wins

6

Avarage consecutive losses

1

Backtests Settings

Symbol

GBPCHF (Great Britain Pound vs Swiss Franc)

Period

15 Minutes (M15) 1970.01.01 00:00 - 1970.01.01 00:00 (2009.06.01 - 2009.11.01)

Model

Every tick (the most precise method based on all available least timeframes)

Parameters

____Scalper___________="--- Scalper EURCHF, EURGPB, GBPCHF or USDCAD M15 ---"; UseScalperStrategy=true; Scalper_Lots=0.1; Scalper_UseMM=true; Scalper_LotsRiskReductor=5; Scalper_MaxLots=10; Scalper_UseAutoGMToffset=false; Scalper_ManualGMToffset=0; Scalper_StartWorkTimeHour=21; Scalper_StartSessionMinute=0; Scalper_EndWorkTimeHour=23; Scalper_EndSessionMinute=30; Scalper_EURGBP_TakeProfit=6; Scalper_EURGBP_StopLoss=35; Scalper_EURCHF_TakeProfit=5; Scalper_EURCHF_StopLoss=49; Scalper_GBPCHF_TakeProfit=10; Scalper_GBPCHF_StopLoss=81; Scalper_USDCAD_TakeProfit=10; Scalper_USDCAD_StopLoss=58; Scalper_StealthMode=true; Scalper_ProfitLimit=0; Scalper_LossLimit=0; Scalper_UseCustomLevels=true; Scalper_RelaxHours=0; Scalper_SimpleHeightFilter=true; Scalper_TrendFilter=true; Scalper_TradeMonday=true; Scalper_TradeFriday=false; Scalper_OneTrade=0; Scalper_OneOpenTrade=false; Scalper_ReverseTrade=0; Scalper_UseFilterMA=false; Scalper_PeriodFilterMA=100; Scalper_PriceFilterMA=0; Scalper_MethodFilterMA=0; Scalper_MaxSpread=5; Scalper_Slippage=6; Scalper_ExpertComment="TradingRobot"; Scalper_MagicNumber=12464336; ____FapTurbo__________="---------- FapTurbo EUR/USD M1 ----------"; FapTurbo_Lots=0.01; FapTurbo_LotsRiskReductor=1; FapTurbo_MaxOrders=1; FapTurbo_MaxLots=10; FapTurbo_StopTime=9; FapTurbo_aaa=35; FapTurbo_bbb=48; FapTurbo_TakeProfit=140; FapTurbo_StopLoss=500; FapTurbo_TrailingStop=0; FapTurbo_DurationInHours=0; FapTurbo_CloseAfterXmonths=1; FapTurbo_PeriodMALarge=100; FapTurbo_PeriodMASmall=30; FapTurbo_PriceMA_0_6=0; FapTurbo_TypeMA_0_3=0; FapTurbo_ShiftMALarge=3; FapTurbo_ShiftMASmall=1; FapTurbo_LookForDays=2; FapTurbo_CriticalDays=45; FapTurbo_RelaxDays=0; FapTurbo_AlterPosLotReducer=0; FapTurbo_AlterPositions=0; FapTurbo_TradeNFP=1; FapTurbo_TradeFriday=1; FapTurbo_Prudent=0; FapTurbo_SymAlligatorOnCritica=1; FapTurbo_FixedDirection=1; FapTurbo_ClsLsrOnMrktChnge=0; FapTurbo_AlwaysTrade=0; FapTurbo_LowLot=0.1; FapTurbo_TooGoodToBeTrue=50; FapTurbo_PrudentPeriod=30; FapTurbo_StartWorkTimeHour=0; FapTurbo_StartWorkTimeMin=0; FapTurbo_EndWorkTimeHour=0; FapTurbo_EndWorkTimeMin=0; FapTurbo_OneTrade=0; FapTurbo_SpanGator=0.5; FapTurbo_SlipPage=3; FapTurbo_ExpertComment="FapTurboEA"; FapTurbo_MagicNumber=12464337; ____Other_Parameters__="-----------------------------------------"; TradeMicroLots=true; SendEmail=false; SoundAlert=false; SoundFileAtOpen="alert.wav"; SoundFileAtClose="alert.wav"; ColorBuy=Blue; ColorSell=Red; WriteLog=false; WriteDebugLog=false; PrintLogOnChart=false; KEY="012345";

Bars in test

62113

Ticks modelled

31207901

Modelling quality

99.00%

Initial Deposit

$10000.00

Spread

Backtests Results

Total net profit

1200.53

Gross profit

3507.16

Gross loss

-2306.63

Profit factor

1.52

Expected payoff

8.58

Absolute Bal DD

177.21

Maximal Bal DD

569.41 (4.93%)

Relative Bal DD

4.93% (569.41)

Total Trades

140

Short positions

71 (90.14%)

Long positions

69 (85.51%)

Profit trades

123 (87.86%)

Loss trades

17 (12.14%)

Largest Profit trade

79.20

Largest Loss trade

-285.95

Average Profit trade

28.51

Average Loss trade

-135.68

Maximum consecutive wins (profit in money)

39 (1096.68)

Maximum consecutive losses (loss in money)

2 (-298.02)

Maximal consecutive profit (count of wins)

1096.68 (39)

Maximal consecutive loss (count of losses)

-298.02 (2)

Avarage consecutive wins

9

Avarage consecutive losses

1

Backtests Settings

Symbol

USDCAD (US Dollar vs Canadian Dollar)

Period

15 Minutes (M15) 1970.01.01 00:00 - 1970.01.01 00:00 (2009.06.01 - 2009.11.01)

Model

Every tick (the most precise method based on all available least timeframes)

Parameters

____Scalper___________="--- Scalper EURCHF, EURGPB, GBPCHF or USDCAD M15 ---"; UseScalperStrategy=true; Scalper_Lots=0.1; Scalper_UseMM=true; Scalper_LotsRiskReductor=5; Scalper_MaxLots=10; Scalper_UseAutoGMToffset=false; Scalper_ManualGMToffset=0; Scalper_StartWorkTimeHour=21; Scalper_StartSessionMinute=0; Scalper_EndWorkTimeHour=23; Scalper_EndSessionMinute=30; Scalper_EURGBP_TakeProfit=6; Scalper_EURGBP_StopLoss=35; Scalper_EURCHF_TakeProfit=5; Scalper_EURCHF_StopLoss=49; Scalper_GBPCHF_TakeProfit=10; Scalper_GBPCHF_StopLoss=81; Scalper_USDCAD_TakeProfit=10; Scalper_USDCAD_StopLoss=58; Scalper_StealthMode=true; Scalper_ProfitLimit=0; Scalper_LossLimit=0; Scalper_UseCustomLevels=true; Scalper_RelaxHours=0; Scalper_SimpleHeightFilter=true; Scalper_TrendFilter=true; Scalper_TradeMonday=true; Scalper_TradeFriday=false; Scalper_OneTrade=0; Scalper_OneOpenTrade=false; Scalper_ReverseTrade=0; Scalper_UseFilterMA=false; Scalper_PeriodFilterMA=100; Scalper_PriceFilterMA=0; Scalper_MethodFilterMA=0; Scalper_MaxSpread=5; Scalper_Slippage=6; Scalper_ExpertComment="TradingRobot"; Scalper_MagicNumber=12464336; ____FapTurbo__________="---------- FapTurbo EUR/USD M1 ----------"; FapTurbo_Lots=0.01; FapTurbo_LotsRiskReductor=1; FapTurbo_MaxOrders=1; FapTurbo_MaxLots=10; FapTurbo_StopTime=9; FapTurbo_aaa=35; FapTurbo_bbb=48; FapTurbo_TakeProfit=140; FapTurbo_StopLoss=500; FapTurbo_TrailingStop=0; FapTurbo_DurationInHours=0; FapTurbo_CloseAfterXmonths=1; FapTurbo_PeriodMALarge=100; FapTurbo_PeriodMASmall=30; FapTurbo_PriceMA_0_6=0; FapTurbo_TypeMA_0_3=0; FapTurbo_ShiftMALarge=3; FapTurbo_ShiftMASmall=1; FapTurbo_LookForDays=2; FapTurbo_CriticalDays=45; FapTurbo_RelaxDays=0; FapTurbo_AlterPosLotReducer=0; FapTurbo_AlterPositions=0; FapTurbo_TradeNFP=1; FapTurbo_TradeFriday=1; FapTurbo_Prudent=0; FapTurbo_SymAlligatorOnCritica=1; FapTurbo_FixedDirection=1; FapTurbo_ClsLsrOnMrktChnge=0; FapTurbo_AlwaysTrade=0; FapTurbo_LowLot=0.1; FapTurbo_TooGoodToBeTrue=50; FapTurbo_PrudentPeriod=30; FapTurbo_StartWorkTimeHour=0; FapTurbo_StartWorkTimeMin=0; FapTurbo_EndWorkTimeHour=0; FapTurbo_EndWorkTimeMin=0; FapTurbo_OneTrade=0; FapTurbo_SpanGator=0.5; FapTurbo_SlipPage=3; FapTurbo_ExpertComment="FapTurboEA"; FapTurbo_MagicNumber=12464337; ____Other_Parameters__="-----------------------------------------"; TradeMicroLots=true; SendEmail=false; SoundAlert=false; SoundFileAtOpen="alert.wav"; SoundFileAtClose="alert.wav"; ColorBuy=Blue; ColorSell=Red; WriteLog=false; WriteDebugLog=false; PrintLogOnChart=false; KEY="012345";

Bars in test

62116

Ticks modelled

12934356

Modelling quality

99.00%

Initial Deposit

$10000.00

Spread

Backtests Results

Total net profit

3371.33

Gross profit

4216.23

Gross loss

-844.89

Profit factor

4.99

Expected payoff

29.83

Absolute Bal DD

96.65

Maximal Bal DD

501.68 (3.65%)

Relative Bal DD

3.96% (458.90)

Total Trades

113

Short positions

52 (86.54%)

Long positions

61 (90.16%)

Profit trades

100 (88.50%)

Loss trades

13 (11.50%)

Largest Profit trade

94.89

Largest Loss trade

-390.72

Average Profit trade

42.16

Average Loss trade

-64.99

Maximum consecutive wins (profit in money)

22 (946.98)

Maximum consecutive losses (loss in money)

2 (-348.20)

Maximal consecutive profit (count of wins)

946.98 (22)

Maximal consecutive loss (count of losses)

-390.72 (1)

Avarage consecutive wins

8

Avarage consecutive losses

1

Scalper result

Analysis

Now recall how the huge traders number using this Forex robot might adversely affects the market, as mentioned before. To confirm this we could have EURCHF as an example and start from now backwards showing the real trade over the backtest trade:

2009.09.30 18:42 buy 1.51711 close 2009.10.01 06:30 1.51734

2009.09.30 21:42 buy 1.51625 close 2009.09.30 22:57 1.51670

It's clear that the GMT offset difference is -3, and the trades are closed faster during backtesting due to the need of less pips to reach the profit target.

Slippage: 8.6 pips

2009.09.28 18:14 sell 1.50893 close 2009.09.30 10:57 1.50874

2009.09.28 21:16 sell 1.50940 close 2009.09.29 01:10 1.50945

Slippage: 4.7 pips

By testing through August, no matching trades on EURCHF could be found, this may be as the version being used back then was v47 in addition to the slower spread in the backtests compared to the authors server. Through July, a matching can be found:

2009.07.30 19:16 sell 1.53120 close 2009.07.30 23:16 1.53250

2009.07.30 23:15 sell 1.53140 close 2009.07.31 00:52 1.53110

Slippage: 2 pips

However, a difference resulted from those 2 pips; in the backtest, the position was closed at a profit, while on the real account it was closed at a loss.

It's now clear that FAPTurbo is destroying itself by slippage and may be the widened spreads, and up till now there is no clear evidence that the market has opposite moves to the FAPTurbo positions due to the huge mass of users entering the market simultaneously in the same directions.

Strategy and Parameters

It's mainly an Asian session scalper on 8 different currency pairs in addition to another unique strategy for EURUSD on the M1 timeframe is the "long term strategy". The included comprehensive manual attempts to explain everything related to the Forex market up to VPS solutions, it even didn't ignore history data and backtesting. The package includes ex4 and DLL files and the EA supports so many parameters that are briefly explained in the manual, with mention of this disclaimer:

Other settings can be left as defaults. All other settings can be left as they are, and you can be confident in the knowledge that we have worked hard to optimize the default settings to ensure you achieve good results.

A question arises; why the Forex robot parameters are so important if they could work without modifying them? The authors may think that an EA being full of parameters will be more satisfying for a customer, while the only parameter that could be modified by a standard user seems to be the "GMT offset". Accordingly, the following backtests were run on a modified GMT offset. You may also need to modify the "money management risk", it's 5 in the EA by default that is good enough for backtesting, but the "long term strategy" was manually set to be automatic with a lot factor of 1, which looks like a correct risk setting for the pips number involved in every trade.

The new and improved versions FAPTurbo 2.0 and FAPTurbo 3.0 got many enhanced features significantly supporting the capital risk protection, including the High Spread Protection System, Automatic Risk Scaling, and Built-In Loss Prevention System.

The Bottom Line

The real winner is the one that had a chance to run FAPTurbo in 2008, it worth its cost at that time, but now it may not be a good idea to run it on a live account.

Was the first generation of the EA profitable in the past? Yes, for some time, but not in the few months that preceded the release of the next generation, though. Will it be profitable again in the future? FAPTurbo 2.0 and FAPTurbo 3.0 work 100% on Forex trading automation, and you'll just need to update your account capital size when necessary. Yet regularly it has been making money for many traders and is expected to be the safest and most consistent Forex trading robot.

Promotional Video (by the Vendor)

King Forex

Sun, 23 Feb 2014

FAP Turbo Revolution new robots I think its good so I am keen interested to purchase it very soon.

Other Forex Robots from Forex EA Lab

The old-style of FAPTurbo works as an Asian session scalper including a long-term advanced strategy trading around the clock on EURUSD with high SL & TP targets.

Starting from FAPTurbo 2.0 and of course FAPTurbo 3.0 the EA could trade 8 different pairs with an extremely high trades frequency in addition to the crypto-currency Bitcoin, the electronic money that is making news.

Starting from FAPTurbo 2.0 and of course FAPTurbo 3.0 the EA could trade 8 different pairs with an extremely high trades frequency in addition to the crypto-currency Bitcoin, the electronic money that is making news.

Fapturbo 2.0 trades 6 pairs with an extremely high trades frequency in addition to the crypto-currency Bitcoin, the electronic money that is making news.

GPS Forex Robot independently takes all of the information from the market and calculates the necessary parameters for optimal trading. On the backtests the EA shows unbelievable stability and very good profit. Moreover, this robot is not sensitive to the spread. For example, with the EURUSD pair, for only one trading operation, the expert takes an average profit in 8 pips, while the average spread for this currency, for example on the Alpari UK or IamFX brokers, is only 0.6 pips.

Tags

Valery Trading

Tickmill

Algocrat AI

FXAutomater

WallStreet Forex Robot 3.0 Domination

Tick Data Suite

Waka Waka

FBS

IC Markets

Perceptrader AI

Forex Diamond

RoboForex

Volatility Factor Pro

StrategyQuant X

XM

HF Markets

InstaForex

Alpari

Forex Combo System

GPS Forex Robot

FX Scalper

GrandCapital

Golden Pickaxe

Automated Forex Tools

Forex Trend Detector

IronFX

Omega Trend

Telegram Signal Copier

Broker Arbitrage

SMRT Algo

AMarkets

FXVM

TradingFX VPS

Gold Miner

Forex Trend Hunter

Quant Analyzer

Binance

Forex Gold Investor

ACY Securities

Gold Scalper PRO

ForexSignals.com

AlgoWizard

RayBOT

FxPro

FXCharger

News Scope EA PRO

FX Choice

Smart Scalper PRO

Commercial Network Services

FX-Builder

Infinity Trader

Pump Trader Robot

Happy Forex

LeapFX Trading Academy

ForexTime

WallStreet Recovery PRO

BlackBull Markets

Libertex

Quant Data Manager

StarTrader

Forex VPS

Best Free Scalper Pro

MTeletool

Pepperstone

VPS Forex Trader

Evening Scalper PRO

QHoster

Telegram Copier

Happy Bitcoin

FX Secret Club

Forex Robot Academy

Trend Matrix EA

Forex Robot Factory (Expert Advisor Generator)

ByBit

Database Mart

Gold Breaker

DARKEAS

Vortex Trader PRO

Magnetic Exchange

Quant Tekel Funded

Swing Trader PRO

EGPForex

Risk

Forex trading can involve the risk of loss beyond your initial deposit. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary.

Forex accounts typically offer various degrees of leverage and their elevated profit potential is counterbalanced by an equally high level of risk. You should never risk more than you are prepared to lose and you should carefully take into consideration your trading experience.

Past performance and simulated results are not necessarily indicative of future performance. All the content on this site represents the sole opinion of the author and does not constitute an express recommendation to purchase any of the products described in its pages.